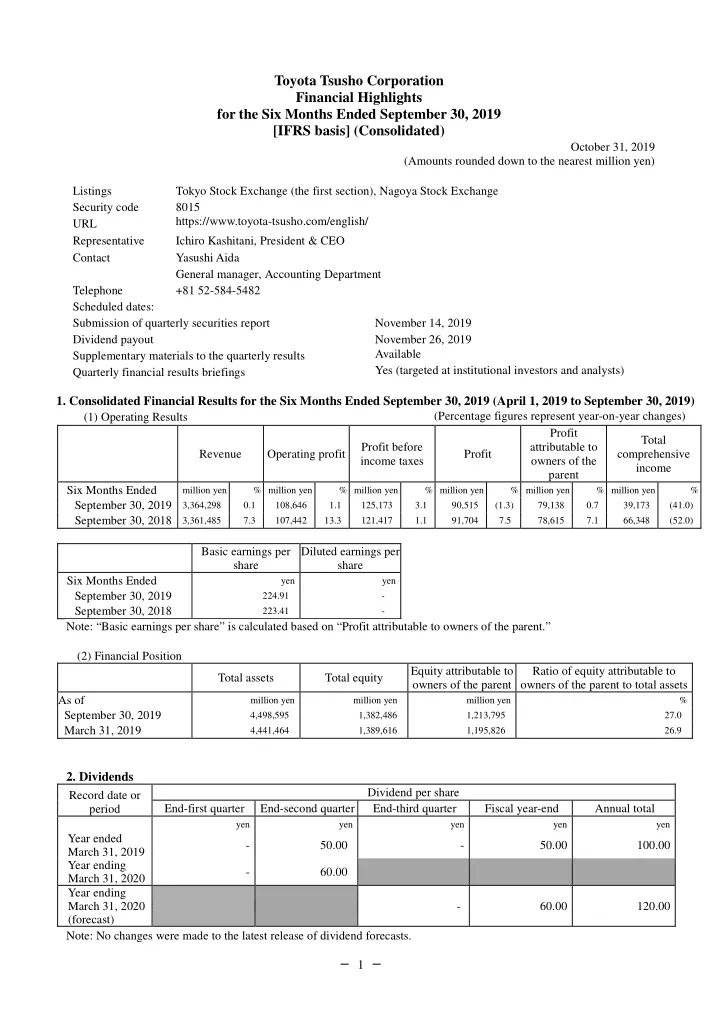

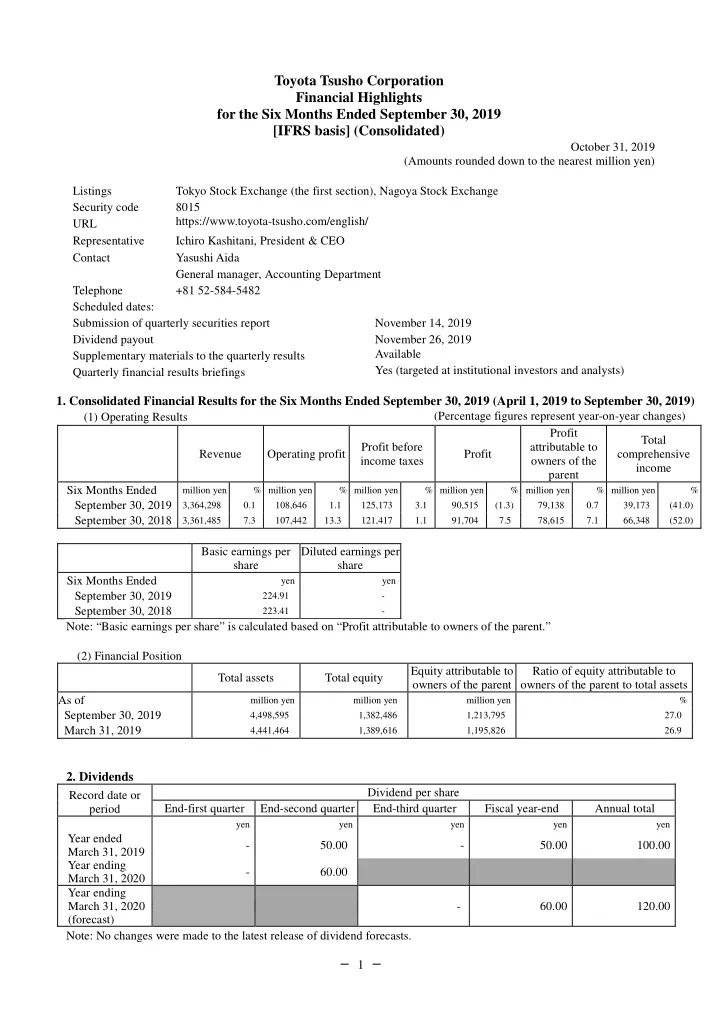

Toyota Tsusho Corporation Financial Highlights for the Six Months Ended September 30, 2019 [IFRS basis] (Consolidated) October 31, 2019 (Amounts rounded down to the nearest million yen) Listings Tokyo Stock Exchange (the first section), Nagoya Stock Exchange Security code 8015 https://www.toyota-tsusho.com/english/ URL Representative Ichiro Kashitani, President & CEO Contact Yasushi Aida General manager, Accounting Department Telephone +81 52-584-5482 Scheduled dates: Submission of quarterly securities report November 14, 2019 Dividend payout November 26, 2019 Available Supplementary materials to the quarterly results Yes (targeted at institutional investors and analysts) Quarterly financial results briefings 1. Consolidated Financial Results for the Six Months Ended September 30, 2019 (April 1, 2019 to September 30, 2019) (1) Operating Results (Percentage figures represent year-on-year changes) Profit Total Profit before attributable to Revenue Operating profit Profit comprehensive income taxes owners of the income parent Six Months Ended million yen % million yen % million yen % million yen % million yen % million yen % September 30, 2019 3,364,298 0.1 108,646 1.1 125,173 3.1 90,515 (1.3) 79,138 0.7 39,173 (41.0) September 30, 2018 3,361,485 7.3 107,442 13.3 121,417 1.1 91,704 7.5 78,615 7.1 66,348 (52.0) Basic earnings per Diluted earnings per share share Six Months Ended yen yen September 30, 2019 224.91 - September 30, 2018 223.41 - Note: “Basic earnings per share” is calculated based on “Profit attributable to owners of the parent.” (2) Financial Position Equity attributable to Ratio of equity attributable to Total assets Total equity owners of the parent owners of the parent to total assets As of million yen million yen million yen % September 30, 2019 4,498,595 1,382,486 1,213,795 27.0 March 31, 2019 4,441,464 1,389,616 1,195,826 26.9 2. Dividends Dividend per share Record date or period End-first quarter End-second quarter End-third quarter Fiscal year-end Annual total yen yen yen yen yen Year ended - 50.00 - 50.00 100.00 March 31, 2019 Year ending - 60.00 March 31, 2020 Year ending March 31, 2020 - 60.00 120.00 (forecast) Note: No changes were made to the latest release of dividend forecasts. − 1 −

