Implementing a Forecasting Methodology for PCT Applications at WIPO September 8 th , 2003 DEHON Catherine ∇ , ULB, ECARES VAN POTTELSBERGHE Bruno α , ULB, Solvay Business School Abstract: This paper investigates the effectiveness of several methods intending to forecast the number of yearly PCT applications at WIPO. Forecasting exercises have been applied for total PCT applications and for 5 countries accounting for more than 70 per cent of total PCT applications. So far, with the available data, the best ‘fit’ is obtained either with yearly data on total PCT and the AR(1) method (as opposed to country-specific estimations that have been subsequently aggregated for total PCT previsions) or with panel data estimates that include economic variables (GDP and R&D) for 5 countries. The forecasts of total PCT applications in 2002 range between 120 and 127 thousands units and between 140 and 150 thousands units in 2003. Several avenues for improvement are suggested, including an improved linearization of the basic series (other than logarithmic transformation), the use of sector specific data (as opposed to country-specific), and the use of national priority applications for the prevision of the forthcoming declining growth period (or ‘stationary’ period). ∇ ECARES, Faculté SOCO, Institut de Statistique, Université Libre de Bruxelles (ULB), av F.D. Roosevelt 50 CP 114, 1050 Brussels, BELGIUM. Tel: +32-2-650.3858, E-mail: cdehon@ulb.ac.be. α Solvay Business School, Université Libre de Bruxelles (ULB), Solvay SA Chair of Innovation, Centre E. Bernheim, av F.D. Roosevelt 50 CP 145/1, 1050 Brussels, BELGIUM. Tel: +32-2-650.48.99, E-mail: bruno.vanpottelsberghe@ulb.ac.be. This research was partly performed when Bruno van Pottelsberghe was visiting professor at the Institute of Innovation Research (IIR), Hitotsubashi University, Tokyo, from July 2003 to December 2003. 1

1. Introduction Since the start of the Patent Cooperation Treaty an increasing number of priority applications have gone through the PCT Process. PCT application have been booming for about twenty years now, witnessing the usefulness of allowing applicants to wait up to three years to decide whether it is worth it to enter into the international phase of protecting their inventions. For the Treaty itself the boom is a great success, but it probably creates some organisational complexities for WIPO authorities as yearly PCT applications jumped from about 5000 in the early eighties to 20.000 in the early nineties and well over 100.000 in the early 2000’s. It is well known that the statistical property of this kind of “non-stationary” series makes forecasting exercises more difficult to implement. The objective of this paper is to perform several methods intending to forecast the number of PCT applications at WIPO. Forecasting exercises are applied for total PCT applications and for 5 main countries accounting for about 80 per cent of total PCT applications. The focus is essentially put on the necessary steps required to implement an effective forecasting methodology. Table 1. Potential forecasting methods of total PCT applications. PCT Series only Economic Model Yearly Monthly GDP, RD GDP, RD Yearly and TO Total PCT √ √ √ √ Country √ √ √ √ Table 1 presents the alternative methodologies that are used in this paper to forecast the number of PCT applications. Beside the statistical methods that are to be tested, several choices have to be done to test the validity of the forecasting techniques. For instance, one can focus exclusively on the available statistical series of PCT applications, or rely on an economic model that would take into account some economic variables (such as GDP, R&D expenses). This economic model can also be improved with some indicators of technological opportunity (TO) within each country. Furthermore, one can work with yearly data, quarterly data, or monthly data. 2

