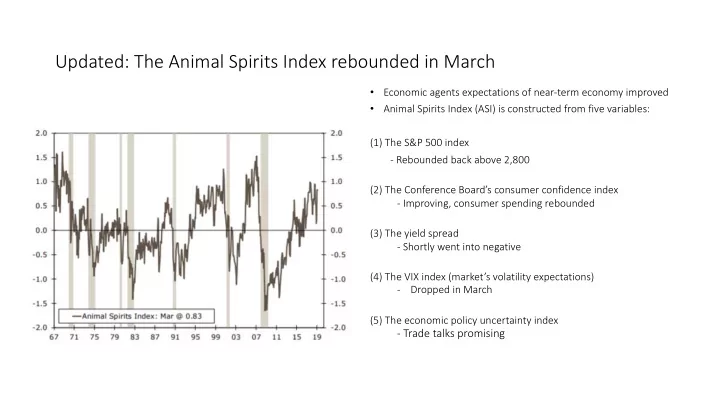

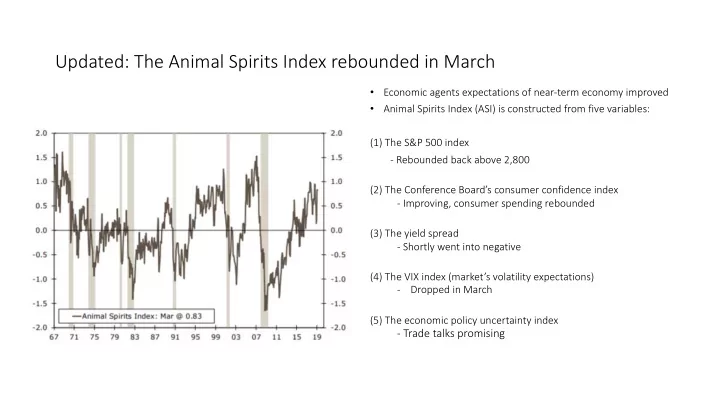

Updated: The Animal Spirits Index rebounded in March • Economic agents expectations of near-term economy improved • Animal Spirits Index (ASI) is constructed from five variables: (1) The S&P 500 index - Rebounded back above 2,800 (2) The Conference Board’s consumer confidence index - Improving, consumer spending rebounded (3) The yield spread - Shortly went into negative (4) The VIX index (market’s volatility expectations) - Dropped in March (5) The economic policy uncertainty index - Trade talks promising

Yield Curve flattening: means less now • Previously a signal of recession in 12-18 months 3.00 • Narrowing recently because of Fed’s QE policies and 2.50 unwinding of their balance sheet (estimation is that it reduced the term premium by about 60 bps) 2.00 • Flood to safety from Europe 1.50 • This inversion was rather insignificant compared to previous cycles and would need to invert significantly 1.00 more and remain inverted for longer period of time to be a reliable signal. 0.50 • Also, financial conditions are not currently as restrictive as in previous cycles and economic 0.00 2012-01-01 2012-05-01 2012-09-01 2013-01-01 2013-05-01 2013-09-01 2014-01-01 2014-05-01 2014-09-01 2015-01-01 2015-05-01 2015-09-01 2016-01-01 2016-05-01 2016-09-01 2017-01-01 2017-05-01 2017-09-01 2018-01-01 2018-05-01 2018-09-01 2019-01-01 fundamentals remain strong Treasury Spread: 10-year yield - 1-year yield

Talk of an imminent U.S. recession is a bit overdone • Expansions perpetuate themselves with a self-generating mechanism (jobs – income – consumption – jobs) • Economic expansion has reached 118 months, record is 120 months • The underlying fundamentals of the U.S. economy are generally solid at present • 2018 Growth: 3.2% with .75% fiscal stimulus after-burner • Residential fixed investment contributed 0.23 and 0.13 points to GDP in 2016, 2017; detracted 0.01 in 2018 • 2019: back to a steady pace of 2 to 2.5% growth • Labor markets, consumer spending, business investment, wages, exports, energy, debt levels still all on steady sustainable paths • Interest rates still low, inflation still constrained • Still a low chance of recession in next 12 months

