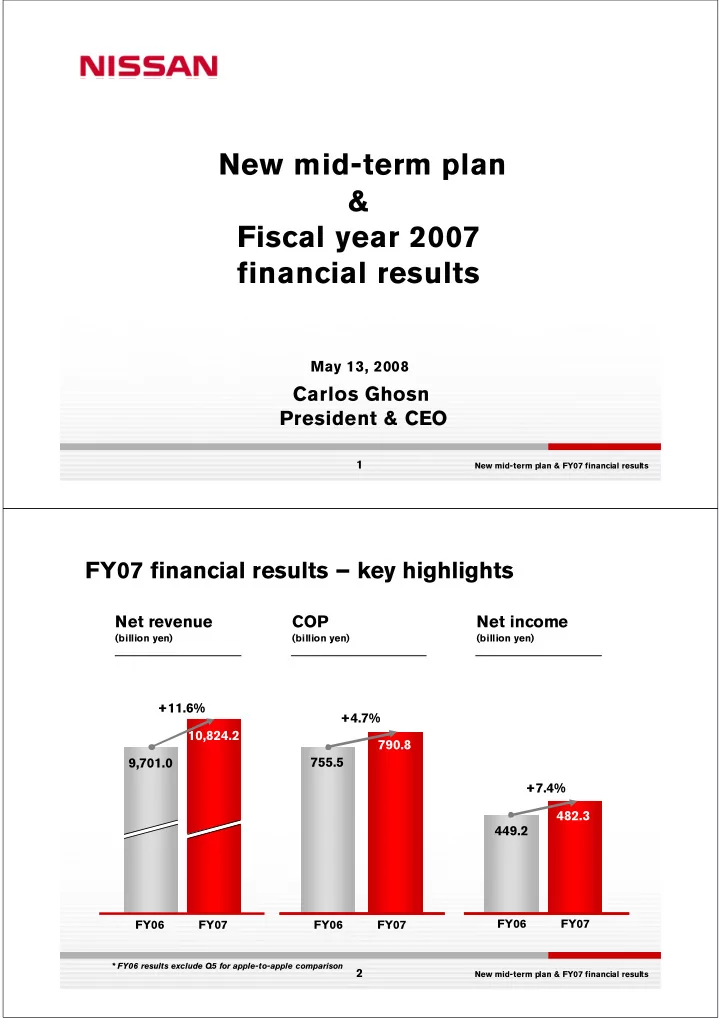

New m mid- d-te term pl plan & Fiscal al year year 2 2007 fina fi nanc ncial r resul sults May 13, 13, 20 2008 08 Carlos rlos Gh Ghos osn President & CE Pr nt & CEO 1 New mid-term plan & FY07 financial results FY07 financial results – key highlights Net revenue COP Net income (billion yen) (billion yen) (billion yen) +11.6% +4.7% 10,824.2 790.8 9,701.0 755.5 +7.4% 482.3 449.2 FY06 FY07 FY06 FY07 FY06 FY07 * FY06 results exclude Q5 for apple-to-apple comparison 2 New mid-term plan & FY07 financial results

FY07 performance FY08 outlook NISSAN Value-Up review New mid-term plan 3 New mid-term plan & FY07 financial results FY07 global product launches 4 New mid-term plan & FY07 financial results

FY07 sales performance Global retail sales 3,770 4,000 +8.2% 3,569 3,483 3,500 3,389 3,057 3,000 (thousand units) 2,771 2,633 2,597 2,530 2,500 2,000 0 FY06 FY07 FY99 FY00 FY01 FY02 FY03 FY04 FY05 NRP NISSAN 180 NISSAN Value-Up 5 New mid-term plan & FY07 financial results FY07 sales performance Retail sales by region: Japan 800 740 GT-R X-TRAIL 721 -2.5% 600 (thousand units) Serena Note 400 200 TIV: 5.32 million units (-5.3%) Nissan share: 13.6% (+0.4points) 0 FY06 FY07 6 New mid-term plan & FY07 financial results

