H1 2020 REVENUE Nicolas VALTILLE Stphanie BIA 27th JULY 2020 H1 - PowerPoint PPT Presentation

H1 2020 REVENUE Nicolas VALTILLE Stphanie BIA 27th JULY 2020 H1 2020 REVENUE H1 2020 REVENUE TAKEAWAYS Solid performance of Data H1 revenue slightly below Respons & accelerated expectations diversification Strong cash flow Early

H1 2020 REVENUE Nicolas VALTILLE Stéphanie BIA 27th JULY 2020

H1 2020 REVENUE H1 2020 REVENUE – TAKEAWAYS Solid performance of Data H1 revenue slightly below Respons & accelerated expectations diversification Strong cash flow Early stage signs of gradual generation despite recovery with revenue decrease lowest point reached in May 2 27th JULY 2020

H1 2020 REVENUE Q2 2020 HI G HLI G HTS 3 27th JULY 2020

H1 2020 REVENUE Q2 2020 AT A GLANCE (reported growth) -20.9% -42.1% -31.1% €352.0M* €74.5M €111.4M GROUP GERMANY FRANCE -21.1% +16.5%** -23.4% €45.8M €59.7M €60.6M DATA RESPONS INTERNATIONAL NORTH AMERICA * Including Data Respons, consolidated since March 1st, 2020. ** Pro forma constant growth. Pro forma revenue: Organic + Data Respons revenue since 1st Jan 2019. 4 27th JULY 2020

H1 2020 REVENUE H1 2020 AT A GLANCE (reported figures except for Data Respons) -12.7% -28.7% -20.1% €778.0M* €181.3M €264.2M GROUP GERMANY FRANCE -9.4% +16.8%** -15.3% € 96.3 M** €130.4M €138.1M DATA RESPONS INTERNATIONAL NORTH AMERICA * Including Data Respons, consolidated since March 1st, 2020. ** Pro forma constant revenue & growth. Pro forma revenue: Organic + Data Respons revenue since 1st Jan 2019. Data Respons revenue: consolidated revenue from 1st March 2020: €64M – pro forma constant revenue: €96.3M 5 27th JULY 2020

H1 2020 REVENUE REVENUE BY QUARTER 469.0 443.7 446.3 445.2 441.1 425.9 357.6 353.9 358.0 349.8 352.0 328.3 338.2 310.3 299.5 285.6 268.3281.8272.9 254.4 226.1 235.6 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 6 27th JULY 2020

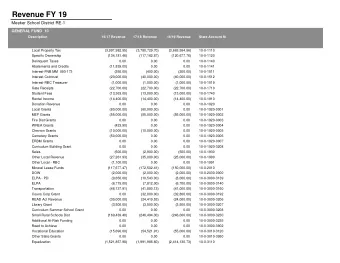

H1 2020 REVENUE H1 2020: BY BU PRO FORMA H1 2020 H1 2019 REPORTED ORGANIC €M CONSTANT REVENUE REVENUE GROWTH (%) GROWTH (%) GROWTH (%) FRANCE 264.2 330.8 -20.1% -20.1% -20.1% GERMANY 181.3 254.3 -28.7% -28.7% -28.7% NORTH AMERICA 138.1 152.4 -9.4% -11.6% -11.6% INTERNATIONAL 130.4 153.9 -15.3% -15.4% -15.4% - - - DATA RESPONS 64.0 +16.8% TOTAL GROUP 778.0 891.4 -12.7% -20.3% -17.1% 7 27th JULY 2020

H1 2020 REVENUE H1 2019 - 2020: GEO DIVERSIFICATION North North America America France France 17% 17% 34% 37% Nordics 6% H1 2020 H1 2019 € 778.0M € 891.4M Intl Germany Intl Germany 17% 26% 17% 29% 8 27th JULY 2020

H1 2020 REVENUE H1 2020: SECTOR DIVERSIFICATION Others 10% ORGANIC GROWTH Telco 5% (H1 2020) Automotive 29% Life sciences 6% Energy Mobility H1 2020 5% Aero Railways Auto € 778.0M 74% Railways -15 % +1 % -32 % 5% Suppliers 9% Energy Life Sciences Telco Aerospace -4% -14 % +54 % 31% 9 27th JULY 2020

H1 2020 REVENUE OUTLOOK 10 27th JULY 2020

H1 2020 REVENUE OUTLOOK FOR 2020 H1 2020 revenue and profit impacted by the crisis H1 revenue slightly below expectations as low point occurred in May rather than April Profit from ordinary operations to be negative for the half Significant one- off costs to be expected (More than €40M related to the COVID 19 situation and €10M resulting from the roll -out of Fit-2-Clear Now performance plan) Early stage signs of recovery Visibility gradually improving although remaining limited for large accounts Confidence in gradual recovery still expected in Q3 and then Q4 11 27th JULY 2020

H1 2020 REVENUE FINANCIAL STRUCTURE Financial Capacity protected Immediate measures taken from the outset the crisis Cash collection and charges deferral measures positively impacted the cash position Strong cash flow generated in the first half despite important revenue drop Solid financial structure Deterioration of the Net Debt contained in spite of Data Respons being cashed out in H1 Leverage ratio as of June 30 th to be well below 4.5 times Various options being worked out to benefit from the soundest possible balance sheet structure 12 27th JULY 2020

H1 2020 REVENUE THANK YOU! NEXT PUBLICATION – H1 2020 RESULTS ON SEPTEMBER 10, 2020 13 27th JULY 2020

H1 2020 REVENUE CONTACT akka-technologies @akka_tech AKKATechnologies1 akka-technologies.com 14 27th JULY 2020

H1 2020 REVENUE GLOSSARY Cash flow from operations before tax and Operating profit: profit form ordinary activities financing costs (EBITDA): operating profit adjusted calculated before non-recurring items and for additions to depreciation and amortization. expenses relating to stock options and free shares. EPS (Earnings Per Share): group net income divided Operating margin: ratio of operating profit to by weighted average number of shares revenue. outstanding less treasury stocks. Organic growth: Revenue growth at constant Free cash flow: EBITDA +/- change in working scope and exchange rates. capital – net financial charges and taxes paid – capex. Free cash flow generation is measured as % Pro forma constant growth: Organic growth + Data Respons revenuesince 1 st January 2019 of total revenue. Leverage: ratio of net consolidated financial debt to EBITDA. Net Debt: The aggregate of cash and cash equivalents, overdrafts and short-term bank borrowings, non-current and debt, and financial instruments. surplus cash/(net debt) does not include non-current and current lease obligations (IFRS 16 impact). 15 27th JULY 2020

H1 2020 REVENUE DISCLAIMER This presentation does not contain or constitute an offer of securities for sale or an invitation or inducement to invest • in securities in France, the United States or any other jurisdiction. This presentation may contain information expressed as forward-looking statements. Forward-looking statements are • statements that are not historical facts. Forward-looking statements may include anticipations, projections and their underlying assumptions as well as statements (regarding plans, objectives, expectations and intentions, future financial results, potential events, operations, services, products). Such information concerns either trends or targets and cannot be regarded as results forecasts or as any other performance indicator. This information is by nature subject to risk and uncertainty, that may cause the actual results to differ from those • mentioned in the forward-looking statements. Even though AKKA Group’s management believes that the expectations reflected as of the date of this presentation in such forward-looking statements are reasonable, this information does not reflect the Group's future performance and is not intended to give any assurances or comfort as to future results. Therefore no-one should unduly rely on these forward-looking statements. The AKKA Group makes no commitment to update this information. More comprehensive information on the AKKA Technologies Group may be obtained on our website. • 16 27th JULY 2020

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.