EXPORT CREDIT IT CONDITIONS A PRACTITIONER’S REPORT FROM THE COMMERCIAL BANKING SPHERE International Working Group meeting, 4 th February, 2015 – BRUSSELS

The European Ban ankin ing Federation – facts & fig figures 32 national Member Associations ( 28 EU, 4 EFTA countries) Plus 14 associated members, including Russia and Turkey Representing more than 4,500 banks (major cross-border and small regional entities) Serving approximately 400,000,000 customers with a network of more than 200,000 branches Member banks are contributing to EU bank lending with EUR 23,200,000,000 in 2013 ( 80 % of bank lending in Europe) 2

EBF F ad advocacy in in Export Credit it rela lated top opics • Since 1993 the EBF Export Credit Working Group has been actively supporting trade & export related discussions with regulators, export-oriented corporates, ECAs and other banks • 25 members - 12 banks and 10 representatives from national banking federations - representing 18 countries • Major priorities include Basel rules, Funding (last three years), rules and stipulations for Export Credits (Common Approaches), operational regulation (compliance, KYC, AML, sanctions etc.) • Policy Paper 2014 edition (reported on improved liquidity but reduced balance sheet capacity), next step 11 Feb discussion with cabinet of Mrs. Malmström, Commissioner for Trade • Dialogue with EU COM, EIB, EBA, ECB, OECD; WTO, support for ICC Trade Register, next step discussion with ECB 20 Feb 3

Export Credits from a commercial bank’s perspective • Interesting “niche” business for commercial banks - normally less then 1-2 % of a commercial bank’s balance sheet • For several banks Export Credits are important door openers to export/import oriented corporates, other banks follow a more opportunistic approach • Major banks in export credits have teams of up to 60-80 senior specialists , supported by sector experts, project finance specialists, middle office & others • The risk profile of export credits is very low - according to the ICC MLT Trade Register Report 2014 the exposure weighted default rate for the period from 2006 to 2012 is 0.35 %, EL 0.02 % • With the implementation of Basel III/CRR there is no favourable regulatory treatment of ECA covered export credits anymore • ECAs are safeguarding jobs in the industry – but they are also rather diverse in their export promotion approaches (legal structure and governmental backing for ECA, scope of cover, sourcing requirements & other criteria for cover, policy wordings • Export Credits are considered as countercyclical risk mitigant, oftenly used in emerging markets 4

The countercycli lical l natu ture of of Export Credits: Hermes Current Financial and economic crisis, from 2007 transformation of Eastern European economies, from 1990 „second“ oil crisis 1980 / LatAm debt crisis 1982 „first“ oil crisis 1973 Data provided 5 by HERMES

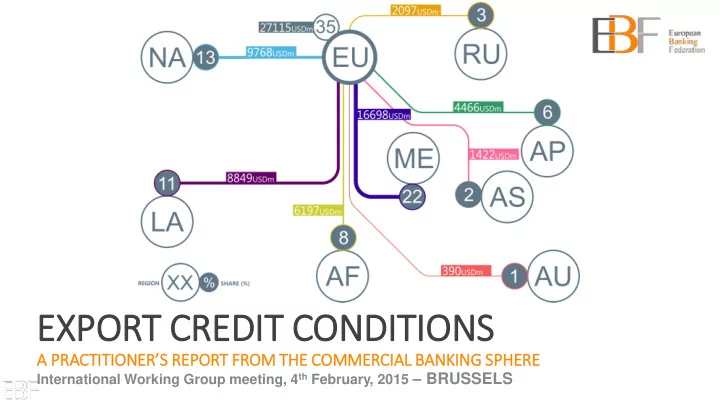

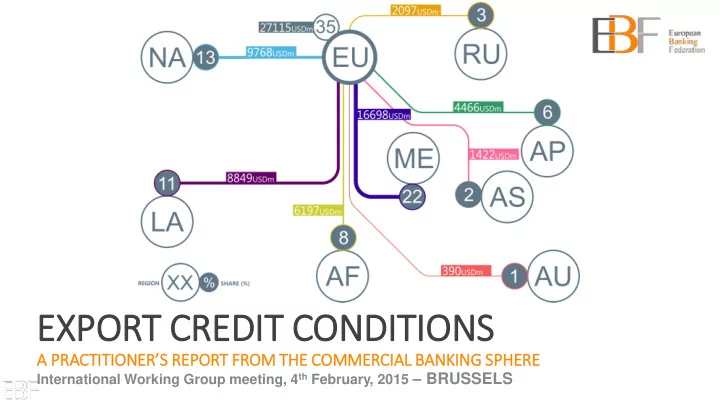

Major ECA’s and lenders in 2014 Total Export Credit volume registered in TXF data (FY 2014): 116,659.79 USDm* * Export Credit data submitted by 18 banks and some ECAs to tagmydeals – covering approx. 60-80 % of the market as a whole 6

Maj ajor bor orrowers an and destin ination cou ountrie ies in in 20 2014 14* Top 12 borrowing countries in export finance, considering the overall amount of every deal with at least one ECA or export finance tranche. * Export Credit data submitted by 18 banks and some ECAs to tagmydeals – covering approx. 60-80 % of the market as a whole 7

Sect ector & ratin ing breakdown in in Exp xport Cr Credits - 2014 res esults* The arrows indicate a volume increase or decrease in the rating band * Export Credit data submitted by 18 banks and some ECAs to tagmydeals – covering approx. 60-80 % of the market as a whole 8

