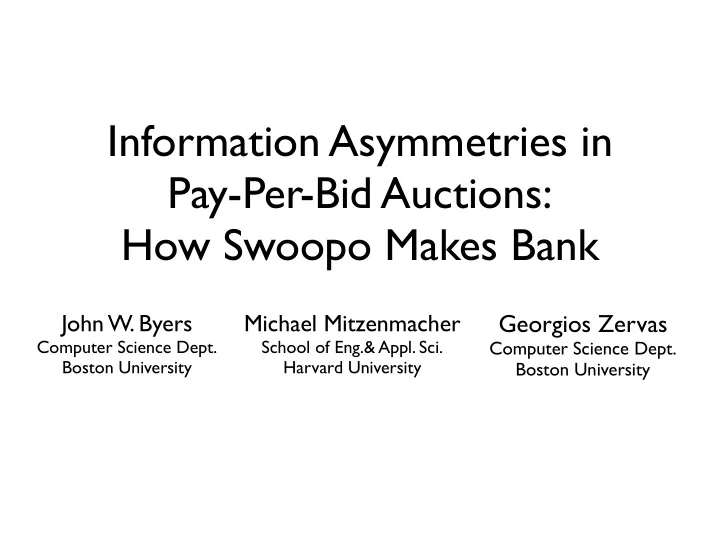

Information Asymmetries in Pay-Per-Bid Auctions: How Swoopo Makes - PowerPoint PPT Presentation

Information Asymmetries in Pay-Per-Bid Auctions: How Swoopo Makes Bank John W. Byers Michael Mitzenmacher Georgios Zervas Computer Science Dept. School of Eng.& Appl. Sci. Computer Science Dept. Boston University Harvard University

Information Asymmetries in Pay-Per-Bid Auctions: How Swoopo Makes Bank John W. Byers Michael Mitzenmacher Georgios Zervas Computer Science Dept. School of Eng.& Appl. Sci. Computer Science Dept. Boston University Harvard University Boston University

? ? In 25 secs Swoopo earned 16 * 60 cents = $9.60 in bid fees

In 25 secs Swoopo earned 11 * 60 cents = $6.60 in bid fees

In 25 secs Swoopo earned 11 * 60 cents = $6.60 in bid fees Not bad. That’s about $ 1000 /hour. (...but of course not all auctions are as profitable)

2008 revenues were $28,300,000

“...a scary website that seems to be exploiting the low- price allure of all- pay auctions.”

“...a scary website that seems to be exploiting the low- price allure of all- pay auctions.” “...devilish...”

“...a scary website that seems to be exploiting the low- price allure of all- pay auctions.” “...devilish...” “The crack cocaine of online auction websites.”

Previous work predicts profit-free equilibria [Augenblick ’09, Platt et al. ’09, Hinnosaar ’09] Some of this prior work tries to explain the profit using risk-loving preferences and sunk cost fallacies

Previous work predicts profit-free equilibria [Augenblick ’09, Platt et al. ’09, Hinnosaar ’09] Outcomes dataset (121,419 auctions) • Total number of bids • Bid fee • Price increment • Retail price • Winner

Previous work predicts profit-free equilibria [Augenblick ’09, Platt et al. ’09, Hinnosaar ’09] 1.0 0.8 Auctions (%) 0.6 Overall profit margin: 85.97% 0.4 0.2 0.0 0 200 400 600 800 1000 Profit margin (%) From Outcomes dataset

Previous work predicts profit-free equilibria [Augenblick ’09, Platt et al. ’09, Hinnosaar ’09] 200% ● 6 ● 1 ● 1 ● ● 1 1 ● ● ● 1 1 1 ● 1 ● Profit margin 100% 1 ● ● ● 1 2 1 ● 1 ● ● ● ● 1 5 1 2 2 ● ● ● 5 ● 2 1 ● ● ● ● ● ● ● 1 5 ● ● ● 6 ● 1 5 1 5 5 1 5 1 5 ● 1 5 6 6 6 2 ● 1 5 1 5 ● ● 1 ● 1 2 ● 6 ● 50% ● 1 2 1 2 ● 1 2 1 2 1 2 ● ● 1 5 5 1 ● ● 2 4 2 4 0% ● 2 4 − 50% ● 2 4 ● 2 4 2008 − 08 2008 − 11 2009 − 02 2009 − 05 2009 − 08 2009 − 11 Month From Outcomes dataset

Basic symmetric pay-per-bid model • n , number of players • b , bid cost (60 cents for Swoopo) • v , value of the auctioned item ($ 10s to $ 1,000s ) Fixed-price auctions • p , fixed purchase price (usually $0) • last bidder acquires item for price p Ascending-price auctions • s , price increment (between 1 and 24 cents/bid) • last bidder acquires item for sq • where q number of bids Predicts zero profit!

Symmetric equilibrium for fixed-price auctions Indifference condition: A player’s expected profit per bid should be zero. µ , probability that somebody places a subsequent bid b b = ( v p )(1 µ ) µ = 1 v p , probability that an individual player places a subsequent bid 1 b 1 µ = (1 ) n 1 = 1 n 1 v p

Symmetric equilibrium for ascending-price auctions Indifference condition: The player making the ( q+ 1 ) st bid is betting b no future player will bid µ q + 1 , probability that somebody places the ( q+ 1 ) st bid b b = ( v sq )(1 µ q + 1 ) µ q + 1 = 1 v sq q + 1 , probability that a player bids after q bids have been placed 1 b 1 µ q + 1 = (1 q + 1 ) n 1 q + 1 = 1 n 1 v sq Time varying

Expected revenue in equilibrium is v • A player puts a value of b at risk with each bid for an expected reward of b . • This implies zero profit per bid in expectation. • Since players are symmetric the expected profit across all bids is also zero. • At the end of the auction an item of value v is transferred from the auctioneer to the winner. • This has to be counterbalanced by a total cost of v in bid fees which is the auctioneer’s revenue.

