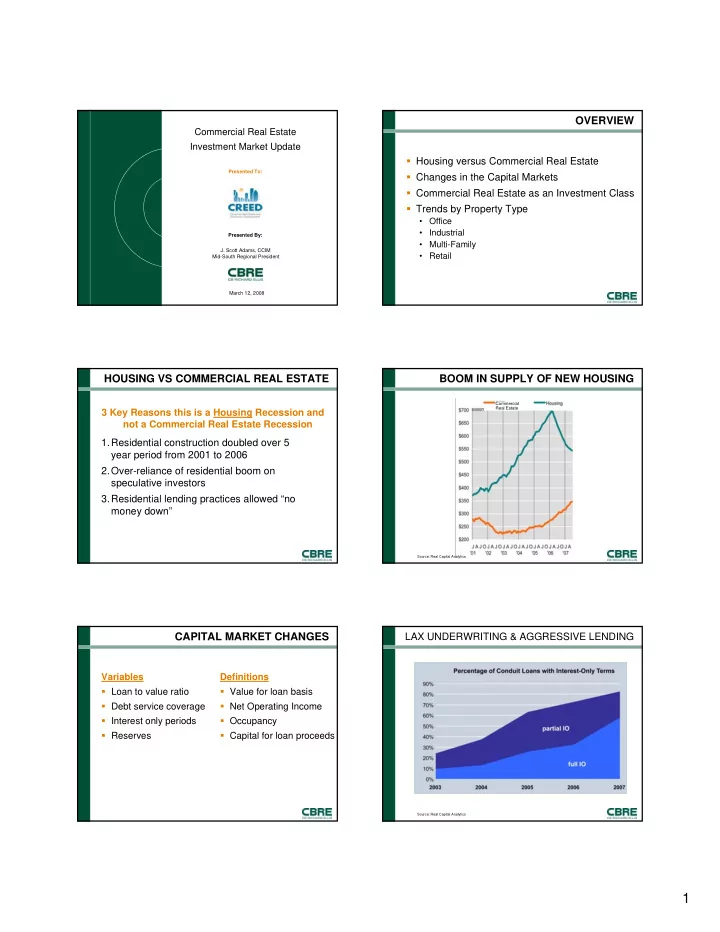

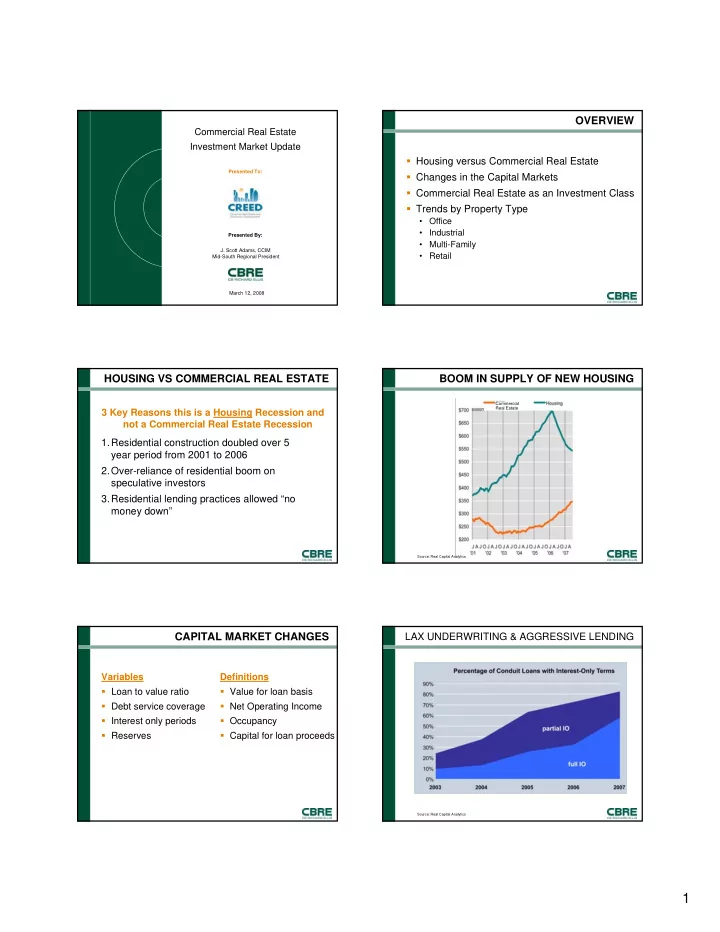

OVERVIEW Commercial Real Estate Investment Market Update � Housing versus Commercial Real Estate Presented To: � Changes in the Capital Markets � Commercial Real Estate as an Investment Class � Trends by Property Type • Office • Industrial Presented By: • Multi-Family J. Scott Adams, CCIM • Retail Mid-South Regional President March 12, 2008 HOUSING VS COMMERCIAL REAL ESTATE BOOM IN SUPPLY OF NEW HOUSING Commercial Real Estate 3 Key Reasons this is a Housing Recession and not a Commercial Real Estate Recession 1.Residential construction doubled over 5 year period from 2001 to 2006 2.Over-reliance of residential boom on speculative investors 3.Residential lending practices allowed “no money down” Source: Real Capital Analytics CAPITAL MARKET CHANGES LAX UNDERWRITING & AGGRESSIVE LENDING Variables Definitions � Loan to value ratio � Value for loan basis � Debt service coverage � Net Operating Income � Interest only periods � Occupancy � Reserves � Capital for loan proceeds Source: Real Capital Analytics 1

US COMMERCIAL PROPERTY SALES US COMMERCIAL PROPERTY SALES Office, Industrial, Multifamily & Retail Properties Commercial Real Estate is now a “Major Food Group” � Alternative investment opportunities not rock solid either � Underlying fundamentals remain healthy � Commercial real estate with predictable and transparent contractual cash flows � Key perspective is returns on a “risk adjusted basis” Source: Real Capital Analytics; minimum value of $5 million ANALYSIS OF INVESTMENT RETURNS EVOLUTION OF INVESTMENT RETURNS Last 5 Years vs. Next 5 Years How Investment Returns have been so Great Big Difference! � Moderate growth in net operating income • Growth in rents • Rising occupancy � Sharp decline in capitalization rates Office, Industrial, Retail, Multi-Housing: NCREIF Weighted Source: TWR Investment Database NATIONAL OFFICE SALES 2007 HAMPTON ROADS OFFICE SALES � The Good News: Economic expansion has been LANDMARK TRANSACTIONS increasingly driven by office-occupying industries Gee’s Group Portfolio 150 W. Main � The Bad News: Softening economy will lead to Twin Oaks I & II slower growth in rents and less space absorption Lynnhaven Corporate Center I Higher volume and lower cap rates $250 10.0% 9.0% $200 8.0% Total Price (in billion) 7.0% Average Cap Rate $150 6.0% Silver Oak 5.0% $100 4.0% 3.0% $50 2.0% 1.0% $0 0.0% 2003 2004 2005 2006 2007 Southport Centre 150 W. Main Source: Real Capital Analytics 2

