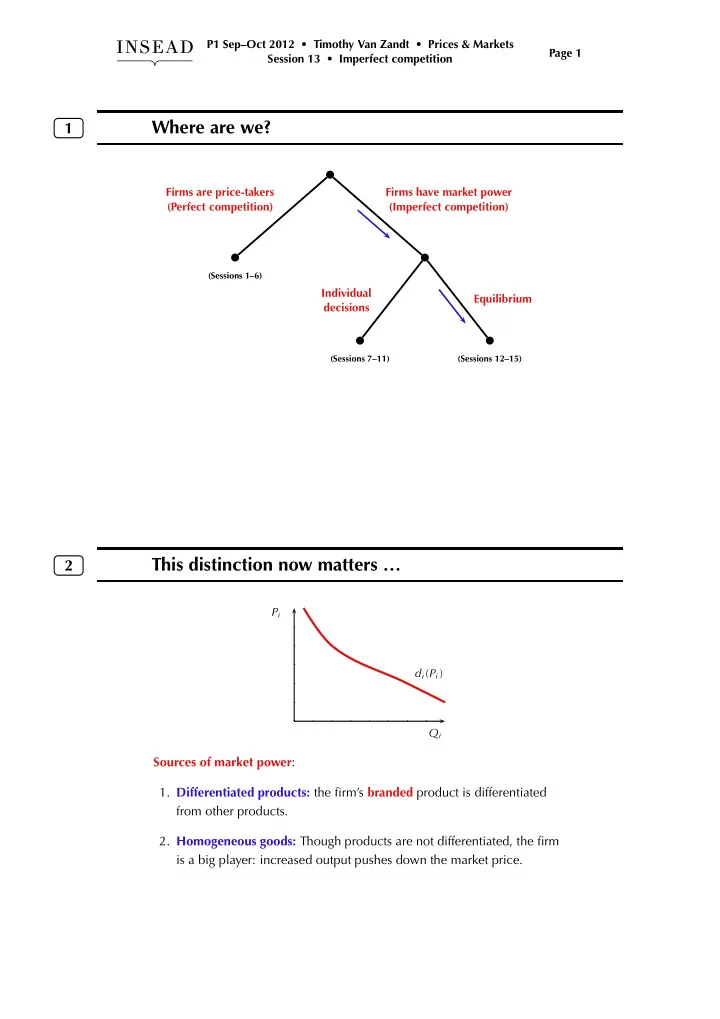

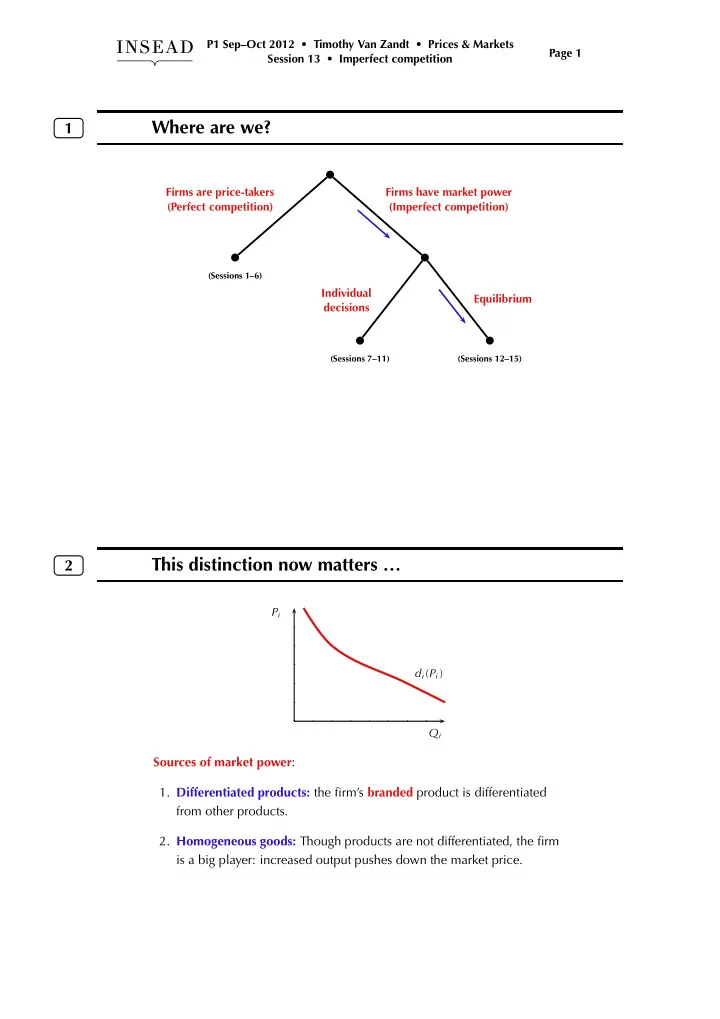

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 1 Session 13 • Imperfect competition Where are we? 1 Firms are price-takers Firms have market power (Perfect competition) (Imperfect competition) (Sessions 1–6) Individual Equilibrium decisions (Sessions 7–11) (Sessions 12–15) Say: We did uniform pricing and price discrimination at individual level, but we only bring uniform pricing to equilibrium. This distinction now matters … 2 P i d i ( P i ) Q i Sources of market power : 1. Differentiated products: the firm’s branded product is differentiated from other products. 2. Homogeneous goods: Though products are not differentiated, the firm is a big player: increased output pushes down the market price.

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 2 Session 13 • Imperfect competition We begin with … 3 Price competition with differentiated products Recall the pricing game from Session 12: Firm B Low Med High 19 18 10 Low 20 25 31 24 28 21 Med Firm A 23 31 38 30 40 34 High 15 27 42 We extend this to a full range of prices. Let’s use the same story 4 Recently appointed Recently appointed CEO of Firm A CEO of Firm B

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 3 Session 13 • Imperfect competition Firm A’s pricing problem 5 € 36 30 This is P ∗ 24 d A A “uniform pricing with market power” 18 MC A (Sessions 8 and 9). 12 6 20 40 60 80 100 Q A Q ∗ A − 6 MR A Nash equilibrium 6 € € 36 36 30 30 P ∗ P ∗ 24 24 d A d B A B 18 18 MC A MC B 12 12 6 6 Q A Q B 20 40 60 80 100 20 40 60 80 100 Q ∗ Q ∗ − 6 A − 6 B MR A MR B

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 4 Session 13 • Imperfect competition Let’s use the numbers from Airbus-Boeing example 7 Demand functions: Q A = 60 − 3 P A + 2 P B Q B = 60 − 3 P B + 2 P A Both firms have constant MC = 12 . From the demand Some best responses … 8 elasticity exercise Firm A’s demand curve when P B = 24 and when P B = 30 : P A P B = 30 ⇒ Q A = 120 − 3 P A 40 30 P B = 24 ⇒ Q A = 108 − 3 P A 20 10 30 60 90 120 Q A

