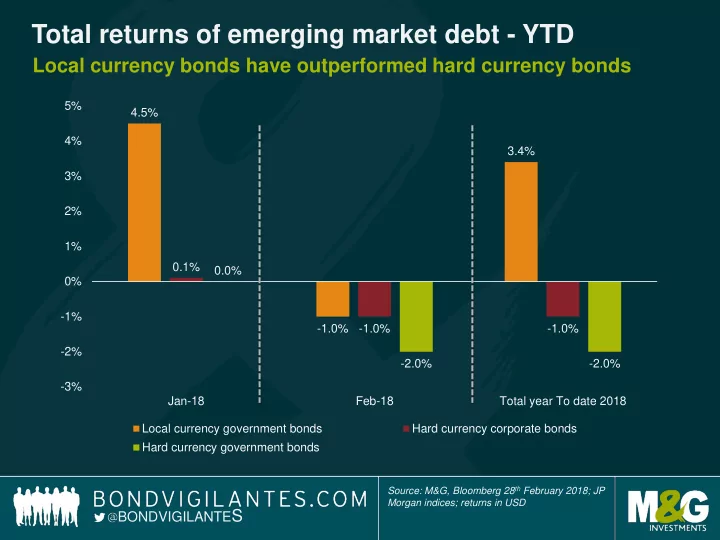

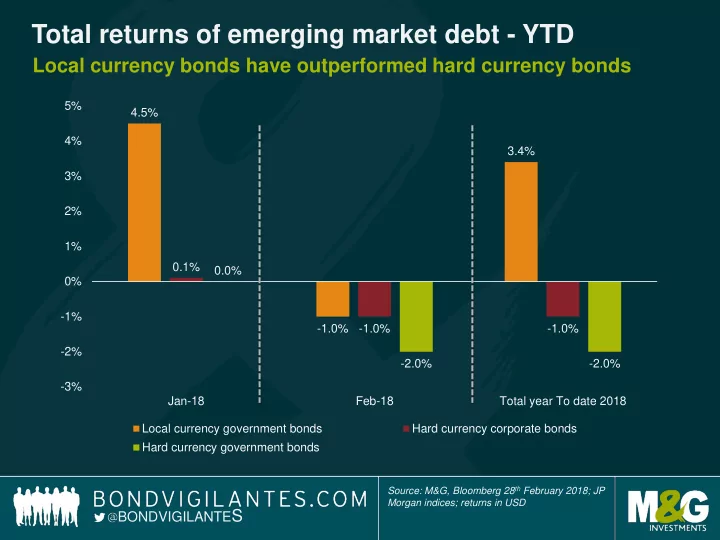

Total returns of emerging market debt - YTD Local currency bonds have outperformed hard currency bonds 5% 4.5% 4% 3.4% 3% 2% 1% 0.1% 0.0% 0% -1% -1.0% -1.0% -1.0% -2% -2.0% -2.0% -3% Jan-18 Feb-18 Total year To date 2018 Local currency government bonds Hard currency corporate bonds Hard currency government bonds Source: M&G, Bloomberg 28 th February 2018; JP Morgan indices; returns in USD BONDVIGILANTE S

EM hard currency funds have replenished more than the entire AUM lost since the taper tantrum Funds flow index (% AUM, Jan 2010 = 100) 170 160 150 140 130 120 110 100 90 Jan 2010 Jan 2011 Jan 2012 Jan 2013 Jan 2014 Jan 2015 Jan 2016 Jan 2017 Source: EPFR: Deutsche Bank, January 2018 BONDVIGILANTE S

China is attempting to tackle its debt problem Total non-financial debt across developed and emerging markets DM = developed markets; EMXC = emerging markets excluding China Source: Morgan Stanley Research estimates, March 2018 BONDVIGILANTE S

Recommend

More recommend