Our contribution: Asymmetric players population estimate, n 3 key bid fee, b parameters item valuation, v 1) What if these parameters vary from player to player? 2) What if some players aren’t aware that they vary?

Mistaken population estimates for fixed-price auctions Not just a theoretical concern: Swoopo displays the list of bidders active in the last 15 minutes. 60% Active bidders 40% 20% 0% 1 2 5 10 20 50 100 200 Minutes before end of auction

Mistaken population estimates for fixed-price auctions Trace dataset (4,328 auctions) • Time and user of each bid • Plus all attributes of Outcomes dataset

Mistaken population estimates for fixed-price auctions Thought experiment: True number of players is n but everyone thinks there are n-k players b b = ( v p )(1 ) = 1 v p where is the perceived probability someone places a subsequent bid Mistaken players Omniscient players 1 1 = 1 (1 ) = 1 (1 µ ) n k 1 n 1 ≫ n 1 b b µ = 1 µ = 1 n k 1 v p v p µ Reminder: pr. one player bids, pr. some player bids

Mistaken population estimates for fixed-price auctions Overestimation Underestimation ● 700 ● 500 ● Revenue ($) ● ● 300 ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● 100 − 15 − 10 − 5 0 5 10 15 k n = 50, v = 100, b = 1

Mistaken population estimates for fixed-price auctions Over and underestimation in equal measures: Swoopo still profits ● Underestimation by k ● 700 Over − and underestimation by k ● 600 Revenue ($) ● 500 ● 400 ● ● 300 ● ● 200 ● ● ● ● ● 100 ● ● ● 0 5 10 15 k n = 50, v = 100, b = 1

Mistaken population estimates for fixed-price auctions • Underestimates of the number of players increase Swoopo's profit. • Overestimates of the number of players decrease Swoopo's profit. • But not symmetrically! • Mixtures of over/underestimates with the right mean will increase Swoopo's profit!

Modeling general asymmetries Two groups of players, A & B Group A Group B • size k • size n-k • bid b A • bid b B • value v A • value v B • population • population estimate n A estimate n B • aware of B • unaware of A

A Markov chain for modeling general asymmetries A B W A W B A ( q + 1) = P A ( q ) p AA ( q ) + P P B ( q ) p BA ( q ) WA ( q + 1) = P A ( q ) p AW A ( q ) + P P W A ( q )

Mistaken population estimates for ascending-price auctions Trivial upper bound: ( Q + 1)( b + s ) Auction revenue 500 ● ● ● ● ● ● ● 400 ● Revenue ($) 300 ● ● 200 ● ● 100 ● ● ● ● ● ● ● ● ● ● ● ● ● − 40 − 20 0 20 40 k n = 50, v = 100, b = 1, s = 0.25

Asymmetries in bid fees

Asymmetries in bid fees

Asymmetries in bid fees 2500 65% 2000 Frequency 1500 Mean: 34.72% 1000 500 winners’ discount 0 0% 50% 100% 150% 200% 250% 300% Percentage of retail price 150 55% 100 Frequency Mean: 45.09% 50 winners’ discount accounting for previously lost auctions 0 0% 50% 100% 150% 200% 250% 300% Percentage of retail price

Asymmetries in bid fees for fixed-price auctions Auction revenue • Group A of size k has a ● k=5 ● 1100 k=25 discounted bid and they k=45 900 know it. Revenue ($) 700 ● • Group B of size n-k think 500 ● ● everyone is paying b . 300 ● ● ● ● ● ● ● ● ● 100 ● ● ● ● ● ● ● 0.05 0.20 0.40 0.60 0.80 1.00 b A Group A advantage 6x ● k=5 ● k=25 5x k=45 ● Synergy! Group A advantage ● 4x ● ● ● 3x ● ● ● ● ● 2x ● ● ● ● ● ● ● 1x ● ● 0x 0.05 0.20 0.40 0.60 0.80 1.00 b A n = 50, v = 100, b B = 1

Asymmetries in bid fees for ascending-price auctions Auction revenue • Group A of size k has a 300 k=5 ● ● k=25 discounted bid and they 250 ● k=45 ● ● 200 ● know it. Revenue ($) ● ● ● 150 ● ● ● ● • Group B of size n-k think ● ● ● ● ● 100 ● ● ● everyone is paying b . 50 0 0.05 0.20 0.40 0.60 0.80 1.00 b A Group A advantage 12x k=5 ● ● k=25 10x k=45 Group A advantage ● 8x ● 6x ● ● 4x ● ● ● ● ● ● 2x ● ● ● ● ● ● ● ● ● 0x 0.05 0.20 0.40 0.60 0.80 1.00 b A n = 50, v = 100, b B = 1, s = 0.25

Varying object valuations

Varying object valuations

Same auction id... Same players... Different currency! Different value!

Varying object valuations for fixed-price auctions Auction revenue 200 • Revenue is naturally 150 bounded by maximum Revenue ($) valuation 100 ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● • The more players ● 50 overestimate the item k=5 ● k=25 the better for Swoopo k=45 0 0.05 0.50 1.00 1.50 2.00 α n = 50, v = 100, b B = 1

Collusion & shill bidding: The role of hidden information

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.