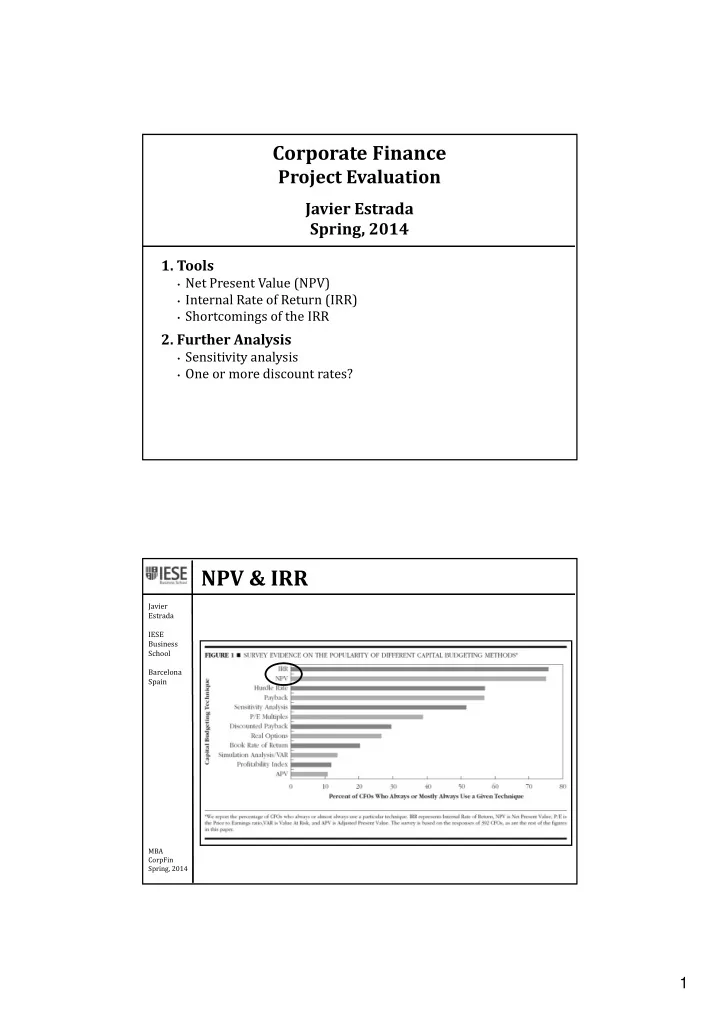

Corporate Finance Project Evaluation Javier Estrada Spring, 2014 1. Tools • Net Present Value (NPV) • Internal Rate of Return (IRR) • Shortcomings of the IRR 2. Further Analysis • Sensitivity analysis • One or more discount rates? NPV & IRR Javier Estrada IESE Business School Barcelona Spain MBA CorpFin Spring, 2014 1

IRR – Shortcomings Javier Estrada IESE Business School Barcelona Spain MBA CorpFin Spring, 2014 IRR – Shortcomings The IRR is plausible, intuitive, and widely used but … Javier Estrada IESE Business School Barcelona Spain Multiple IRRs MBA CorpFin No IRR Spring, 2014 2

IRR – Shortcomings Which of these risk‐free options would you prefer? Javier Estrada You give me $1 today, I give you back $2 next week IESE Business You give me $1m today, I give you back $1.9m next week School Barcelona Spain Scale Problem Executive takeaway The IRR is plausible, intuitive, useful, and widely used, but tricky • Therefore, when discussing a project’s IRR … think whether there will be negative CFs along the way if you are considering competing projects, keep the scale MBA CorpFin problem in mind Spring, 2014 Sensitivity Analysis Javier Estrada IESE Business School Barcelona Spain MBA CorpFin Spring, 2014 3

The Discount Rate – One or More? Which discount rate (DR) should be used? Javier Estrada The company ‐ wide DR? IESE Business Or a narrower DR? School • The DR for the relevant division or country Barcelona Spain In theory, each project should have its own DR If not, overinvestment in ‘risky’ projects and underinvestment in ‘conservative’ projects BUT, the narrower the DR, the more difficult and inaccurate is its estimation • Then the relevant question becomes: Are the projects, divisions, or countries ‘substantially’ different? If not, then use the same, company‐wide DR If yes, then estimate different DRs for different divisions MBA CorpFin or countries Spring, 2014 The Discount Rate – One or More? Which DR should be used? Javier Estrada A constant DR over time? IESE Business A time ‐ varying DR? School • The DR expected for each period Barcelona Spain In theory, each period should have its own DR, but … time‐varying DRs … • complicate the NPV calculation substantially • render the IRR approach useless can you really foresee every and each period’s DR? remember, a constant DR simply means that we get the average DR right MBA CorpFin Spring, 2014 4

The Discount Rate – One or More? Javier Estrada IESE Business School Barcelona Spain MBA CorpFin Spring, 2014 The Discount Rate – One or More? Javier Estrada IESE Business School Barcelona Spain Taken from Best Practice EVA by Bennett Stewart, 2013 MBA CorpFin Spring, 2014 5

The Discount Rate – One or More? Javier Estrada IESE Business School Barcelona Spain Taken from Best Practice EVA by Bennett Stewart, 2013 MBA CorpFin Spring, 2014 The Discount Rate – One or More? Javier Estrada IESE Business School Barcelona Spain Adapted from “Best Practices in Estimating the Cost of Capital: An Update” by Todd Brotherson, Kenneth Eades, Robert Harris, and Robert Higgins. Journal of Applied Corporate Finance, 2013. MBA CorpFin Spring, 2014 6

Recommend

More recommend