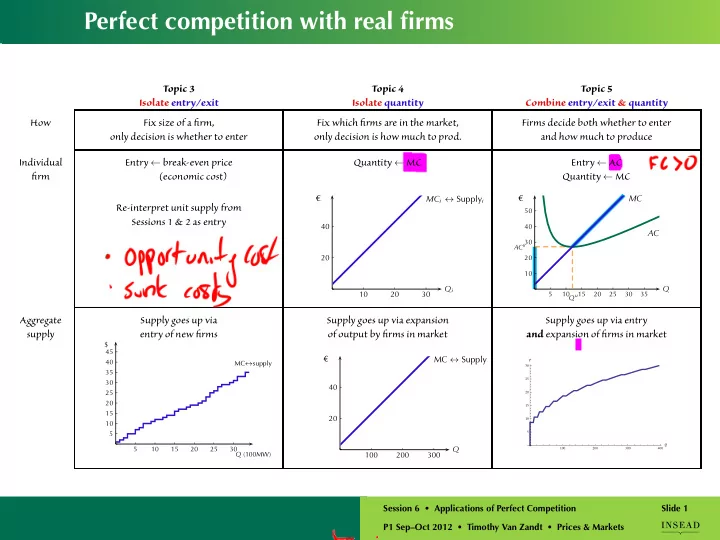

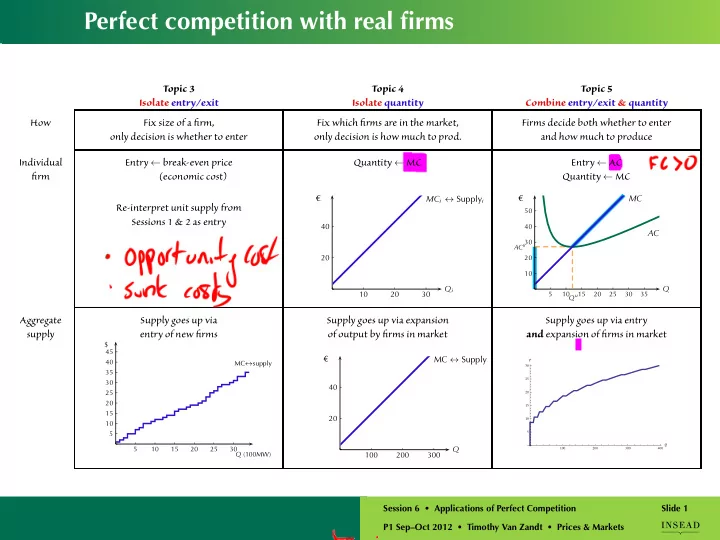

Perfect competition with real firms Topic 3 Topic 4 Topic 5 Isolate entry/exit Isolate quantity Combine entry/exit & quantity How Fix size of a firm, Fix which firms are in the market, Firms decide both whether to enter only decision is whether to enter only decision is how much to prod. and how much to produce Individual Entry ← break-even price Quantity ← MC Entry ← AC firm (economic cost) Quantity ← MC € € MC i ↔ Supply i MC Re-interpret unit supply from 50 Sessions 1 & 2 as entry 40 40 AC 30 AC u 20 20 10 Q i Q 10 20 30 5 10 15 20 25 30 35 Q u Aggregate Supply goes up via Supply goes up via expansion Supply goes up via entry supply entry of new firms of output by firms in market and expansion of firms in market $ 45 € MC ↔ Supply 40 P MC ↔ supply 30 35 25 30 40 25 20 20 15 15 20 10 10 5 5 Q 5 10 15 20 25 30 Q 100 200 300 400 Q (100MW) 100 200 300 Session 6 • Applications of Perfect Competition Slide 1 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

This picture always holds $ Consumer surplus MC ↔ Supply P ∗ → 35 Producer MV ↔ Demand surplus Q ∗ → 50 Q Session 6 • Applications of Perfect Competition Slide 2 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

