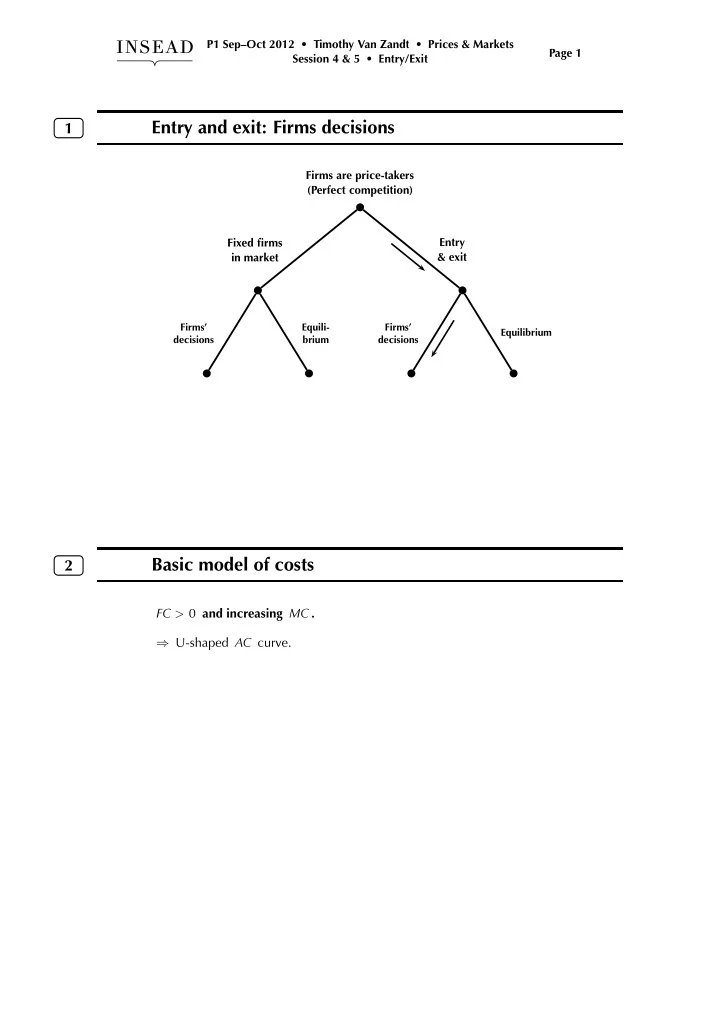

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 1 Session 4 & 5 • Entry/Exit Entry and exit: Firms decisions 1 Firms are price-takers (Perfect competition) Fixed firms Entry in market & exit Firms’ Equili- Firms’ Equilibrium decisions brium decisions Basic model of costs 2 FC > 0 and increasing MC . ⇒ U-shaped AC curve.

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 2 Session 4 & 5 • Entry/Exit Quantity decision depends only on the MC curve 3 € MC 8 7 6 5 4 3 2 1 Q 10 20 30 40 50 60 70 Entry decision depends only the AC curve 4 € 8 7 6 AC 5 4 3 2 1 Q 10 20 30 40 50 60 70

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 3 Session 4 & 5 • Entry/Exit Can combine to see entry and scale decisions at same time 5 € MC 8 7 AC 6 5 4 3 2 1 Q 10 20 30 40 50 60 70 Exercise 3.8 6 TC = 144 + 3 Q + Q 2 FC = 144 constant/intercept MC = 3 + 2 Q derivative AC = 144 Q + 3 + Q TC / Q Q u = 12 solves MC = AC AC u = 27 = ac ( Q u ) = mc ( Q u )

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 4 Session 4 & 5 • Entry/Exit MC curve 7 50 40 30 20 10 5 10 15 20 25 30 35 AC curve 8 50 40 30 20 10 5 10 15 20 25 30 35

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 5 Session 4 & 5 • Entry/Exit Together 9 € MC 50 40 AC 30 AC u 20 10 Q 5 10 15 20 25 30 35 Q u Exercise 4.5: What if MC goes up by 10 10 € MC 50 40 AC 30 AC u 20 10 Q 5 10 15 20 25 30 35 Q u