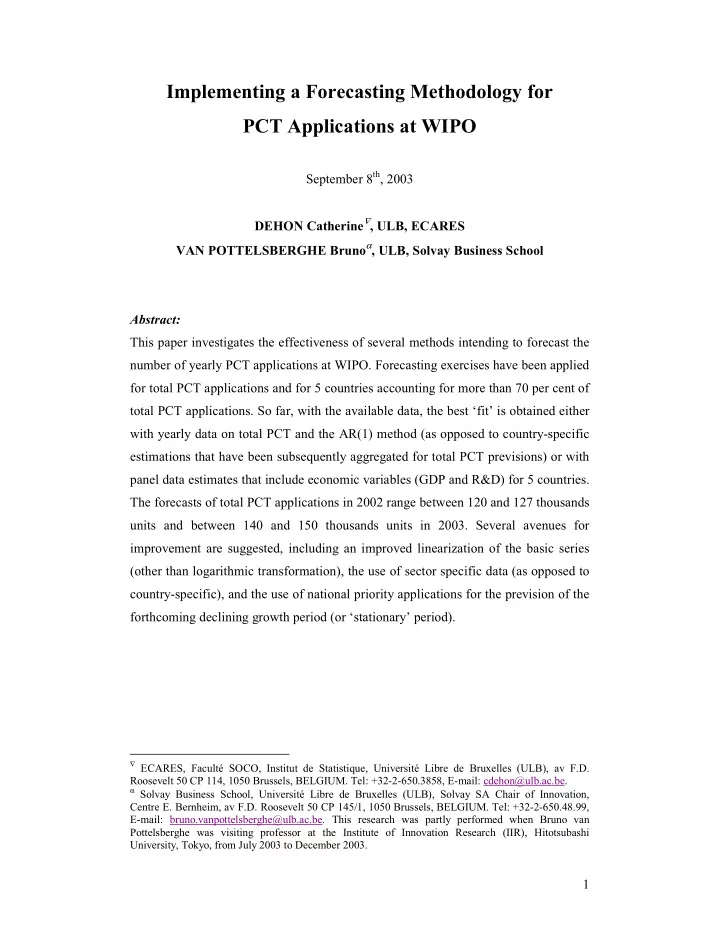

In what follows the forecasting “performance” of these methods is evaluated for both a short term prevision (1 year) and a medium term prevision (2 to 4 years). The next section presents the broad statistical properties of the PCT time series and shows that they are far from stationary. We then apply a linearization process and perform two main forecasting methods (AR(1) and trend). The tests are performed on the total PCT application yearly and on 6 individual countries (that are subsequently added to get the global view). The ‘MAPE’ method is used to assess the forecasting quality of these methods. Section 3 reproduces a similar approach but with monthly data. The economic models are estimated in Section 4. The parameters estimated for these models are then used to implement additional forecast. Section 5 is devoted to a summary of the empirical findings, including actual forecast of PCT applications for the coming years) and a discussion on the potential improvements of forecasting techniques, in terms of raw data needs and statistical methodologies. 2. Yearly time series analysis of PCT applications Figure 1 shows the annual number of PCT applications since 1978. It also gives the annual number of PCT for 6 countries and EPO priorities accounting for more than 70% of the total until 1979 and more than 80% since 1980. The first two years (1978-1979) witness the very beginning of the series and an early adaptation phase. They have therefore been dropped for the empirical exercise. The series that are used for all the forecasting methods start in 1980 and end in 2001. Figure 1 clearly shows that they follow an exponential form of the following type: PCT t = α β t + error (1) where α and β are the unknown parameters. In this equation, β represents the growth rate of PCT applications. To get a linear form of this relation, we take the logarithmic transformation (see Figure 2), hence we obtain a so called trend stationary process with a deterministic linear trend 1 : 1 A possible extension is to maximize the quality of forecast using other Box-Cox transformations. 3

