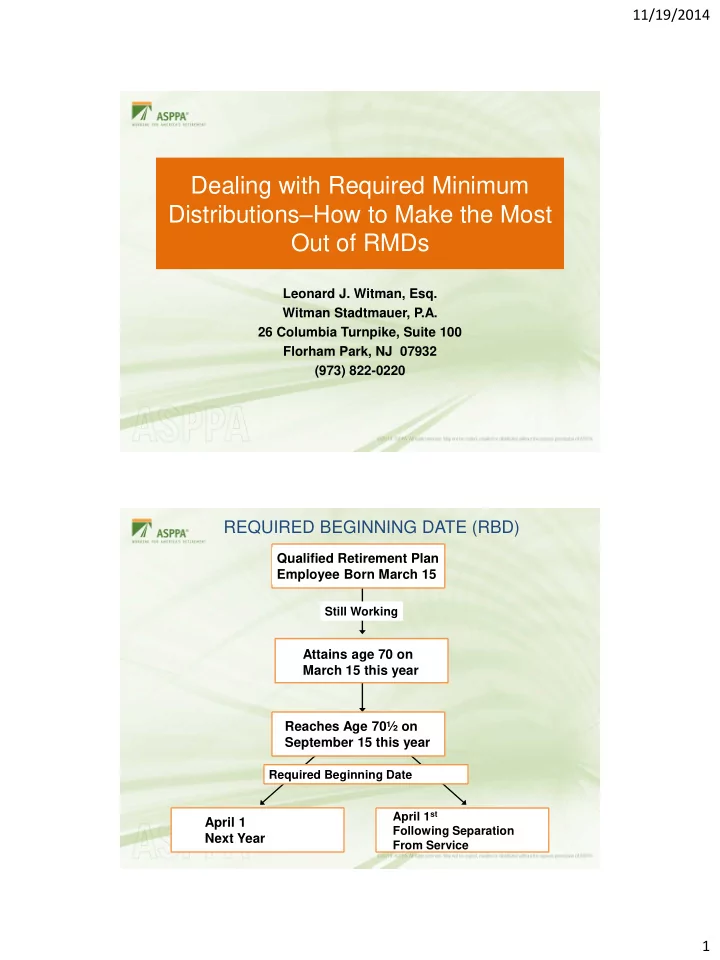

11/19/2014 Dealing with Required Minimum Distributions – How to Make the Most Out of RMDs Leonard J. Witman, Esq. Witman Stadtmauer, P.A. 26 Columbia Turnpike, Suite 100 Florham Park, NJ 07932 (973) 822-0220 REQUIRED BEGINNING DATE (RBD) Qualified Retirement Plan Employee Born March 15 Still Working Attains age 70 on March 15 this year Reaches Age 70½ on September 15 this year Required Beginning Date April 1 st April 1 Following Separation Next Year From Service 1

11/19/2014 FAILURE TO COMMENCE DISTRIBUTIONS AT THE REQUIRED BEGINNING DATE Calculation of Penalty Mr. Kugler, Age 70½ 50% Excise Tax Prior Terminated Mr. K, age 73 Keogh Plan $100,000 $100,000 RMDs not made for ages 70½ to 73 RMDs not made for: Mr. K now age 73 Age 70½ $ 3,650 Profit Sharing Plan $119,102 Age 71 3,996 Age 72 4,393 Total $12,039 RMD for age 73 - $4,824 First take $4,824 minimum distribution for RMDs current age 73 before end of year For past 3 years $12,039 50% Excise Tax on $12,039 not Excise Tax x 50% withdrawn (ages 70½ to 72) $6,020 Amount Due $ 6,020 REQUIRED BEGINNING DATE - TAKING DISTRIBUTION AT AGE 70½ RATHER THAN DEFERRING UNTIL APRIL 1 OF THE FOLLOWING YEAR Scenario 1 One Distribution Each Year 1st Year Distribution Age 70 3.65% of $300,000, or $10,950 Tax Bracket 31% 2nd Year Distribution Age 71 3.77% of $310,050 or $11,689 Tax Bracket 36% Cumulative $22,639 Distributions Year 1 and 2 Net After Tax 15,037 2

11/19/2014 REQUIRED BEGINNING DATE - TAKING DISTRIBUTION AT AGE 70½ RATHER THAN DEFERRING UNTIL APRIL 1 OF THE FOLLOWING YEAR Scenario 2 Scenario 1 Two Distributions Second Year One Distribution Each Year 1st Year Distribution Age 70 No Distribution This Year 3.65% of $300,000, or $10,950 Tax Bracket 31% 2nd Year: Two Distributions 2nd Year Distribution First for age 70: Age 71 3.77% of $300,000 or $11,310 Second for Age 71: 3.77% of $310,050 or $11,689 3.77% of $321,000 or $12,102 Tax Bracket 36% Tax Bracket 36% $23,412 $22,639 Cumulative Both in Year 2 Year 1 and 2 Distributions 14,984 15,037 Net After Tax REQUIRED BEGINNING DATE - NO DISTRIBUTION AT AGE 70½ TWO DISTRIBUTIONS THE FOLLOWING YEAR Scenario 1 One Distribution Each Year 1st Year Distribution Age 70 3.65% of $300,000, or 10,950 Tax Bracket 36% 2nd Year Distribution Age 71 3.77% of $310,050 or $11,689 Tax Bracket 28% $22,639 Cumulative Year 1 and 2 Distributions $15,424 Net After Tax 3

