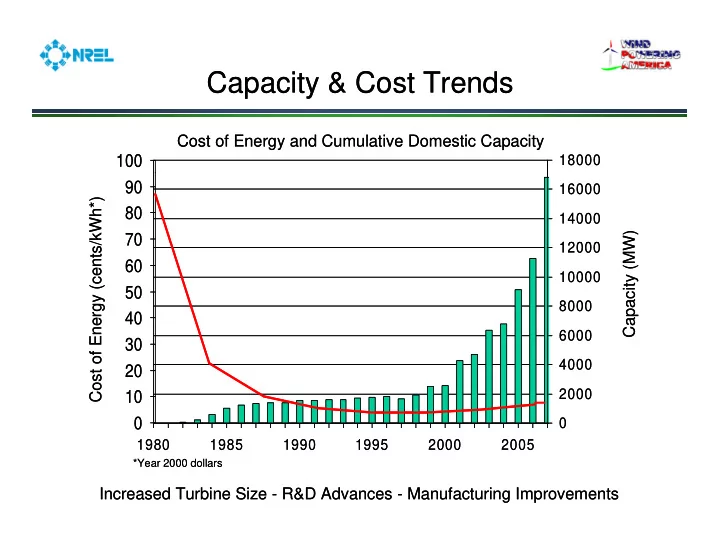

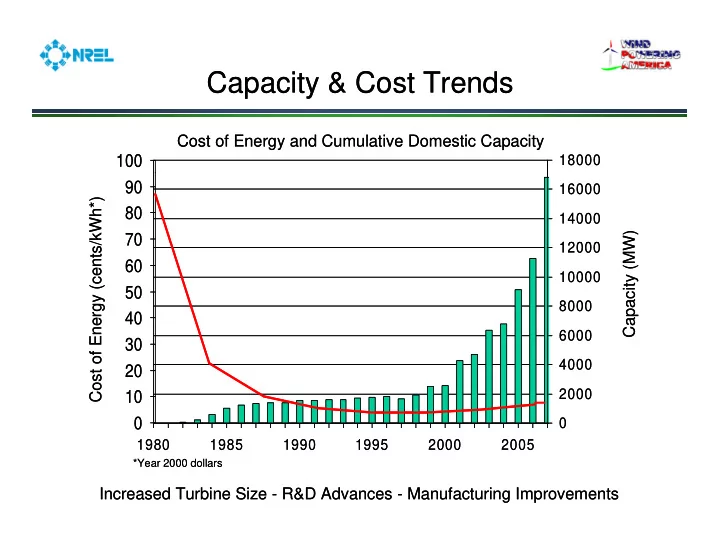

Capacity & Cost Trends Capacity & Cost Trends Cost of Energy and Cumulative Domestic Capacity Cost of Energy and Cumulative Domestic Capacity 100 100 18000 18000 90 90 16000 16000 /kWh*) /kWh*) 80 80 14000 14000 W) W) 70 70 70 70 pacity (MW pacity (MW rgy (cents/ rgy (cents/ 12000 12000 12000 12000 60 60 10000 10000 50 50 8000 8000 Cap Cap 40 40 40 40 ost of Ener ost of Ener 6000 6000 30 30 4000 4000 20 20 Co Co 2000 2000 10 10 0 0 0 0 1980 1980 1985 1985 1990 1990 1995 1995 2000 2000 2005 2005 *Year 2000 dollars *Year 2000 dollars Increased Turbine Size - R&D Advances - Manufacturing Improvements Increased Turbine Size - R&D Advances - Manufacturing Improvements

U.S. Wind Power Capacity Up 46% in 2007 U.S. Wind Power Capacity Up 46% in 2007 6,000 18,000 Annual US Capacity (left scale) city (MW) 5,000 15,000 ty (MW) Cumulative US Capacity (right scale) 4,000 12,000 ative Capac ual Capacit 3,000 9,000 2,000 2,000 6,000 6,000 Annu Cumula 1,000 3,000 0 0 0 0 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Source: AWEA Record year for new U S wind capacity: Record year for new U.S. wind capacity: • 5,329 MW of wind added ( more than double previous record) • Roughly $9 billion in investment

