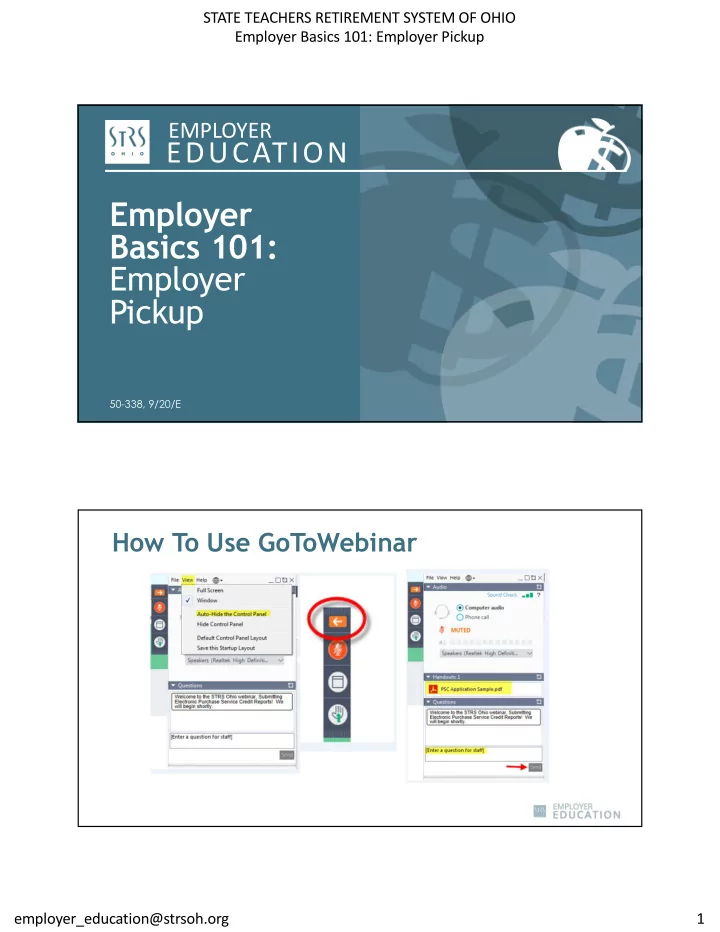

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Employer Basics 101: Employer Pickup EMPLOYER EDUCATION Employer Basics 101: Employer Pickup 50-338, 9/20/E How To Use GoToWebinar employer_education@strsoh.org 1

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Employer Basics 101: Employer Pickup Agenda • History of Employer Pickup • Employee Groups • Pickup Plan Types • Financial Impact • Required Forms History of Employer Pickup • What is employer pickup? • In 1983, the IRS issued an opinion that allowed member contributions to be withheld on a tax-deferred basis • What are the rules? • Adopt a plan • No retroactive plans employer_education@strsoh.org 2

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Employer Basics 101: Employer Pickup Employee Groups Three recognized employee groups • Superintendents • Administrators • Teachers Pickup Plan Types Comparing types of pickup Fringe Benefit Pickup Fringe Benefit Pickup Plan Types: Salary Reduction Pickup Not Included in Included in Compensation Compensation (Pickup-on-Pickup) Member’s salary reduced by Employer agrees to pay Employer agrees to pay the amount of member member’s pretax member’s pretax contributions How does it work? contributions and employer contributions and considers the payment as remits pretax compensation for retirement purposes Who funds member Employer funds all or Employer funds all or Member contributions? a portion a portion Reduced gross income for Further compensates Further compensates employee What’s the benefit to state and federal tax employee without reducing without reducing gross income the member? purposes gross income for tax for tax purposes and increases purposes income for retirement purposes Groups?* Teachers Administrators Superintendents/Administrators * While any group or individual can have any type of pickup plan, generally districts tend to grant these types of pickup to the identified groups of employees. employer_education@strsoh.org 3

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Employer Basics 101: Employer Pickup Pickup Plan Types Comparing pickup plan types by the dollar Fringe Benefit Pickup Fringe Benefit Pickup Plan Types: Salary Reduction Pickup Not Included in Included in Compensation Compensation (Pickup-on-Pickup) Base contract $70,000 $70,000 $70,000 Member contribution due $9,800 $9,800 $9,800 ($70,000 x 14%) + (14% of $9,800) Federal state & federal $60,200 $70,000 $70,000 income Compensation for STRS $70,000 $70,000 $79,800 Ohio purposes Financial Impact Financial impact on a member and a district Fringe Benefit Salary Fringe Benefit Pickup Pickup Included in Plan Types: Reduction Not Included in Compensation Pickup Compensation (Pickup-on-Pickup) Base contract amount $70,000 $70,000 $70,000 Compensation for STRS Ohio purposes $70,000 $70,000 $79,800 Member contribution due (14%) $9,800 $9,800 $11,172 Employer contribution due (14%) $9,800 $9,800 $11,172 Total contributions due from employer $9,800 $19,600 $22,344 employer_education@strsoh.org 4

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Employer Basics 101: Employer Pickup Required Forms • Notification for Employer Pickup of Employee Contributions • Certified copy of school board resolution Required Forms employer_education@strsoh.org 5

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Employer Basics 101: Employer Pickup Questions? We’re here to assist you • Call toll-free: 888-535-4050 • Send an email: report@strsoh.org • Visit our website: www.strsoh.org/employer Thank You! • This webinar will be available in the Education & Training section of the employer website • Certificates of completion will be emailed within two weeks employer_education@strsoh.org 6

STATE TEACHERS RETIREMENT SYSTEM OF OHIO Employer Basics 101: Employer Pickup Exiting the Webinar • Click “File” on the control panel and select “Exit — Leave Webinar” employer_education@strsoh.org 7

Recommend

More recommend