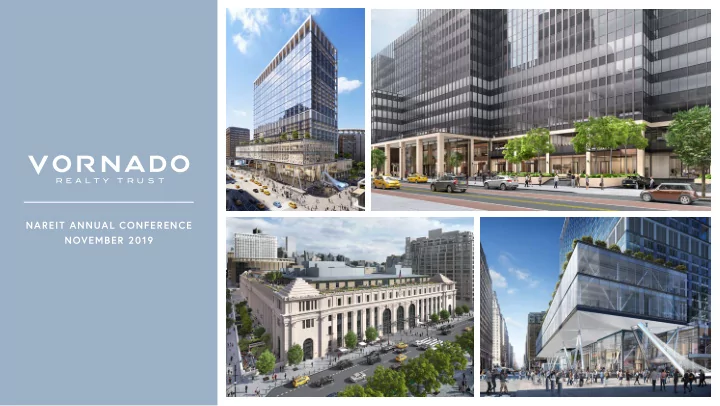

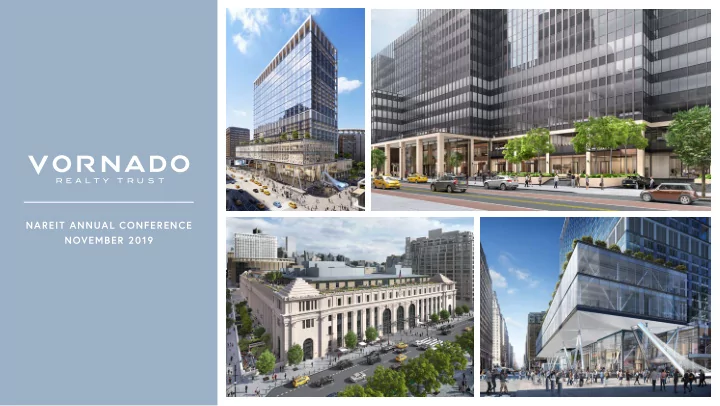

NAREIT ANNUAL CONFERENCE NOVEMBER 2019

OVERVIEW NEW YORK CITY FOCUSED BEST-IN-CLASS LEADING OPERATING ASSETS PLATFORM UNIQUE & SCALABLE FORTRESS BALANCE PENN DISTRICT SHEET OPPORTUNITY TRACK RECORD OF VALUE CREATION 1

HEADER TEXT HERE DEEP, TALENTED & EXPERIENCED MANAGEMENT TEAM C O R P O R AT E O F F I C E R S STEVEN ROTH MICHAEL J. FRANCO DAVID R. GREENBAUM JOSEPH MACNOW GLEN WEISS BARRY S. LANGER HAIM S. CHERA Chairman of the Board President Vice Chairman Executive Vice President, Executive Vice President, Executive Vice President, Executive Vice President, and Chief Executive Officer Chief Financial Officer, Office Leasing Development Head of Retail Chief Administrative Officer Co-Head of Real Estate Co-Head of Real Estate E X E C U T I V E V I C E P R E S I D E N T S MIKE DOHERTY ROBERT ENTIN EDWARD P. HOGAN, JR. FRED GRAPSTEIN MARK HUDSPETH MATTHEW IOCCO MYRON MAURER THOMAS SANELLI GASTON SILVA CRAIG STERN President & CEO of BMS Executive Vice President, Executive Vice President, Executive Vice President, Executive Vice President, Executive Vice President, Chief Operations Officer, Executive Vice President & Chief Operations Officer Executive Vice President, Chief Information Officer Retail Leasing Hotel Pennsylvania Head of Capital Markets Chief Accounting Officer theMART Chief Financial Officer, Tax & Compliance New York DAVID BELLMAN CLIFF BROSER ELANA BUTLER PAMELA CARUSO CATHERINE CRESWELL RICH FAMULARO JOSH GLICK ADAM GREEN GARY HANSEN PAUL C. HEINEN JAN LACHAPELLE Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President & Senior Vice President, Senior Vice President, S E N I O R Development Design Acquisitions & Capital Markets Retail Leasing Counsel Office Leasing Counsel Investor Relations Controller Office Leasing Acquisitions & Capital Markets Controller - Alexander’s Office Leasing, theMART Acquisitions & Capital Markets & Construction V I C E P R E S I D E N T S FRANK MAIORANO SUSAN MCCULLOUGH MARIO RAMIREZ RICHARD RECZKA ALAN RICE JESSICA ROSS STEVE SANTORA GEOFF SMITH NICK STELLO LISA VOGEL ELI ZAMEK Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Senior Vice President, Tax & Compliance theMART - Tradeshows Acquisitions & Capital Markets Acquisitions & Capital Markets Corporation Counsel Financial Planning & Analysis Financial Operations Development IT Infrastructure Marketing Development Design & Construction 2