11/19/2014 REQUIRED BEGINNING DATE - NO DISTRIBUTION AT AGE 70½ TWO DISTRIBUTIONS THE FOLLOWING YEAR Scenario 1 Scenario 2 One Distribution Each Year Two Distributions Second Year 1st Year Distribution Age 70 No Distribution This Year 3.65% of $300,000, or 10,950 Tax Bracket 36% 2nd Year: Two Distributions 2nd Year Distribution First for age 70: Age 71 3.77% of $300,000 or $11,310 Second for Age 71: 3.77% of $310,050 or $11,689 3.77% of $321,000 or $12,102 Tax Bracket 28% Tax Bracket 28% $23,412 $22,639 Cumulative Both in Year 2 Year 1 and 2 Distributions $16,857 $15,424 Net After Tax DISTRIBUTIONS AT AGE 70½ FROM A QUALIFIED PLAN AND SEVERAL INDIVIDUAL RETIREMENT ACCOUNTS Profit Sharing Plan IRA 1 IRA 2 IRA 3 Mr. K $500,000 $100,000 $50,000 $50,000 Profit Sharing Plan 10% Yield 7% Yield 2% Yield Account CD Mutual Fund Money Market Balance Required Minimum DISTRIBUTION FOR YEAR ONE Required Calculated Calculated Calculated Withdrawal Withdrawal Withdrawal Withdrawal 3.65% of $500,000 $3,650 $1,825 $1,825 or $18,250 Actual Withdrawal Actual Withdrawal Actual Withdrawal Actual Withdrawal $18,250 $0 $0 $7,300 Total Withdrawals $25,550 (3.65% of $700,000) 4

11/19/2014 LIFETIME REQUIRED MINIMUM DISTRIBUTIONS Age of Distribution Redetermined Employee Period Applicable Percentage 70 27.4 3.65% 71 26.5 3.77% 72 25.6 3.91% 73 24.7 4.05% 74 23.8 4.20% 75 22.9 4.37% 76 22.0 4.55% 77 21.2 4.72% 78 20.3 4.93% 79 19.5 5.13% 80 18.7 5.35% 81 17.9 5.59% 82 17.1 5.85% 83 16.3 6.13% 84 15.5 6.45% 85 14.8 6.76% LIFETIME REQUIRED MINIMUM DISTRIBUTIONS Age of Distribution Redetermined Employee Period Applicable Percentage 86 14.1 7.09% 87 13.4 7.46% 88 12.7 7.87% 89 12.0 8.33% 90 11.4 8.77% 91 10.8 9.26% 92 10.2 9.80% 93 9.6 10.42% 94 9.1 10.99% 95 8.6 11.63% 96 8.1 12.35% 97 7.6 13.16% 98 7.1 14.08% 99 6.7 14.93% 100 6.3 15.87% 101 5.9 16.95% 5

11/19/2014 REQUIRED MINIMUM LIFETIME DISTRIBUTIONS AT AGE 70½ AND SUBSEQUENT IRA ROLLOVER BY SURVIVING SPOUSE Mr. K’s Beginning Distribution Applicable Income RMD Ending Age Balance Period Percentage (7%) Balance 70 $1,000,000 27.4 3.65% 70,000 (36,496) 1,033,504 71 1,033,504 26.5 3.77% 72,345 (39,000) 1,066,849 (41,674) 72 1,066,849 25.6 3.91% 74,679 1,099,854 73 1,099,854 24.7 4.05% 76,990 (44,529) 1,132,316 74 1,132,316 23.8 4.20% 79,262 (47,576) 1,164,001 75 1,164,001 22.9 4.37% 81,480 (50,830) 1,194,652 76 1,194,652 22.0 4.55% 83,626 (54,302) 1,223,975 21.2 (57,735) 77 1,223,975 4.72% 85,678 1,251,919 78 1,251,919 20.3 4.93% 87,634 (61,671) 1,277,882 79 1,277,882 19.5 5.13% 89,452 (65,532) 1,301,801 80 1,301,801 18.7 5.35% 91,126 (69,615) 1,323,313 81 1,323,313 17.9 5.59% 92,632 (73,928) 1,342,016 (78,480) 82 1,342,016 17.1 5.85% 93,941 1,357,477 16.3 (83,281) 83 1,357,477 6.13% 95,023 1,369,220 84 1,369,220 15.5 6.45% 95,845 (88,337) 1,376,728 85 1,376,728 14.8 6.76% 96,371 (93,022) 1,380,077 SIGNIFICANCE OF DESIGNATED BENEFICIARY (DB) AND THE RBD FOR THE DB The DB is the DB Individual that Mr. K’s IRA Son Inherits the IRA from the IRA Owner 6

