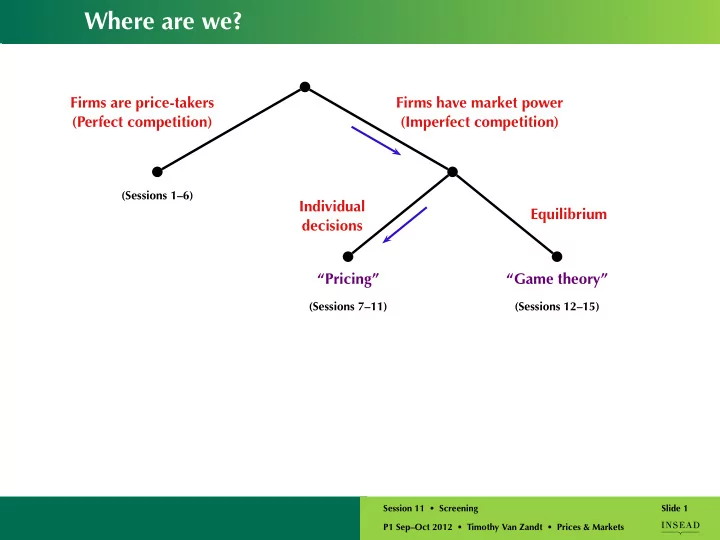

Where are we? Firms are price-takers Firms have market power (Perfect competition) (Imperfect competition) (Sessions 1–6) Individual Equilibrium decisions “Pricing” “Game theory” (Sessions 7–11) (Sessions 12–15) Session 11 • Screening Slide 1 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

from basic pricing, The Conundrum Topics 8 & 9 $ Consumer surplus 25 20 Deadweight P π loss 15 mc ( Q ) Profit 10 d ( P ) 5 Cost 20 40 60 80 100 120 140 160 Q π Q Session 11 • Screening Slide 2 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

What would it take to generate and extract all gains from trade? Case of unit demand € 25 20 15 mc ( Q ) 10 d ( P ) 5 20 40 60 80 100 120 140 160 Q Session 11 • Screening Slide 3 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

More realistic price discrimination Perfect price discrimination is a useful benchmark, but is never attainable. However: The informational and other constraints that make PPD impossible should not lead you to revert to uniform pricing. There may be other feasible pricing schemes that partially achieve the goals of PPD. For example: • Session 10: Weaker form of explicit price discrimination: Differentiated pricing across coarsely divided market segments. • Session 11: Various means of implicit price discrimination (screening). Session 11 • Screening Slide 4 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Pricing with Market Power Pricing Uniform Price discrimination (Sessions 7–9) Explicit Implicit (Session 10) (Sessions 11) Explicit: Customers have different trading opportunities . Implicit: Same trading opportunities, just different decisions. Session 11 • Screening Slide 5 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Explicit or implicit? 1. Child, student, and senior-citizen discounts. Explicit 2. Diff. airline prices (for coach seats) for business and leisure travelers. Implicit 3. Different prices for medicine in different countries or for different uses. Explicit 4. Different utility rates for residential and business customers. Explicit 5. Different phone plans for high-usage and low-usage customers. Implicit 6. Higher prices when a product is first introduced (e.g., books). Implicit Session 11 • Screening Slide 6 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

As told to me by a Dec’08 student … … who prior to INSEAD managed a 5-star hotel in China. A normal 5-star hotel has from 20 to 50 prices, decided by weekday or weekend, room type, view from the room, with/without extra service such as breakfast, peak holiday season, type of guest (walk-in, group, corporate), nationality (on average Japanese groups pays more than Chinese groups). However, most of time, prices depend on the “rack rate” (the maximum charge) because other prices follow simple mathematical calculation (e.g. add 15 dollars for breakfast, groups are 80% of rack rate on weekend, and 70% on weekday…). Session 11 • Screening Slide 7 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Some cases 1. Non-linear pricing (not covered, but see Chapter 11B if interested) 2. Product differentiation (today) 3. Bundling (today) Session 11 • Screening Slide 8 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Screening with differentiated products Scenario: Airline has B business customers and L leisure customers. Type of Valuation Make sure everyon customer Unrestricted Restricted understands this d Business €1000 €700 Leisure €600 €550 Constant MC = €300 CONSTANT MARGINAL COST = €300 PER TICKET (Same for unrestricted and restricted tix.) Explain: This highlights d based differences as oppo to cost-based differences Session 11 • Screening Slide 9 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

FPM Perfect price discrimination Ex. 11.2 Type of Valuation Make sure eve customer Unrestricted Restricted understands t Business €1000 €700 Leisure €600 €550 Constant MC = €300 P B = 1000 P L = 600 Profit = 700 B + 300 L Session 11 • Screening Slide 10 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