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 5 Session 13 • Imperfect competition In general: from Topic 9 on shifting demand … 9 Higher price by Firm B Firm A ’s demand curve shifts … ⇒ Higher Volume? Lower Elasticity? up Firm A ’s profit-maximizing price goes ⇒ complements Thus, the pricing decisions are strategic So remember, with price competition … 10 When the goods are substitutes , the pricing decisions are strategic complements . (Holds for linear demand, and usually in the real world.)

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 6 Session 13 • Imperfect competition Q A = 60 − 3 P A + 2 P B 11 Firm A’s “residual” demand and best reply Constant MC = 12 When Firm B charges P B , Firm A ’s demand curve is: Q A = (60 + 2 P B ) − 3 P A ⇒ Firm A ’s choke price is: 20 + 2 3 P B ⇒ Firm A ’s optimal price is: 20 + 2 3 P B + 12 = 16 + 1 3 P B 2 Firm A ’s reaction curve: P A = 16 + 1 3 P B Nash equilibrium 12 Prices ( P ∗ A , P ∗ B ) such that: In words … As an equation … P A = 16 + 1 3 P B P ∗ A is a best response by firm A to P ∗ B P B = 16 + 1 3 P A P ∗ B is a best response by firm B to P ∗ A

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 7 Session 13 • Imperfect competition Illustrating Nash equilibrium graphically 13 P B 16 + 1 P A 3 P B = 55 16 + 1 P B 3 P A = 50 45 40 35 30 25 20 15 10 5 5 10 15 20 25 30 35 40 45 50 55 P A Wrap up: 14 Price competition with differentiated products 1. Each firm’s decision is same as “pricing with market power”: Topics 8&9. 2. Goods are substitutes ⇒ prices are strategic complements. (Always with linear demand; almost always in real life.) 3. Interaction captured by Nash equilibrium. Each firm’s price maximizes its own profit given price of the other firm.

