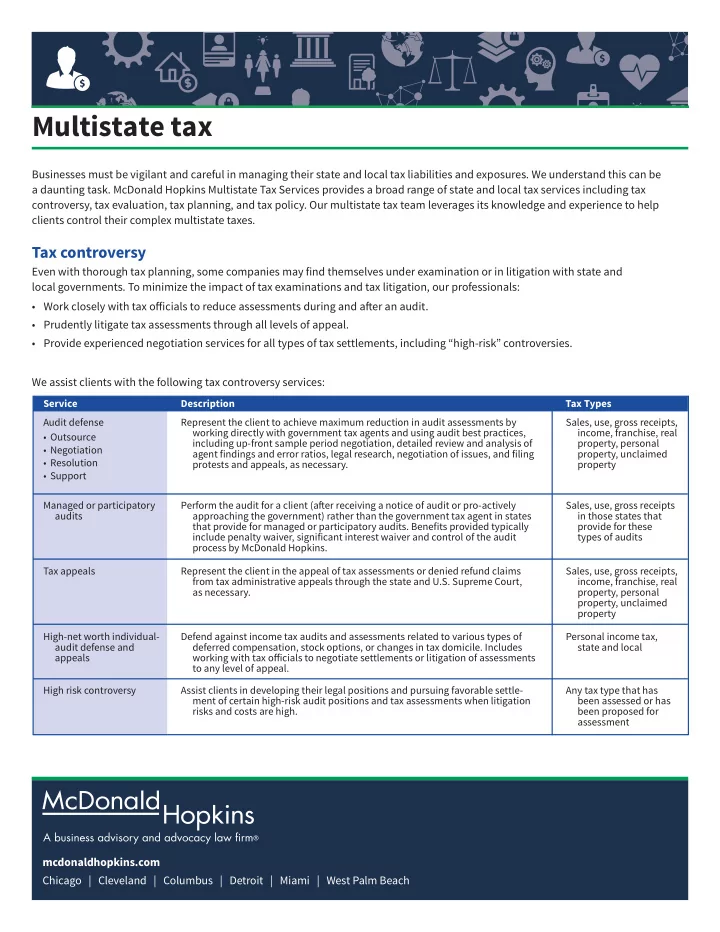

including up-front sample period negotiation, detailed review and analysis of • Prudently litigate tax assessments through all levels of appeal. Personal income tax, ment of certain high-risk audit positions and tax assessments when litigation Perform the audit for a client (afuer receiving a notice of audit or pro-actively • Support • Resolution • Negotiation • Outsource • Provide experienced negotiation services for all types of tax settlements, including “high-risk” controversies. working with tax ofgicials to negotiate settlements or litigation of assessments • Work closely with tax ofgicials to reduce assessments during and afuer an audit. Multistate tax Businesses must be vigilant and careful in managing their state and local tax liabilities and exposures. We understand this can be a daunting task. McDonald Hopkins Multistate Tax Services provides a broad range of state and local tax services including tax controversy, tax evaluation, tax planning, and tax policy. Our multistate tax team leverages its knowledge and experience to help clients control their complex multistate taxes. Tax controversy Even with thorough tax planning, some companies may find themselves under examination or in litigation with state and local governments. To minimize the impact of tax examinations and tax litigation, our professionals: We assist clients with the following tax controversy services: Service Description Tax Types Audit defense Represent the client to achieve maximum reduction in audit assessments by Sales, use, gross receipts, working directly with government tax agents and using audit best practices, income, franchise, real property, personal agent findings and error ratios, legal research, negotiation of issues, and filing property, unclaimed protests and appeals, as necessary. property Managed or participatory Sales, use, gross receipts audits approaching the government) rather than the government tax agent in states in those states that that provide for managed or participatory audits. Benefits provided typically provide for these include penalty waiver, significant interest waiver and control of the audit types of audits process by McDonald Hopkins. Tax appeals Represent the client in the appeal of tax assessments or denied refund claims Sales, use, gross receipts, from tax administrative appeals through the state and U.S. Supreme Court, income, franchise, real as necessary. property, personal property, unclaimed property High-net worth individual- Defend against income tax audits and assessments related to various types of audit defense and deferred compensation, stock options, or changes in tax domicile. Includes state and local appeals to any level of appeal. High risk controversy Assist clients in developing their legal positions and pursuing favorable settle - Any tax type that has been assessed or has risks and costs are high. been proposed for assessment mcdonaldhopkins.com Chicago | Cleveland | Columbus | Detroit | Miami | West Palm Beach