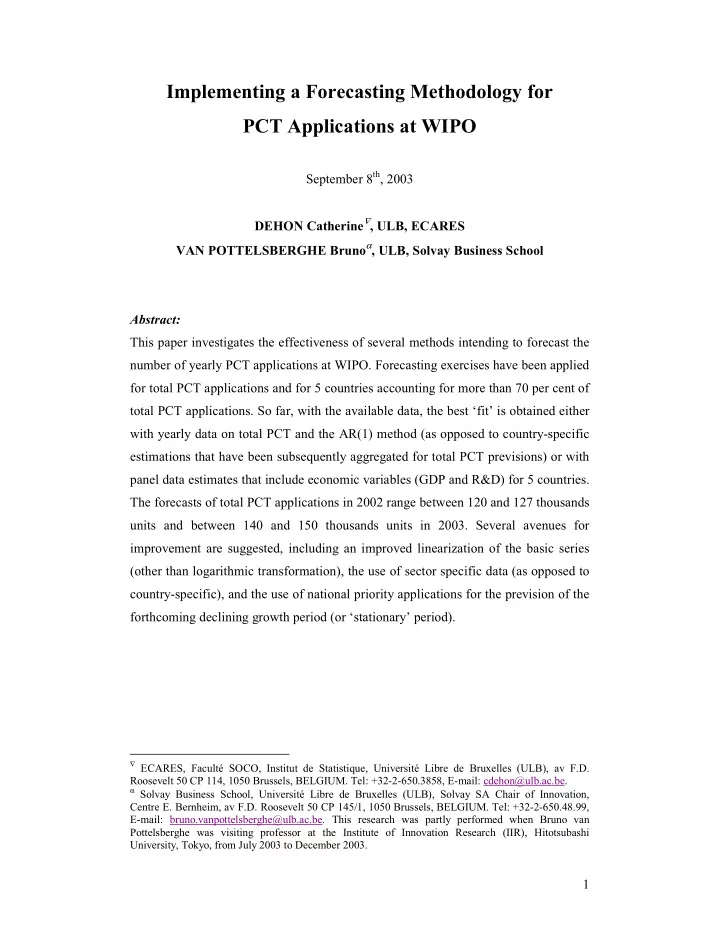

Figure 1. Annual number of PCT since 1978 (total and selected countries) 120000 50000 14000 12000 100000 40000 10000 80000 30000 8000 60000 6000 20000 40000 4000 10000 20000 2000 0 0 0 78 80 82 84 86 88 90 92 94 96 98 00 78 80 82 84 86 88 90 92 94 96 98 00 78 80 82 84 86 88 90 92 94 96 98 00 TOTAL_PCT US GERMANY 12000 8000 5000 10000 4000 6000 8000 3000 6000 4000 2000 4000 2000 1000 2000 0 0 0 78 80 82 84 86 88 90 92 94 96 98 00 78 80 82 84 86 88 90 92 94 96 98 00 78 80 82 84 86 88 90 92 94 96 98 00 JAPAN UK FRANCE 5000 1600 4000 1200 3000 800 2000 400 1000 0 0 78 80 82 84 86 88 90 92 94 96 98 00 78 80 82 84 86 88 90 92 94 96 98 00 EPO CHINA log(PCT t ) = log( α ) + log( β ) t + ε t (2) where ε t is the error term . Thanks to the well-known principle of decomposition of an additive model (with trend, without seasonality, without cycle) it is possible to implement a forecast using estimated trend. Another more flexible direction is to exploit the Box-Jenkins method which consists in modelling the series to make them stationary, to chose an appropriate model and validate the model after estimation. The class of models used are the autoregressive integrated moving averages or ARIMA processes. These processes are the classical stationary ARMA processes after applying the first difference to obtain a stationary serie. The first step consists in obtaining series which are stationary, it is to say, series with mean, variance and covariance remaining constant over time. To reach this objective, the logarithmatic transformation stabilizes the variance and the first difference stationarizes the mean (see Figure 3): ∆ PCT t = log (PCT t ) – log (PCT t-1 ) (3) 4

Figure 2. Number of PCT after logarithm transformation. 12 11 10 11 9 10 10 8 9 9 7 8 8 6 7 7 5 78 80 82 84 86 88 90 92 94 96 98 00 78 80 82 84 86 88 90 92 94 96 98 00 78 80 82 84 86 88 90 92 94 96 98 00 LTOTAL_PCT LUS LGERMANY 10 9 9 9 8 8 8 7 7 7 6 6 6 5 5 5 4 78 80 82 84 86 88 90 92 94 96 98 00 78 80 82 84 86 88 90 92 94 96 98 00 78 80 82 84 86 88 90 92 94 96 98 00 LJAPAN LUK LFRANCE 9 8 8 6 7 4 6 5 2 4 0 3 2 -2 78 80 82 84 86 88 90 92 94 96 98 00 78 80 82 84 86 88 90 92 94 96 98 00 LEPO LCHINA The transformed series ∆ PCT t is an approximation of the proportional growth rate (good approximation if the change in PCT is relatively small): − PCT PCT ∆ PCT t ≈ − t t 1 . (4) PCT − t 1 A model has to be specified for the transformed series. A usual model is the first order autoregressive one (AR(1)): ∆ PCT t = µ + γ ∆ PCT t-1 + ν t (5) where µ and γ are the unknown parameters and ν t the error term. This model seems to be a good choice for the total number of PCT. If we split the series into several country series, the model can be improved. The problem in this case is that the analysis is more complex since we use different models for each country. Performing 5

Recommend

More recommend