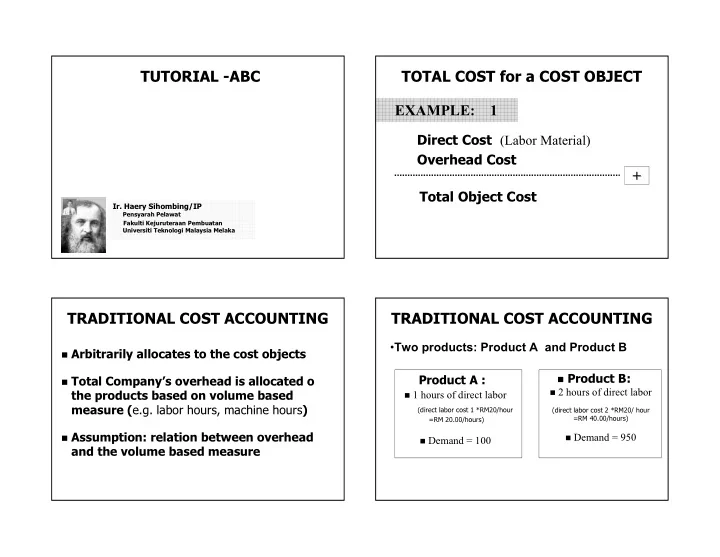

� � � � � � � � TUTORIAL - TUTORIAL -ABC ABC TOTAL COST for a COST OBJECT TOTAL COST for a COST OBJECT EXAMPLE: 1 Direct Cost (Labor Material) Direct Cost (Labor Material) Overhead Cost Overhead Cost + + Total Object Cost Total Object Cost Ir. Haery Sihombing Ir. Haery Sihombing/IP /IP Pensyarah Pelawat Fakulti Kejuruteraan Pembuatan Universiti Teknologi Malaysia Melaka TRADITIONAL COST ACCOUNTING TRADITIONAL COST ACCOUNTING TRADITIONAL COST ACCOUNTING TRADITIONAL COST ACCOUNTING • Two products: Product A Product A and Product B Product B � Arbitrarily allocates to the cost objects Arbitrarily allocates to the cost objects � Product B: Product B: Product A : � Total Company Total Company’ ’s overhead is allocated o s overhead is allocated o Product A : � 2 hours of direct labor 2 hours of direct labor the products based on volume based � 1 hours of direct labor 1 hours of direct labor the products based on volume based measure ( e.g. labor hours, machine hours e.g. labor hours, machine hours ) ) measure ( (direct labor cost 1 *RM20/hour (direct labor cost 1 *RM20/hour (direct labor cost 2 *RM20/ hour (direct labor cost 2 *RM20/ hour =RM 40.00 40.00/hours) /hours) =RM =RM 20.00/ =RM 20.00/hours) hours) � Assumption: relation between overhead Assumption: relation between overhead � Demand = 950 Demand = 950 � Demand = 100 Demand = 100 and the volume based measure and the volume based measure

� � � � � � � � � � � � � � � � � TRADITIONAL COST ACCOUNTING TRADITIONAL COST ACCOUNTING ACTIVITY BASED COSTING ACTIVITY BASED COSTING � TOTAL OVERHEAD = RM 100,000.00 TOTAL OVERHEAD = RM 100,000.00 � More Accurate Cost Management Methodology More Accurate Cost Management Methodology � TOTAL DIRECT LABOR = 2,000 Hours TOTAL DIRECT LABOR = 2,000 Hours � Focuses on indirect costs (overhead) Focuses on indirect costs (overhead) RM 100,000/2000 Hours = RM 50/ Hours RM 100,000/2000 Hours = RM 50/ Hours � Traces rather than allocates each expense Traces rather than allocates each expense category to the particular cost object category to the particular cost object Product A : 1 hours of direct labor 1 hours of direct labor � Product A : � Makes Makes “ “ indirect indirect ” ” expense expense “ “ direct direct ” ” Product B : 2 hours of direct labor 2 hours of direct labor � Product B : � TCA Overhead Allocation : TCA Overhead Allocation : A A = RM = RM 50/unit 50/unit B = RM = RM 100/unit 100/unit B ABC Basic Premise When To Use ABC ABC Basic Premise When To Use ABC � Cost objects consume activities Cost objects consume activities � Overhead is high Overhead is high � Activities consume resources Activities consume resources � Products are diverse: complexity, Products are diverse: complexity, volume, amount of direct labor volume, amount of direct labor � This consumption of resources is what driver This consumption of resources is what driver costs � Cost of errors are high Cost of errors are high costs � Understanding this relationship is critical to Understanding this relationship is critical to � Competition is stiff Competition is stiff successfully managing overhead successfully managing overhead

