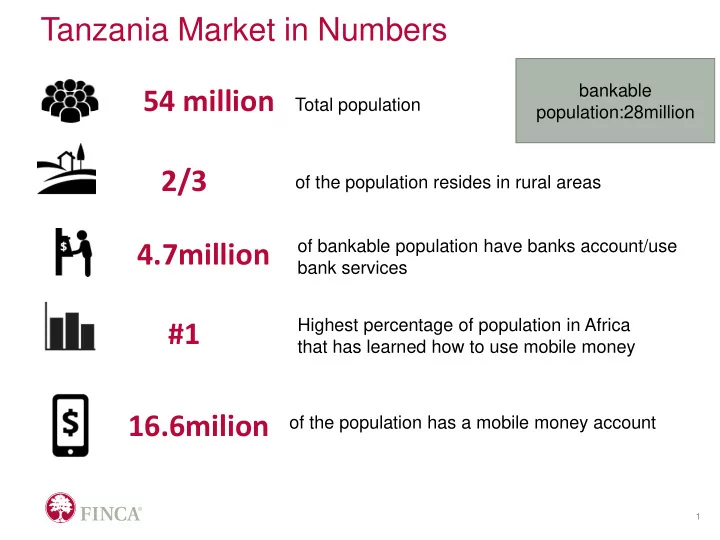

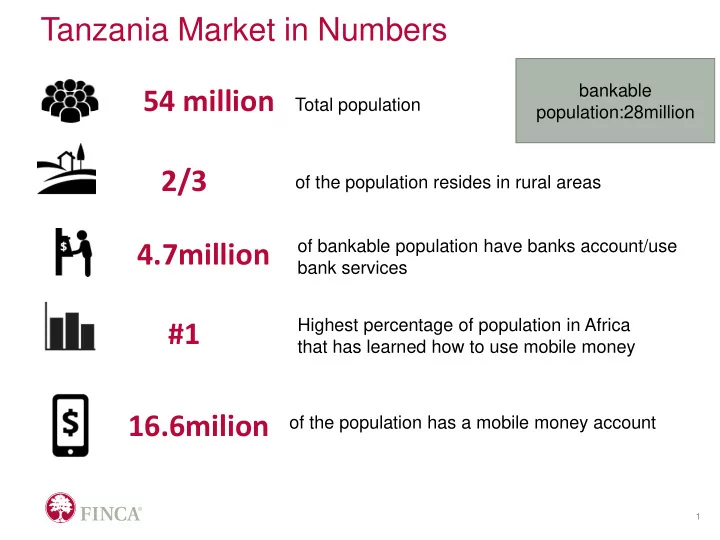

Tanzania Market in Numbers bankable 54 million Total population population:28million 2/3 of the population resides in rural areas of bankable population have banks account/use 4.7million bank services Highest percentage of population in Africa #1 that has learned how to use mobile money 16.6milion of the population has a mobile money account 1

FINCA MFB Snapshot • In Incorporated: 1998 • Cu Customer: 153,000 • # # Br Branches: 24 • Br Branchle less Ch Channels: − Mobile Banking − Agency Banking (135+ agents) Proprietary and Confidential

Bond Market in Tanzania FINCA Microfinance Bank ❑ Corporate Listed Bond in Tanzania 1. Call to order and establishment of the quorum ▪ Statistics shows that while the bond market in the world is over 140% of the global GDP, In Tanzania the bond market is less than 7% of Tanzania’s GDP and only 2% of it is the corporate bond. ▪ Therefore, while the bond market in Tanzania is that underdeveloped, there is a very strong need for the long term funding as well as long term investments. ▪ Major challenges of bond market in Tanzania includes issuance and set up costs, a lot of capital market requirements and covenants requirements, market infrastructure and knowledge and awareness of bond market.

Funding strategy for FINCA Microfinance Bank FINCA Microfinance Bank ❑ The Bond issuance is planned to leverage local funding vs offshore borrowings as well as long vs short term financing ❑ The arrangement started back in 2016 with the following ley partners ✓ NICC and PCGL – the lead arrangers ✓ PWC – the reporting accountant ✓ Lawfiled – Legal advisors ✓ CRDB – Trustee/registrar ✓ ALCB – Anchor investor and also assisted to cover some of set up costs ✓ USAID – Guarantor of investors

Ongoing and pending tasks and Pending Tasks FINCA Microfinance Bank • This phase is complete Preparation • The Joint Lead Transaction Advisors prepared the Information Memorandum for the Offer and made the subsequent submission to CMSA for approval. CMSA reverted with their feedback and the team is in the process of addressing the concerns raised prior to re-submission. We expect the resubmission to take place the week ending 13 th April 2018. • Other offer documentation to be submitted include: − Due diligence and Legal Opinion − Accountants report documentation − Guarantee Agreement − Trust Deed − Agency Agreement − Pricing Supplement • Following CMSA approval, FINCA will be required to run two advertisements in the dailies outlining the key features of the Offer • NICC and PCGL will sound off the Tanzanian markets by way of investor roadshows to determine Investor roadshows appetite for the issue as well as structure preference. and Offer Launch • Following the investor roadshows, the Offer will be launched and remain open for a period of 10 working days

Summary of the Transaction Key Parties FINCA Microfinance Bank FINCA (Issuer) USAID (Guarantor) ALCB Fund (Anchor Investor) I ncentivize local banks and financial Diversification of funding sources institutions to begin lending to SME’s Encourage high impact businesses to tap the Increased brand visibility Motivation in an effort to increase their bottom local capital markets, maximising local Likely to obtain better pricing due to lines while promoting prosperity and investment and reducing FX risks the perceived liquidity. security “Hand - holding” role including selection of Work with investors, local financial advisers institutions, and development Role Issuer of Notes organizations to design and deliver Provide of TA for reporting accountant and investment alternatives that unlock lawyers financing Prospective anchor investor in the bond Private capital through the use of guarantees is accomplished at a Diversification of asset classes for fraction of the cost of conventional local investors donor support and seeks to Confidence to Issuer to go through lengthy Value-add Public listing of the bond makes it an permanently replace short-term donor process; patience! admissible investment for most fund funding with long-term and managers. sustainable, locally-generated, private capital Delays stemming from accountants/regulators Delays from auditors in submitting Difference in legal terms between MIVs and working papers to reporting accountant Delays with the Trustee and execution Challenges capital markets of relevant agreements Delays in publishing of audited In the meantime, market and economic accounts conditions move on! Preparation for a capital market issuance is key Getting the right third party advisors is Get the advisers right and ensure they are Lessons critical providing appropriate service Public issuances can be a time consuming process

Recommend

More recommend