FY07 sales performance Retail sales by region: U.S. Infiniti EX Altima 1,200 1,000 1,059 1,035 G35 Sedan Versa +3.0%* (thousand units) 800 G37 Coupe Rogue 600 400 200 TIV: 15.8 million units (-3.5%*) Nissan share: 6.7% (+0.4 points) 0 FY06 FY07 7 *adjusted to daily selling rates(DSR) New mid-term plan & FY07 financial results FY07 sales performance Retail sales by region: Europe QASHQAI 636 600 +17.9% 540 (thousand units) X-TRAIL 400 200 TIV*: 21.9 million units (+6.1%) Nissan share*: 2.9% (+0.3 points) 0 FY06 FY07 * Nissan estimated 8 New mid-term plan & FY07 financial results

FY07 sales performance Retail sales by region: General Overseas Markets First time to hit 1-million mark 1,200 1,061 1,000 +22.1% (thousand units) 869 800 Livina 600 400 200 0 FY06 FY07 9 New mid-term plan & FY07 financial results FY07 sales performance Retail sales by region: General Overseas Markets 600 250 132 +17.1% 458 (thousand units) 400 200 198 PV +36.4% 307 363 150 146 +26.0% 200 235 100 LCV 50 151 128 0 0 FY06 FY06 FY07 FY07 Middle East China 10 New mid-term plan & FY07 financial results

FY07 technology advancements 1 0 all- new technologies 10 NAVI-ICC Intelligent # of innovative car technologies Pedal LDP VVEL Around View 5 5 Monitor Dual clutch 4 transmission Full Speed 3 Range ICC Pop Up 2 2 2 Engine Hood On-board eco driving service Premium Midship package FY 00 01 02 03 04 05 06 07 11 New mid-term plan & FY07 financial results FY07 technology advancements Gasoline Engine Technology: VVEL * Contributes to a 10% reduction in CO 2 emissions, improves torque output by 10% VVEL * VVEL = variable valve event and lift 12 New mid-term plan & FY07 financial results

FY07 technology advancements Pop Up Engine Hood Before actuator operates After actuator operates 13 New mid-term plan & FY07 financial results FY07 technology advancements Around View Monitor Monitor display (example) 14 New mid-term plan & FY07 financial results

FY07 technology advancements Lane Departure Prevention System control Warning! 15 New mid-term plan & FY07 financial results FY07 financial performance (A) (B) (B)/(A) FY06 FY06 FY07 Variance (billion yen) (Published) (Excl. 5Q)* Consolidated 10,468.6 9,701.0 +11.6% 10,824.2 net revenue Consolidated 776.9 755.5 +4.7% 790.8 operating profit Operating profit 7.4% 7.8% 7.3% -0.5 points margin Net income 460.8 449.2 482.3 +7.4% Net cash 254.7 180.3 FOREX 114.4 JPY/USD 117.0 JPY/USD 117.0 JPY/USD Rate 148.2 JPY/EUR 146.2 JPY/EUR 161.6 JPY/EUR 16 * Reference New mid-term plan & FY07 financial results

FY07 dividend policy 40 40 34 29 30 Dividend per share / yen 24 19 20 14 10 8 7 0 0 FY99 FY00 FY01 FY02 FY03 FY04 FY05 FY06 FY07 NRP NISSAN 180 NISSAN Value-Up 17 New mid-term plan & FY07 financial results FY07 performance FY08 outlook NISSAN Value-Up review New mid-term plan 18 New mid-term plan & FY07 financial results

FY08 outlook Global retail sales objective 3,900 +3.5% 4,000 3,770 3,569 3,389 3,483 3,500 (thousand units) 3,000 2,500 2,000 0 FY04 FY05 FY06 FY07 FY08 19 New mid-term plan & FY07 financial results FY08 all-new product launches 9 all- new global launches Japan Europe North America Mini SUV Teana QASHQAI+2 Cube FX Murano G37 Fairlady Z Maxima GT-R G37 Coupe Teana G37 Convertible 370Z EX Murano 370Z FX GT-R General Overseas Markets Bakkie successor Murano X-TRAIL Grand Livina All-new global launches Regional launches 20 New mid-term plan & FY07 financial results

