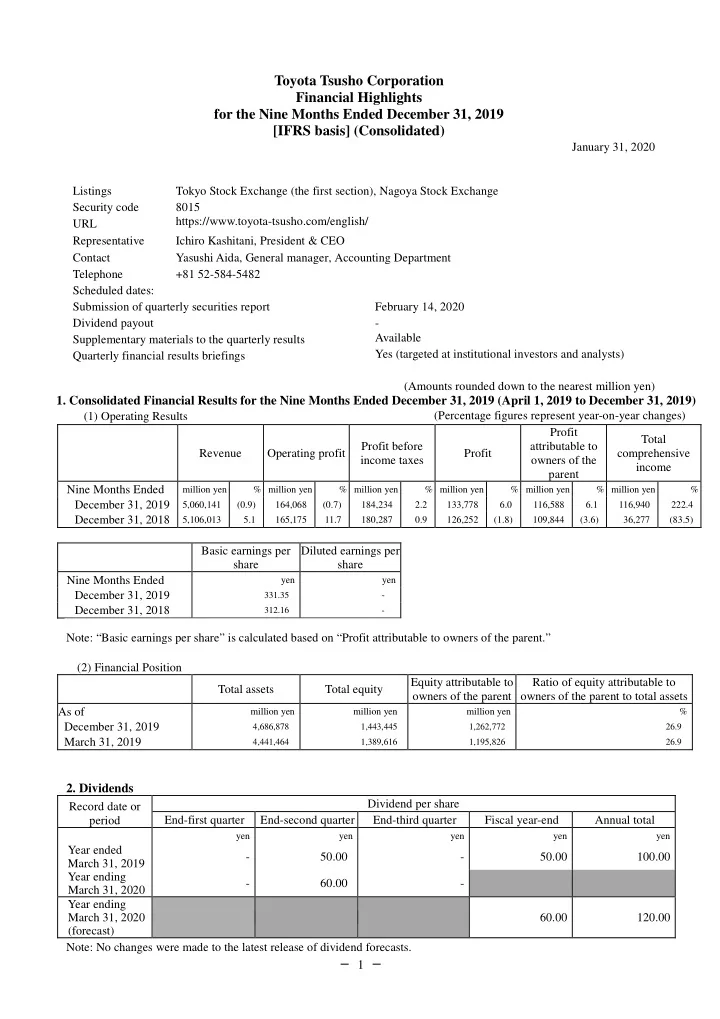

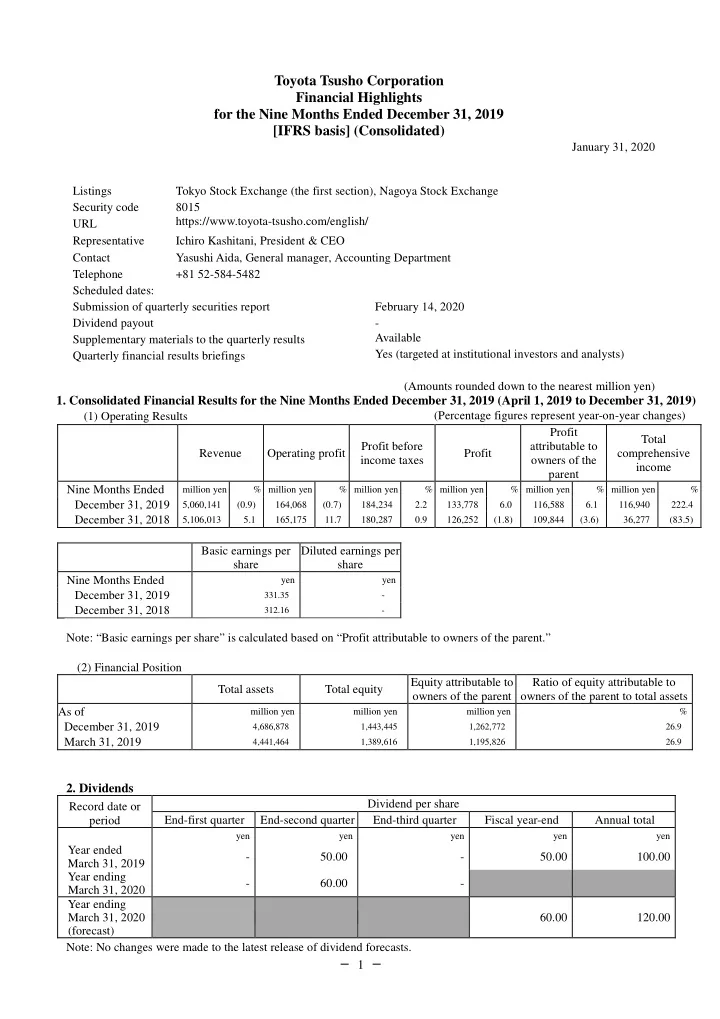

Toyota Tsusho Corporation Financial Highlights for the Nine Months Ended December 31, 2019 [IFRS basis] (Consolidated) January 31, 2020 Listings Tokyo Stock Exchange (the first section), Nagoya Stock Exchange Security code 8015 https://www.toyota-tsusho.com/english/ URL Representative Ichiro Kashitani, President & CEO Contact Yasushi Aida, General manager, Accounting Department Telephone +81 52-584-5482 Scheduled dates: Submission of quarterly securities report February 14, 2020 Dividend payout - Available Supplementary materials to the quarterly results Yes (targeted at institutional investors and analysts) Quarterly financial results briefings (Amounts rounded down to the nearest million yen) 1. Consolidated Financial Results for the Nine Months Ended December 31, 2019 (April 1, 2019 to December 31, 2019) (Percentage figures represent year-on-year changes) (1) Operating Results Profit Total Profit before attributable to Revenue Operating profit Profit comprehensive income taxes owners of the income parent Nine Months Ended million yen % million yen % million yen % million yen % million yen % million yen % December 31, 2019 5,060,141 (0.9) 164,068 (0.7) 184,234 2.2 133,778 6.0 116,588 6.1 116,940 222.4 December 31, 2018 5,106,013 5.1 165,175 11.7 180,287 0.9 126,252 (1.8) 109,844 (3.6) 36,277 (83.5) Basic earnings per Diluted earnings per share share Nine Months Ended yen yen December 31, 2019 331.35 - December 31, 2018 312.16 - Note: “Basic earnings per share” is calculated based on “Profit attributable to owners of the parent.” (2) Financial Position Equity attributable to Ratio of equity attributable to Total assets Total equity owners of the parent owners of the parent to total assets As of million yen million yen million yen % December 31, 2019 4,686,878 1,443,445 1,262,772 26.9 March 31, 2019 4,441,464 1,389,616 1,195,826 26.9 2. Dividends Dividend per share Record date or End-first quarter End-second quarter End-third quarter Fiscal year-end Annual total period yen yen yen yen yen Year ended - 50.00 - 50.00 100.00 March 31, 2019 Year ending - 60.00 - March 31, 2020 Year ending March 31, 2020 60.00 120.00 (forecast) Note: No changes were made to the latest release of dividend forecasts. − 1 −