� � � � � � � � � � � � � � � � � � � � ABC Illustration ABC Illustration ABC Steps ABC Steps 1. INDENTIFY ACTIVITIES 1. INDENTIFY ACTIVITIES � Identifies activities Identifies activities � Determine cost for each activity Determine cost for each activity � Set Set- -up up � Determine cost drivers Determine cost drivers � Machining Machining � Collect activity data Collect activity data � Receiving Receiving � Calculate product cost Calculate product cost � Packing Packing � Engineering Engineering ABC Illustration ABC Illustration ABC Illustration ABC Illustration 2. DETERMINE ACTIVITY COST 2. DETERMINE ACTIVITY COST 3. DETERMINE COT DRIVERS 3. DETERMINE COT DRIVERS = RM 10,000 = RM 10,000 � Set Set- -up up = Number of Setups = Number of Setups � Set Set- -up up = RM 40,000 = RM 40,000 � Machining Machining = Machining Hours = Machining Hours � Machining Machining = RM 10,000 = RM 10,000 � Receiving Receiving = Number of Receipt = Number of Receipt � Receiving Receiving = RM 10,000 = RM 10,000 � Packing Packing = Number of Deliveries = Number of Deliveries � Packing Packing = RM 30,000 � Engineering Engineering = RM 30,000 = Engineering Hours = Engineering Hours � Engineering Engineering

� � ABC Illustration ABC Illustration ABC Illustration ABC Illustration 4. ACTIVITY DATA 4. ACTIVITY DATA 5. PRODUCT COST CALCULATION 5. PRODUCT COST CALCULATION ACTIVITY ACTIVITY Cost Cost PRODUCT PRODUCT RM RM PRODUCT PRODUCT RM RM � Overhead for Product A = Overhead for Product A = (RM) (RM) A A B B Set- -up up 10,000 1 2,500 3 7,500 RM 24,500 : 100 = RM 245 245 Set 10,000 1 2,500 3 7,500 RM 24,500 : 100 = RM Machining 40,000 100 2,000 1900 38,000 Machining 40,000 100 2,000 1900 38,000 Receiving Receiving 10,000 10,000 1 1 2,500 2,500 3 3 7,500 7,500 � Overhead for Product B = Overhead for Product B = Packing Packing 10,000 10,000 1 1 2,500 2,500 3 3 7,500 7,500 Engineering Engineering 30,000 30,000 500 500 15,000 15,000 500 500 15,000 15,000 RM 75,000 : 950 = RM 79. 47 79. 47 RM 75,000 : 950 = RM 24,500 75,500 24,500 75,500 Undercosting & Overcosting Overcosting PRODUCT COST TCA Vs. ABC PRODUCT COST TCA Vs. ABC Undercosting & EXAMPLE: 2 Cost for Product A : Cost for Product A : Cost for Product B : Cost for Product B : Jose, Roberta, and Nancy order separate items for lunch. Overhead TCA Overhead TCA RM RM 50,00 50,00 Overhead Overhead TCA TCA RM RM 100,00 100,00 Overhead ABC Overhead ABC RM RM 245,00 245,00 Overhead ABC Overhead ABC RM RM 79.47 79.47 Jose’s order amounts to $14 Direct Cost TCA Direct Cost TCA RM RM 20,00 20,00 Direct Cost TCA Direct Cost TCA RM RM 40,00 40,00 Roberta consumed 30 Direct Cost ABC ABC RM RM 20,00 20,00 Direct Cost ABC ABC RM RM 40,00 40,00 Direct Cost Direct Cost Nancy’s order is 16 TOTAL TCA TOTAL TCA RM RM 70,00 70,00 TOTAL TOTAL TCA TCA RM RM 140,00 140,00 Total $60 TOTAL ABC TOTAL ABC RM RM 265,00 265,00 TOTAL TOTAL ABC ABC RM RM 119,47 119,47 What is the average cost per lunch?

