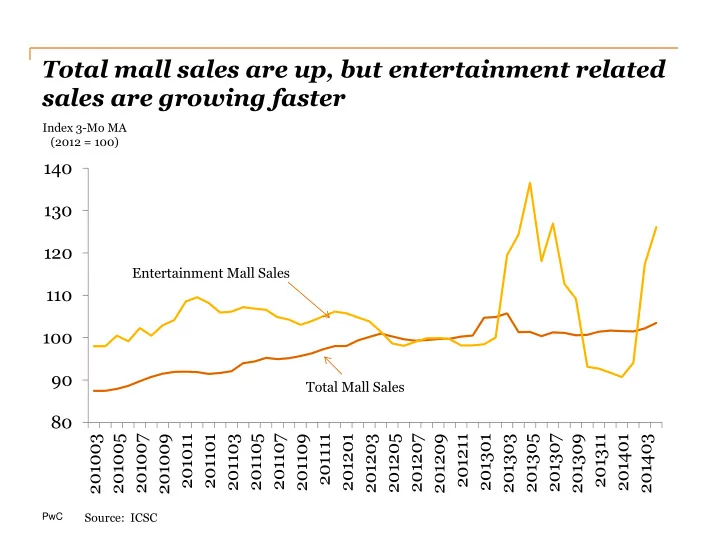

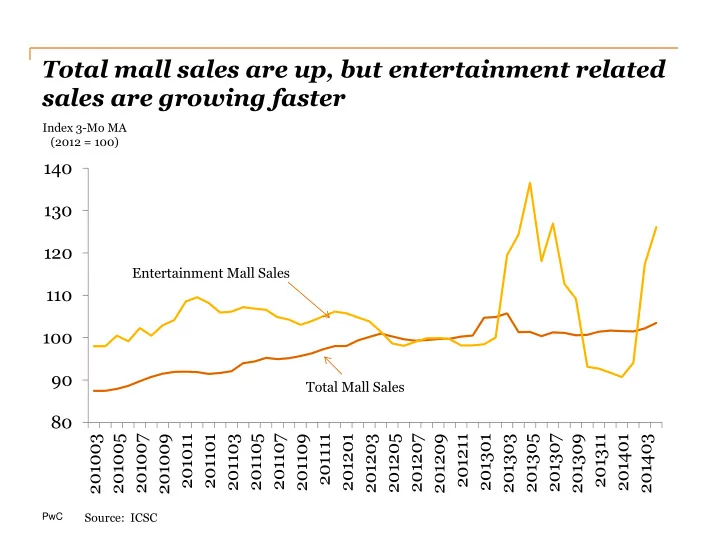

Total mall sales are up, but entertainment related sales are growing faster Index 3-Mo MA (2012 = 100) 140 130 120 Entertainment Mall Sales 110 100 90 Total Mall Sales 80 201003 201005 201007 201009 201011 201101 201103 201105 201107 201109 201111 201201 201203 201205 201207 201209 201211 201301 201303 201305 201307 201309 201311 201401 201403 Source: ICSC PwC

Mall Shopping Behavior Number of trips has But spending a little less recovered… time per trip Monthly visits to the Minutes Spent Mall 92 90 3.4 88 3.3 86 3.2 84 3.1 82 3.0 80 2.9 78 2.8 76 2.7 74 2.6 72 2001 2004 2007 2010 2012 2001 2004 2007 2010 2012 Source: ICSC

Nearly 61.0 million square feet of obsolete mall space continues to deteriorate Estimated Obsolete Availability Rate MSF Inventory 70.0% 61.0 Obsolete 60.0% 61.0 50.0% 61.0 40.0% 61.0 30.0% 60.9 20.0% 60.9 Viable 10.0% 60.9 60.9 0.0% Source: CoStar, Obsolete = Space 4 or more years old with a vacancy rate of over 30% PwC

Mall demand by class MSF The shortage of 3.0 available “A” 2.5 space is 2.0 pushing tenants 1.5 to “B/C” 1.0 locations 0.5 0.0 2010 1Q 2010 2Q 2010 3Q 2010 4Q 2011 1Q 2011 2Q 2011 3Q 2011 4Q 2012 1Q 2012 2Q 2012 3Q 2012 4Q 2013 1Q 2013 2Q 2013 3Q 2013 4Q 2014 1Q -0.5 -1.0 -1.5 -2.0 Class A Class B/C Source: CoStar PwC

Retail market slower to recover… Cumulative # of Markets 80 70 60 50 40 30 20 10 0 2014 2015 2016 2017 2018 Recession Recovery Expansion Contraction 1 2 3 4 5 6 7 8 9 10 11 12 Source: Reis, PwC Investor Survey PwC

…but appears to have turned the corner 2.5% 94.0% 2.0% 93.0% 1.5% 92.0% 1.0% 91.0% 0.5% 90.0% 0.0% 89.0% -0.5% 88.0% -1.0% 87.0% -1.5% 86.0% Supply Demand Occupancy Source: PwC, CBRE-EA PwC

Retail market likely to be very selective about new development Supply as % of Inventory Demand as % of Inventory San Jose 1.6% 1.9% Tacoma 1.5% 1.4% Knoxville 1.4% 1.4% Omaha 1.0% 1.0% Austin 1.0% 1.2% Opportunity? Orlando 0.5% 1.3% Syracuse 0.1% 0.8% Palm Beach 0.8% 1.4% Birmingham 0.2% 0.8% Phoenix 0.2% 0.8% Risk? Wichita 0.2% -0.1% New Haven 0.2% 0.1% Tacoma 1.5% 1.4% Chattanooga 0.2% 0.2% Omaha 1.0% 1.0% Source: PwC, Reis, Inc. PwC

Retail vacancy rates improve in the 25 largest markets 16.0% Cyclical Peak 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% YE 2014 Forecast 2.0% 0.0% Source: PwC, CBRE-EA PwC

Retail cap rates trend downward over the past five years, but flattened over the past four quarters 9.00% 8.50% 8.00% Historical Average Retail Cap Rate = 7.38% 7.50% 7.00% 6.50% Regional Mall Power Center Strip Center 6.00% Source: PwC Real Estate Investor Survey PwC

Investors show renewed interest in retail Number Billions US$ 4,000 80.0 3,500 70.0 3,000 60.0 2,500 50.0 2,000 40.0 Number 1,500 30.0 Dollar 1,000 20.0 500 10.0 - 0.0 Source: PwC, Real Capital Analytics PwC

Recommend

More recommend