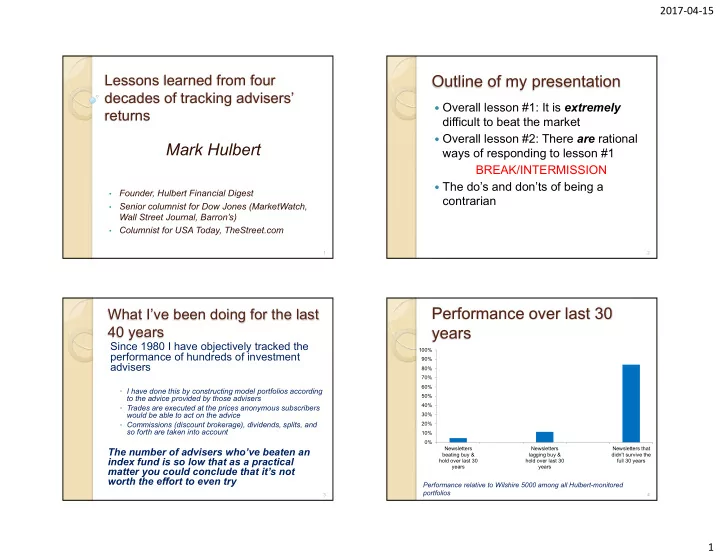

2017-04-15 Lessons learned from four Outline of my presentation decades of tracking advisers’ � Overall lesson #1: It is extremely returns difficult to beat the market � Overall lesson #2: There are rational Mark Hulbert ways of responding to lesson #1 BREAK/INTERMISSION � The do’s and don’ts of being a Founder, Hulbert Financial Digest • contrarian Senior columnist for Dow Jones (MarketWatch, • Wall Street Journal, Barron’s) Columnist for USA Today, TheStreet.com • 1 2 Performance over last 30 What I’ve been doing for the last 40 years years Since 1980 I have objectively tracked the 100% performance of hundreds of investment 90% advisers 80% 70% 60% ◦ I have done this by constructing model portfolios according 50% to the advice provided by those advisers 40% ◦ Trades are executed at the prices anonymous subscribers would be able to act on the advice 30% ◦ Commissions (discount brokerage), dividends, splits, and 20% so forth are taken into account 10% 0% The number of advisers who’ve beaten an Newsletters Newsletters Newsletters that beating buy & lagging buy & didn't survive the index fund is so low that as a practical hold over last 30 hold over last 30 full 30 years years years matter you could conclude that it’s not worth the effort to even try Performance relative to Wilshire 5000 among all Hulbert-monitored portfolios 3 4 1

2017-04-15 How did mutual funds fare? Lessons learned According to Lipper, the VFINX has � If you were to have picked an adviser outperformed 67% of all U.S. domestic equity at random 30 years ago, you would mutual funds over the last 30 years. This is have had a one-in-twenty chance of very similar to my results for investment bettering the return of a simple index newsletters, due to survivorship bias Lipper doesn’t have survivorship data over entire • fund 30-year period. � Corollary: The average thing you do is But, according to Standard & Poor’s over the last • 5 years, the following percentage of funds didn’t a mistake survive even 5 years: 38.3% of large-cap funds • 39.1% of mid-cap funds • 45.5% of small-cap funds • 5 6 Frozen versus actual Consider… portfolios � This is another illustration showing Performance of average stock bought, relative to the average stock sold that the average thing we do is a 0.00% mistake -0.50% -1.00% � Consider what would happen if an -1.50% adviser had frozen into place his/her -2.00% portfolio at the beginning of the year -2.50% -3.00% ◦ Would this frozen portfolio at the end of -3.50% the year be ahead or behind his actual -4.00% trading portfolio? 4 months later 1 year later 2 years later Source: UC Berkeley Professor Terrence Odean, based on trading histories of 64,000 accounts at a discount brokerage firm 7 8 2

2017-04-15 Degree to which frozen portfolios But what about the best beat actual portfolios (annualized performers? average) � These results—which reflect the 1.00% average across large universes— wouldn’t have to be devastating if 0.90% there were some way of doing better than average 0.80% � That turns out to be a big if. 0.70% � There’s precious little evidence that going with the past’s winners improves 0.60% your odds of future success � The most robust correlations exist at 0.50% Newsletters Mutual funds* the bottom of the rankings * The Structure and Performance of the Money Management Industry , by Josef Lakonishok (University 9 10 of Illinois at Urbana-Champaign;) Andrei Shelifer (Harvard); Robert Vishny (University of Chicago) Why are these results so Regression to the mean dismal? � Luck plays a far bigger role in 100% investment performance than skill 90% Expectation if investment success were a matter of pure luck 80% � Our psychology makes things even Average percentile rank in year t+1 70% worse 60% 50% 40% 30% 20% 10% 0% Top 10% 2 3 4 5 6 7 8 9 Bottom 10% Decile of performance ranking in year t 11 12 3

