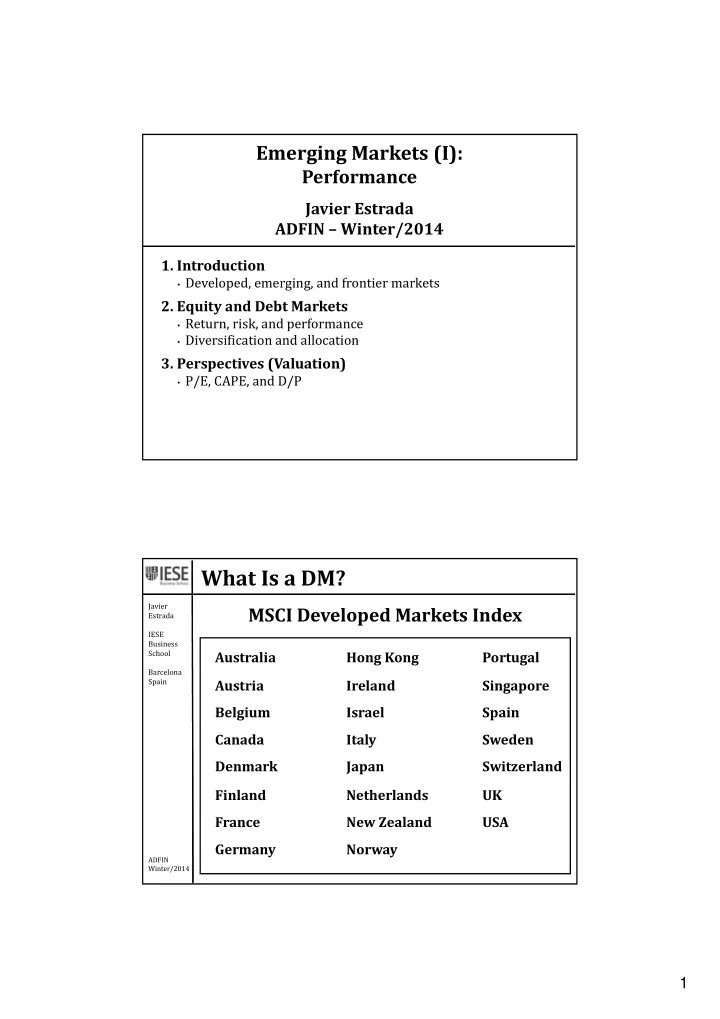

Emerging Markets (I): Performance Javier Estrada ADFIN – Winter/2014 1. Introduction • Developed, emerging, and frontier markets 2. Equity and Debt Markets • Return, risk, and performance • Diversification and allocation 3. Perspectives (Valuation) • P/E, CAPE, and D/P What Is a DM? Javier MSCI Developed Markets Index Estrada IESE Business School Australia Hong Kong Portugal Barcelona Spain Austria Ireland Singapore Belgium Israel Spain Canada Italy Sweden Denmark Japan Switzerland Finland Netherlands UK France New Zealand USA Germany Norway ADFIN Winter/2014 1

What Is an EM? Javier MSCI Emerging Markets Index (EMI) Estrada IESE Business Asia (8) EMEA (8) LatAm (5) School Barcelona Czech Rep. China Argentina Spain Egypt India Brazil Greece Indonesia Chile Hungary Korea Colombia Israel Malaysia Mexico Jordan Pakistan Peru Morocco Philippines Venezuela Poland Sri Lanka Russia Taiwan South Africa Thailand Turkey ADFIN Winter/2014 What Is an FM? Javier MSCI Frontiers Markets Index Estrada IESE Business Argentina Kuwait Romania School Barcelona Bahrain Lebanon Serbia Spain Bangladesh Lithuania Slovenia Bulgaria Mauritius Sri Lanka Croatia Morocco Tunisia Estonia Nigeria Ukraine Jordan Oman UAE Kazakhstan Pakistan Vietnam Kenya Qatar ADFIN Winter/2014 2

What is an FM? Javier Estrada IESE Business School Barcelona Spain ADFIN Winter/2014 EMs in Perspective Javier Estrada EMs are … IESE Business School Barcelona Spain 70% of the world’s population 45% of the world’s land mass 30 ‐ 35% of the world’s GDP 10 ‐ 15% of the world’s equity market cap ADFIN Winter/2014 3

EMI – Weights by Country Javier Estrada IESE CHN ‐ KOR ‐ TAI: 48% Business CHN ‐ … ‐ SAF: 66% School Barcelona Spain ADFIN Winter/2014 EMI – Weights by Region Javier Estrada IESE Business School Barcelona LatAm Spain 19% Asia EMEA 63% 18% ADFIN Winter/2014 4

2013 Returns Javier Estrada IESE Avg: –4.2% Business School EMI: –2.3% Barcelona WOR: 23.4% Spain ADFIN Winter/2014 2013 and Beyond Javier Estrada IESE Business School Barcelona Spain ADFIN Winter/2014 5

