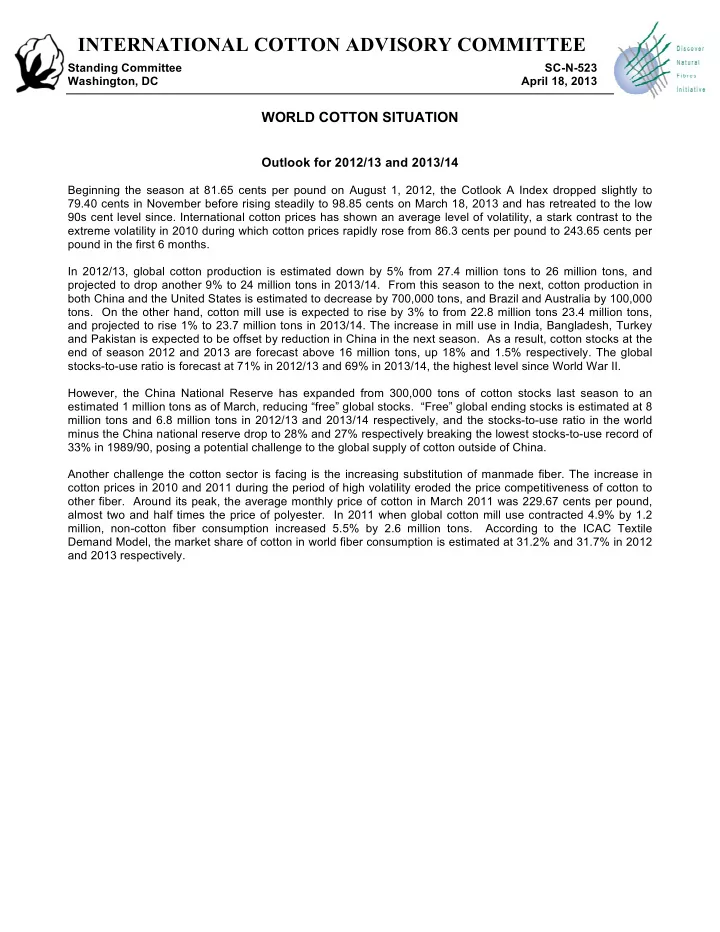

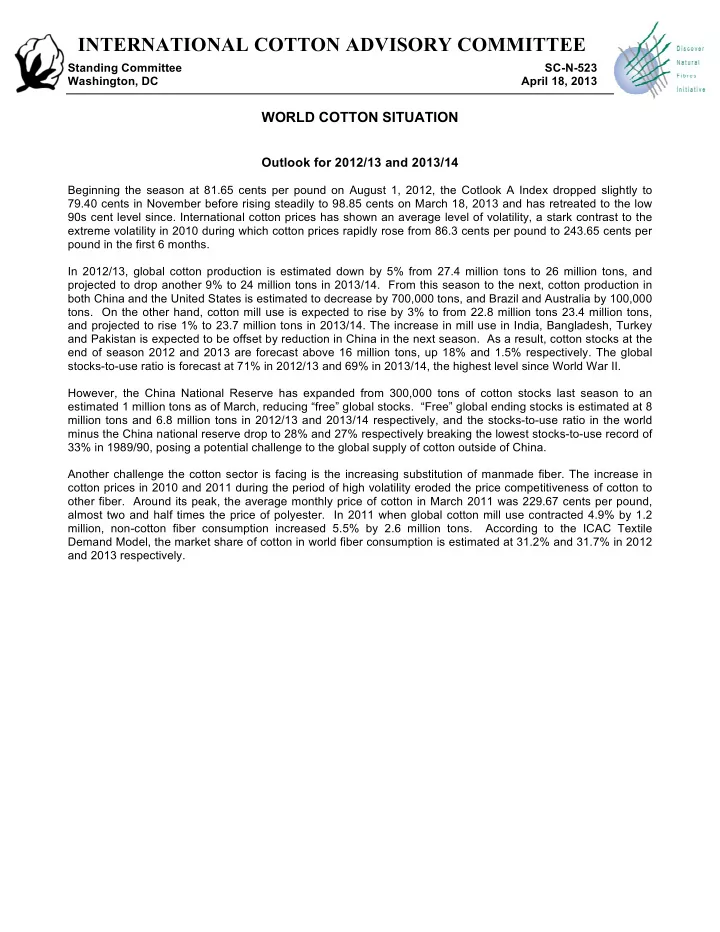

INTERNATIONAL COTTON ADVISORY COMMITTEE Standing Committee SC-N-523 Washington, DC April 18, 2013 WORLD COTTON SITUATION Outlook for 2012/13 and 2013/14 Beginning the season at 81.65 cents per pound on August 1, 2012, the Cotlook A Index dropped slightly to 79.40 cents in November before rising steadily to 98.85 cents on March 18, 2013 and has retreated to the low 90s cent level since. International cotton prices has shown an average level of volatility, a stark contrast to the extreme volatility in 2010 during which cotton prices rapidly rose from 86.3 cents per pound to 243.65 cents per pound in the first 6 months. In 2012/13, global cotton production is estimated down by 5% from 27.4 million tons to 26 million tons, and projected to drop another 9% to 24 million tons in 2013/14. From this season to the next, cotton production in both China and the United States is estimated to decrease by 700,000 tons, and Brazil and Australia by 100,000 tons. On the other hand, cotton mill use is expected to rise by 3% to from 22.8 million tons 23.4 million tons, and projected to rise 1% to 23.7 million tons in 2013/14. The increase in mill use in India, Bangladesh, Turkey and Pakistan is expected to be offset by reduction in China in the next season. As a result, cotton stocks at the end of season 2012 and 2013 are forecast above 16 million tons, up 18% and 1.5% respectively. The global stocks-to-use ratio is forecast at 71% in 2012/13 and 69% in 2013/14, the highest level since World War II. However, the China National Reserve has expanded from 300,000 tons of cotton stocks last season to an estimated 1 million tons as of March, reducing “free” global stocks. “Free” global ending stocks is estimated at 8 million tons and 6.8 million tons in 2012/13 and 2013/14 respectively, and the stocks-to-use ratio in the world minus the China national reserve drop to 28% and 27% respectively breaking the lowest stocks-to-use record of 33% in 1989/90, posing a potential challenge to the global supply of cotton outside of China. Another challenge the cotton sector is facing is the increasing substitution of manmade fiber. The increase in cotton prices in 2010 and 2011 during the period of high volatility eroded the price competitiveness of cotton to other fiber. Around its peak, the average monthly price of cotton in March 2011 was 229.67 cents per pound, almost two and half times the price of polyester. In 2011 when global cotton mill use contracted 4.9% by 1.2 million, non-cotton fiber consumption increased 5.5% by 2.6 million tons. According to the ICAC Textile Demand Model, the market share of cotton in world fiber consumption is estimated at 31.2% and 31.7% in 2012 and 2013 respectively.