NATIONAL INDUSTRIAL SALES 2007 HAMPTON ROADS INDUSTRIAL SALES � The Good News: Export business and business to LANDMARK TRANSACTIONS business services are expected to continue to grow Commonwealth Storage � The Bad News: Impacted by the slowing economy especially with goods related to housing and retailers $40 Higher volume and lower cap rates 10.0% 9.0% $35 8.0% $30 Total Price (in billion) 7.0% Average Cap Rate $25 6.0% $20 5.0% 4.0% $15 3.0% $10 2.0% $5 1.0% $0 0.0% 2003 2004 2005 2006 2007 Source: Real Capital Analytics NATIONAL MULTI-FAMILY SALES HAMPTON ROADS MULTI-FAMILY TRANSACTIONS � The Good News: More people will decide to rent LANDMARK TRANSACTIONS rather than pursue home ownership The Heights and The Myrtles at Olde Towne Portfolio � The Bad News: Shadow competition of rental supply created by unsold homes and condos listed for rent Slow down in volume growth and cap rate decline $120 8.0% 7.0% $100 6.0% Total Price (in billion) $80 Average Cap Rate 5.0% $60 4.0% 3.0% $40 2.0% The Myrtles The Heights $20 1.0% $0 0.0% 2003 2004 2005 2006 2007 Source: Real Capital Analytics NATIONAL RETAIL SALES HAMPTON ROADS RETAIL TRANSACTIONS � The Good News: Continued growth in lifestyle & LANDMARK TRANSACTIONS town centers; new concepts continue to emerge Denbigh Village Denbigh Village Lynnhaven North � The Bad News: Future performance impacted by slowdown in employment & consumer demand Higher volume and lower cap rates $80 9.0% 8.0% $70 7.0% $60 Total Price (in billion) 6.0% Average Cap Rate $50 Lynnhaven North 5.0% $40 4.0% $30 3.0% $20 2.0% $10 1.0% $0 0.0% 2003 2004 2005 2006 2007 Source: Real Capital Analytics 3

FINAL THOUGHTS “The retailers that have the right merchandise at the right price are still doing significant business. There are winners and losers in market share, and consumers are voting every day with their purchases.” - Daniel Hurwitz, President & CEO of Developers Diversified Realty Corp. This concept applies to all of us in the commercial real estate profession and not just for retailer sales. 4

Recommend

More recommend