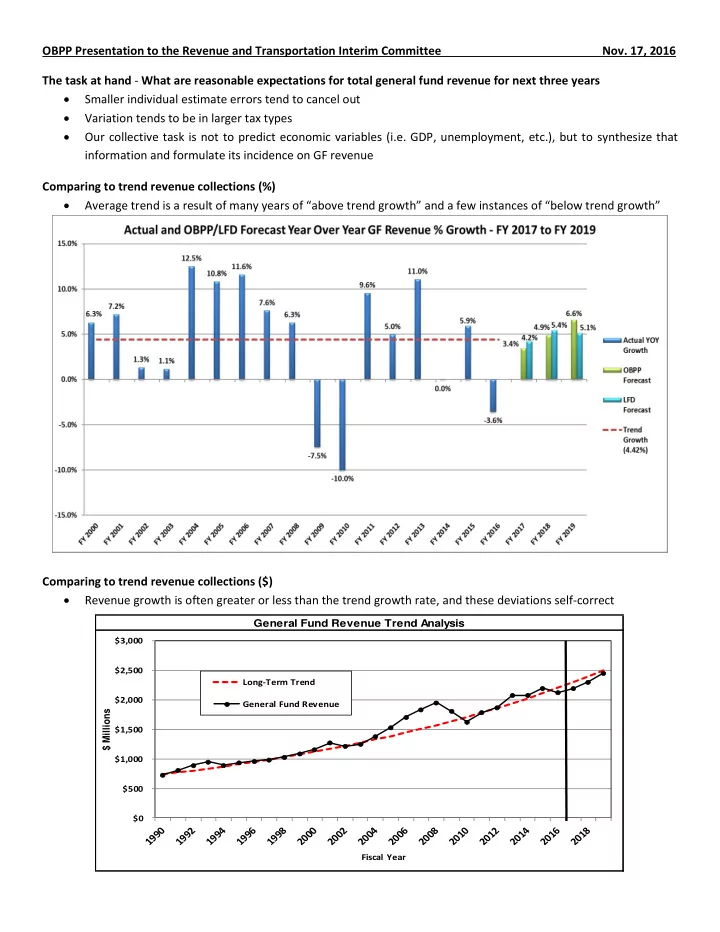

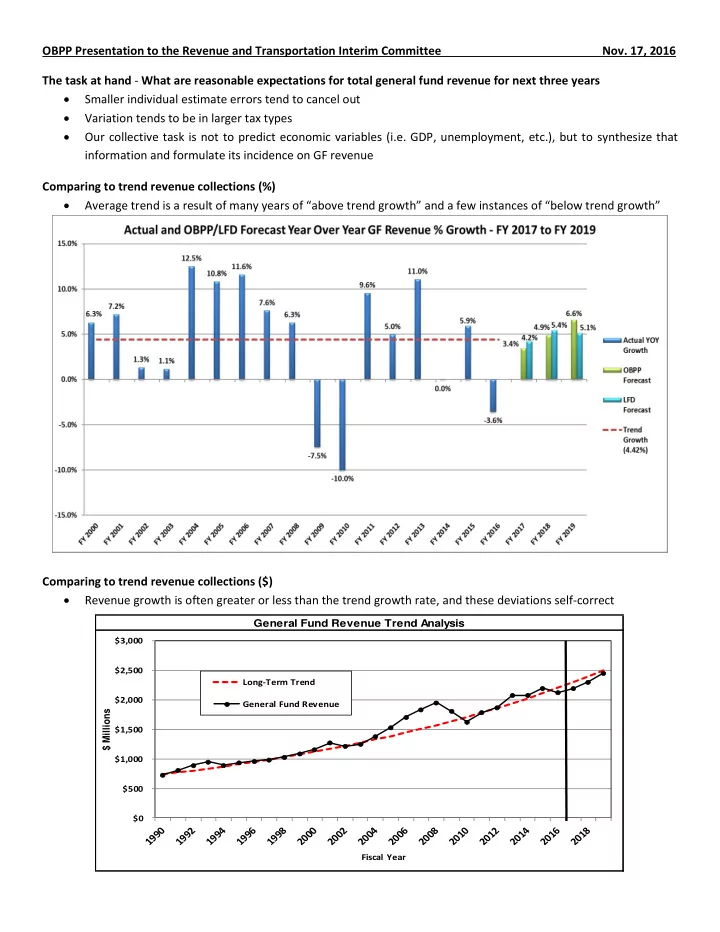

OBPP Presentation to the Revenue and Transportation Interim Committee Nov. 17, 2016 The task at hand - What are reasonable expectations for total general fund revenue for next three years Smaller individual estimate errors tend to cancel out Variation tends to be in larger tax types Our collective task is not to predict economic variables (i.e. GDP, unemployment, etc.), but to synthesize that information and formulate its incidence on GF revenue Comparing to trend revenue collections (%) Average trend is a result of many years of “above trend growth” and a few instances of “below trend growth” Comparing to trend revenue collections ($) Revenue growth is often greater or less than the trend growth rate, and these deviations self-correct General Fund Revenue Trend Analysis $3,000 $2,500 Long-Term Trend $2,000 General Fund Revenue $ Millions $1,500 $1,000 $500 $0 Fiscal Year

Year-to-Date Revenue Analysis Following is a range of estimates based on a 16-year collection YTD extrapolation methodology YTD extrapolation analysis improves as the year progresses, with the February extrapolation being the “Gold Standard” Wage Withholding as a Leading Indicator