People Want Renewable Energy! People Want Renewable Energy! Total Installed Wind Capacity Total Installed Wind Capacity 110000 100000 1. Germany: 23,300 MW 90000 2. United States: 20,413 MW 80000 3. Spain: 15,900 MW 70000 acity (MW) 4. China: 9000 MW 60000 5. India: 8,757 MW 5. India: 8,757 MW 50000 50000 Capa 40000 World total Oct 2008: 105,732 MW 30000 20000 10000 0 2 2 3 3 4 4 5 5 6 6 7 7 8 8 9 9 0 0 1 1 2 2 3 3 4 4 5 5 6 6 7 7 8 8 9 9 0 0 1 1 2 2 3 3 4 4 5 5 6 6 7 7 8 8 8 8 8 8 8 8 8 8 9 9 9 9 9 9 9 9 9 9 0 0 0 0 0 0 0 0 0 9 9 9 9 9 9 9 9 9 9 9 9 9 9 9 9 9 9 0 0 0 0 0 0 0 0 0 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 United States Europe Rest of World Source: WindPower Monthly

U.S Lagging Other Countries in Wind U.S Lagging Other Countries in Wind As a Percentage of Electricity Consumption As a Percentage of Electricity Consumption As a Percentage of Electricity Consumption As a Percentage of Electricity Consumption 22% on 20% 20% Generation Consumpti 18% Approximate Wind Penetration, end of 2007 16% Approximate Wind Penetration, end of 2006 14% of Electricity 12% 12% ected Wind 10% 8% 6% 4% 4% Proj as % o 2% 0% many Italy mark pain ugal land eece ands stria ndia UK eden U.S. ance ralia nada rway hina apan razil TAL Sp Portu In Denm Aus Gre Austr Germ Fra Can Ch Irel Netherla Swe Ja Nor TO B Source: Berkeley Lab estimates based on data from BTM Consult and elsewhere Note: Figure only includes the 20 countries with the most installed wind capacity at the end of 2007

Wind Power Contributed 35% of Wind Power Contributed 35% of All New Generating Capacity in the US in 2007 All New Generating Capacity in the US in 2007 All New Generating Capacity in the US in 2007 All New Generating Capacity in the US in 2007 100% 100 W) ns Additions (GW acity Addition • Wind was the 2 nd - 80% 80 largest resource added for the 3 rd - straight year straight year al Capacity A Annual Capa 60% 60 • Up from 19% in 40% 40 2006, 12% in 2005, Percent of A Total Annu and <4% in 2000- 20% 20 2004 0% % 0 2000 2001 2002 2003 2004 2005 2006 2007 Wind Other Renewable Gas (CCGT) Gas (non-CCGT) Coal Other non-Renewable Total Capacity Additions (right axis) Source: EIA, Ventyx, AWEA, IREC, Berkeley Lab

Installed Project Costs Are On the Installed Project Costs Are On the Rise, After a Long Period of Decline Rise, After a Long Period of Decline Rise, After a Long Period of Decline Rise, After a Long Period of Decline $4,500 Individual Project Cost (253 projects totaling 15.8 GW) 07 $/kW) $4,000 Average Project Cost Polynomial Trend Line $3,500 ject Cost (20 $3,000 $2,500 $2,000 , nstalled Proj $1,500 $1,000 Increase of ~$700/kW Increase of ~$700/kW $500 $500 I $0 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Source: Berkeley Lab database (some data points suppressed to protect confidentiality) Source: Berkeley Lab database (some data points suppressed to protect confidentiality) Note: Includes 227 projects built from 1983-2007, totaling ~13 GW (77% of capacity at end of 2007); additional ~2.8 GW of projects proposed for installation in 2008

Wind Has Been Competitive with Wind Has Been Competitive with Wholesale Power Prices in Recent Years Wholesale Power Prices in Recent Years Wholesale Power Prices in Recent Years Wholesale Power Prices in Recent Years 90 Wind project sample includes 80 projects built from 1998-2007 70 Wh 60 2007 $/M 50 40 30 20 Nationwide Wholesale Power Price Range (for a flat block of power) 10 Cumulative Capacity-Weighted Average Wind Power Price 0 2003 003 2004 00 2005 005 2006 006 2007 00 53 projects 66 projects 87 projects 107 projects 128 projects 2,466 MW 3,267 MW 4,396 MW 5,801 MW 8,303 MW Source: FERC 2006 and 2004 "State of the Market" reports, Berkeley Lab database, Ventyx • Wholesale price range reflects flat block of power across 23 pricing nodes (see previous map) • Wind prices are capacity-weighted averages from cumulative project sample