6. Applications of Perfect Competition ➥ 1. Market dynamics. 2. Simulation results. 3. Bagels and Cranberries (“Growth and Profitability”). Session 6 • Applications of Perfect Competition Slide 3 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Long-run dynamics $ 60 S long 50 P ∗ 2 → 40 P ∗ 1 → 30 20 D 2 10 D 1 10 20 30 40 50 60 70 80 90 Q Session 6 • Applications of Perfect Competition Slide 4 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Firms’ short-run responses to price changes $ 60 S long 50 40 P ∗ 1 → 30 20 10 D 1 10 20 30 40 50 60 70 80 90 Q Session 6 • Applications of Perfect Competition Slide 5 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Short-run vs. long-run price adjustment $ S short 60 S long 50 40 30 20 D 2 10 D 1 10 20 30 40 50 60 70 80 90 Q Session 6 • Applications of Perfect Competition Slide 6 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Bottom line Whatever the source of adjustment delays and costs: Adjustment delays and costs imply that supply adjusts less in the short run than in the long run—hence, prices are more volatile in the short run than in the long run. Session 6 • Applications of Perfect Competition Slide 7 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Interpreted as delays for entry $ S short 60 S long 50 40 30 20 D 2 10 D 1 10 20 30 40 50 60 70 80 90 Q Session 6 • Applications of Perfect Competition Slide 8 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Price and capacity dynamics in a competitive industry ������ ���������������������� ����� �������� � � � ����� � � � � � � � ����� � � � � � � � � � � � � � � � � ����� � � � � � � � � � � � � � � � � � � ����� � � � � � � � � �������� � � � � ��������� � ��������� ���������� ���� ������ ����� � �� ����� � �� ����� ��� � ��������������������������� ��������������������������� �������� ������� ���������������� �������� ��������� ���������������� ���� �������������������� �������������������� ��������������������� ��������������������� � ���������������������� � ��������������������� �� (Courtesy of David Besanko.) Session 6 • Applications of Perfect Competition Slide 9 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Bulk shipping Bulk shipping: vessels designed to carry a homogeneous unpacked dry or liquid cargo, for individual shippers on non-scheduled routes. • Common cargo: iron ore, grain, coal, bauxite, phosphates, steel, cement, sugar, wood chips. • “Taxis, not buses”. (Entire cargo belongs to one shipper.) • 72% of world seaborn trade (by weight). (Data is thanks to Myrto Kaloupsidi.) Session 6 • Applications of Perfect Competition Slide 10 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Market structure Session 6 • Applications of Perfect Competition Slide 11 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Shipping prices Session 6 • Applications of Perfect Competition Slide 12 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Demand volatility Maarket is characterized by demand volatility due to changing export patterns, macroeconomic cycles. Session 6 • Applications of Perfect Competition Slide 13 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Elasticity 1 Transportation costs are a small portion of total cost for most goods (e.g. for gasoline $0.07 per gallon). 2 Few short-run substitutes. 3 Disruptions are costly: • “Just-in-time” inventory models • “Continuous-flow” refining So what? Session 6 • Applications of Perfect Competition Slide 14 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Demand volatility Demand: inelastic and volatile + Supply: inelastic ⇓ Volatile prices Session 6 • Applications of Perfect Competition Slide 15 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

6. Applications of Perfect Competition ✓ 1. Market dynamics. ➥ 2. Simulation results. 3. Bagels and Cranberries (“Growth and Profitability”). Session 6 • Applications of Perfect Competition Slide 16 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

6. Applications of Perfect Competition ✓ 1. Market dynamics. ✓ 2. Simulation results. 3. Bagels and Cranberries (“Growth and Profitability”). ➥ Session 6 • Applications of Perfect Competition Slide 17 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Bagels and Cranberries: Key ideas When making entrepreneurial decision: 1. Understand exit and entry of competitors to determine: • Do you have a long-term comparative advantage? • Otherwise, will short-term gains justify entry? When to get out? 2. Remember: Growth does not guarantee profit if the growth is equally well anticipated by the other potential entrants. 3. Distinguish between: • Returns to a productive asset. • Returns to entrepreneurial/organizational comparative advantage. Why? To determine whether owner of asset ≡ entrepreneur/organization that uses the asset is efficient. Session 6 • Applications of Perfect Competition Slide 18 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

6. Applications of Perfect Competition ✓ 1. Market dynamics. ✓ 2. Simulation results. 3. Bagels and Cranberries (“Growth and Profitability”). ➥ Session 6 • Applications of Perfect Competition Slide 19 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

This week (Wed) Session 7: Elasticity of demand • Prep Guide 8. • FPM Ch. 8. • A demand estimation exercise to hand in. (Fri) Session 8: Pricing with Market Power • Prep Guide 7. • FPM Ch. 7. Session 6 • Applications of Perfect Competition Slide 20 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Reminder: Next week you have … … optional review and quiz . Monday Tuesday Wednesday Thursday Friday Session 9 Review Quiz Session 10 – Quiz covers only up through Session 8. Session 6 • Applications of Perfect Competition Slide 21 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Recommend

More recommend