3. Forecast of Consolidated Earnings for the Fiscal Year ending March 31, 2020 (April 1, 2019 to March 31, 2020) (Percentage figures represent year-on-year changes) Profit attributable to owners of Basic earnings per share the parent million yen % yen Full year 150,000 13.1 426.27 Note: No changes were made to the latest release of earnings forecasts. *Notes (1) Changes affecting the consolidation status of significant subsidiaries (changes in specified subsidiary resulting in change in scope of consolidations) during the period: Yes (Name) Toyota Tsusho Thai Holdings Co., Ltd. Newly consolidated: One (2) Changes in accounting policy and changes in accounting estimates: 1) Changes in accounting policy required by IFRS: Yes 2) Changes other than the above 1): None 3) Changes in accounting estimates: None Note: For details, please refer to (Changes in Accounting Policy) on page 13. (3) Number of issued shares (common stock) 1) Number of issued shares at end of period (Treasury shares included): September 30, 2019: 354,056,516 shares March 31, 2019: 354,056,516 shares 2) Number of shares held in treasury at end of period: September 30, 2019: 2,205,515 shares March 31, 2019: 2,169,311 shares 3) Average number of shares outstanding during the period: Six Months Ended September 30, 2019: 351,864,293 shares Six Months Ended September 30, 2018: 351,885,590 shares *Quarterly review status This report is exempt from the quarterly review by certified public accountant or audit firm. *Appropriate use of earnings forecasts and other important information 1. The above forecasts, which constitute forward-looking statements, are based on information available to the Company as of the date of the release of this document. Actual results may differ materially from the above forecasts due to a range of factors. 2. The Company is scheduled to hold a quarterly earnings briefing for institutional investors and analysts on Friday, November 1, 2019. The presentation materials for the earnings briefing will be posted on its website promptly following the earnings announcement. *This is an abridged translation of the original Japanese document and is provided for informational purposes only. If there are any discrepancies between this and the original, the original Japanese document prevails. − 2 −

