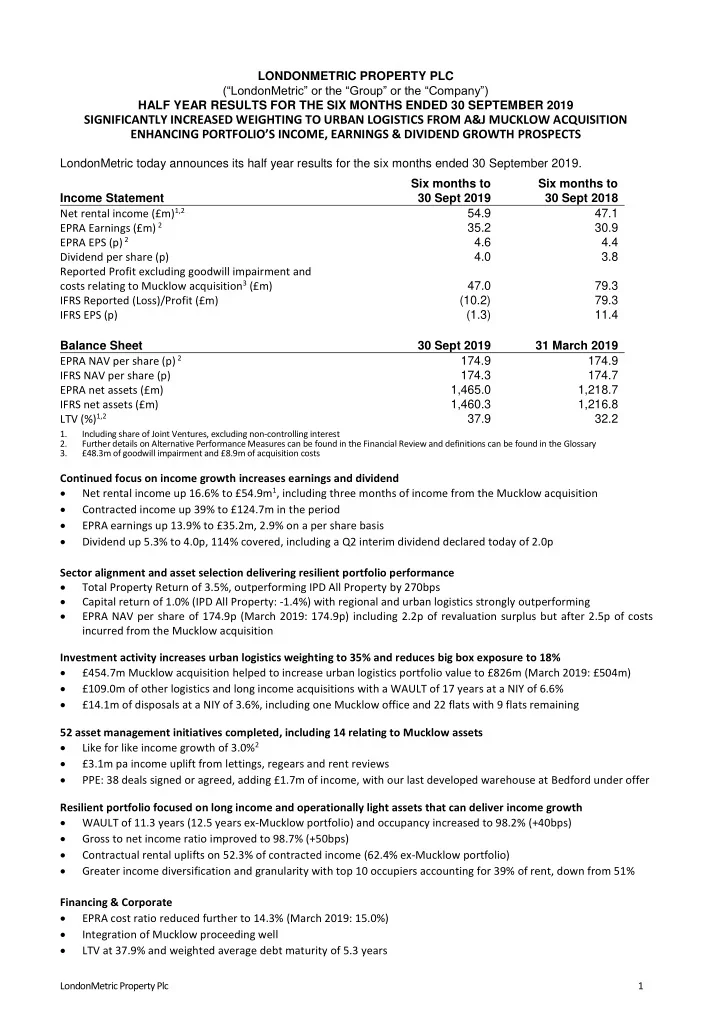

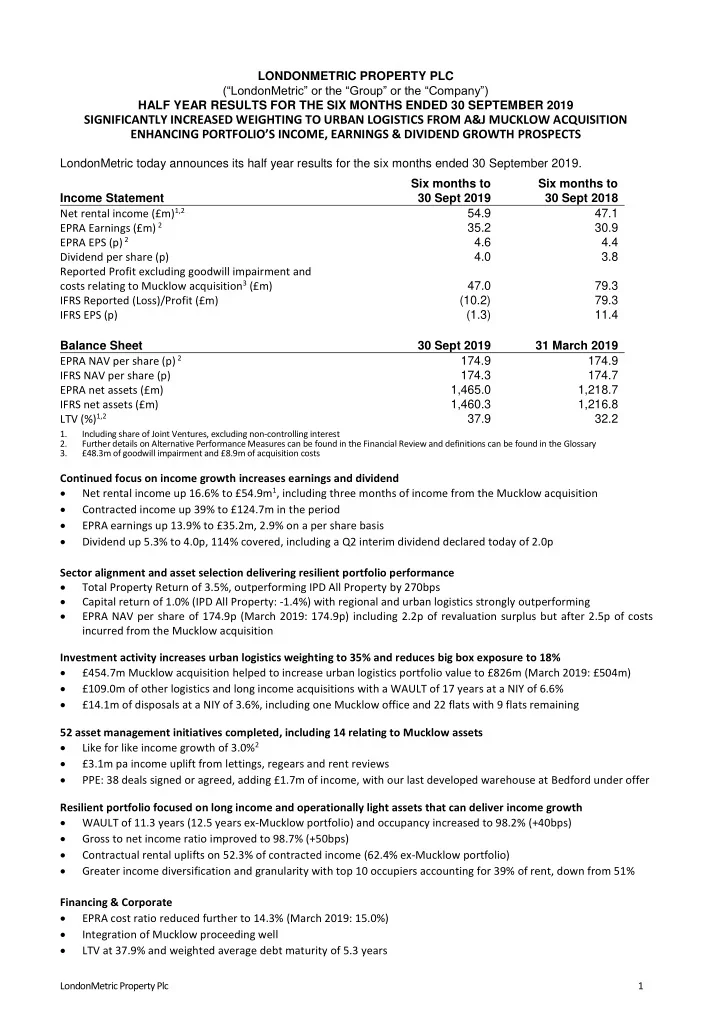

LONDONMETRIC PROPERTY PLC (“LondonMetric” or the “Group” or the “Company”) HALF YEAR RESULTS FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2019 SIGNIFICANTLY INCREASED WEIGHTING TO URBAN LOGISTICS FROM A&J MUCKLOW ACQUISITION ENHANCING PORTFOLIO’S INCOME, EARNINGS & DIVIDEND GROWTH PROSPECTS LondonMetric today announces its half year results for the six months ended 30 September 2019. Six months to Six months to Income Statement 30 Sept 2019 30 Sept 2018 Net rental income (£m) 1,2 54.9 47.1 EPRA Earnings (£m) 2 35.2 30.9 EPRA EPS (p) 2 4.6 4.4 Dividend per share (p) 4.0 3.8 Reported Profit excluding goodwill impairment and costs relating to Mucklow acquisition 3 (£m) 47.0 79.3 IFRS Reported (Loss)/Profit (£m) (10.2) 79.3 IFRS EPS (p) (1.3) 11.4 Balance Sheet 30 Sept 2019 31 March 2019 EPRA NAV per share (p) 2 174.9 174.9 IFRS NAV per share (p) 174.3 174.7 EPRA net assets (£m) 1,465.0 1,218.7 IFRS net assets (£m) 1,460.3 1,216.8 LTV (%) 1,2 37.9 32.2 1. Including share of Joint Ventures, excluding non-controlling interest 2. Further details on Alternative Performance Measures can be found in the Financial Review and definitions can be found in the Glossary 3. £48.3m of goodwill impairment and £8.9m of acquisition costs Continued focus on income growth increases earnings and dividend • Net rental income up 16.6% to £54.9m 1 , including three months of income from the Mucklow acquisition • Contracted income up 39% to £124.7m in the period • EPRA earnings up 13.9% to £35.2m, 2.9% on a per share basis • Dividend up 5.3% to 4.0p, 114% covered, including a Q2 interim dividend declared today of 2.0p Sector alignment and asset selection delivering