Specific Considerations by Tax Type Individual Income Tax Wages expected to continue rising Weaker than expected revenues were in part absorption of retroactive federal tax changes (PATH Act) Consumer led growth taking hold in a sustainable manner (due to wage growth locally and nationally) Approaching full employment due to broad-based economic growth Data may be underestimating base growth in the labor sector – but we want to wait and see Corporate Income Tax PATH Act shifted bonus depreciation Corporate profits dropped in CY 2016 but are expected to rise by 2017/2018 in all IHS Markit scenarios Tax revenues will however lag due to the extension of tax advantages for corporations Vehicles Continued growth is expected in new cohort registrations The recession-induced drop in vehicle purchases leads mid cohort registrations lower Total annual light vehicle registrations grow steadily as new vehicles exceed permanent registrations Shocks to new vehicle purchases persist for many years, but the effect on revenue dampens over time Video Gambling Employment and wage gains contribute to rising Montana disposable income The percentage of disposable income spent on video gaming remains fairly constant Oil and Gas Montana Bakken oil output is declining in the absence of new wells The rate of decline in oil output will level off as wells age Oil prices rise slowly as the market returns to balance o OPEC output deal would provide lift to prices o IEA projects continued growth in world oil demand WTI and Montana prices draw closer together as transportation constraints ease due to shrinking production Natural gas production and prices remain steady due to ample domestic supply Interest Rates The Federal Reserve is expected to continue to pursue monetary policy normalization Rising employment, wages, and inflation allow the Fed to gradually increase the target range of the federal funds rate in the coming years. Long term interest rates are expected to tick upward Short-term investments owned by the State of Montana will see increased rates of return, while long-term investments will take longer to respond due to the ongoing existence of a stock of safe, relatively low-yield assets Coal Severance Total coal production is projected to rise slowly over the next three years Some export volumes are expected to come back online in the face of improving international coal prices Declining coal stocks in the electric power sector will increase domestic shipments from Montana mines

Comparison of OBPP and LFD Estimates Comparison of the General Fund Revenue Estimates by the LFD and OBPP for the 19 Biennium (Million $) Estimate FY 2017 FY 2018 FY 2019 3 Yr. Total LFD $2,209.9 $2,330.2 $2,448.9 $6,989.0 OBPP $2,194.3 $2,301.4 $2,452.6 $6,948.3 Difference $15.5 $28.8 -$3.7 $40.6 Looking Forward Major Montana - IHS Markit, Bureau of Economic Analysis, Bureau of Labor Statistics, & Federal Reserve Data Releases with their Potential Interaction with the Level of the Revenue Estimate and the Legislative Schedule IHS National Data IHS State Potential Impact Date of Possible Full OBPP Date of Legislative Release Major New Data (MT, BEA, BLS, Federal Reserve) Data on Revenue Revenue Estimate Update. Significance (2017 approximate) Release Estimate (Assumes five work days) Monday, December 15, 2016 17 Nov - Local Area Personal Income ,2015 Budget Adjustments 18 Nov - State Employment and Unemployment (October 2016) December 6-Dec-16 26 Nov - US Personal Income & Outlays Oct 2016 13-Dec-16 Minor Tuesday, December 20, 2016 29 Nov - US GDP Q3 2016 (2nd est.); Corp. Profits Q3 2016 (preliminary) Jan 2 (Day 1) 13-14 Dec - Federal Reserve Meeting and Projections 7 Dec - State GDP, Q2 2016 Jan 23 (Day 17) 7 Dec - County Employment and Wages QCEW Q2 2016 Last day for new Revenue Bills 16 Dec - State Unemployment (November 2016) January 30-Dec-16 20 Dec - State Quarterly Personal Income Q3:2016 6-Jan-17 Minor Wednesday, January 11, 2017 22 Dec - US GDP Q3 2015 (third est.) Corp Profits (revised); 2 Jan - SABHRS December Collections (including CY 2016 Withholding) Feb 24 (Day 45) mid-Jan - DOR TY 16 Protested Property taxes Transmittal of General Bills 27 Jan - US GDP - 4th quarter and Annual 2016 (advance estimate) February 7-Feb-17 31 Jan - Feb 1 Federal Reserv e Meeting 14-Feb-17 Major Tuesday, February 21, 2017 1 Feb - SABHRS January Collections (including January Annual W/H update) 30 Feb - US Personal Income , December 2016 March 19 (Day 60) Transmittal Feb 28 - US GDP , Q4 2016, & HJR 2; Annual 2016 (second estimate) 2 Mar - SABHRS February Collections; 8-Mar-17 15-Mar-17 Minor March 27 (Date 67) Wednesday, March 22, 2017 March 9 Mar County Employment and Wages QCEW Q3 2016 Transmittal of Revenue 2 Mar - CBO Projection s\ and Appropriation Bills 14-15 Mar - Federal Reserve & Projections April 18 (Day 80), 3 Apr - SABHRS February Collections Transmittal of amended 17 Mar - CY 2016 State Employment Benchmark Revenue Bills (including HJR2) 17 Mar - January & February Montana Employment & Unemployment Monday April 25 (Monday, April 10 last da for April 7-Apr-17 28 Mar - State Annual & Quarterly Personal Income, 14-Apr-17 Major 90th Legislative Day Revenue bill hearing) Q4 2016; Sine die 30 Mar - US GDP Q4 & Annual 2016 (3rd Est.); Corporate Profits, Q4 and 2016). 3 Apr - SABHRS March Collections.

Recommend

More recommend