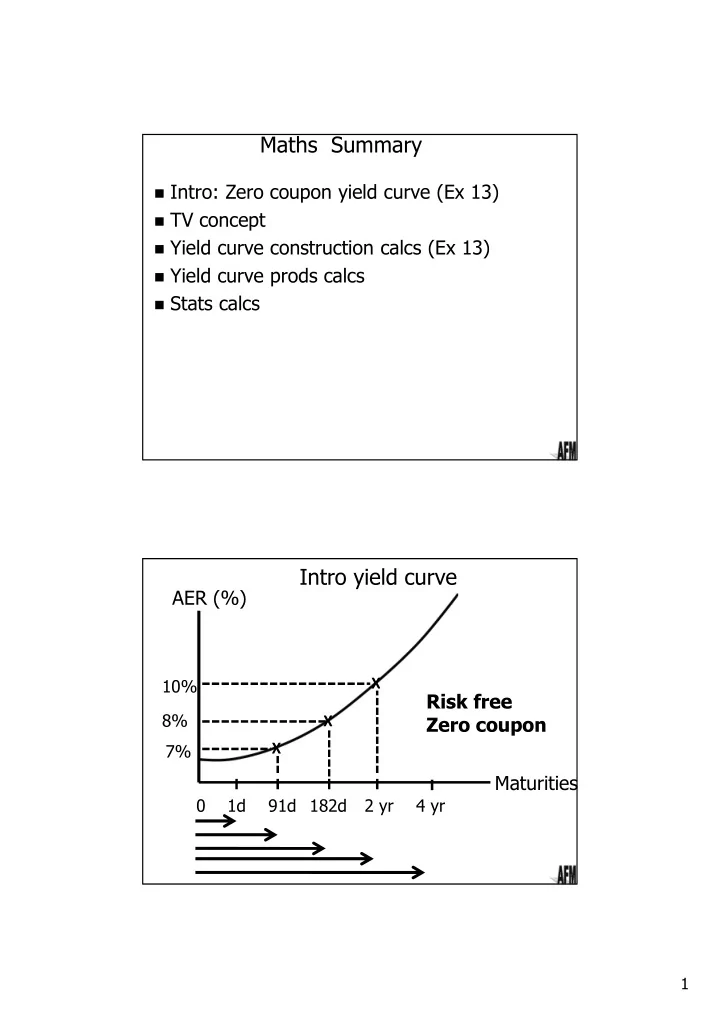

Maths Summary � Intro: Zero coupon yield curve (Ex 13) � TV concept � Yield curve construction calcs (Ex 13) � Yield curve prods calcs � Stats calcs Intro yield curve AER (%) 10% Χ Risk free 8% Zero coupon Χ 7% Χ Maturities 0 1d 91d 182d 2 yr 4 yr 1

TV Concept � Money is dated = TV R1 today ≠ R1 tomorrow � Money has to work? Why? � Earn interest (i) � Simple � Compound TV Concept John invests R5000 @ 5% simple interest rate. How much interest does he have after: a) 1 yr (365 days) b) 30 days (1 month) c) 60 days (2 months)? a) (365/365) x 5 /100 x 5000 = 250 b) (30/365) x 5/100 x 5000 = R20.5479 = R20.55 OR (1/12) x 5/100 x 5000 = R20.83 c) (60/365) x 5/100 x 5000 = R41.10 OR (2/12) x 5/100 x 5000 = R41.67 2

TV Concept John invests R5000 @ 5% NACM . How much interest does he have after: a) 1 yr (365 days) b) 30 days (1 month) c) 60 days (2 months)? Assume int. re-invested (=> PMT = 0) TV Concept 1 YR 1 month 2 months Clear All √ √ End Mode √ √ 5000 √ √ +- √ √ PV √ √ 5 I/YR √ √ √ √ 12 P/YR 12 N 1 N 2 N 0 PMT √ √ Press FV 5 255.809 5 020.83 5 041.75 Int = FV – PV = 255.81 20.83 41.75 AER?255.81 / 5000 x 100 = 5.1162 = 5.12% HP calc: 5 Nom% ; 12 P/YR; Press EFF% = 5.12%NACA 3