resilient portfolio performance • Total Property Return of 3.5%, outperforming IPD All Property by 270bps • Capital return of 1.0% (IPD All Property: -1.4%) with regional and urban logistics strongly outperforming • EPRA NAV per share of 174.9p (March 2019: 174.9p) including 2.2p of revaluation surplus but after 2.5p of costs incurred from the Mucklow acquisition Investment activity increases urban logistics weighting to 35% and reduces big box exposure to 18% • £454.7m Mucklow acquisition helped to increase urban logistics portfolio value to £826m (March 2019: £504m) • £109.0m of other logistics and long income acquisitions with a WAULT of 17 years at a NIY of 6.6% • £14.1m of disposals at a NIY of 3.6%, including one Mucklow office and 22 flats with 9 flats remaining 52 asset management initiatives completed, including 14 relating to Mucklow assets • Like for like income growth of 3.0% 2 • £3.1m pa income uplift from lettings, regears and rent reviews • PPE: 38 deals signed or agreed, adding £1.7m of income, with our last developed warehouse at Bedford under offer Resilient portfolio focused on long income and operationally light assets that can deliver income growth • WAULT of 11.3 years (12.5 years ex-Mucklow portfolio) and occupancy increased to 98.2% (+40bps) • Gross to net income ratio improved to 98.7% (+50bps) • Contractual rental uplifts on 52.3% of contracted income (62.4% ex-Mucklow portfolio) • Greater income diversification and granularity with top 10 occupiers accounting for 39% of rent, down from 51% Financing & Corporate • EPRA cost ratio reduced further to 14.3% (March 2019: 15.0%) • Integration of Mucklow proceeding well • LTV at 37.9% and weighted average debt maturity of 5.3 years LondonMetric Property Plc 1