Provide a “reverse” tax audit service designed primarily to identify refund and The myriad of multistate tax laws can be difgicult to comply with on a consistent basis. Our professionals assist clients with evaluating when necessary and allows for efgicient updating for future law/regulatory Provides management with the necessary back-up for more in-depth analysis In-house training Benefits typically include penalty waiver and limited look-back periods. • Work with the applicable multistate and local taxing jurisdiction to obtain refunds of any overpayments. • Develop strategies to resolve any exposures identified as part of the evaluation. • Assist clients with addressing the causes of the refunds or exposures so they can be in compliance prospectively. Negotiate with state and local jurisdictions to mitigate historical tax obligations requirements (i.e., nexus) and an estimated tax risk computation. Conduct a proactive analysis of a client’s Ohio Commercial Activity Tax (CAT) McDonald Hopkins Multistate tax 2 Tax evaluation their current multistate tax positions to determine if they are entitled to any refunds or have any possible exposures. Our professionals: • Partner with our clients to analyze tax filings and tax payments made to vendors to determine if the appropriate amount of tax has been paid. We assist clients with the following tax evaluation services: Service Description Tax Types R.A.C.E. TM -Refund Analysis Sales, use, gross receipts, & Compliance overpayment opportunities, secondarily to identify areas of significant risk. income, franchise, real Evaluation property, personal property, unclaimed property CAT scan TM Sales, use, gross payments and filings to determine optimal filing positions, identify potential receipts, income, refunds, and mitigate future exposure. franchise Multistate nexus review Analyze a client’s activities to determine those states in which the client has filing Sales, use, gross receipts, income, franchise, real property, personal property, unclaimed property Voluntary disclosure Sales, use, gross receipts, for a client that has failed to file for various taxes where an obligation exists. income, franchise, real property, personal property, unclaimed property Due diligence Analyze a target’s tax audit exposure and potential successor liability issues Sales, use, gross receipts, relating to the client’s purchase of target. income, franchise, real property, personal property, unclaimed property Design and deliver a customized sales and use tax training program specific to Sales, use the client’s industry and work environment. The client benefits by avoiding tax overpayments and unexpected tax liabilities in the future. Tax compliance matrix Research and complete an easy to use, determination tool for use in tax Sales, use, gross compliance by the client’s accounting and/or tax personnel. receipts, income, franchise changes.

efgective tax rate agreement with the state taxing authority. Perform an analysis of the impact of changing one’s tax domicile, especially in associated with business expansion (gross business volume, new products, by government tax ofgicials, significant tax saving opportunities still exist. We work proactively with clients to: • Identify and implement tax reduction strategies consistent with business operations. • Review existing tax planning structures to ensure their integrity upon examination. • Minimize multistate tax consequences of business transactions. Analyze (on a proactive basis) multijurisdictional opportunities and exposures Assist individual clients with the specific steps necessary to efgectively establish light of the sale of a business or pending retirement of a high-ranking company 3 McDonald Hopkins Multistate tax Tax planning We believe that even in an environment of increased scrutiny of tax structures and increased enforcement efgorts We assist clients with the following tax planning services: Service Description Tax Types Multistate tax planning Review a client’s operations, identify alternative legal structures, and implement Sales, use, gross receipts, those structures to take advantage of state tax benefits. income, franchise, real property, personal property, unclaimed property Residency planning Personal income taxstate and local leader. tax domicile in another state. UCO-Use Tax Compliance Simplify and lower the cost of a client’s use tax compliance by developing an Use Optimizer- efgective rate agreements Business expansion All appropriate taxes for planning industry new marketing methods or new locations). Relocation analysis Analyze and compare state and local tax costs related to alternate locations being All appropriate taxes for considered by a client. industry State and local credits Review client’s tax filings to determine the availability of unclaimed state and All appropriate taxes for and incentives local tax credits or incentives. industry as well as other non-tax Assist a company with obtaining tax incentives when expanding an existing incentives facility or building a new facility.

Recommend

More recommend