1. Consolidated Results of Operations (1) Overview of Operating Performance 1) Business Environment In the first six months of the fiscal year (April 1 – September 30, 2019), the global economy as a whole trended toward slower growth because of factors including an economic slump in Europe and China, despite a robust U.S. economy. Escalation of the conflict between the U.S. and China led to worldwide heightening of concern about an economic downturn. Federal Reserve Board interest rate policy underpinned business activity in the U.S., with the economy remaining on a recovery trend fueled by robust personal consumption, despite slowing of exports to China and other markets attributable to declining external demand resulting from trade friction between the U.S. and China. In the European economy, although exports are showing a recovery trend, signs of economic deceleration stemming in part from sluggish internal demand continued. The outlook for the future remained uncertain amid fraught Brexit negotiations between the UK and EU. In the Chinese economy, the trend toward economic deceleration continued in the wake of a slump in infrastructure investment and deterioration of consumer sentiment, despite attempts to prop up the economy with tax cuts, subsidies, and other measures amid economic rebalancing from investment-led to consumption-led growth resulting from a shift in China’s growth strategy from a quantitative to a qualitative focus. Also, slowing of economic growth came into sharp focus due to intensification of trade friction with the U.S. Emerging market economies gradually slowed as a result of declining exports and stagnant resource prices resulting from slowing of the Chinese economy. Against this backdrop, the Japanese economy continued to gradually recover, driven by improvement in the employment and income environments, despite continuing weakness in exports and production due to declining exports to Asia partly attributable to the economic slowdown in China. Concerns about a slowdown strengthened however, in response to sluggishness in Europe, China, and other overseas economies as well as trade frictions. 2) Business Activities by Segment (I) Metals For the purpose of helping to realize an eco-friendly recycling society, in September 2019 the Group launched on a full-scale basis a demonstration project for recycling of end-of-life vehicles, which has been adopted for the New Energy and Industrial Technology Development Organization’s (NEDO) project for construction of an efficient and appropriate recycling system for end-of-life vehicles in Thailand. (II) Global Parts & Logistics The Group acquired an equity stake in Israel-based UVeye Ltd. in a private placement offering in June 2019 and is now pursuing collaboration with UVeye, which provides vehicle inspection services through visual analysis utilizing artificial intelligence (AI) for the purpose of improving efficiency and labor-saving in vehicle inspection. (III) Automotive To further establish the Toyota brand in Myanmar and contribute to the country’s economy, in June 2019 the Group acquired an equity stake in Toyota Myanmar Co., Ltd., a vehicle production company established by Toyota Motor Corporation, and began preparations for local production. (IV) Machinery, Energy & Projects For the purpose of supporting the development of local communities through community-level electrification, the Group acquired an equity stake in U.S.-based venture company Powerhive Inc. in a private placement offering in July 2019. Powerhive engages in a mini-grid business that combines solar power generation systems and storage batteries in non-electrified areas of Kenya. (V) Chemicals & Electronics For the purpose of regional development and popularization of ultra-compact electric vehicles, in July 2019 the Group launched Ha:moRIDE, a micromobility sharing service that utilizes ultra-compact “COMS” electric vehicles from Toyota Motor Corporation, as a tourism-focused MaaS business in Kumejima, Okinawa Prefecture, under the name Kumejima Ha:mo. (VI) Food & Consumer Services For the purpose of functional enhancement of a health support business that utilizes personal health data, in August 2019 the Group acquired an equity stake in, and entered into a business alliance with, M-aid Co., Ltd. On the occasion of the equity investment in M-aid Co., Ltd., the Group also entered into a business alliance with Sugi Pharmacy Co., Ltd. for the purpose of constructing a next-generation preventive medical services model. (VII) Africa For the purpose of accelerating initiatives in the mobility business in Africa, in August 2019 the Group decided to establish Mobility 54 Investment SAS, an investment company specializing in capital investments and loans to mobility-related start-ups, in partnership with CFAO SAS. − 3 −

Recommend

More recommend