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 8 Session 13 • Imperfect competition Next we do … 15 Quantity competition with homogeneous products Also called Cournot competition 1. Firms’ goods are perfect substitutes. 2. So firm doesn’t set price; it chooses how much to sell. 3. Market determines market-clearing price. 4. But each firm’s output decision affects this price. Corning and glass substrate 16 Corning has over 50% market share of glass substrate. There are different grades (“5G, 6G, …”), but for a particular grade the products of different suppliers are viewed as close substitutes. News item from December 2005 (for example): The aggressive capacity added by both Corning of the U.S., the world’s No. 1 substrate supplier, and AGC, the No. 2, will lead to price drops for glass substrates and will especially benefit TV panel makers …

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 9 Session 13 • Imperfect competition Indonesian Cement Market 17 Three major players: • 45%: Semen Gresik [State-owned] • 37%: Indocement [Owned by HeidelbergCement since 2001] • 17%: Holcim Indonesia [Owned by Holcim (Swiss) since 2006] The protagonists 18 Indocement Semen Gresik CEO of Indocement CEO of Semen Gresik

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 10 Session 13 • Imperfect competition Nash equilibrium 19 € € 36 36 30 30 P ∗ P ∗ 24 d 1 24 d 2 1 2 18 18 MC 1 MC 2 12 12 6 6 20 40 60 80 100 Q 1 20 40 60 80 100 Q 2 Q ∗ Q ∗ 1 2 − 6 − 6 MR 1 MR 2 Market demand curve vs. Indocement’s demand curve 20 MARKET DEMAND INDOCEMENT’S DEMAND Q = 1500 − 50 P When Q other = 500 P P 30 30 25 25 20 20 15 15 10 10 5 5 500 1000 1500 500 1000 1500 Q Q i

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 11 Session 13 • Imperfect competition Indocement’s quantity decision (Constant MC = 10) 21 When Q other = 200 When Q other = 500 P P 30 30 25 25 20 20 15 15 10 10 5 5 500 1000 1500 500 1000 1500 Q i Q i Nash equilibrium 22 Q 2 1000 800 600 400 200 Q 1 200 400 600 800 1000

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 12 Session 13 • Imperfect competition Wrap up: 23 Quantity competition with homogeneous goods 1. Each firm’s output decision is same as “pricing with market power”: Topics 8&9. 2. Quantities are strategies substitutes. (Always with linear demand; almost always in real life.) 3. Use this model (rather than price competition) • for homogeneous products like oil, lycine, glass substrate, • to analyze investments in capacity. Finally … 24 Imperfect competition with exit/entry

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 13 Session 13 • Imperfect competition Falafel vendors on the beach of Beirut 25 h c a e B See website for details, but you Numerical example: Cournot 26 don’t have to be able to do this. • Market demand curve: Q = 1500 − 50 P • Constant MC = 10 . Then I calculate the Nash equilibrium for any number N of firms.

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 14 Session 13 • Imperfect competition Transition from monopoly to perfect competition 27 Q = 1500 - 50P || P = 30 - Q/50 Number Total Output Profit per Price of firms Output per firm firm 1 500 20.00 500 5,000 2 667 16.67 333 2,222 3 750 15.00 250 1,250 4 800 14.00 200 800 5 833 13.33 167 556 6 857 12.86 143 408 7 875 12.50 125 313 8 889 12.22 111 247 9 900 12.00 100 200 10 909 11.82 91 165 11 917 11.67 83 139 12 923 11.54 77 118 13 929 11.43 71 102 14 933 11.33 67 89 15 938 11.25 63 78 So what happens if fixed costs are lower?? 28 Lower fixed costs ⇒

Recommend

More recommend