What’s different this time? Housing market in 2007 Housing Market in 2019 The big 3 imbalances • Finance • Finance • Dodd-Frank • Inexhaustible demand for securitized • Well-capitalized loans • Housing • Low quality loans • single-family housing starts are roughly 50% below last • Loosely regulated peak • Severely underbuilt, and getting worse • Housing • Consumer • Overbuilt • households have de-levered over the past ten years • Highly overvalued • student debt an issue for future consumption but not enough for a recession • Consumer • disposable personal income is up 50% over the past ten years • Highly indebted • Buyer irrational exuberance

IPO floodgate opens – 2019 on pace for record exit value

Is the “Uber Effect” going to be as large as the “Facebook Effect”? • Uber made its S-1 public on Thursday • The company is eyeing a price range of $48 to $55 per share, which would raise about $10 billion and value the company between $90 billion and $100 billion. • SoftBank is the biggest shareholder, 16.3% interest. If Uber hits the high end of its range and is valued at $100 billion, would be worth $16.3 billion. • Uber claims consumers used its services to travel about 26 billion miles during 2018—or enough to circumnavigate the globe more than a million times. • MaaS (Mobility-as-a-Service) platform, global, one-stop shop for urban transportation as well as auxiliary services • Uber will spin out the next generation of notable founders, according to survey of founders, but so will Slack, Airbnb, and other IPO…..

1Q is the second-highest recorded capital investment in the last decade • 2018 largest on record for VC activity, 2019 continue Deal value ($B) Deal count $50 3,500 Angel & Seed Early VC on same pace $45 Later VC 3,000 • Fewer, larger venture deals $40 • Hot item: life sciences (digital+biology) 2,500 $35 • The slew of VC-backed IPOs coming up in 2019 will $30 2,000 create significant liquidity for investors to reinvest in venture funds for the next wave of startups $25 1,500 $20 • Policy issues: • foreign investment - the Foreign Investment $15 1,000 Risk Review Modernization Act (FIRRMA) could $10 push away foreign co-investors and reduce 500 capital for US startups; and immigration(!!). $5 $0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2015 2016 2017 2018 2019

But, housing a critical issue: California needs 3.5 million housing units to close the housing gap 6 Jobs per 1 Housing Permits Added CA has lowest housing per capita ratio over last 6 years after Utah

San Francisco inventory lowest in 5 years – are sellers waiting for IPO rush? 40% Dec_18, 36% All 30% YOY Change in $0- $1M-2 $2M- Invent for-sale (March) $1M M 3M $3M+ ory 20% Mar_19, 19% Alameda 22% 37% 28% 17% 26% Nov_18, 8% 10% Contra Costa 11% 15% 18% 13% 12% Nov_18, 5% 0% Marin 8% 3% 16% 24% 9% Mar_19, -9% -10% Napa 20% 8% -16% 14% 14% -20% San Francisco -31% -11% -4% -3% -17% San Mateo -10% 29% 27% 32% 17% -30% Mar_19, -31% Santa Clara 23% 33% 24% 26% 27% -40% Mar_17 Apr_17 May_17 Jun_17 Jul_17 Aug_17 Sep_17 Oct_17 Nov_17 Dec_17 Jan_18 Feb_18 Mar_18 Apr_18 May_18 Jun_18 Jul_18 Aug_18 Sep_18 Oct_18 Nov_18 Dec_18 Jan_19 Feb_19 Mar_19 Sonoma 15% -6% 0% 15% 11% Total 12% 18% 15% 19% 14% SF More than $1M SF Less than $1M Bay Area Total Less SF 7 BAY AREA MARKET UPDATE

Selma Hepp’s Economic Update • It will be a good year • GDP growth outlook for 2019: 2%+ • Labor markets to remain tight • Rising wages to put pressure on profits • Exports, business investment continue to grow • Inflation to remain constrained • Interest rates still low • Debt levels still safe • Where people move (want to move) will drive regional growth • VC investment continue to fuel our economy and local housing markets

Recommend

More recommend