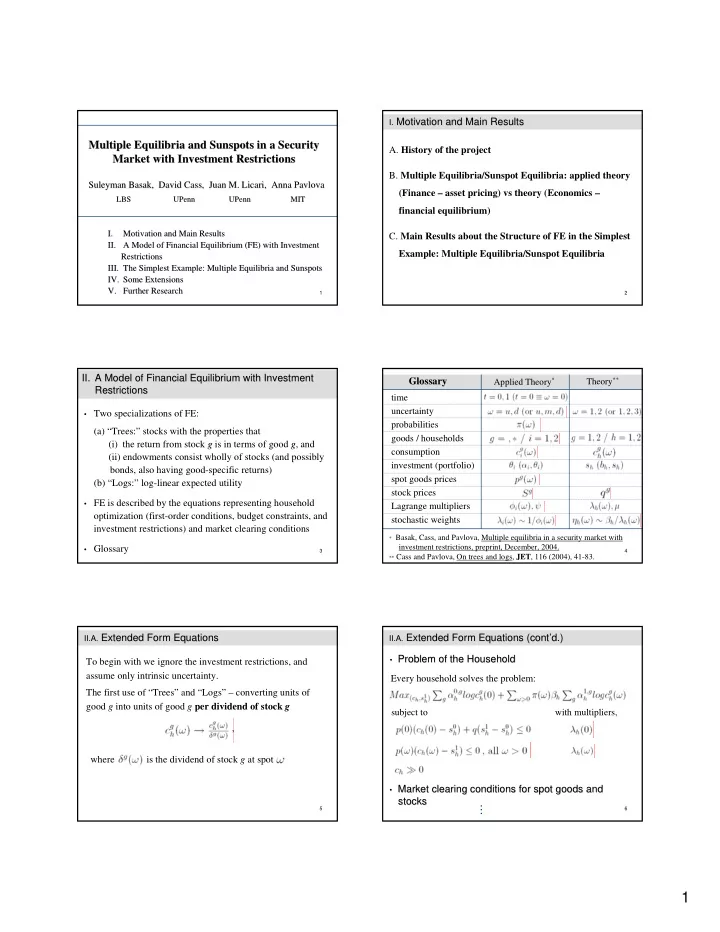

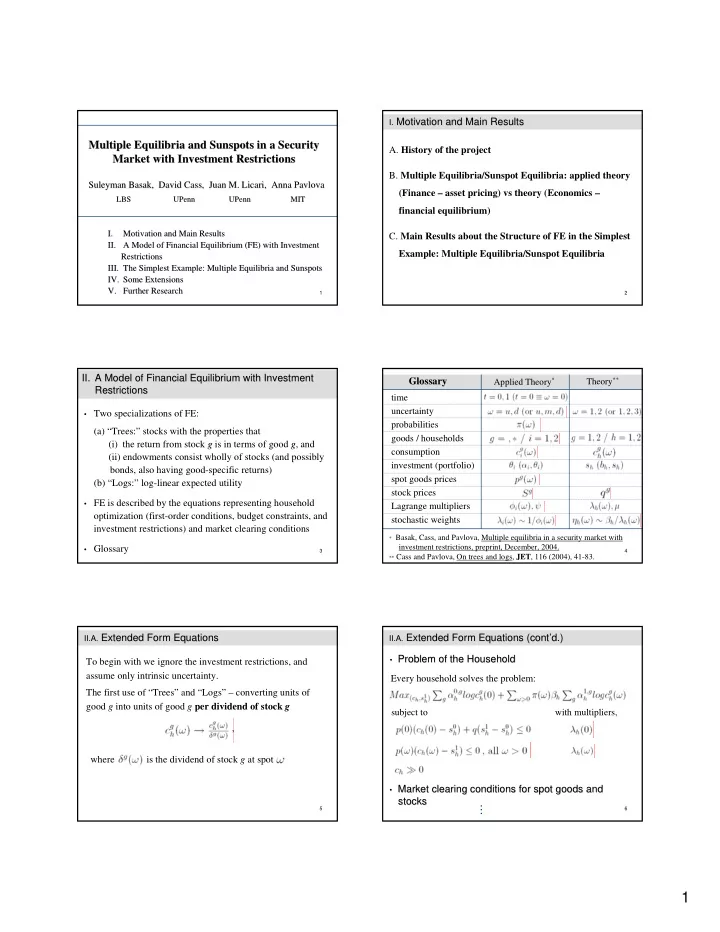

I. Motivation and Main Results Motivation and Main Results I. Multiple Equilibria and Sunspots in a Security Multiple Equilibria and Sunspots in a Security A. History of the project Market with Investment Restrictions Market with Investment Restrictions B. Multiple Equilibria/Sunspot Equilibria: applied theory Suleyman Suleyman Basak Basak, David Cass, Juan M. Licari, Anna , David Cass, Juan M. Licari, Anna Pavlova Pavlova (Finance – asset pricing) vs theory (Economics – LBS UPenn UPenn MIT LBS UPenn UPenn MIT financial equilibrium) I. Motivation and Main Results I. Motivation and Main Results C. Main Results about the Structure of FE in the Simplest II. II. A Model of Financial Equilibrium (FE) with Investment A Model of Financial Equilibrium (FE) with Investment Example: Multiple Equilibria/Sunspot Equilibria Restrictions Restrictions III. The Simplest Example: Multiple Equilibria and Sunspots III. The Simplest Example: Multiple Equilibria and Sunspots IV. Some Extensions Some Extensions IV. V. V. Further Research Further Research 1 2 II. A Model of Financial Equilibrium with Investment A Model of Financial Equilibrium with Investment II. Glossary Applied Theory * Theory ** Glossary Restrictions Restrictions time uncertainty • Two specializations of FE: probabilities (a) “Trees:” stocks with the properties that goods / households (i) the return from stock g g is in terms of good g g , and consumption (ii) endowments consist wholly of stocks (and possibly investment (portfolio) bonds, also having good-specific returns) spot goods prices (b) “Logs:” log-linear expected utility stock prices • FE is described by the equations representing household Lagrange multipliers optimization (first-order conditions, budget constraints, and stochastic weights investment restrictions) and market clearing conditions * Basak, Cass, and Pavlova, Multiple equilibria in a security market with investment restrictions, preprint, December, 2004. • Glossary 3 4 ** Cass and Pavlova, On trees and logs, JET , 116 (2004), 41-83. II.A. Extended Form Equations Extended Form Equations II.A. Extended Form Equations (cont’d.) Extended Form Equations (cont’d.) II.A. II.A. • Problem of the Household Problem of the Household • To begin with