11/19/2014 THE DESIGNATED BENEFICIARY MUST BE FINALIZED BY SEPTEMBER 30 FOLLOWING THE YEAR OF THE IRA OWNER'S DEATH Year Mr. K Died DB Brother Names Mr. K Died 1/20 RMD was taken Daughter IRA $1,000,000 Before He Died As Successor Beneficiary Year Following IRA Owner’s (Mr. K) Death No RMDs Paid DB (Brother) to Brother Daughter is Dies on 8/1 RMD will be Successor Beneficiary Paid on 12/30 If Brothers are Classified as DB RMDs Based Deceased Brother’s on Brother’s Daughter is IRA Remaining Successor Beneficiary 12.4 Year Life Expectancy IRA Has Until 9/30 of Year Following IRA Owner’s Death to Finalize Determination of DB Daughter’s Life Brother’s Daughter Mr. K Expectancy Should in Effect Become IRA Owner (36 Years) DB Used For RMDs 7

11/19/2014 THE ADVANTAGE OF INCLUDING CONTINGENT IRA BENEFICIARIES If Mr. K (Sole DB) Predeceases Mrs. K (IRA Owner) and She Does Not Name a New DB At Her Death Mrs. K’s Mrs. K’s IRA Proceeds IRA Estate Payable to Her Estate If Mrs. K Had Named Her Son as Primary and Grandson as Secondary DBs Mrs. K’s Son At Her Death IRA Designated Beneficiary If there are No Contingent Beneficiaries and Mr. K Files a Qualified Disclaimer at Her Death At Her Death Mrs. K’s Mrs. K’s IRA Proceeds IRA Estate Payable to Assume Mr. K Files Qualified Disclaimer at Her Death If Mrs. K Names Son as Primary and Grandson as Secondary DB IRA Death Proceeds Mrs. K’s Son Paid to Primary IRA Contingent Beneficiary 8

11/19/2014 IRA STRETCH OUT VIA OUTRIGHT DISTRIBUTION TO SURVIVING SPOUSE VS. ACCUMULATION QTIP TRUST ARRANGEMENT IRA Remains in Rollover to Mr. K’s If Mrs. K Mr. K’s Name Mrs. K’s IRA If QTIP IRA Is Outright QTIP Trust is Trust Age 60 At Mr. K’s DB Non-Spousal DB Is DB $1,000,000 Death First 10 Years No RMDs From Mrs. K’s RBD in Year After Mr. K’s Death Age 60 to 70 RMDs via 20 Years 24.4 Year Fixed Period Until Mrs. K’s RBD at age 70½ Next 10 Years Life Expectancy for Death To death at age 80 Mrs. K’s age 61 Via Favorable Uniform Table Mrs. K’s death in 20 years - age 80 Son is Next Beneficiary Son, Age 51 is the DB (Not DB) Maximum duration of Mrs. K Received RMDs RMD Payout 33.3 Years For 20 Years (Life Expectancy at Age 51) Son will Receive RMDs For Remaining 4.4 years SINGLE LIFE EXPECTANCY TABLE V (SPOUSAL DB) Used by Spousal Designated Beneficiary Starting Life Redetermined Applicable Age Expectancy Percentage 50 34.2 2.92% 51 33.3 3.00% 52 32.3 3.10% 53 31.4 3.18% 54 30.5 3.28% 55 29.6 3.38% 56 28.7 3.48% 57 27.9 3.58% 58 27.0 3.70% 59 26.1 3.83% 60 25.2 3.97% 61 24.4 4.10% 62 23.5 4.26% 63 22.7 4.41% 64 21.8 4.59% 9

11/19/2014 SINGLE LIFE EXPECTANCY TABLE V (SPOUSAL DB) Used by Spousal Designated Beneficiary Starting Life Redetermined Applicable Age Expectancy Percentage 65 21.0 4.76% 66 20.2 4.95% 67 19.4 5.15% 68 18.6 5.38% 69 17.8 5.62% 70 17.0 5.88% 71 16.3 6.13% 72 15.5 6.45% 73 14.8 6.76% 74 14.1 7.09% 75 13.4 7.46% 76 12.7 7.87% 77 12.1 8.26% 78 11.4 8.77% 10.8 9.26% 79 80 10.2 9.80% ELONGATED QUALIFIED PLAN DISTRIBUTION TECHNIQUES Summary RMDs During Mr. K’s lifetime $ 900,044 During son’s lifetime 5,325,818 During grandson’s lifetime 9,290,013 --------------- $15,515,875 10

Recommend

More recommend