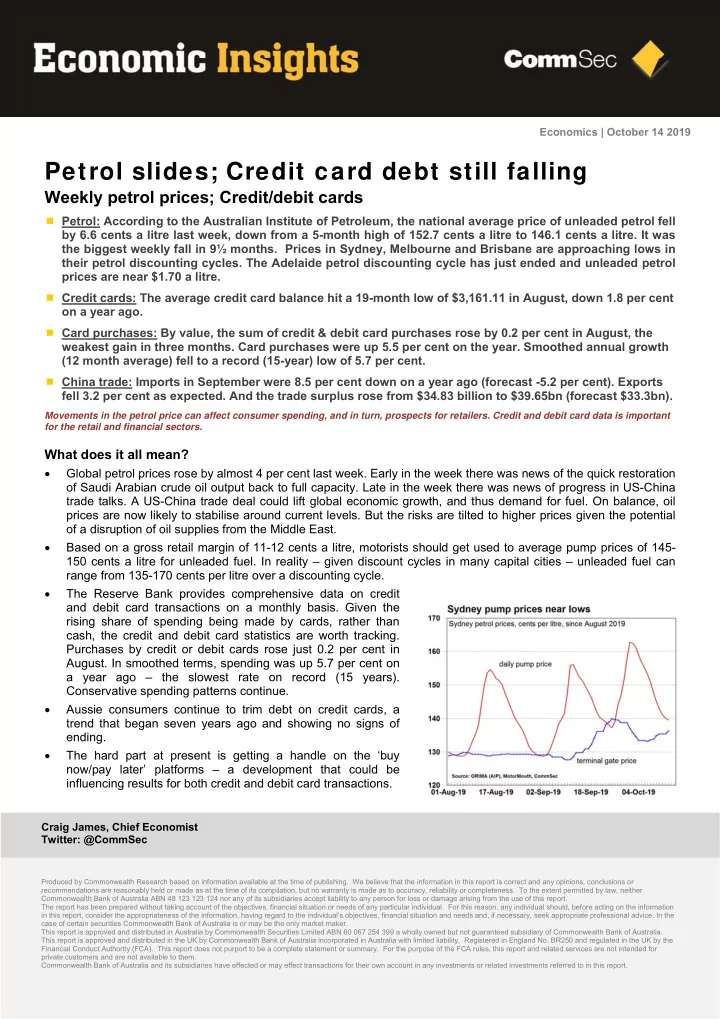

Economics | October 14 2019 Petrol slides; Credit card debt still falling Weekly petrol prices; Credit/debit cards Petrol: According to the Australian Institute of Petroleum, the national average price of unleaded petrol fell by 6.6 cents a litre last week, down from a 5-month high of 152.7 cents a litre to 146.1 cents a litre. It was the biggest weekly fall in 9½ months. Prices in Sydney, Melbourne and Brisbane are approaching lows in their petrol discounting cycles. The Adelaide petrol discounting cycle has just ended and unleaded petrol prices are near $1.70 a litre. Credit cards: The average credit card balance hit a 19-month low of $3,161.11 in August, down 1.8 per cent on a year ago. Card purchases: By value, the sum of credit & debit card purchases rose by 0.2 per cent in August, the weakest gain in three months. Card purchases were up 5.5 per cent on the year. Smoothed annual growth (12 month average) fell to a record (15-year) low of 5.7 per cent. China trade: Imports in September were 8.5 per cent down on a year ago (forecast -5.2 per cent). Exports fell 3.2 per cent as expected. And the trade surplus rose from $34.83 billion to $39.65bn (forecast $33.3bn). Movements in the petrol price can affect consumer spending, and in turn, prospects for retailers. Credit and debit card data is important for the retail and financial sectors. What does it all mean? Global petrol prices rose by almost 4 per cent last week. Early in the week there was news of the quick restoration of Saudi Arabian crude oil output back to full capacity. Late in the week there was news of progress in US-China trade talks. A US-China trade deal could lift global economic growth, and thus demand for fuel. On balance, oil prices are now likely to stabilise around current levels. But the risks are tilted to higher prices given the potential of a disruption of oil supplies from the Middle East. Based on a gross retail margin of 11-12 cents a litre, motorists should get used to average pump prices of 145- 150 cents a litre for unleaded fuel. In reality – given discount cycles in many capital cities – unleaded fuel can range from 135-170 cents per litre over a discounting cycle. The Reserve Bank provides comprehensive data on credit and debit card transactions on a monthly basis. Given the rising share of spending being made by cards, rather than cash, the credit and debit card statistics are worth tracking. Purchases by credit or debit cards rose just 0.2 per cent in August. In smoothed terms, spending was up 5.7 per cent on a year ago – the slowest rate on record (15 years). Conservative spending patterns continue. Aussie consumers continue to trim debt on credit cards, a trend that began seven years ago and showing no signs of ending. The hard part at present is getting a handle on the ‘buy now/pay later’ platforms – a development that could be influencing results for both credit and debit card transactions. Craig James, Chief Economist Twitter: @CommSec Produced by Commonwealth Research based on information available at the time of publishing. We believe that the information in this report is correct and any opinions, conclusions or recommendations are reasonably held or made as at the time of its compilation, but no warranty is made as to accuracy, reliability or completeness. To the extent permitted by law, neither Commonwealth Bank of Australia ABN 48 123 123 124 nor any of its subsidiaries accept liability to any person for loss or damage arising from the use of this report. The report has been prepared without taking account of the objectives, financial situation or needs of any particular individual. For this reason, any individual should, before acting on the information in this report, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice. In the case of certain securities Commonwealth Bank of Australia is or may be the only market maker. This report is approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399 a wholly owned but not guaranteed subsidiary of Commonwealth Bank of Australia. This report is approved and distributed in the UK by Commonwealth Bank of Australia incorporated in Australia with limited liability. Registered in England No. BR250 and regulated in the UK by the Financial Conduct Authority (FCA). This report does not purport to be a complete statement or summary. For the purpose of the FCA rules, this report and related services are not intended for private customers and are not available to them. Commonwealth Bank of Australia and its subsidiaries have effected or may effect transactions for their own account in any investments or related investments referred to in this report.