we ignore the investment restrictions, and assume only intrinsic uncertainty. Every household solves the problem: The first use of “Trees” and “Logs” – converting units of good g into units of good g per dividend of stock g subject to with multipliers, , where is the dividend of stock g at spot • Market clearing conditions for spot goods and Market clearing conditions for spot goods and • stocks stocks . 5 6 . . 1

II.A. Extended Form Equations (cont’d.) Extended Form Equations (cont’d.) II.B. Reduced Form Equations Reduced Form Equations II.A. II.B. The second use of “Trees” and “Logs” – reducing the number of variables and equations We can use the previous equations to simplify the system to consist of just the spot goods price equations, no-arbitrage conditions, budget constraints, and stock market clearing . . . conditions. At this point, it is convenient to replace the Lagrange multipliers by the stochastic weights . . . . After some manipulation, this yields: where 7 8 II.B. Reduced Form Equations (cont’d.) Reduced Form Equations (cont’d.) II.B. Reduced Form Equations (cont’d.) Reduced Form Equations (cont’d.) II.B. II.B. Note that SGP’s (1) By the analogue of Walras’ law, Mr. H’s budget constraints are redundant, and good (2) For the purposes of analysis, the variables and eqs. NAC’s equations can be reduced even further by normalizing prices, say, by setting , all , and then (i) BC’s substituting for spot goods prices, and (ii) using Ms. 1’s NAC’s, substituting for stock prices in the remaining bad eqs. NAC’s. This leaves only , , , and , , as variables. 9 10 III. The Leading Example: The Leading Example: 2 states, goods, and households 2 states, goods, and households III.A. A Specific Investment Restriction A Specific Investment Restriction III. III.A. Notice specially that, since there are equal number of states Suppose that Mr. 2 faces the additional constraint and stocks, the stock market is potentially complete. For simplicity (and without any loss of generality), we take with , and or , , ω and relabel , all . , (now) relative price , and associated with multiplier . We establish, first, a multiplicity of equilibria, then second (based on the same technique), an abundance of sunspot equilibria – some of which are especially interesting from an “applied” perspective. 11 12 2

