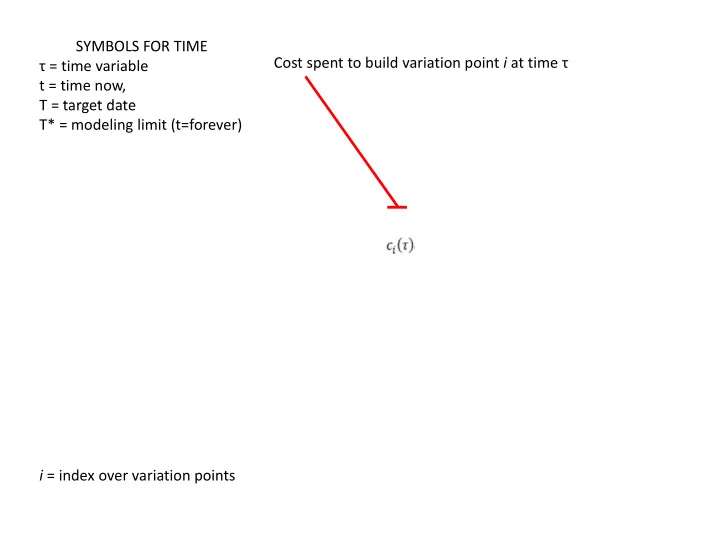

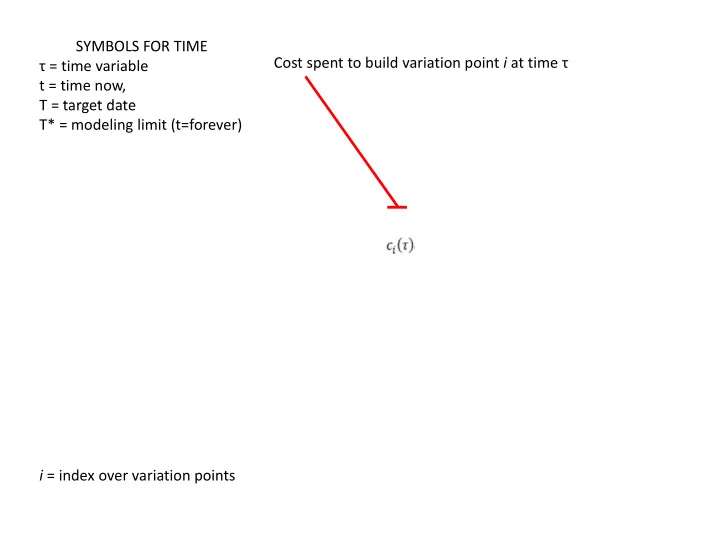

SYMBOLS FOR TIME Cost spent to build variation point i at time τ τ = time variable t = time now, T T = target date target date T* = modeling limit (t=forever) i = index over variation points

SYMBOLS FOR TIME Cost spent to build variation point i at time τ τ = time variable t = time now, T T = target date target date T* = modeling limit (t=forever) …adjusted by a factor to account for net present value of money i = index over variation points r = assumed interest rate

SYMBOLS FOR TIME Cost spent to build variation point i at time τ τ = time variable t = time now, Expected cost summed over T T = target date target date all relevant time intervals T* = modeling limit (t=forever) …adjusted by a factor to account for net present value of money i = index over variation points r = assumed interest rate

SYMBOLS FOR TIME τ = time variable t = time now, Expected costs of building variation point i T T = target date target date incurred from now until time T T* = modeling limit (t=forever) i = index over variation points r = assumed interest rate

SYMBOLS FOR TIME τ = time variable t = time now, T T = target date target date T* = modeling limit (t=forever) value of variation point i in product k at time τ at time τ i = index over variation points r = assumed interest rate k = index over products

SYMBOLS FOR TIME τ = time variable t = time now, T T = target date target date T* = modeling limit (t=forever) value of variation point i in product k at time τ at time τ = marginal value of the i th variation point in the k th product at time τ . i t i th k th d t t ti i = index over variation points marginal cost of tailoring variation r = assumed interest rate point i for use in product k k = index over products

SYMBOLS FOR TIME τ = time variable t = time now, T T = target date target date T* = modeling limit (t=forever) …adjusted by a factor to account for net present value of money value of variation point i in product k at time τ at time τ = marginal value of the i th variation point in the k th product at time τ . i t i th k th d t t ti i = index over variation points marginal cost of tailoring variation r = assumed interest rate point i for use in product k k = index over products

SYMBOLS FOR TIME τ = time variable t = time now, T T = target date target date T* = modeling limit (t=forever) …adjusted by a factor to account for net present value of money summed over all time value of variation point i in product k at time τ at time τ = marginal value of the i th variation point in the k th product at time τ . i t i th k th d t t ti i = index over variation points marginal cost of tailoring variation r = assumed interest rate point i for use in product k k = index over products

SYMBOLS FOR TIME τ = time variable t = time now, T T = target date target date T* = modeling limit (t=forever) …adjusted by a factor to account for net present value of money Value cannot Value cannot be negative summed over all time value of variation point i in product k at time τ = at time τ marginal value of the i th variation point in the k th product at time τ . i t i th k th d t t ti i = index over variation points marginal cost of tailoring variation r = assumed interest rate point i for use in product k k = index over products

SYMBOLS FOR TIME τ = time variable t = time now, T T = target date target date T* = modeling limit (t=forever) value of variation point i in product k over all time i = index over variation points r = assumed interest rate k = index over products

SYMBOLS FOR TIME τ = time variable t = time now, T T = target date target date T* = modeling limit (t=forever) value of variation point i in product k over all time… …and over all products i = index over variation points r = assumed interest rate k = index over products

SYMBOLS FOR TIME τ = time variable t = time now, T T = target date target date T* = modeling limit (t=forever) probability that variation point i will be ready for use by time T value of variation point i in product k over all time… …and over all products i = index over variation points r = assumed interest rate k = index over products

SYMBOLS FOR TIME τ = time variable t = time now, Expected costs of building variation point i T T = target date target date incurred from now until time T T* = modeling limit (t=forever) probability that variation point i will be ready for use by time T value of variation point i in product k over all time… …and over all products i = index over variation points r = assumed interest rate k = index over products

SYMBOLS FOR TIME τ = time variable t = time now, Expected costs of building variation point i T T = target date target date incurred from now until time T T* = modeling limit (t=forever) Value cannot be negative be negative probability that variation point i will be ready for use by time T value of variation point i in product k over all time… …and over all products i = index over variation points r = assumed interest rate k = index over products

SYMBOLS FOR TIME τ = time variable t = time now, Expected costs of building variation point i T T = target date target date incurred from now until time T T* = modeling limit (t=forever) Value cannot Value of variation point i be negative be negative over the time interval (t T) over the time interval (t,T) probability that variation point i will be ready for use by time T value of variation point i in product k over all time… …and over all products i = index over variation points r = assumed interest rate k = index over products

SYMBOLS FOR TIME Cost spent to build a variation point at time τ τ = time variable t = time now, Expected cost summed over T T = target date target date all relevant time intervals T* = modeling limit (t=forever) …adjusted by a factor to account Value cannot Value of variation point i for net present value of money be negative be negative over the time interval (t T) over the time interval (t,T) Value cannot Value cannot be negative summed over all time value of variation point i in product k probability that variation point i at time τ = at time τ will be ready for use by time T expected value marginal value of the i th variation over all products point in the k th product at time τ . i t i th k th d t t ti i = index over variation points marginal cost of tailoring variation r = assumed interest rate point i for use in product k k = index over products

Recommend

More recommend