Economic Insights: Petrol slides; Credit card debt still falling What do the figures show? Petrol prices On Friday , the Brent crude price rose by US$1.41 or 2.4 per cent to US$60.51 a barrel. And the US Nymex price rose by US$1.15 or 2.1 per cent to US$54.70 a barrel. Over the week Brent rose by 3.7 per cent and Nymex rose by 3.6 per cent. According to the Australian Institute of Petroleum , the national average price of unleaded petrol fell by 6.6 cents in the past week to 146.1 cents a litre – the biggest fall since the week to December 23 last year. The metropolitan price fell by 9.2 cents to 145.2 cents a litre, and the regional price fell by 1.4 cents to 147.8 cents a litre. Average unleaded petrol prices across states and territories over the past week were : Sydney (down by 13.5 cents to 145.8 c/l), Melbourne (down by 9.3 cents to 139.8 c/l), Brisbane (down by 14.2 cents to 150.4 c/l), Adelaide (down by 0.1 cents to 146.5 c/l), Perth (down by 2.6 cents to 144.7 c/l), Darwin (down by 1.0 cents to 147.6 c/l), Canberra (down by 0.2 cents to 148.7 c/l) and Hobart (up by 0.1 cents to 155.6 c/l). The smoothed gross retail margin for unleaded petrol eased from 12.44 cents a litre last week to 11.99 cents a litre (24-month average: 13.1 cents a litre). The national average diesel petrol price fell by 0.1 cents to 150.1 cents a litre over the week. The metropolitan price also fell by 0.1 cents to 148.8 cents a litre and the regional price fell by 0.1 cents to 151.1 cents a litre. The key Singapore gasoline price rose by US$1.70 last week (2.3 per cent) to US$77.00 a barrel. In Australian dollar terms, the Singapore gasoline price rose by US$2.15 (1.9 per cent) to $113.62 a barrel or 71.46 cents a litre. MotorMouth records the following average retail prices for unleaded fuel in capital cities today: Sydney 139.6c; Melbourne 137.2c; Brisbane 144.3c; Adelaide 168.6c; Perth 135.7c; Canberra 148.7c; Darwin 147.6c; Hobart 156.0c. Today, the national average wholesale (terminal gate) unleaded petrol price stands at 136.4 cents a litre, up by 3.2 cents over the week. The terminal gate diesel price stands at 136.4 cents a litre, down by 1.6 cents over the past week. Credit and debit card lending The average credit/charge card balance was $3,161.11 in August, down 1.8 per cent on a year ago. The average limit was $9,414.19, down 0.9% on a year ago. The number of credit and charge card purchases rose by 0.3 per cent in July (up 4.3 per cent annual). The value of purchases made with credit and charge cards rose by 0.5 per cent in August and was up 1.7 per cent on a year ago. Overseas purchases were down 0.6 per cent on the year but the value of domestic purchases was up 1.7 per cent on the year. (Overseas purchases represented 6.13 per cent of all purchases.) The value of personal credit and charge card transactions in August were down 0.6 per cent on a year ago while purchases on commercial credit/charge cards were up 11.4 per cent on a year ago. The value of debit card purchases fell 0.2 per cent in August but were still up 9.4 per cent on the year. By value, the sum of credit & debit card purchases rose by 0.2 per cent in August, the weakest gain in three months. Card purchases were up 5.5 per cent on the year. Smoothed annual growth (12 month average) fell to a record (15-year) low of 5.7 per cent. The number of credit and charge card accounts stood near a 5-year low in August (lowest since November October 14 2019 2

Recommend

More recommend