NEW YORK CITY IS OUR HOME & CONTINUES TO BE A MAGNET FOR TALENT AND COMPANIES ECONOMIC GROWTH LABOR POOL • New York City has captured the greatest share • New York City has a growing population of of US (8.9%) and Global GDP (2.6%) of all cities educated individuals (net in-migration of 33K between 2010-2018 people with bachelor degrees between 2014-2017) • New York City created more jobs than peers across a diverse set of industries, while Tier 2 fast-growing cities are more heavily skewed to technology TALENT ATTRACTION INNOVATION • New York City is the leading city for talent • New York City is leading in new companies formed attraction domestically (#1 city for top U.S. college (e.g., start-up density of 154.7 new businesses per graduates) and abroad (31% H1B visa approvals) 1000 vs. 150.4 for San Francisco) • New York City has the most ultra high net worth • New York City has reached $13B of VC funding in individuals globally and is growing start-ups so far this year and captured 16% of total U.S. VC funding, second only to San Francisco 3 Source: McKinsey & Co., PwC / CB Insights MoneyTree

RATIONALE FOR OWNING VORNADO STOCK • Attractive common dividend yield of 4.0% 1 • Trading at a signifjcant discount to NAV • Deep, talented, proven management team • Fortress balance sheet with substantial cash and available liquidity (~$3.36 billion today and growing) to fund Penn District and take advantage of future investment opportunities • Only signifjcant way to invest publicly in fast growing West Side of Manhattan • Growth from Penn District redevelopment – over 9 million SF existing portfolio with signifjcant NOI upside and value creation – 6.8 million SF of offjce with average in-place rents of $67 PSF; neighboring properties to the west asking rents range from $98-225 PSF 2 – 5.2 million SF under development now, which is being self-fjnanced with cash from 220 CPS • Farley Building (845,000 rentable SF) development in process • PENN 1 redevelopment in process • PENN 2 transformation (1.8 million rentable SF) to commence in 1Q20 – Hotel Pennsylvania site (2.8 million rentable SF of development) – Other development sites • Internal growth over time from highly sought-after existing assets (e.g., 770 Broadway, 555 California Street, theMART) • Largest owner of LEED certifjed buildings in New York City with 26 million SF • Management has consistently acted to create shareholder value 1. As of 11/7/2019 market close. 2. As of 9/30/2019. 4

FORTRESS BALANCE SHEET (Amounts in millions) SEPTEMBER 30, 2019 Secured debt $ 5,674 Unsecured debt 1,855 Pro rata share of non-consolidated debt 2,807 Less: noncontrolling interests' share of consolidated debt (484) • Investment grade debt — Baa2/BBB Total debt 9,852 • $2.1 BN in revolver capacity Projected cash proceeds from 220 Central Park South (1,787) Cash, restricted cash and marketable securities 1 (995) • $1.0 BN in cash 1 Net Debt $ 7,070 • Weighted average debt maturity — 3.6 years • ~$9 BN of unencumbered assets TTM EBITDA, as adjusted 2 $ 1,119 Net Debt/EBITDA, as adjusted 6.3x 1. Includes $105 million 150 West 34th Street loan participation and deducts potential special dividend of approximately $390 million. 5 2. See page 30 for non-GAAP reconciliation.

