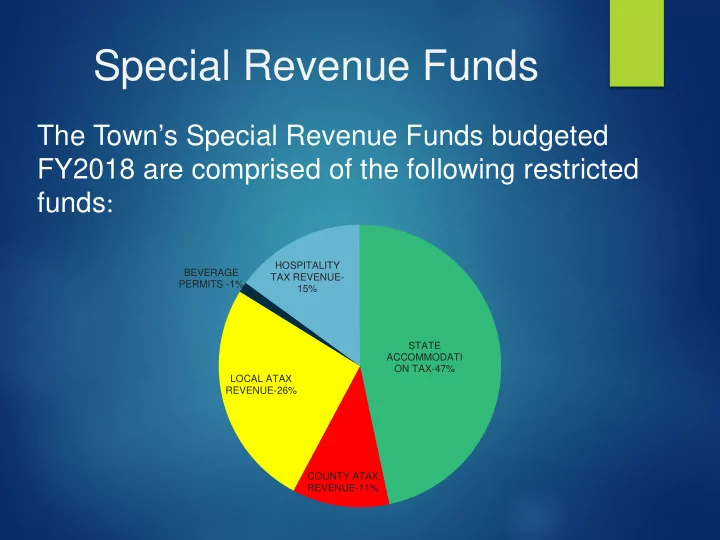

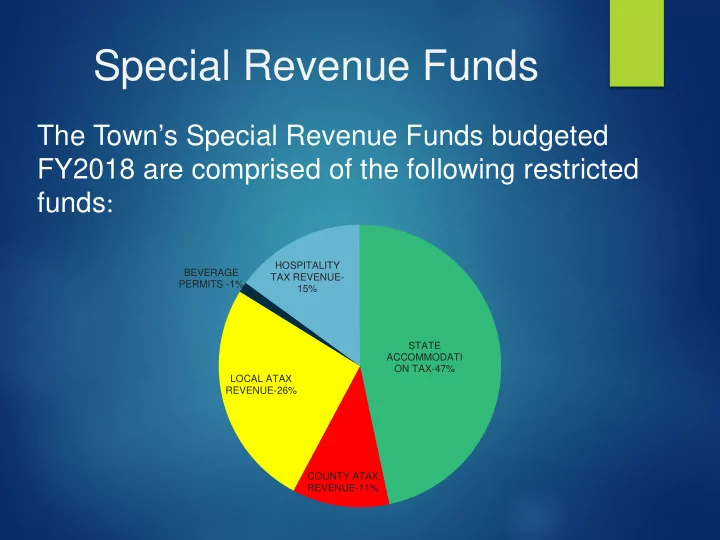

Special Revenue Funds The Town’s Special Revenue Funds budgeted FY2018 are comprised of the following restricted funds : HOSPITALITY BEVERAGE TAX REVENUE- PERMITS -1% 15% STATE ACCOMMODATI ON TAX-47% LOCAL ATAX REVENUE-26% COUNTY ATAX REVENUE-11%

Special Funds SC Code of Laws restricts use of special fund revenues to the following purposes: (1) tourism-related buildings including, but not limited to, civic centers, coliseums, and aquariums; (2) tourism-related cultural, recreational, or historic facilities; (3) beach access, renourishment, or other tourism-related lands and water access; (4) highways, roads, streets, and bridges providing access to tourist destinations; (5) advertisements and promotions related to tourism development; or (6) water and sewer infrastructure to serve tourism-related demand. (1) In a county in which at least nine hundred thousand dollars in accommodations taxes is collected annually pursuant to Section 12-36-920, the revenues of the local accommodations tax authorized in this article may also be used for the operation and maintenance of those items provided in (A)(1) through (6) including police, fire protection, emergency medical services, and emergency-preparedness operations directly attendant to those facilities.

Special Funds-Fund Balances, Last Five Fiscal Years 4,500,000 4,000,000 3,500,000 3,000,000 2,500,000 2,000,000 1,500,000 1,000,000 500,000 - F Y2013 F Y2014 F Y2015 F Y2016 F Y2017 F Y2018 Budg e te d SAT AX CAT AX L AT AX Ho spita lity T a x Be ve ra g e T a x Ca pita l Pro je c ts

Special Re ve nue F unds State Accommodation Tax- An accommodation tax is a tax on gross proceeds derived from the rental or charges for accommodations furnished to transients. South Carolina state law allows the State to impose 2% accommodation tax. The state distributes about 85% of the amount it collects to the municipalities. Revenues from this tax must be spent on advertising and promotion of tourism and tourism related activities except for the first $25K plus 5% of the remaining total revenues which is allocated to GF and is not restricted. This revenue has also a time restriction and needs to be spent within 2 years of receipt.

Special Revenue Funds County Ac c ommoda tion T a x Re ve nue - Charleston Co unty le vie s 2% a c c o mmo da tio n ta x, o f whic h po rtio n is la te r disb urse d to the munic ipa litie s whe re the y we re e a rne d . T he T o wn ha s b e e n re c e iving 20% o f the fe e s c o lle c te d , c o nting e nt o n the use o f the mo ne y o n c a pita l pro je c ts o r se rvic e s tha t will pro mo te to urism in Cha rle sto n Co unty. T he T o wn use s tho se funds ma inly fo r b e a c h mo nito ring a nd re pa irs, b e a c h pa tro l a nd e nviro nme nta l pro je c ts.

Special Revenue Funds Local Accommodation Tax- As allowed by South Carolina law, the Town levies 1% municipal local accommodation tax. These fees are remitted to the Town by the City of Charleston monthly. Revenues from this tax are used mainly on operations of Environmental department, cultural events, partial deputies cost, beach upkeep and reserves for future beach projects.

Special Revenue Funds Hospitality Tax- Hospitality tax is paid by the consumer or patrons of the restaurants, grocery stores, convenience stores and any other establishments that sell prepared food and beverages; 1% tax is remitted to the Town by the required businesses on monthly basis. The Town uses those funds for island beautification and reserves for future capital projects.

Special Revenue Funds ax- Sta te la w a llo ws the sta te to Beverage T issue a lc o ho lic b e ve ra g e pe rmits to a utho rize d o rg a niza tio ns. Pe rmits a re va lid fo r 52 we e k pe rio d a nd ha ve $3K filing fe e . T he se funds a re furthe r distrib ute d to the munic ipa litie s in whic h the re ta ile r who pa id the fe e is lo c a te d. T he T o wn use s tho se funds fo r re se rve s fo r future c a pita l pro je c ts.

Recommend

More recommend