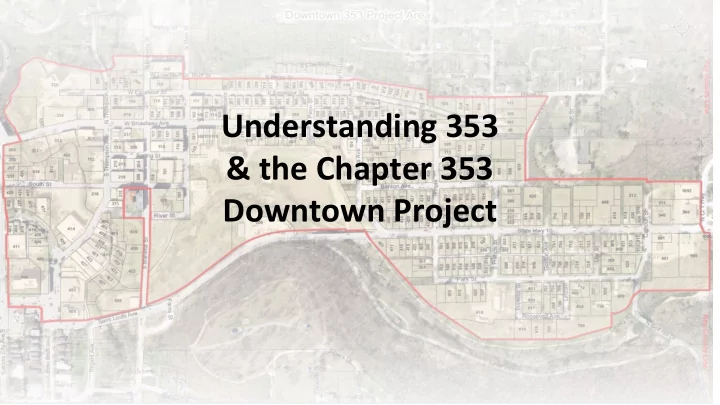

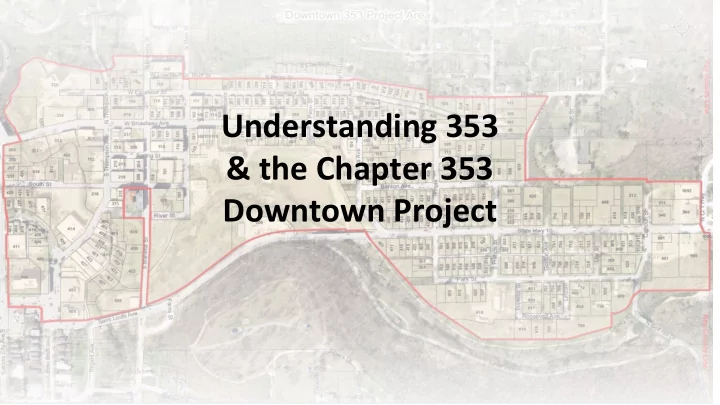

Understanding 353 & the Chapter 353 Downtown Project

What is Chapter 353? Chapter 353 tax abatement is an incentive allowed by Missouri law to encourage the redevelopment of blighted areas through the abatement of real property taxes. Purpose of Program: • Remove blight • Encourage reinvestment • Encourage Preservation • Increase home ownership • Improve the value and appearance of neighborhoods

How does it work? Tax abatement on real property taxes is available for a period of up to 25 years. During the first 10 years, the tax is a 100% abatement on the assessed value of the improvement on the property.

What does it mean to taxing partners? Taxing partners are foregoing the tax on the property with an expectation that the taxes will continue to improve over time instead of diminishing. The intent is to eliminate the blight and allow the values to improve for the benefit of the property owner and the taxing partners.

Steps in Establishing a 353 Cities must have a Urban Redevelopment Corporation (URC) established in order to provide this incentive STEP ONE Form a URC STEP TWO Determine a Redevelopment Project is needed

Property Demographics 432 Parcels 250 different owners 49 own more than one parcel 8 property owners own four or more properties 24% of the parcels are owned by government or not for profit organizations

Definition of Blighted Area: “Blighted area, that portion of the city within which legislative authority of such city determines that by reason of age, obsolescence, inadequate or outmoded design or physical deterioration have become economic and social liabilities, and that such conditions are conductive to ill health, transmission of disease, crime or inability to pay reasonable taxes.” Missouri Revised Statutes 353.020

Dangerous Buildings: 67% of the City’s dangerous buildings are within the 353 boundaries. Renter Occupancy: Renter occupancy is trending upward. Excelsior Springs rent occupancy continues to trend higher than Clay County’s numbers. Home Ownership: Home ownership has been declining since 2000.

