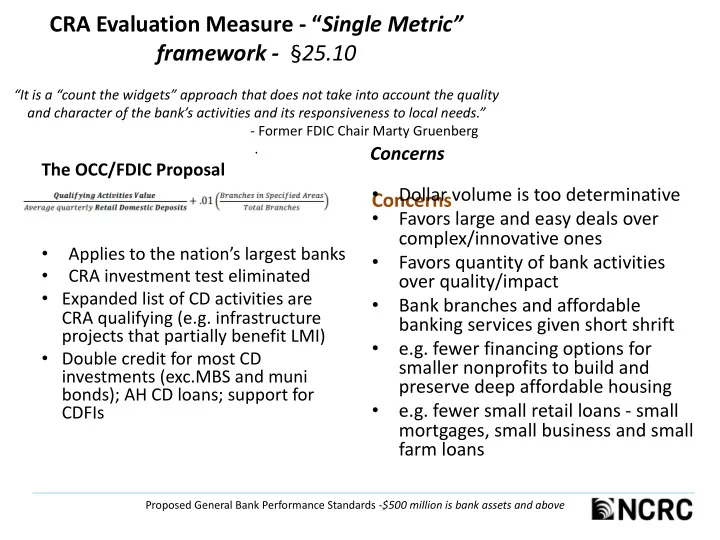

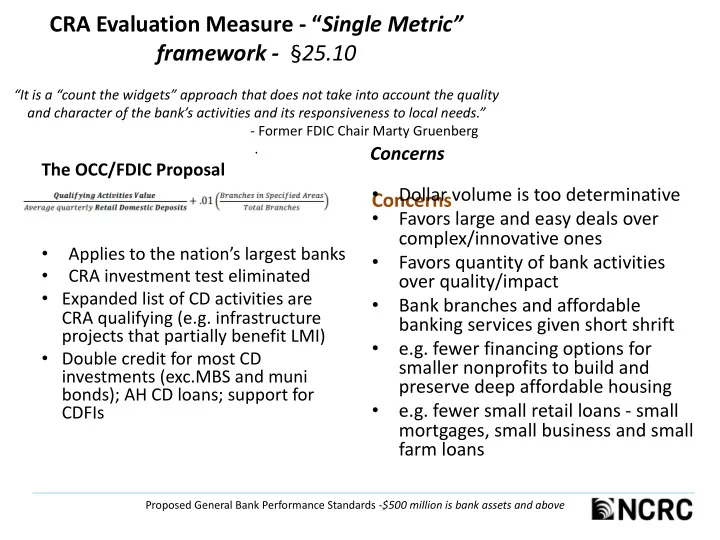

CRA Evaluation Measure - “ Single Metric” framework - § 25.10 “It is a “count the widgets” approach that does not take into account the quality and character of the bank’s activities and its responsiveness to local needs.” - Former FDIC Chair Marty Gruenberg . Concerns The OCC/FDIC Proposal Dollar volume is too determinative • Concerns Favors large and easy deals over • complex/innovative ones Applies to the nation’s largest banks • Favors quantity of bank activities • CRA investment test eliminated • over quality/impact • Expanded list of CD activities are Bank branches and affordable • CRA qualifying (e.g. infrastructure banking services given short shrift projects that partially benefit LMI) e.g. fewer financing options for • • Double credit for most CD smaller nonprofits to build and investments (exc.MBS and muni preserve deep affordable housing bonds); AH CD loans; support for e.g. fewer small retail loans - small • CDFIs mortgages, small business and small farm loans Proposed General Bank Performance Standards -$500 million is bank assets and above

Presumptive CRA ratings - § 25.12 “These presumptive standards undermine one of the most important benefits of CRA - the incentive for banks to develop partnerships with local community organizations and other stakeholders to address community needs - because the banks can satisfy their CRA obligations by simply hitting the metric..” OCC/FDIC Proposal Concerns Dollar volume results in new Banks could fail the exam in • • “presumptive rating” nearly half of their local – 11% and up = Outstanding communities and still pass – 6% = Satisfactory Discourages what CRA has • – 3% = Needs to Improve done best – encourage – Less than 3% = substantial community partnerships noncompliance Rations CRA – the perfect CRA Ratings at both the • • assessment area and bank level becomes the enemy of the good Other performance standards • – e.g. 2% CD minimum “empirical benchmarks” • appear arbitrary; impact – e.g. retail lending test (pass/fail) unknown Proposed General Bank Performance Standards -$500 million is bank assets and above

CRA Qualifying – expanded activities/areas - §25.04 “expands eligible and qualifying CRA activities to include some of what banks already do in the ordinary course of business, thereby diluting the effectiveness of CRA.” OCC/FDIC Proposal Concerns • More and not less CRA Agencies to publish non- • exhaustive list of examples of grade inflation – weakening qualifying activities • More activities; less LMI Community development • focus and impact expanded, including • e.g. Will double affordable – essential infrastructure – OZ funds (e.g. stadium repair) housing/CD credit mean – financial literacy for all easier middle-income – RH that “partially or primarily projects over harder low- benefit” middle income in high income projects? cost areas Proposed General and Small Bank Performance Standards

CRA Qualifying – definitions - §§ 25.04, 25.03 ”CD loans, investments, and services would no longer have to have a primary purpose of CD targeted on LMI individuals and areas, small business or small farms, or underserved or distressed rural areas.” Concerns OCC/FDIC proposal • Gone: “primary purpose” • Undermines CRA’s historic of CD test targeted at LMI+ focus on LMI • New: “partially or • Banks appear to do more in primarily” benefit/serve dollar volume, but less LMI standard impactful activities • More “pro-rata" credit for • CRA grade inflation the dollar values that partially benefits LMI • Unclear impact • Expands qualifying middle- income tracts Proposed General and Small Bank Performance Standards

Retail Lending Distribution Test - § 25.11 ( depending on the bank’s retail products) Concerns OCC/FDIC Proposal Borrower distribution test • Can fail in half of local AAs & still • – for mortgages, small pass at the bank-level business/small farms, consumer Low pass/fail standard -either • loans demographic or peer comparator, Geographic distribution test • not both – for small small business/small Arbitrary thresholds • farms, consumer loans No review of mortgage lending in • New higher small biz/small farm • LMI neighborhoods limits: No incentive for small loans to • – $2 mill. dollar loan limit home buyers, small business, – $2 mill. annual revenue limit small farms Local AA: meet or exceed • e.g. could pass with mainly high • – 55% of LMI demographic cost consumer lending percentage – 65% of peer loans percentage Proposed General Bank Performance Standards - -$500 million is bank assets and above

Assessment Areas (AAs) - §25.08 ”…we do not know how many or where these deposit- based assessment areas might be, or how they would benefit low-and moderate-income communities. It is not clear that communities that are so- called “credit deserts” would necessarily benefit from the five percent threshold .” OCC/FDIC Proposal Concerns • Facility-based AAs – same as • Favors easy retail and CD today activities around the • New deposit-based AAs –if country over local credit 50% of deposits outside needs branches, then where they • Deposit data is limited - how receive 5% many new AAs? Where? In • CRA credit in AAs and more credit deserts? Rural areas? outside AAs credit at the • Arbitrary deposit-based AA bank-level thresholds • Strategic Plans rules revised & required for some Proposed General and Small Bank Performance Standards

The OCC’s General CRA Performance Standards – from the proposed rule Proposed General Bank Performance Standards - > $500 million is bank assets

Recommend

More recommend