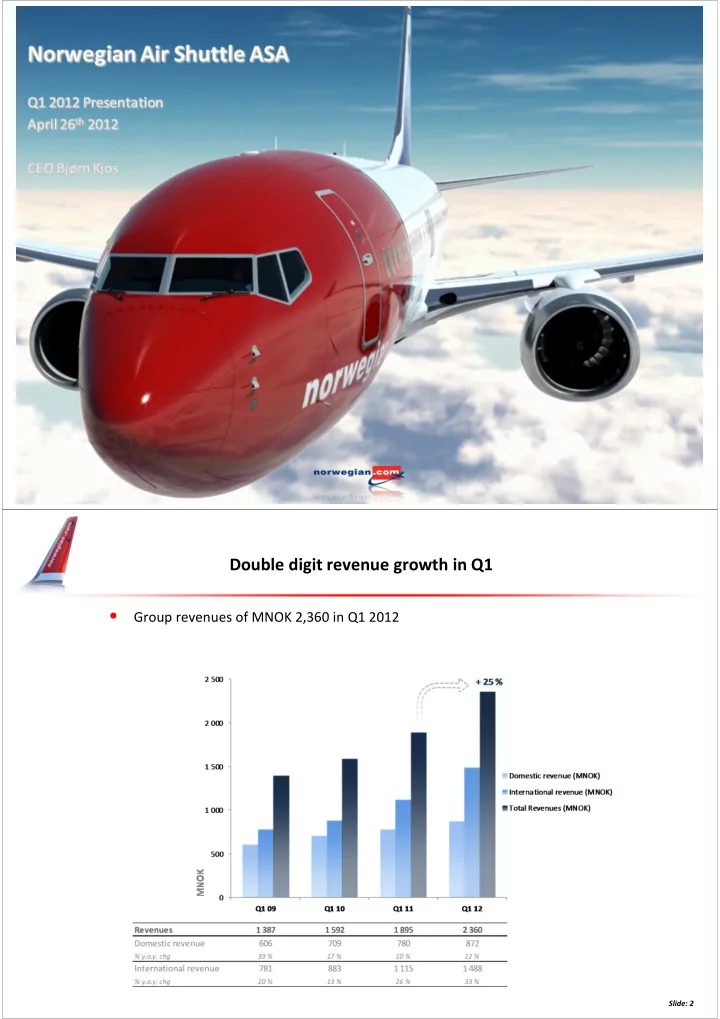

Double digit revenue growth in Q1 • Group revenues of MNOK 2,360 in Q1 2012 Slide: 2

Seasonally slow Q1 affected by soaring oil price – EBITDAR MNOK - 252 (-230) – EBITDA MNOK - 497 (-430) – EBIT MNOK - 575 (-495) . – Pre-tax profit (EBT) MNOK - 398 (-406) – Net profit MNOK - 286 (-293) EBITDAR development Q1 EBT development Q1 Slide: 3 Underlying EBT improvement of MNOK 47 • Fuel price up 15 % since last year – equivalent to MNOK 115 • More efficient aircraft saves MNOK 25 in fuel cost • MNOK 33 accumulated provisions for re-delivery 737-300 ‘s • MNOK 16 Wet Lease cost 100 0 -100 -259 -306 -200 -398 -406 16 33 -300 25 Result improvement MNOK 47 115 100 EBT (MNOK) -400 -500 Q1 2012 Fuel Price More efficient Provisions Wet Lease Underlying Underlying Expansion Q1 2011 Acutal increase aircraft reduce re-delivery Q1 2012 Q1 2011 (SE, DK, FI) Actual consumption 737-300 4