City’s Comprehensive Plan Addresses Needs of Community Neighborhood Conservation: Excelsior Springs should implement neighborhood conservation programs, including an aggressive residential rehabilitation program. Excelsior Springs should develop rehabilitation programs to promote the stabilization of housing stock that is in need of significant rehabilitation. These programs should emphasize the leveraging of private funds to extend the use of scarce public resources.

STEP THREE Development Plan Plan addresses the redevelopment of homes and commercial properties within the boundaries. Requirements: Minimum of $3,500 spent on the exterior of the home or $15,000 of the commercial property. Abatement period = 10 years or project cost (whichever is less). In some cases, additional abatement years can be obtained by addressing public needs such as sidewalk improvements. Each project is a redevelopment plan with a separate development agreement between the City and the property owner. Development agreements require that blight be removed from the property in order to receive the abatement.

WHAT QUALIFIES EXTERIOR INTERIOR ▪ Masonry work • Painting ▪ Paint • Plumbing ▪ Chimney repair • Insulation ▪ Window/Door replacement • Electrical Work ▪ Roof • Flooring ▪ Landscaping/fencing • Heating/HVAC

Downtown Excelsior Springs 353 Redevelopment Plan Tax Impact Analysis (Assumptions) Taxing Jurisdictions Tax Rate State Levy 0.0300 Clay County Services 0.1566 County/Handicap 0.1182 County/Mental Health 0.0985 County/Senior Citizens 0.0491 County/Health 0.0985 Library District 0.3153 Excelsior Springs School District 5.1044 City/General Fund 0.6408 City/Parks and Recreation 0.3608 City/Hospital 0.1804 Total Residential Rate 7.1526 County Sur Tax 1.5900 Total Commercial Rate 8.7426

Downtown Excelsior Springs 353 Redevelopment Plan Tax Impact Analysis (Assumptions) Downtown Residential Abatement Schedule Year First Abatement Activated 2018 Year Last Abatement Activated 2027 Downtown Commercial Abatement Schedule Year First Abatement Activated 2018 Year Last Abatement Activated 2032 Downtown Property Values Initial Appraised Value Land (2017) 4,440,600.00 Initial Appraised Value Improvements (2017) 27,519,800.00 Initial Assessed Value Land 657,535.20 Initial Assessed Value Improvements 4,039,144.80

Downtown Excelsior Springs 353 Redevelopment Plan Tax Impact Analysis 353 Benefit Summary Taxes Paid incl Taxes Paid No Taxes Paid Value of Tax District Improvement Project with 353 Abatement Impact w/o 353 Total 10,204,974 10,382,329 2,225,865 177,356 12,608,194 Note: As each taxing district calculates their annual tax rate, the process in place to ensure a taxing district does not realize a windfall in tax revenue because of an increase in property value is to lower the tax rate so tax revenues do not increase greater than the cost of living. Likewise, when there is a decrease in property values, the tax rate is increased so the taxing district does not experience a loss in tax revenues

How Utilizing Multiple Programs for Home Improvement Can Assist Over the age of 62: Annual Income: $32,000 Annual Property Tax: $ 800 Amount Spent on Rehab: $20,000 Funding Options: USDA: Grant $ 7,500 USDA: 1% Loan $13,500 Loan Payment: $62.09 353 Tax Abatement $800/annually ($66.66/Monthly) Additional Outlay above Abatement: $-4.00 Other Savings and Opportunities: Ameren Energy Efficiency Savings PACE Funding for Energy Efficiency Improvements Utility Savings

How Utilizing Multiple Programs for Home Improvement Can Assist Family of Four: Annual Income: $32,000 Annual Property Tax: $ 800 Amount Spent on Rehab: $20,000 Funding Options: USDA: 1% Loan $20,000 Loan Payment: $91.98 353 Tax Abatement $800/annually ($66.66/Monthly) Additional Outlay above Abatement: $25.32 Other Savings and Opportunities: Ameren Energy Efficiency Savings PACE Funding for Energy Efficiency Improvements Utility Savings

QUESTIONS?

Recommend

More recommend