Wind Built After 1997 Was Competitive Wind Built After 1997 Was Competitive with Wholesale Prices in Most Regions in 2007 with Wholesale Prices in Most Regions in 2007 with Wholesale Prices in Most Regions in 2007 with Wholesale Prices in Most Regions in 2007 80 Wind project sample includes projects built from 1998 2007 Wind project sample includes projects built from 1998-2007 70 60 Wh 50 50 2007 $/MW 40 30 20 2007 Average Wholesale Power Price Range By Region 2007 Capacity-Weighted Average Wind Power Price By Region 10 Individual Project 2007 Wind Power Price By Region 0 0 Texas Heartland Mountain Northwest California Great Lakes East New England Total US 4 projects 65 projects 15 projects 13 projects 12 projects 6 projects 12 projects 1 project 128 projects 476 MW 2,857 MW 1,757 MW 1,219 MW 691 MW 547 MW 714 MW 42 MW 8,303 MW Source: Berkeley Lab database, Ventyx Note: Even within a region there are a range of wholesale power prices because multiple wholesale price hubs exist in each area (see earlier map)

Installed Wind Capacities Installed Wind Capacities (‘99 (‘99 – October ‘08) ( 99 ( 99 October ‘08) October 08) October 08) *Preliminary data

Drivers for Wind Power Drivers for Wind Power • Declining Wind Costs D li i Wi d C t • Fuel Price Uncertainty • Federal and State • Federal and State Policies • Economic Development • Public Support • Green Power • Energy Security • Carbon Risk

CO CO 2 prices significantly prices significantly increase the cost of coal increase the cost of coal increase the cost of coal increase the cost of coal

Windy Rural Areas Need Windy Rural Areas Need Economic Development Economic Development Economic Development Economic Development

Oklahoma Oklahoma – – Economic Impacts Economic Impacts from 1000 MW of new wind development from 1000 MW of new wind development Wind energy’s economic “ripple effect” Totals Direct Impacts Indirect & (construction + 20yrs) (construction + 20yrs) Induced Impacts Induced Impacts Payments to Landowners: Construction Phase: Total economic benefit = • $2.7 Million/yr • 1,650 new jobs $1.16 billion Local Property Tax Revenue: • $141 M to local New local jobs during • $6.4 Million/yr y economies economies construction = 3,500 t ti 3 500 Construction Phase: Operational Phase: New local long-term jobs • 1,800 new jobs • 250 local jobs = 500 • $189 M to local economies • $20 M/yr to local Operational Phase: economies • 250 new long-term jobs 250 ne long term jobs • $21 M/yr to local economies Construction Phase = 1-2 years All jobs rounded to the nearest 50 jobs; All values greater than Operational Phase = 20+ years $10 million are rounded to the nearest million

Weatherford Wind Energy Center, OK Weatherford Wind Energy Center, OK • 147 MW (1.5-MW turbines) turbines) • Landowner payments: $300,000 in annual lease payments lease payments • 150 workers during peak construction • 6 fulltime O&M positions 6 fulltime O&M positions • Property taxes: $17 million over 20 years • Sawartzky Construction • Sawartzky Construction received $300,000 in revenue from the project • Owned by FPL Energy • Owned by FPL Energy • Constructed in 2005

Soaring Demand Spurs Expansion Soaring Demand Spurs Expansion of U.S. Wind Turbine Manufacturing of U.S. Wind Turbine Manufacturing Online Prior to 2007 Online or Announced in 2007 Announced in 2008 Source: AWEA, updated Sept 2008

Environmental Benefits Environmental Benefits • No SOx or NOx No SOx or NOx • No particulates • No mercury No mercury • No CO2 • No water

Source: NOAA

-Water Nexus Water Nexus Energy- Energy

Recommend

More recommend