EBF F su survey confirms th that MLT liq liquid idit ity has as im improved ECAs and public authorities have done a lot to support MLT liquidity in Europe Funded refi financing sol oluti tions:13 of 20 markets surveyed have funded systems Unfunded refinancing sol oluti tions: more common since the crisis, currently Belgium, France, Germany, Netherlands, Spain; securitisation guarantee model Co Covered bo bonds: various - most active markets Austria, Belgium, France, Germany, UK Pub ublic capital mark arket t tr tran ansacti tions: active markets in France, Germany, UK Di Direct t len ending: since crisis, available in 7 countries; in some cases SMEs only CI CIRR: In EU – and more widely – there are marked differences in availability and terms. Arrangement provisions now under discussion In Asia and US access to MLT liquidity was in general more stable during the recent crisis – but ECAs also offered/supported funding solutions (e.g. direct lending by US Eximbank, KEXIM, JBIC or project bonds) 9

Acc ccess to o MLT liq liquid idity for banks has im improved in in Europe 550 Spreads for 5 years 500 Funding costs over the crisis cycle 450 400 350 300 ASW (in bps) 250 200 150 GER FRA 100 Covered 50 ESP 0 SCANDI NED -50 1-Jan-07 1-Jan-08 1-Jan-09 1-Jan-10 1-Jan-11 1-Jan-12 1-Jan-13 1-Jan-14 1-Jan-15 10

Ban anks s in in Asi sia have favourable acc access to o MLT liq liquid idity USD JBIC vs USD Japanese Banks Senior Unsecured 150 Banks considered: Nomura (Baa1/BBB+/A-) 125 Mizuho (-/A/A-) Bank of Tokyo-Mitsubishi (A1/A+/A) 100 Sumitomo Mitsui (Baa2/A/A-) ASW (in bps) 75 50 25 0 -25 31-Dec-14 14-May-16 26-Sep-17 8-Feb-19 22-Jun-20 4-Nov-21 19-Mar-23 31-Jul-24 11 Japanese Banks $ Senior Unsecured JBIC $

... ...and ban anks in in US as as well! ll! USD PEFCO vs USD US Banks Senior Unsecured 150 Banks considered: Bank of America (Baa2/A-/A) 125 Merril Lynch (Baa2/A-/A) CitiGroup (Baa2/A-/A) 100 Morgan Stanley (Baa2/A-/A) ASW (in bps) 75 Goldman Sachs (Baa1/A-/A) JP Morgan (A3/A/A+) 50 Wells Fargo (A2/A+/AA- 25 0 -25 31-Dec-14 14-May-16 26-Sep-17 8-Feb-19 22-Jun-20 4-Nov-21 19-Mar-23 31-Jul-24 US Banks $ Senior Unsecured PEFCO $ 12

Maximum tenors ac accordin ing to OECD Arr rrangement Maximum term - Repayment flexibility in case of timing imbalance [1] Repayment of principal years Equal repayments. First repayment no later than 6 First repayment of principal no later than 12 months from starting 5 / 8.5 with prior Cat I country months from starting point, repayments no less point of credit, repayments no less frequently than every 12 notification frequently than every 6 months. months. MWA: 4.5 – Sov; 5 – non-Sov Cat II country 10 As above Repayment: as above; MWA: 5.25 – Sov; 6 – non-Sov Rail [2] 12 - Cat I ; 14 - Cat II As above Repayment: as above; MWA: 6.25 - Cat I; 7.25 - Cat II Repayment instalments: as above . Nuclear 18 - main plant As above Max. repayment term: 15 years; MWA: 9 First repayment of principal no later than 18 months from start, 15/18 [3] Below SDR10m: Climate change, As above repayments no less frequently than every 12 months. 5/8.5 - Cat I; 10 - Cat II renewable energy MWA: 60% max. available tenor 12 (more with prior Non-nuclear power As above MWA: 6.25 notification) Equal repayments. First repayment no later than 6 months of start, others at regular intervals of normally 6 and max.12 Ships 12 months. 12 – new; 15 - Equal repayments. First repayment no later than 3 months from start, repayments no less frequently than 3 months (or 6 Civil aircraft exceptionally for both after prior notification). With prior notification, final payment can be on a specified date. Used aircraft: max 10 Among conditions for project finance terms: first repayment no later than 24 months after starting point; MWA: 7.25 . Project finance 14 Principal may be repaid in unequal instalments; principal& interest in less-frequent than semi-ann. instalments subject to conditions. [1] “ An imbalance in the timing of the funds available to the obligor and the debt service profile available under an equal, semi-annual 13 repayment schedule ” – subject to various conditions including to Maximum Weighted Average term, and principal repayment schedule. [2] Maximum repayment term cannot exceed the useful life of the asset. [3] Carbon capture and storage – 18 years; Fossil fuel substitution and Energy efficiency – 15 years.

All ll in indiv ivid idual l tenors s of of Export Credits in in 20 2014 14* In various ECA Export Credits 2014 maximum tenors according to OECD arrangement have been used amount in mln. average tenor in years * Export Credit data submitted by 18 banks and some ECAs to tagmydeals – covering approx. 60-80 % of the market as a whole 14

Examples for or rec ecent tenors of of PRI RI dea eals in in em emerging mar arkets PRI should be seen as complimentary option for MLT Export Credits Oil Oil Oil & Gaz Energy Defense Data provided by Petrochemicals, Defense Transport Infrastructure Marine Infrastructure tenor in years 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 15

Tran ansportation se sector – ECA tenors an and alt alternatives 16

Energy & Renewables – ECA tenors & alt alternativ ives * combined cycle is under renewables 17

Petrochemic icals ls, LN LNG, min inin ing – ECA tenors & alt alternativ ives 18

Tele lecoms – ECA tenors & alt alternatives 19

Recommend

More recommend