Risks and opportunities Opportunities + Product launches + TIV growth in emerging markets + LCV growth + Infiniti global expansion + LCC utilization (parts and services) + Expansion of alliance with AvtoVAZ Risks – Model mix deterioration – TIV decline in mature markets – Commodity and energy prices – FOREX 21 New mid-term plan & FY07 financial results FY08 outlook FY07 FY08 (billion yen) *1 Consolidated net revenue 10,824.2 10,350.0 Consolidated operating profit 790.8 550.0 Ordinary profit 766.4 545.0 482.3 Net income 340.0 R&D 457.5 500.0 sales ratio 4.8% 4.2% 428.9 CAPEX 470.0 *2 sales ratio 4.5% 4.0% FX rate 114.4 JPY/USD 100.0 JPY/USD assumption *1 Forecast 22 New mid-term plan & FY07 financial results *2 Incl. vendor tooling from FY08 (60.0 billion yen in FY08)

FY07 performance FY08 outlook NISSAN Value-Up review New mid-term plan 23 New mid-term plan & FY07 financial results NISSAN Value-Up commitments Profit commitment Top level operating profit margin among global automakers in FY05-07 24 New mid-term plan & FY07 financial results

NISSAN Value-Up commitments Profit commitment Top level operating profit margin among global automakers in FY05-07 Volume commitment 4.2 million sales in FY08 FY09 25 New mid-term plan & FY07 financial results NISSAN Value-Up commitments Profit commitment Top level operating profit margin among global automakers in FY05-07 Volume commitment 4.2 million sales in FY08 FY09 Return on invested capital 20% average ROIC over the plan 17% average ROIC achieved Top level among global automakers 26 New mid-term plan & FY07 financial results

FY07 performance FY08 outlook NISSAN Value-Up review New mid-term plan 27 New mid-term plan & FY07 financial results Revenue growth evolution Cons nsolidated ne net r t reve venue nue 12,000 10,824 10,469 10,000 9,428 8,577 75 % 75 (billion yen) 7,429 8,000 6,829 6,196 6,090 5,977 6,000 4,000 0 FY07 FY99 FY00 FY01 FY02 FY03 FY04 FY05 FY06 NRP NISSAN 180 NISSAN Value-Up 28 New mid-term plan & FY07 financial results

Sales volume evolution Globa obal re retail sa sales 4,000 3,770 3,569 3,483 3,500 3,389 45 % 45 (thousand units) 3,057 3,000 2,771 2,633 2,597 2,530 2,500 2,000 0 FY99 FY00 FY01 FY02 FY03 FY04 FY05 FY06 FY07 NRP NISSAN 180 NISSAN Value-Up 29 New mid-term plan & FY07 financial results 30 New mid-term plan & FY07 financial results

NI SSAN GT 2 0 1 2 “Complete “Growth “Value up with “Revive our revival on track sustained and trust” for profitable company” performance” growth” FY00 FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 NRP NISSAN 180 NISSAN Value-Up NISSAN GT 2012 31 New mid-term plan & FY07 financial results NI SSAN GT 2 0 1 2 com mitments Qu Qualit lity le leadership ip I n products, services, brands and m a nagem ent 32 New mid-term plan & FY07 financial results

Quality leadership Perceived Quality Perceived Quality Product Quality Product Quality & & Attractiveness Attractiveness Top level in all Most No. 1 position in 50+% No. 1 position in 50+% Top level in all Most Influential Indicators of all segments of all segments Influential Indicators Qu Qualit Qualit Qu lity lity lead eader ership lead eader ership Sales Sales Quality of Quality of & & Managem ent Service Quality Managem ent Service Quality Top level industry norm Top level CS in Japan, U.S., Top level industry norm Top level CS in Japan, U.S., Europe & 4 main regions Europe & 4 main regions 33 New mid-term plan & FY07 financial results Quality leadership Influential external indicators Influential external indicators Great eat B Britai ain: “Wh “What at C Car? r?” Ge Germany: y: “A “ADA DAC” U.S.: U. “C “Con onsu sumer R r Report orts” s” 米国 ドイツ 中国 Chin Ch ina: JD JDP I IQS Italy: It “Q “Quattroru roruot ote” Brazil zil: : “Qua uatr tro Ro Roda das” South Afr uth Africa ca: PSI PSI 34 New mid-term plan & FY07 financial results

Recommend

More recommend