III.A. A Specific Investment Restriction (cont’d) A Specific Investment Restriction (cont’d) III.A. A Specific Investment Restriction (cont’d) A Specific Investment Restriction (cont’d) III.A. III.A. Adding the constraint entails two modifications of the This leads to our first main result, based on distinguishing the reduced form equations: First, the term is added to the second period budget constraints from the rest of the reduced right hand side of Mr. 2’s NAC for stock 2, and second, the form equations, the singular equations (TSE) from the complementary slackness condition regular equations (TRE) (this labeling reflects the fact that the reduced form equations have an especially critical point – which will be formally described if time permits). is added to his first-order conditions. 13 14 III.A. A Specific Investment Restriction (cont’d) A Specific Investment Restriction (cont’d) III.A. A Specific Investment Restriction (cont’d) A Specific Investment Restriction (cont’d) III.A. III.A. Proposition 1. Assume that , Proposition 1. (cont’d) Proposition 1. (cont’d) Proposition 1. , and Case 2. . There is an open interval with s.t., for Then, there are two cases to consider. , TRE have exactly two distinct solutions with, for Case 1. . example, . TRE have a unique solution with , all , (Here and after, it is convenient to utilize the so-called applied so that is colinear to , all . In particular, this theory notation [sic]). implies that TSE reduce to a single equation which has a one- dimensional continuum of solutions s.t. . 15 16 III.A. A Specific Investment Restriction (cont’d) A Specific Investment Restriction (cont’d) III.B. An Abstract Investment Restriction An Abstract Investment Restriction III.A. III.B. Moreover, TSE have a unique solution independent of the For this analysis, we ignore the investment restriction itself stochastic weights and elaborate the analysis of local perturbations of TRE (still including as a variable) around the “stationary” solution . // , all , in order to derive properties of their global solutions. The basic rationale is that if , then we can We emphasize that this example is very robust. The results “tailor” many investment restrictions which depend on we describe obtain on an open set of all the parameters of endogenous variables (when they are specified in parametric the model, including . form). In fact, this can be done for the specific investment restriction introduced in the preceding section – as illustrated in Fig. 1 below. 17 18 3

III.B. An Abstract Investment Restriction (cont’d) An Abstract Investment Restriction (cont’d) III.B. An Abstract Investment Restriction (cont’d) An Abstract Investment Restriction (cont’d) III.B. III.B. Let represent TRE, where Proposition 2. Under the same hypotheses as in Proposition 1, Proposition 2. there is a mapping s.t. , for , (the “dependent” variables), (i) and , and (the “independent” variable), (ii) and . , and . 19 20 III.B. An Abstract Investment Restriction (cont’d) An Abstract Investment Restriction (cont’d) Figure 1. Relating the local and global results Figure 1. Relating the local and global results III.B. Remark. In fact, while , and (so that for the variable , we have while ). Applying Proposition 2 for the specific investment restriction introduced earlier yields Proposition 1, as illustrated in Figure 1. 21 22 III.B. An Abstract Investment Restriction (cont’d) An Abstract Investment Restriction (cont’d) III.B. An Abstract Investment Restriction (cont’d) An Abstract Investment Restriction (cont’d) III.B. III.B. A very important aspect of both Propositions is that if Interpretation of the Propositions Concerning Multiple (which must be the case when ), then Equilibria. There are two types of equilibria, Pareto efficient (E-type) and Pareto inefficient (I-type). For the E-type, there is Rank = 2 and a continuum of equilibria, but in which spot goods prices and allocations are identical. Moreover, the asset market is -1 incomplete. For the I-type, there are exactly two distinct is independent of , . equilibria, but in which the portfolio strategies are identical (in a T-period environment with T>2, this means that investors Both this critical property of TSE and the local analysis of TRE appear to be quite generalizable. follow a buy-and-hold strategy). Moreover, the asset market is complete. 23 24 4

Recommend

More recommend