FPM Uniform Pricing Ex. 11.1 Type of Valuation Make sure eve customer Unrestricted Restricted understands t Business €1000 €700 Leisure €600 €550 Constant MC = €300 Say: “A particularly simple monopoly-pricing problem.” Charge either: 1000 to sell to business customers ⇒ Profit = 700 B 600 to sell to everybody ⇒ Profit = 300( B + L ) Session 11 • Screening Slide 11 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Like FPM Screening with restricted & unrestricted tix Ex. 11.3 Type of Valuation Make sure eve customer Unrestricted Restricted understands t Business €1000 €700 Leisure €600 €550 Constant MC = €300 SELL: Restricted tix to leisure travelers for P R = 550 . Unrest. tix to business travelers for P U = 850 . ⇒ Profit = 250 L + 550 B Session 11 • Screening Slide 12 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Like FPM Comparison of 3 options Ex. 11.4 (A) sell only unrestricted tickets for 1000 to business travelers; Profit: 700 B 600 (B) sell only unrestricted tickets for to all travelers; Profit: 300 (L+B) 850 (C) sell unrestricted tickets to business travelers for 550 and restricted tickets to leisure travelers for . Profit: 250 L + 550B Session 11 • Screening Slide 13 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Like FPM Comparison of 3 options Ex. 11.4 A Profit 600 C 500 400 300 B 200 100 % Bus. travelers ( B ) 10 20 30 40 50 60 70 80 90 B best C best A best Session 11 • Screening Slide 14 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Different design of restricted tix Type of Valuation Make sure eve customer Unrestricted Restricted understands t Business €1000 €700 Leisure €600 €550 Constant MC = €300 Type of Valuation Make sure everyon customer Unrestricted Restricted understands this d Business €1000 €600 Leisure €600 €500 Constant MC = €300 900 (D) sell unrestricted tickets to business travelers for 500 and restricted tickets to leisure travelers for . Profit: 200 L + 600B Session 11 • Screening Slide 15 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Comparison of 4 options A Profit 600 D C 500 400 300 B 200 100 % Bus. travelers ( B ) 10 20 30 40 50 60 70 80 90 B best C best D best A best Session 11 • Screening Slide 16 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Explicit or implicit price discrimination? Session 11 • Screening Slide 17 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Exercise 11.5 – Bundling Pricing of a two-concert mini season (Wagner and Harbison) at a theater. Highly segmented market, with only three types of customers: Type of Valuation customer Wagner Harbison A 50 5 B 40 40 C 5 50 A customer may go to one or both of the concerts. Session 11 • Screening Slide 18 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Perfect price discrimination Type of Valuation customer Wagner Harbison A 50 5 B 40 40 C 5 50 Session 11 • Screening Slide 19 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

No bundling Type of Valuation customer Wagner Harbison A 50 5 B 40 40 C 5 50 Session 11 • Screening Slide 20 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Pure bundling Type of Valuation customer Wagner Harbison A 50 5 B 40 40 C 5 50 Session 11 • Screening Slide 21 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Mixed bundling Type of Valuation customer Wagner Harbison A 50 5 B 40 40 C 5 50 Session 11 • Screening Slide 22 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Bottom line Even if you cannot explicitly segment market (due to lack of observability or to legal restrictions) do not ignore the composition of your market! Construct menus of deals thinking about what each type of customer will choose. Session 11 • Screening Slide 23 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Price discrimination: Session 10 (Thurs), Session 11 (Today) Topic 10 – Explicit Price Discrimination Called 3rd-Degree Price Discimination in most texts 1. What? When? How? 2. Bottom line: Charge higher price to segment with less elastic demand. Not covered by Topic 11 – Implicit Price Discrimination (Screening) most (any?) texts 1. Perfect price discrimination (benchmark) 2. Screening via differentiated products 3. Bundling Session 11 • Screening Slide 24 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

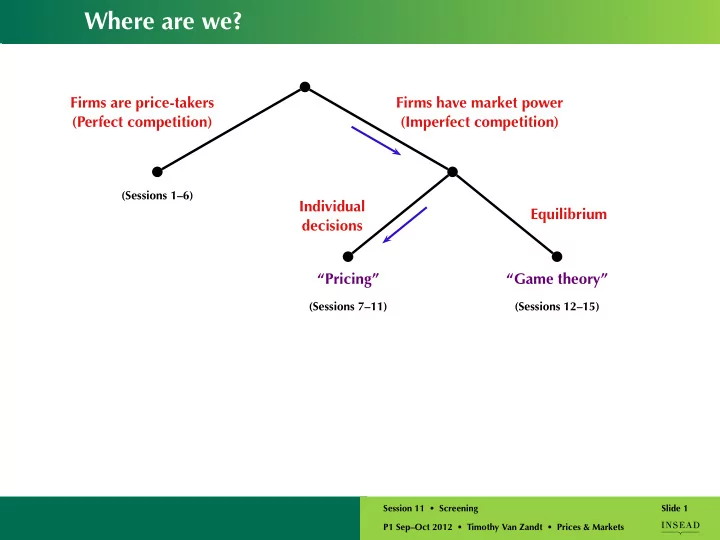

Coming next … Firms are price-takers Firms have market power (Perfect competition) (Imperfect competition) (Sessions 1–6) Individual Equilibrium decisions “Pricing” “Game theory” (Sessions 7–11) (Sessions 12–15) Session 11 • Screening Slide 25 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Recommend

More recommend