3. Forecast of Consolidated Earnings for the Fiscal Year ending March 31, 2020 (April 1, 2019 to March 31, 2020) (Percentage figures represent year-on-year changes) Profit attributable to owners of Basic earnings per share the parent million yen % yen Full year 150,000 13.1 426.27 Note: No changes were made to the latest release of earnings forecasts. *Notes (1) Changes affecting the consolidation status of significant subsidiaries (changes in specified subsidiary resulting in change in scope of consolidations) during the period: Yes (Name) Toyota Tsusho Thai Holdings Co., Ltd. Newly consolidated: One (2) Changes in accounting policy and changes in accounting estimates: 1) Changes in accounting policy required by IFRS: Yes 2) Changes other than the above 1): None 3) Changes in accounting estimates: None Note: For details, please refer to (Changes in Accounting Policy) on page 13. (3) Number of issued shares (common stock) 1) Number of issued shares at end of period (Treasury shares included): December 31, 2019: 354,056,516 shares March 31, 2019: 354,056,516 shares 2) Number of shares held in treasury at end of period: December 31, 2019: 2,209,316 shares March 31, 2019: 2,169,311 shares 3) Average number of shares outstanding during the period: Nine Months Ended December 31, 2019: 351,859,265 shares Nine Months Ended December 31, 2018: 351,884,948 shares *Quarterly review status This report is exempt from the quarterly review by certified public accountant or audit firm. *Appropriate use of earnings forecasts and other important information 1. The above forecasts, which constitute forward-looking statements, are based on information available to the Company as of the date of the release of this document. Actual results may differ materially from the above forecasts due to a range of factors. 2. The Company is scheduled to hold a quarterly earnings briefing for institutional investors and analysts on Friday, January 31, 2020. The presentation materials for the earnings briefing will be posted on its website promptly following the earnings announcement. *This is an abridged translation of the original Japanese document and is provided for informational purposes only. If there are any discrepancies between this and the original, the original Japanese document prevails. − 2 −