Andrew Jones, Chief Executive of LondonMetric, commented: “Against a backdrop of continued uncertainty and disruption, we have again delivered strong financial and operational outperformance, underpinned by a further realignment of our portfolio in response to macro trends that continue to impact direct real estate. We believe that these are profound and permanent shifts. “The acquisition of A&J Mucklow was a significant milestone and accelerated our conviction call to increase our weighting to the urban logistics sector where rents are rising to reflect growing consumer demand for quicker and more efficient deliveries. We call it the Amazon race. This transaction, together with our other long income acquisitions, reflect the ongoing focus on improving our portfolio to benefit from the evolving consumer revolution and a global search for yield. “We will therefore look to allocate further capita l into these sectors and assets where the income is reliable, repetitive and which we expect to grow over time. After all, we expect income and income growth to be the defining characteristics of the next decade’s investment environment. We remain convince d that this strategy will allow us to continue to outperform and to deliver our shareholders an attractive, progressive and well covered dividend.” For further information, please contact: LONDONMETRIC PROPERTY PLC: +44 (0)20 7484 9000 Andrew Jones (Chief Executive) Martin McGann (Finance Director) Gareth Price (Investor Relations) FTI CONSULTING: +44 (0)20 3727 1000 Dido Laurimore / Richard Gotla Londonmetric@fticonsulting.com Meeting and audio webcast A meeting for investors and analysts will be held at 8.30am today at 200 Aldersgate, Aldersgate Street, EC1A 4HD. The conference call dial-in for the meeting is: +44 (0)330 336 9125 (Participant Passcode: 6015938). For the live webcast see: https://webcasting.brrmedia.co.uk/broadcast/5d7b96021e79456d8fcc51f5 An on demand recording will be available shortly after the meeting from the same link and from: http://www.londonmetric.com/investors/reports-and-presentations Notes to editors LondonMetric is a FTSE 250 REIT that owns one of the UK’s leading listed logistics platforms alongside a diversified long income portfolio, with 17 million sq ft under management. It owns and manages desirable real estate that meets occupiers’ demands, delivers reliable, repetitive and growing income -led returns and outperforms over the long term. Further information is available at www.londonmetric.com Neither the content of LondonMetric’s website nor any other website accessible by hyperlinks from its website are incorporated in, or form part of this announcement nor, unless previously published by means of a recognised information service, should any such content be relied upon in reaching a decision to acquire, continue to hold, or dispose of shares in LondonMetric. This announcement may contain certain forward- looking statements with respect to LondonMetric’s expectations and plans, strategy, management objectives, future developments and performance, costs, revenues and other trend information. These statements and forecasts involve risk and uncertainty because they relate to future events and circumstances. There are a number of factors which could cause actual results or developments to differ materially from those expressed or implied by these forward-looking statements and forecasts. Certain statements have been made with reference to forecast price changes, economic conditions and the current regulatory environment. Any forward-looking statements made by or on behalf of LondonMetric speak only as of the date they are made. LondonMetric does not undertake to update forward-looking statements to reflect any changes in LondonMetric’s expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based. Nothing in this announcement should be construed as a profit forecast. Past share price performance cannot be relied on as a guide to future performance. Alternative performance measures: The Group financial statements are prepared in accordance with IFRS where the Group’s interests in joint ventures and non-controlling interests are shown as single line items on the income statement and balance sheet. Management reviews the performance of the business principally on a proportionately consolidated basis which includes the Group’s share of joint ventures and excludes non-controlling interests on a line by line basis. Alternative performance measures are financial measures which are not specified under IFRS but are used by management as they highlight the underlying performance of the Group’s property rental business and are based on the EPRA Best Practice Recommendations (BPR) reporting framework which is widely recognised and used by public real estate companies. LondonMetric Property Plc 2

Recommend

More recommend