4/17/2013 Cotlook A Index U.S. cents/lb 250 Outlook for World Cotton 2010/11 200 Supply and Use 2011/12 150 2012/13 2009/10 100 50 April 18, 2013 0 Aug 09 Aug 10 Aug 11 Aug 12 Cotlook A Index in 2012/13 Cotton Production U.S. cents/lb Million Tons 100 8 98.85 7.3 6.7 2012/13 95 6 5.6 5.6 2013/14 90 4 3.7 88.80 3.1 85 2.1 2.1 2 1.3 1.2 1.0 1.0 0.9 0.8 80 0 75 Aug Sep Oct Nov Dec Jan Feb Mar Apr Ma Growth in World Cotton Mill Use Cotton Mill Use 20% 10% 10% 6% 6% 7% 3% 3% 3% 2% 1% 0% 1% Million Tons 0% ‐ 7% ‐ 10% ‐ 4% 8.3 2012/13 7.9 8 ‐ 11% ‐ 20% 2013/14 00/01 02/03 04/05 06/07 08/09 10/11 12/13 6 5.2 4.7 4 Growth in World GDP 2.5 2.4 2 10% 5.3% 1.3 1.4 4.9% 4.6%5.3% 5.4% 4.8% 0.9 0.9 0.8 0.9 3.9% 3.2% 3.3%4.0% 0.7 0.7 2.3%2.9% 3.6% 2.8% 5% 0 0% ‐ 0.7% ‐ 5% 2000 2002 2004 2006 2008 2010 2012 2014 1

4/17/2013 Cotton Imports World Cotton Production & Mill Use Million tons World less China China Million tons 30 Production 10 27.4 26.0 8 25 23.7 23.5 6 23.4 22.8 Mill Use 4 20 2 15 0 03/04 05/06 07/08 09/10 11/12 13/14 03/04 05/06 07/08 09/10 11/12 13/14 Cotton Exports World Ending Stocks Million tons Million tons Stocks-to-Use Ratio 3.5 20 0.80 2010/11 3 2011/12 0.71 0.69 16 2.5 2012/13 0.62 0.60 2013/14 2 0.50 0.50 12 0.50 0.48 0.46 0.42 1.5 0.40 0.39 0.34 8 1 0.20 0.5 4 0 0 0.00 US India Brazil Australia Uzbek. 03/04 05/06 07/08 09/10 11/12 13/14 World Ending Stocks Estimated Size of China National Reserve Minus China National Reserve Million tons Stocks-to-Use Ratio Million tons 0.8 12 16 10 0.6 8 12 No estimate available 0.38 0.41 6 0.4 8 4 0.28 0.27 2 0.2 4 0 Aug ‐ 11 Oct ‐ 11 Dec ‐ 11 Feb ‐ 12 Apr ‐ 12 Jun ‐ 12 Aug ‐ 12 Oct ‐ 12 Dec ‐ 12 Feb ‐ 13 Apr ‐ 13 0 0 03/04 05/06 07/08 09/10 11/12 13/14 2

4/17/2013 World Consumption Fiber Prices of Textile Fibers US Cents/Lb. Million Tons 250 100 Polyester Staple (China) 200 Cellulosic MMF 80 Non ‐ Cellulosic MMF Cotton (A Index) 150 Wool 60 Rayon Staple (China) Cotton 100 40 50 20 0 2000 2002 2004 2006 2008 2010 2012 0 1960 1970 1980 1990 2000 2010 Sources: Cotlook Ltd for Polyester Staple and A Index; PCI Fibres for Rayon Staple Market Share of Cotton in World Textile Fiber Consumption Percentage 60 50 40 31.7 30 1975 1980 1985 1990 1995 2000 2005 2010 3

Recommend

More recommend