Cash & cash equivalents of NOK 1.5 billion • Cash flows from operations in Q1 2012 MNOK +544 (+229) • Cash flows from investing activities in Q1 2012 MNOK -178 (-150) • Cash flows from financing activities in Q1 2012 MNOK +15 (-28) • Cash and cash equivalents at period-end MNOK +1,487 (+1,229) 5 Equity improved by more than MNOK 150 compared to last year • Total balance of NOK 9.7 billion • Net interest bearing debt NOK 2.5 billion • Equity of NOK 1.7 billion at the end of the first quarter • Group equity ratio of 17 % (21 %) 10 000 9 000 Long term liabilities 8 000 3,207 7 000 Non-current assets 2 433 6 000 6,646 Other current liabilities 5 000 4 630 3,527 1 359 4 000 Pre-sold 3 000 tickets 2,291 1 822 Receivables 1,552 2 000 1 260 MNOK Equity 1 000 Cash 1 506 1,661 1 229 1,487 0 Q1 11 Q1 12 Q1 12 Q1 11 Slide: 6 Slide: 6

Traffic growth of 22 % in Q1 2012 • Load up 3 p.p. despite capacity growth of 17 % • Unit revenue (RASK) up 6 % + 17 % 100 % ASK Load Factor 5 000 77 % 77 % 77 % 80 % 75 % 75 % 75 % 74 % 4 000 68 % 65 % 60 % 3 000 44 % 40 % 2 000 Available Seat KM (ASK) 20 % 1 000 Load Factor 0 0 % Q1 03 Q1 04 Q1 05 Q1 06 Q1 07 Q1 08 Q1 09 Q1 10 Q1 11 Q1 12 ASK 208 370 569 933 1 342 2 183 2 674 3 507 4 498 5 266 Load Factor 44 % 65 % 68 % 77 % 75 % 77 % 75 % 75 % 74 % 77 % Slide: 7 Slide: 7 More than 3.6 million passengers in Q1 2012 • An increase of 592,000 passengers 4.0 + 19 % 3.0 2.0 Passengers (million) 1.0 0.0 Q1 03 Q1 04 Q1 05 Q1 06 Q1 07 Q1 08 Q1 09 Q1 10 Q1 11 Q1 12 Pax (mill) 0.2 0.4 0.6 1.0 1.3 2.0 2.1 2.7 3.1 3.6 Slide: 8 Slide: 8

Largest share of growth outside Norway Newly started base in Helsinki with 300,000 passengers in Q1 Norwegian in Oslo Norwegian in Stockholm Norwegian in Copenhagen + 83,000 pax + 232,000 pax + 89,000 pax • Marginal increase in domestic frequencies • New dom. routes to Malmö & Gothenburg • International production growth • Growth due to larger aircraft and charter • Substantial international production growth + 31,000 pax 50 % 40 % + 52,000 pax + 116,000 pax 30 % - 8,000 pax + 116,000 pax 45 % 44 % Market Share Norwegian (Q1) 43 % 20 % 39 % + 97,000 pax 30 % 29 % 29 % 27 % 22 % 10 % 20 % 20 % 19 % 17 % 16 % 16 % 15 % 13 % 11 % 10 % n/a 9 % 8 % 8 % 4 % 0 % International Domestic International Domestic International Domestic From Oslo Airport (OSL) From Oslo Airport (OSL) From Stockholm Airport From Stockholm Airport From Copenhagen Airport From Copenhagen Airport (ARN) (ARN) (CPH) (CPH) Norwegian aiming for CASK NOK 0.30 excluding fuel Scale economies Scale economies New more efficient aircraft New more efficient aircraft Growth adapted to int’l markets Growth adapted to int’l markets • Uniform fleet of Boeing 737-800s • Flying cost of 737-800 lower than 737-300 • Cost level adapted to local markets • Overheads • 737-800 has 38 “free” seats • Outsourcing/ Off-shoring • 3 % lower unit fuel consumption in Q1 Crew and aircraft utilization Crew and aircraft utilization Optimized average stage length Optimized average stage length Automation Automation • Self check-in/ bag drop • Rostering and aircraft slings optimized • Fixed costs divided by more ASKs • Automated charter & group bookings • Q1 utilization of 10.2 BLH pr a/c • Frequency based costs divided by more ASKs • Streamlined operative systems & processes • Q1 stage length up by 3 % 10

