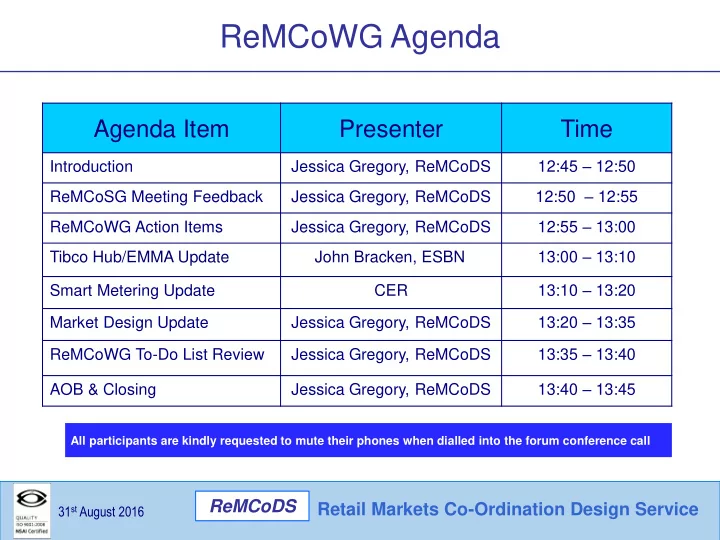

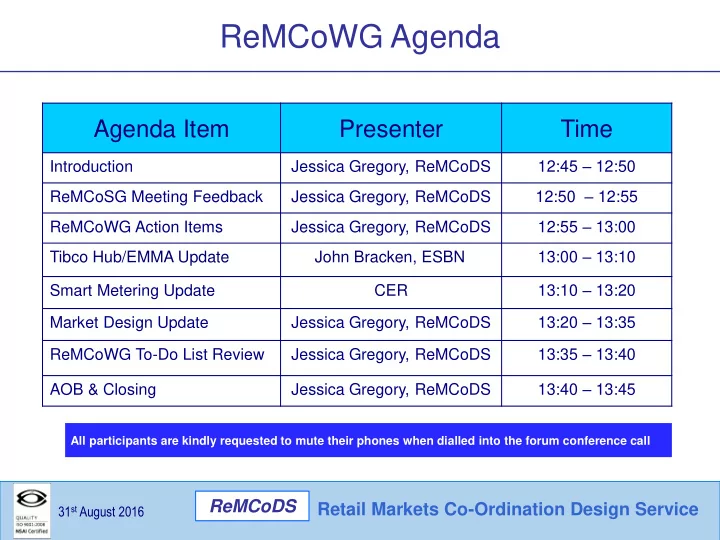

ReMCoWG Agenda Agenda Item Presenter Time 12:45 – 12:50 Introduction Jessica Gregory, ReMCoDS 12:50 – 12:55 ReMCoSG Meeting Feedback Jessica Gregory, ReMCoDS 12:55 – 13:00 ReMCoWG Action Items Jessica Gregory, ReMCoDS 13:00 – 13:10 Tibco Hub/EMMA Update John Bracken, ESBN 13:10 – 13:20 Smart Metering Update CER 13:20 – 13:35 Market Design Update Jessica Gregory, ReMCoDS 13:35 – 13:40 ReMCoWG To-Do List Review Jessica Gregory, ReMCoDS 13:40 – 13:45 AOB & Closing Jessica Gregory, ReMCoDS All participants are kindly requested to mute their phones when dialled into the forum conference call ReMCoDS Retail Markets Co-Ordination Design Service 31 st August 2016

Approval of Minutes Minutes (v1.0) from ReMCoWG meeting 29th June 2016 For Approval Today ReMCoDS Retail Markets Co-Ordination Design Service 31 st August 2016

ReMCoSG Update SG Meeting held on 24 th August 2016 Topic Detail Action Item Status • Currently in the Replan Process. • CER has had productive engagements with all NSMP stakeholders, such as ESBN and GNI and has also been in contact with DC&R, Eirgrid and SEAI. Incorporating Smart changes into • CER is working closely with ESBN and GNI to collate all the MPDs and to formulate an End to End Programme the Co-Ordinated Retail Markets - Plan. this action is being retained as a Smart Metering CER will have an update at this Forum. 105 standing item/placeholder pre-existing • Currently all I-SEM Workstreams are on track. • The latest Quarterly I-SEM update was published on the All Ireland Project Website. I-SEM Both the CER & ESBN will have an I-SEM update at this Forum P Mallon provided the ESBN/NIE Networks TIBCO Project update. He outlined slides on the following: • Project Plan, Message Volumes processed, Cut-Over, Hypercare Period, Next Steps including Market Assurance Recommendations and Retail Market IT Program. CER/UR to agree on how they TIBCO/Schema •1 New Action was logged. Action 136: CER/UR to agree on how they want to receive the outcome of the TIBCO want to receive the outcome of Programme recommendations 136 the TIBCO recommendations New • All agreed that Action 135 should remain open as this Action is currently with the UR who are yet to revert to the CER with their position on the proposal produced by ESBN and NIE Networks. • IT was proposed that ROI goes ahead with the working assumption to follow the plan which would include a CER/UR to provide a decision Co-Ordinated schema release in 2018. CER would be required to formally support this approach. It would have to be around the future Co-ordinated Retail Market acknolwedged that the UR decision may impact the current working assumption. This may or may not lead to a Market Priorities and deliveries Plan change in the plan for a 2018 release. 135 of such Open Next SG on 23 rd November 2016 ReMCoDS Retail Markets Co-Ordination Design Service 31 st August 2016

ReMCoWG Action Items 2 Actions were closed since last ReMCoWG meeting 2 Actions were opened at the last ReMCoWG meeting & 1 Action Carried Forward ReMCoDS Retail Markets Co-Ordination Design Service 31 st August 2016