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 6 Session 4 & 5 • Entry/Exit Exercise 4.6: What if FC goes up? 11 € MC 50 40 AC 30 AC u 20 10 Q 5 10 15 20 25 30 35 Q u Entry and exit: equilibrium 12 Firms are price-takers (Perfect competition) Entry Fixed firms & exit in market Firms’ Equili- Firms’ Equilibrium decisions brium decisions

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 7 Session 4 & 5 • Entry/Exit Aggregate supply and equilibrium? 13 A two-stage view 14 (Entry, then competition between firms in the market.) D J F E e t k r a M C I A H B K G

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 8 Session 4 & 5 • Entry/Exit How would you calculate a numerical example? 15 Simplification: Firms have same MC – heterogeneity is through the FC Then equilibrium depends on # of firms, not their identities Data (cost curve, demand curve) Here is such an example 16 are from simulation rounds 1&2 Equilibrium as function of N V � i N P Qi 1 56.46 354 6,665 2 53.61 319 5,707 3 51.25 292 4,984 4 49.23 269 4,419 5 47.48 250 3,964 6 45.93 234 3,590 7 44.56 221 3,277 8 43.32 209 3,011 9 42.20 198 2,782 10 41.17 188 2,584 11 40.22 180 2,410 12 39.35 172 2,257 13 38.54 165 2,121 14 37.79 159 1,998 15 37.08 153 1,889 16 36.42 147 1,789 17 35.80 142 1,699 18 35.21 138 1,616 19 34.65 133 1,541 20 34.12 129 1,472 21 33.62 126 1,408 22 33.15 122 1,349 23 32.69 119 1,294 24 32.26 116 1,243 25 31.84 113 1,195

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 9 Session 4 & 5 • Entry/Exit Now consider pool of potential firms 17 Potential Entrants FC ACu 50 11.05 150 15.94 250 18.90 350 21.14 450 22.99 550 24.58 650 25.99 750 27.26 850 28.42 950 29.49 1,050 30.49 1,150 31.43 1,250 32.32 1,350 33.16 1,450 33.96 1,550 34.72 1,650 35.45 1,750 36.15 1,850 36.83 1,950 37.48 2,050 38.11 2,150 38.72 2,250 39.31 2,350 39.89 2,450 40.44 Put the data together 18 Equilibrium as function of N Potential Entrants V � i N P Qi FC ACu 1 56.46 354 6,665 50 11.05 2 53.61 319 5,707 150 15.94 3 51.25 292 4,984 250 18.90 4 49.23 269 4,419 350 21.14 5 47.48 250 3,964 450 22.99 6 45.93 234 3,590 550 24.58 7 44.56 221 3,277 650 25.99 8 43.32 209 3,011 750 27.26 850 28.42 9 42.20 198 2,782 10 41.17 188 2,584 950 29.49 1,050 30.49 11 40.22 180 2,410 12 39.35 172 2,257 1,150 31.43 1,250 32.32 13 38.54 165 2,121 14 37.79 159 1,998 1,350 33.16 1,450 33.96 15 37.08 153 1,889 16 36.42 147 1,789 1,550 34.72 1,650 35.45 17 35.80 142 1,699 18 35.21 138 1,616 1,750 36.15 1,850 36.83 19 34.65 133 1,541 20 34.12 129 1,472 1,950 37.48 2,050 38.11 21 33.62 126 1,408 22 33.15 122 1,349 2,150 38.72 2,250 39.31 23 32.69 119 1,294 24 32.26 116 1,243 2,350 39.89 2,450 40.44 25 31.84 113 1,195

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 10 Session 4 & 5 • Entry/Exit Identical firms (free entry) 19 Recipe: 1. P ∗ = i = 2. Q ∗ 3. Q ∗ = 4. N ∗ = Example 20 Each firm: € MC TC = 144 + 3 Q + Q 2 FC = 144 40 AC MC = 3 + 2 Q AC = 144 AC u Q + 3 + Q 20 Q u = 12 AC u = 27 Demand: Q Q = 510 − 10 P 10 20 30 Q u 1. P ∗ = 2. Q ∗ i = 3. Q ∗ = 4. N ∗ =

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 11 Session 4 & 5 • Entry/Exit Exercise 5.5: What if MC goes up by 10? 21 (a) Q ∗ i (b) P ∗ (c) Q ∗ (d) N ∗ Exercise 5.6: What if the FC goes up? 22 (a) Q ∗ i (b) P ∗ (c) Q ∗ (d) N ∗

Recommend

More recommend