2013 and Beyond Javier Estrada IESE Business School Barcelona Spain ADFIN Winter/2014 Mean Returns (GM) Javier Estrada Avg: 11.1% IESE Business EMI: 12.1% School Barcelona WOR: 8.0% Spain ADFIN Winter/2014 6

Total Risk (SD) Javier Estrada IESE Avg: 36.9% Business Over 1/3 decrease School EMI: 23.6% Barcelona Spain WOR: 15.4% ADFIN Winter/2014 Systematic Risk (Beta, wrt World) Javier Estrada Avg: 1.17 IESE Business EMI: 1.17 School Barcelona Spain ADFIN Winter/2014 7

EMI – Performance Javier Estrada IESE Business School Barcelona Spain Avg: 17.6% ADFIN Winter/2014 EMI – Performance Javier Estrada IESE Business $100 $1,956 (GM: 12.1%) School Barcelona Spain 391% 2% 545% ADFIN Winter/2014 8

EMI – Regional Performance Javier Estrada IESE EMI: $1,956 (12.1%) Business School LatAm: $7,279 (17.9%) Barcelona Europe: $915 (8.9%) Spain Asia: $774 (8.2%) ADFIN Winter/2014 EMI – Relative – USA Javier Estrada IESE Business EMI: $1,956 (12.1%) School Barcelona Spain USA: $1,382 (10.6%) ADFIN Winter/2014 9

EMI – Relative – EUR Javier Estrada IESE Business EMI: $1,956 (12.1%) School Barcelona Spain EUR: $1,045 (9.4%) ADFIN Winter/2014 EMI – Relative – WOR Javier Estrada IESE Business EMI: $1,956 (12.1%) School Barcelona Spain WOR: $733 (8.0%) ADFIN Winter/2014 10

EMI – Relative – Last 10 Years Javier Estrada IESE EMI: $298 (11.5%) Business School EUR: $214 (7.9%) Barcelona Spain WOR: $210 (7.7%) USA: $207 (GM: 7.6%) ADFIN Winter/2014 EMI – Relative – Last 5 Years Javier Estrada IESE Business School Barcelona Spain USA: $231 (18.2%) WOR: $206 (15.5%) EMI: $202 (15.1%) EUR: $193 (14.1%) ADFIN Winter/2014 11

Diversification Benefits (2004 ‐ 13) Javier Estrada IESE Annual Diversification Gain = 2.0% CHN Business School 19.6% Barcelona Spain (28.1% , 13.9%) SPA Correlation = 0.60 11.9% 28.1% 39.0% ADFIN Winter/2014 Optimal Diversification (1993 ‐ 2012) Javier Estrada IESE Business School Barcelona Spain Highest RAR: 87% DMs , 13% EMs Correlation = 0.70 ADFIN Winter/2014 12

Diversification & Asset Allocation Javier Estrada IESE Business School Barcelona Spain ADFIN Winter/2014 Diversification & Asset Allocation Javier Estrada IESE Business School Barcelona Spain ADFIN Winter/2014 13

Diversification & Asset Allocation Javier Estrada IESE Business School Barcelona Spain ADFIN Winter/2014 EM Debt Javier Estrada IESE Business School Barcelona Spain ADFIN Winter/2014 14

EMBI – Performance Javier Estrada IESE Avg: 10.9% Business School Barcelona Spain ADFIN Winter/2014 EMBI – Performance Javier Estrada IESE $100 $652 (GM: 9.8%) Business School SD: 13.9% Barcelona Spain ADFIN Winter/2014 15

EMBI – Spreads Javier Estrada IESE 1136 (Aug/98) Business Avg: 452 School Barcelona Spain 315 156 (May/07) ADFIN Winter/2014 EM Ratings (Jan/2014) Javier Estrada IESE Business School Barcelona Spain ADFIN Winter/2014 16

EM Ratings Javier Estrada IESE Business School Barcelona Spain ADFIN Winter/2014 Growth & Returns Javier Estrada IESE Business School Barcelona Spain ADFIN Winter/2014 17

Valuation – P/E Javier Estrada IESE Jan/1/14: 12.1 Avg (1995 ‐ 2013): 13.4 Business School Barcelona Spain ADFIN Winter/2014 Valuation – CAPE Javier Estrada IESE Jan/1/14: 13.3 Avg (1995 ‐ 2013): 15.9 Business School Barcelona Spain ADFIN Winter/2014 18

Valuation – D/P Javier Estrada IESE Jan/1/14: 3.0% Avg (1995 ‐ 2013): 2.3% Business School Barcelona Spain ADFIN Winter/2014 Valuation – RDM – Next 10 Years Javier Estrada 1995 ‐ 2013 Jan/1/14 IESE Growth earnings 8.5% D/P 3.0% Business School Average P/E 13.5 P/E 12.1 Barcelona Spain Growth earnings 8.5% Assumptions ΔP/E (MR) 1.1% ΔP/E (RW) 0.0% R 1 3.0%+8.5%+1.1% = 12.6% R 1 3.0%+8.5%+0.0% = 11.5% Historical (1988 ‐ 2013): 12.1% ADFIN Winter/2014 19

Recommend

More recommend