Undercosting & Overcosting Undercosting & Overcosting Existing Single Indirect- - Cost Pool System Cost Pool System Existing Single Indirect EXAMPLE: 3 $60 ÷ 3 = $20 Kole Corporation manufactures a normal lens (NL) and a complex lens (CL). Kole currently uses a single indirect-cost rate job costing system. Jose and Nancy Roberta is are overcosted. undercosted. Cost objects: 80,000 (NL) and 20,000 (CL). Existing Single Indirect- Existing Single Indirect - Cost Pool System Cost Pool System Existing Single Indirect- Existing Single Indirect - Cost Pool System Cost Pool System Normal Lenses (NL) Complex Lenses (CL) Direct materials $1,520,000 Direct materials $ 920,000 Direct mfg. labor 800,000 Direct mfg. labor 260,000 Total direct costs $2,320,000 Total direct costs $1,180,000 Direct cost per unit: $2,320,000 ÷ 80,000 = $29 Direct cost per unit: $1,180,000 ÷ 20,000 = $59

Existing Single Indirect- - Cost Pool System Cost Pool System Existing Single Indirect- - Cost Pool System Cost Pool System Existing Single Indirect Existing Single Indirect INDIRECT-COST All Indirect Costs COST OBJECT: Indirect Costs POLL $2,900,000 NL AND CL Direct Costs LENSES 50,000 Direct INDIRECT Manufacturing COST-ALLOCATION Labor-Hours BASE DIRECT COSTS $58 per Direct Direct Direct Manufacturing Manufacturing Materials Labor-Hour Labor Existing Single Indirect- Existing Single Indirect - Cost Pool System Cost Pool System Existing Single Indirect Existing Single Indirect- - Cost Pool System Cost Pool System NL: 36,000 × $58 = $2,088,000 Kole uses 36,000 direct manufacturing CL: 14,000 × $58 = $812,000 labor-hours to make NL and 14,000 direct What is the total cost of normal lenses? manufacturing labor-hours to make CL. How much indirect costs are allocated Direct costs $2,320,000 + to each product? Allocated costs $2,088,000 = $4,408,000 What is the cost per unit? $4,408,000 ÷ 80,000 = $55.10

Existing Single Indirect- - Cost Pool System Cost Pool System Existing Single Indirect- - Cost Pool System Cost Pool System Existing Single Indirect Existing Single Indirect Normal lenses sell for $60 each and What is the total cost of complex lenses? complex lenses for $142 each. Direct costs $1,180,000 + Allocated costs Normal Complex $812,000 = $1,992,000 Revenue $60.00 $142.00 What is the cost per unit? Cost 55.10 99.60 $1,992,000 ÷ 20,000 = $99.60 Income $ 4.90 $ 42.40 Margin 8.2% 29.9% Refining a Costing System Refining a Costing System Refining a Costing System Refining a Costing System 1. Design of Products and Process The Design Department designs the molds and defines Direct-cost tracing processes needed (details of the manufacturing operations). 2. Manufacturing Operations Indirect-cost pools Lenses are molded, finished, cleaned, and inspected. 3. Shipping and Distribution Cost-allocation basis Finished lenses are packed and sent to the various customers.

Recommend

More recommend