2017-04-15 Measuring luck versus skill Professor Cornell’s finding � Among large-cap mutual funds, � First method comes from Brad “approximately 92% of the cross- Cornell, Visiting Professor of sectional variation in annual Financial Economics at performance is attributable to random Caltech chance.” � Approach is elegantly simple: � When I applied Cornell’s methodology ◦ Compare the variance of returns to invest newsletters, I reached an over shorter and longer periods almost identical result: 91.86% is due ◦ The greater variance of shorter- to luck. period performance must be due to luck 13 14 Measuring luck versus skill Mauboussin’s conclusion � Another approach comes Michael Mauboussin, head of Global Financial Strategies at Credit Suisse � His insight: The quicker performance regresses to the mean, the greater role that luck must be playing � Recall that we saw on a previous slide that regression to the mean in investing is almost total Source: The Success Equation: Untangling Skill and Luck in Business, from one year to the next Sports, and Investing, by Michael Mauboussin 15 16 4

2017-04-15 Benjamin Graham on luck Lessons learned � Don’t so something stupid � “One lucky break, or one ◦ Avoiding the biggest mistakes is probably supremely shrewd the most important thing we can do decision—can we tell them � The strongest statistical patterns are among the worst performers. apart?—may count for ◦ It’s a better bet that a terrible performer more than a lifetime of will remain a terrible performer than that a journeyman efforts.” top performer will remain top-ranked 17 18 Another lesson: Patience and Lessons learned discipline � Don’t just do something, sit there! � Patience is essential because no one is able to beat the market all the time ◦ The fewer things you do, the better � If you nevertheless do decide to do � You shouldn’t give up on a strategy something just because it lags the market along the way ◦ Do so for reasons/trading rules you have specified in advance, not how you feel in ◦ This is a high hurdle, since losing money the moment and lagging the market are no strangers to market beating advisers 19 20 5

2017-04-15 This makes it difficult to conclude Incidence of lagging/losses statistically that you should get rid among market-beating advisers of your adviser or strategy 50% 45% � You need many data points before you can 40% conclude at the 95% confidence level that 35% an adviser has lost his/her touch Last 10 calendar 30% years � The large variability in short-term results 25% Last 20 calendar years means you need an even larger number of 20% % of rolling 5 year data points before reaching such a 15% periods last 20 years conclusion 10% � Your relationship with an adviser is closer to 5% 0% a marriage than to a one-night stand… Lost money Lagged market 21 22 Consider a strategy that invests Value Line’s Group 1 stocks since in Value Line’s Group 1 stocks 1980 2.00 � This strategy on balance has Value Line outper- outperformed the market by a large Cumulative performance relative to Wilshire 5000 index since forming Wilshire 5000 1.80 margin over the last 40 years Value Line under-performing � Since 2009, however, this strategy has Wilshire 5000 1.60 significantly lagged the market (see mid-1980 1.40 chart on following page) � Is this several-year period of 1.20 underperformance enough to conclude that the Value Line ranking 1.00 system no longer works? 0.80 1980 1985 1990 1995 2000 2005 2010 2015 23 24 6

2017-04-15 Premature to give up on it! Another lesson: Keep risk low � Given the predominant role that luck plays in � At the 95% confidence level, you investment performance, it’s crucial to keep cannot conclude that the data series risk low since the 2009 inflexion is different � That’s because high risk inevitably leads to than what came before losses so big that recovery becomes unlikely � The next slide plots newsletters’ returns over the trailing 20 years against their risk levels. ◦ Notice that once risk exceeds that of the overall market’s, even the best performers earn very little extra return—and the worst performers lose big ◦ Notice also that the trendline that best fits the data points is downward sloping 25 26 Risk versus reward last 20 Yet another reason to keep risk years low � The future is far more unknowable +20% than we think it is +15% Best-fit +10% trendline 20-year annualized return +5% +0% -5% Stock market's -10% risk level -15% -20% 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 Risk as measured by volatility of monthly returns; stock market = 1.0 27 28 7

Recommend

More recommend