Underlying unit cost down 3 % • Unit cost up 2 % – 15 % higher spot fuel price (25 % increase including fuel hedges ) • More efficient aircraft saved MNOK 25 in fuel cost in Q1 0.60 0.55 Fuel share of CASK CASK excl fuel Operating cost EBITDA level per ASK (CASK) 0.11 0.50 0.11 0.45 0.13 0.15 0.40 0.45 0.35 0.40 - 3 % 0.37 0.36 0.30 Q1 09 Q1 10 Q1 11 Q1 12 Cost per ASK (CASK) (NOK) 0.56 0.51 0.50 0.51 CASK ex. fuel 0.45 0.40 0.37 0.36 Norwegian hedges USD/NOK to counter foreign currency risk exposure on USD denominated borrowings translated to the prevailing currency rate at each balance sheet date. Hedge gains and losses are according to IFRS recognized under operating expenses while foreign currency gains and losses from translation of USD denominated borrowings are recognized under financial items and is thus not included in the CASK concept. Hedge effects offset under financial items have not been included in this graph. Slide: 11 Slide: 11 Norwegian positioned in the cost “Survival Belt” – a prerequisite for self sustainability Aiming for the “Comfort Zone” Sources: SAS Group Annual Report 2011, Finnair Plc. year-end report 2011 and Annual Report 2010, Ryanair Annual Report 2011, easyJet Annual Report 2011, Air Berlin Annual Report 2011 and Norwegian’s estimations • Cost per available seat kilometer is an industry-wide cost level indicator often referred to as “CASK”. Usually represented as operating expenses before depreciation and amortization (EBITDA level) over produced seat kilometers (ASK). Here represented including depreciation and financial items. • Finnair: Non-airline operating expenses calculated by deducting “Airline Business” expenses as presented in the “Business segment data” from total operating expenses. • SAS Group: Revenues from mail & freight, ground handling services, technical maintenance and terminal & forwarding services as presented in the 2011 annual report are classified as “non-airline” and are deducted from airline operating expenses. • SAS Group’s figures are unadjusted for “restructuring costs” and “one-offs” as both items have been a constant fixture in most financial statements the last decade. • Foreign exchange rates used are equivalent to the daily average rates corresponding to the reporting periods and as stated by the Central Bank of Norway 12

Ancillary revenues remains a significant contributor • Ancillary revenue comprises 13 % of Q1 revenues 90 80 70 60 Ancillary revenue per passenger (NOK) 50 40 30 20 10 0 Q1 09 Q1 10 Q1 11 Q1 12 Ancillary revenue/ scheduled pax 70 80 86 84 Ancillary revenue/ all pax (inc. charter) 70 80 84 82 Slide: 13 Slide: 13 Current committed fleet plan • 13 new 800 deliveries in 2012 • Short term shortage of 800’s – Temporarily covered by existing 300’s (2012 CASK guidance unaffected) • First 787-8 Dreamliner deliveries expected in Q1 2013 14

Offering a better product at lower cost Expectations for 2012 • Business environment – Uncertain business climate – Seasonal fluctuations – Continued but stabilized yield pressure • Production – The company expects a production growth (ASK) of approximately 15 % – Primarily from increasing the fleet by adding 737-800’s – Capacity deployment depending on development in the overall economy and marketplace • Cost development – Unit cost expected in the area of 0.43 – 0.44 (excluding hedged volumes) • Fuel price dependent – USD 850 pr. ton (excluding hedged volumes) • Currency dependent – USD/NOK 6.00 (excluding hedged volumes) • Based on the current route portfolio • Production dependent • Larger share of aircraft with more capacity and lower unit cost Slide: 16 Slide: 16

Norwegian offers 294 scheduled routes to 112 destinations Slide: 18

Recommend

More recommend