1. Consolidated Results of Operations (1) Overview of Operating Performance 1) Business Environment In the first nine months of the fiscal year (April 1 – December 31, 2019), the global economy as a whole trended toward slower growth because of factors including an economic slump in Europe and China, despite a robust U.S. economy. Prolongation of the conflict between the U.S. and China led to worldwide heightening of concern about an economic downturn. The Federal Reserve Board’s interest rate cuts and other financial policies underpinned business activity in the U.S., and a recovery trend fueled by continuing strength in the employment environment and personal consumption continued, despite slowing of corporate capital investment and production resulting from concerns about the impact of trade friction between the U.S. and China. In the European economy, although personal consumption and government consumption remained firm, signs of economic deceleration stemming from prolongation of a manufacturing slump continued. Also, the outlook for the future remained uncertain amid fraught Brexit negotiations between the UK and EU. In the Chinese economy, the trend of economic deceleration continued in the wake of a slump in infrastructure investment and deterioration of consumer sentiment, despite attempts to prop up the economy with tax cuts, subsidies, and other economic policies amid economic rebalancing from investment-led to consumption-led growth. Also, slowing of economic growth came into sharp focus due to the continuing impact of trade friction with the U.S. The slowdown in economic growth in emerging market economies continued as a result of factors including declining exports and stagnant resource prices resulting in part from slowing of the Chinese economy. Against this backdrop, in Japan an export slump centered on automobiles and iron and steel continued due to the impact of economic deceleration in China, and manufacturing production remained weak. Although the employment and income environments improved, domestic demand cooled due in part to a series of natural disasters, and the Japanese economy showed a trend toward slower growth. Also, concerns about an economic slowdown strengthened in response to trade frictions and sluggishness in Europe, China, and other overseas economies. 2) Business Activities by Segment (I) Metals For the purpose of reducing illegal disposal and appropriately disposing of end-of-life vehicles in India, in October 2019 Toyota Tsusho Corporation, together with Toyota Tsusho India Private Limited and Maruti Suzuki India Limited, an Indian subsidiary of Suzuki Motor Corporation, established Maruti Suzuki Toyotsu India Private Limited, a vehicle dismantling and recycling joint venture. (II) Global Parts & Logistics For the purpose of bolstering assistance for Japanese companies entering Cambodia, in December 2019 Techno Park Poi Pet Pvt Co., Ltd. concluded a business partnership agreement with Sanco Cambo Investment Group Co., Ltd. concerning a second Techno Park rental factory. (III) Automotive To help resolve social problems such as traffic congestion and air pollution, in November 2019 the Toyota Tsusho Group acquired an equity stake in start-up venture Super Highway Labs Private Limited, provider of Shuttl, an app-based medium- and long-distance bus service operated in six cities in India as a new mobility service. (IV) Machinery, Energy & Projects October 2019 marked the start of commercial operation of a 262.5 MW wind power plant that the Company, together with Eurus Energy Holdings Corporation, constructed in the Arab Republic of Egypt for the purpose of contributing to the spread of clean, low-priced renewable energy and further expansion of the wind power generation business. (V) Chemicals & Electronics For the purpose of contributing to resolution of heat and noise issues in electronic devices and shortening of development times, in August 2019 NEXTY Electronics Corporation acquired an equity stake in Ultimate Technologies Inc., continuing a collaborative partnership. (VI) Food & Consumer Services For the purpose of functional enhancement of a health support business that utilizes personal health data, in August 2019 the Group acquired an equity stake in, and entered into a business alliance with, M-aid Co., Ltd. On the occasion of the equity investment in M-aid Co., Ltd., the Group also entered into a business alliance with Sugi Pharmacy Co., Ltd. for the purpose of constructing a next-generation preventive medical services model. − 3 −

Recommend

More recommend