TIBCO Update Wednesday 31st August, 2016

Agenda • Project Plan • Message Volumes processed • Cut-Over • Hypercare Period • Next Steps 6 Footer esbnetworks.ie

Plan on a Page Project 18/07 25/07 01/08 Aug/ 07/03 14/03 21/03 28/03 04/04 11/04 18/04 25/04 02/05 09/05 16/05 23/05 30/05 06/06 13/06 20/06 27/06 04/07 11/07 Phase Sep PT Sup 2.3.2 & WebSphere to Defect Resol. 2.3.3 Suppliers Defect Prep all Supplier EMMAs Resolution & Software 2.3.3 2.3.3 SIT Deployment 2.3.3 Deploy Packaged Deploy Market Retail Market Communications and Feedback Cut-Over Comms Ready to Market commence EMMA Assurance Report IPT Pre- Ops IPT IPT 2 IPT Hard Freeze – CER/UR Project Environment Supplier Close Go/No-Go Go-Live release 2.3.3 PT 1 PT 2.3.2 PT 2.3.3 Soak 2.3.3 Smart ready for PT PT PT OAT Cycle 1 & 2 Prod 2.3.3 SIT Regr. Test Ready Knowledge Transfer KT CER/UR Progress Go-Live Reports 5 th – 7 th Augu Cutover DR3 Hyper- Hypercare care MCR MCR 7 esbnetworks.ie MCR UAT / Regression DR3 MCR Go-Live

Cut-Over • All billing issues were cleared in advance of Cut Over; • Cut over went as planned and per dress rehearsals; • Suppliers with enterprise IT billing systems - their changes went very well; • Suppliers who did not have enterprise IT billing systems - only had validation checks to carryout; • On Friday night some suppliers did not turn off flow of messages but this was resolved quickly; • On Saturday some Suppliers were logged onto their old TIBCO EMMA and reported failed validation. Quickly corrected and logged onto new EMMA and validation completed; • Some suppliers had issues with password management on their EMMA but again resolved. 8 Footer esbnetworks.ie

Hypercare Status - 30 th August • Market Message Processing (up to 3am on 30th August) Note: Reason for Small Variations is fully explainable. 9 esbnetworks.ie

Hypercare period • 2 weeks of Hypercare left provided all going well each week • Project status - Going well and no issues of note • Small event on Thursday 11 th night @ 23:30 • Suppliers EMMAs • Jeopardy management • Suppliers IT infrastructure and infrastructure back-ups • Supplier knowledge of EMMA operations and their database support varies significantly • Market messaging activity is 24 hours a day, every day. 10 Footer esbnetworks.ie

Next Steps Hypercare • Routine daily checks and reporting to continue • Market Communications will continue during Hypercare period but at a reduced level • Individual Supplier interactions as required Project Wrap Up • Deferred Work Package testing nearing completion • Lessons Learned workshops and interviews nearing completion • Project Close Out report nearing completion and Resource roll off progressing Market Assurance Recommendations • Agree approach 11 esbnetworks.ie

Supplier Outages July 2016 2 Planned and 6 Unplanned Outages 12 esbnetworks.ie

TIBCO Update Wednesday 31st August, 2016

Co-ordinated Retail Market Design Update Co-ordinated Retail Market Design update Jessica Gregory ReMCoDS ReMCoDS Retail Markets Co-Ordination Design Service 31 st August 2016

Co-Ordinated Market Release Summary C0-MMR C0-MMR 10.7 (CoBL version 2.4) – Went live successfully on 02 June 2016 Schema Release 2015 Went live Successfully on 05 August 2016 MCR 1111 ReMCoDS wants to thank all MP’s for MCR 1122 their involvement & co-operation for MCR 1133 the duration of the TIBCO & Schema CoBL updated to version 3.0 on 05 August 2016 release 15. We enjoyed working with you all TiBCO Rewrite Project (TUP) Went live Successfully on 05 August 2016 Hypercare concludes on 16 September 2016 Next Schema Market Release (Agreed it will not be 2016, but 2017/2018?) Decision as to when the next Schema and Non Schema releases will take place are pending the outcome to ReMCoSG action 135 (CER/UR to provide a decision around the future Co-ordinated Market Priorities and deliveries of such) ReMCoDS Retail Markets Co-Ordination Design Service 31 st August 2016

DR1180 – New Registrations(1/2) CER have reviewed the New Registration’ process for customers who do not actively choose a supplier as part of the new connection process. In the interest of a level playing field and to further support the development of competition, CER are considering a change to the current default process to a single supplier. The core driver from CER is that the default Supplier, for sites which do not elect a supplier within 5 days of energisation, should not automatically be Electric Ireland. This is seen to be an unfair advantage from market perspective. The intention of the change request is to look at the process and develop an equitable process around New Connections which does not give unfair advantage to any one supplier. RMDS recommends that New Registrations would follow a similar process to that which exists for >=30kVA new connections. The customer must sign up with a supplier of choice before energisation The choice of the Supplier is therefore correctly in the hands of the customer. ReMCoDS Retail Markets Co-Ordination Design Service 31 st August 2016

DR1180 – New Registrations(2/2) When the quotation letter for a new connection is sent out to the customer by ESBN this should contain a paragraph which will detail the requirement for mandatory selection of a Supplier by the customer in advance of energisation. The difference to the current process is that for sites < 30 kVA the customer will in future have to contact a Supplier of choice who will submit a registration to ESBN with the customer name, and receipt of the registration by MRSO becomes a requirement before the site is energised. At Today’s Meeting: For Classification as ROI Specific ReMCoDS Retail Markets Co-Ordination Design Service 31 st August 2016

Recommend

More recommend