COMPONENTS OF PRO-FORMA NOI AT SHARE - CASH BASIS 1 HEADER TEXT HERE 12th W. 42nd St 7th Broadway Bryant Park TIMES SQUARE SOUTH Lexington Av Madison Av Components of NOI at share - Cash Basis Park Av MURRA PENN 1 PENN DISTRICT 100 WEST 33RD 9th Av 8th Av 7th Av 23% PENN DISTRICT Hudson Park W. 34th St W. 34th St Av of the Americas (6th Av) 330 WEST 34TH High Line Upon completion of FARLEY BUILDING High Line E. 30th St E. 30th St NYC RETAIL PENN 15 the developments in PENN 2 Park Av South W. 28th St E. 28th St Lexington Av High Line process, the Penn District 5th Av Madison Av 12th Av PENN 11 is expected to represent FLATIRON 11th Av 10th Av 260 ELEVENTH AVENUE 20% 9th Av 8th Av 7th Av Madison approximately 33% of NOI Square Park High Line CHELSEA W. 23rd St W. 23rd St Broadway Gramarcy Pk N Av of the Americas (6th Av) 512 WEST 22ND STREET Gramarcy Park W. 20th St W. 20th St 14% theMART / 85 TENTH AVENUE UNION SQUARE USQ W 555 CALIFORNIA 10th Av 9th Av 61 NINTH AVENUE 8th Av Union 66% Square NYC OFFICE Park 5th Av W. 14th St W. 14th St B r o High Line Hudson St a 4 UNION SQUARE SOUTH d Gansevoort St w Greenwich Av a y University Pl 8th Av Waverly Pl G W r W. 10th St 770 BROADWAY a e s e h 5th Av n n i W. 4th St w GREENWICH g i 4 t c o t h h n S VILLAGE A S t B Bank St t l e e Washington Sq N. W. 11th St c 7th Av Waverly Pl k e WEST r S t Washington Square Park A v VILLAGE Washington Sq S. o f W. 10th St t S t h r e Commerce e A m e h p 606 BROADWAY o t s i r h C Broadway 7 t h A v r i Barrow St Bleecker St TTM 9/30/19 NOI: $1,169M Thompson St Lafayette St c St a Sulliivan St W. Broadway s HUDSON SQUARE W. Houston St Washington St t S n t o u s 1. For the trailing twelve months ended 9/30/19, as adjusted for (i) the April 18th Retail Transaction, (ii) the termination of the ground lease at 608 Fifth Avenue, (iii) 330 Madison Avenue o H . W Greenwich St Prince St SOHO (sold on July 11, 2019), (iv) 3040 M Street (sold on September 19, 2019), and (v) the adjustment to ofgset the accrual in Q4 2018 for the annual real estate tax increase at theMART. Hudson St Varick St 6 6 6 NOI is a non-GAAP measure. See “Non-GAAP Financial Measures” on page 31 of this presentation for additional information. Spring St W unnel Broome St

SELECT NEW YORK CITY OFFICE PROPERTIES P L A Z A D I S T R I C T M I D T O W N 888 SEVENTH AVENUE 650 MADISON AVENUE 595 MADISON AVENUE 640 FIFTH AVENUE 689 FIFTH AVENUE 731 LEXINGTON AVENUE 1290 AVENUE OF THE AMERICAS G R A N D C E N T R A L P E N N D I S T R I C T 7 WEST 34TH STREET PENN 11 330 WEST 34TH STREET PENN 1 PENN 2 THE FARLEY BUILDING 90 PARK AVENUE M I D T O W N S O U T H PA R K AV E N U E C H E L S E A / M E AT PA C K I N G 7 ONE PARK AVENUE 770 BROADWAY 280 PARK AVENUE 350 PARK AVENUE 61 NINTH AVENUE 512 WEST 22ND STREET 85 TENTH AVENUE

SELECT NEW YORK CITY STREET RETAIL PROPERTIES 689 FIFTH AVENUE 640 FIFTH AVENUE 655 FIFTH AVENUE 697 FIFTH AVENUE 666 FIFTH AVENUE 510 FIFTH AVENUE 828-850 MADISON AVENUE 595 MADISON AVENUE 650 MADISON AVENUE 677 MADISON AVENUE 150 WEST 34TH STREET 435 SEVENTH AVENUE 4 UNION SQUARE 484-486 BROADWAY 1540 & 1535 BROADWAY 8

Recommend

More recommend