TV Concept P/Yr N John invests @ 10.5% � Calc some NAC M from 1 Jan11 to 1 12 18 Jul 12 AERs John invests … NAC Q � AER vs. 1 Jan11 to 1 Jul 12 4 6 Annualised John invests … NAC SA 2 1 Jan11 to 1 Jul 11 1 John invests … NA CA 1 Jan11 to 1 Jan 13 1 2 John invests … NA CM 1 Jan11 to 1 Oct11 12 9 TV Concept � Sometimes disc. Rate Disc. Rate ≠ i First convert into yield (= int. rate) Formula (disc. Rate � int. rate) 365i (365 – id) Calc see later 4

Yield curve construction Ex 13 a) 9.72 Nom%; 365 P/YR; i) Press EFF% = 10.207%NACA ii) 365 x 9.59/100 (365 – 9.59/100 x 91) = 9.825% NACQ iii) 9.825 Nom%; 4 P/YR; Press EFF% = 10.193%NACA iv) 9.96 EFF%; 2 P/YR; Press NOM% = 9.724% LT rates for prods derived in this way Yield curve construction Ex 13 a) v) 8.03 NOM%; 2 P/YR; Press EFF% = 8.191%NACA vi) 8.20 NOM%; 2 P/YR; Press EFF% = 8.368%NACA b) See next slide 5

Yield curve construction Ex 13 AER (%) Χ 10 Χ Χ 9 Χ Χ 8 Maturities 0 1d 91d 182d 2 yr 4 yr c) Negative – downwards, Lower risk (infl.) in LT d) Lower risk (infl.) in LT e)-5000 PV; 8.191 I/YR;1 P/YR; 2 N; 0 PMT; Press FV = 5852.65 Yield curve construction Ex 13 (f) AER (%) Step 1 (1 + 182/365 x 9.724/100) = 1.0484868 Χ 10 Step 2 Χ Χ (1 + 91/365 x 9.825/100) = 1.0244952 9 Χ (1.0484868/1.0244952) -1) x Χ 8 365/(182 -91) x 100 = 9.393% Maturities 0 1d 91d 182d 2 yr 4 yr ? 9.825% 9.724% 6

Yield curve prods calcs � Sign Conventions Fin Calc Inflow Outflow = + = – For below indicate + or – or 0: � PV Initial Investment amount – � PV Loan (Initial amount) + – � Repayment loan (= PMT) � Add Regular Investm (=PMT) – � Reg. inv. withdrawals (= PMT) + � Loan is pd off; FV =? 0 � Loan not pd off (= Residual); FV =? – � Cap left after reg. inv. withdrawals; FV =? + Yield curve prods calcs � Home loan – Mr Kagiso n , PMT � Checklist : FV = PV [1 + i/(P/YR)] � FV = 0 (Pd off) � PV = 1 900 000 � I/YR = 10 � P/YR = 12 � N = 240 � Press PMT = -18 335.41 � If PMT = -20000 � IF I/YR = 9 � How long? � How long? � Press N = 189.017 � Press N = 166.8268 7

Yield curve prods calcs � Car loan (with residual) n , PMT � Checklist : FV = PV [1 + i/(P/YR)] � FV = -60 000 (residual) � PV = 180 000 � I/YR = 13.5 � P/YR = 12 � N = 54 � Press PMT = -3 652.25 Stats Calcs � Weighted Growth rates 90% of investment yields 21% return 10% of investment yields 5% return Overall % return? (0.9 x 21) + (0.1 x 5) = 19.4% 8

Stats Calcs � Std dev Χ 3% Χ 2% 6% Avg 2% Χ 3% Χ � Same Avg, select lower Std dev � But if Avg diff, std dev diff? Stats Calcs � CV = (std dev) / (Average) x 100 Example 15 Health warning 9

Interpolation ? 6.75 6.72 136 – 91 = 45 days 91 136 181 181 – 91 = 90 days Increase over 90 days = 6.75 – 6.72 = 0.03 Increase per day = 0.03 / 90 = 0.000333 Rate for day 92 ( 1 extra day) = 6.72 + (0.000333 x 1 ) = 6.7203 Rate for day 93 ( 2 extra days) = 6.72 + (0.000333 x 2 ) = 6.720666 Rate for day 136 ( 45 extra days) = 6.72 + (0.000333 x 45 ) = 6.735 10

Recommend

More recommend