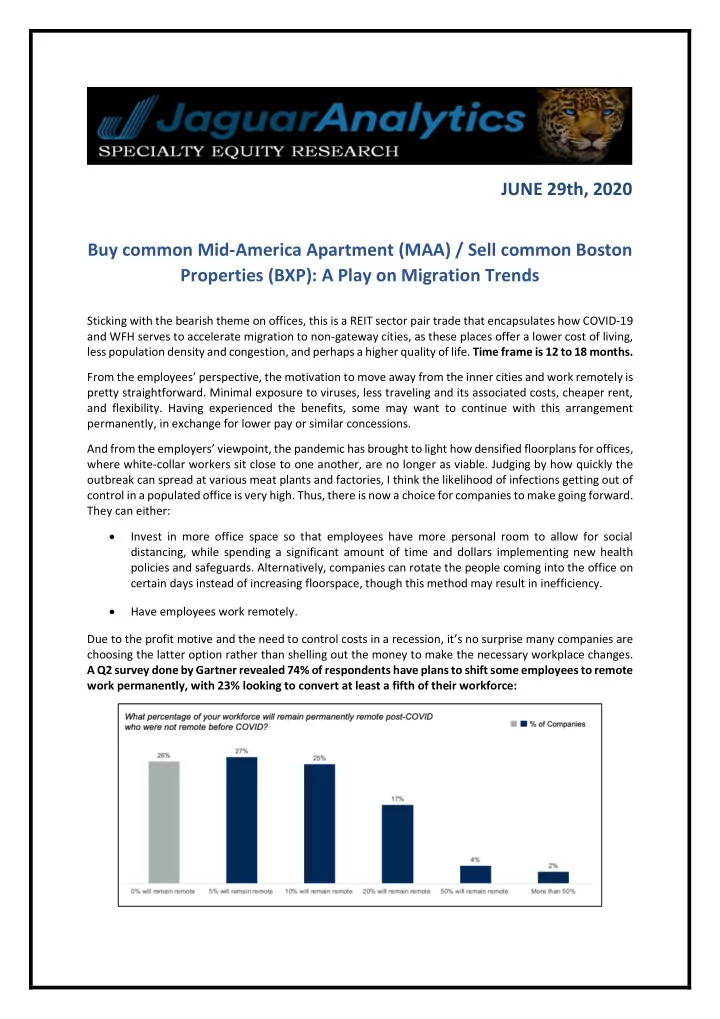

JUNE 29th, 2020 Buy common Mid-America Apartment (MAA) / Sell common Boston Properties (BXP): A Play on Migration Trends Sticking with the bearish theme on offices, this is a REIT sector pair trade that encapsulates how COVID-19 and WFH serves to accelerate migration to non-gateway cities, as these places offer a lower cost of living, less population density and congestion, and perhaps a higher quality of life. Time frame is 12 to 18 months. From the employees ’ perspe ctive, the motivation to move away from the inner cities and work remotely is pretty straightforward. Minimal exposure to viruses, less traveling and its associated costs, cheaper rent, and flexibility. Having experienced the benefits, some may want to continue with this arrangement permanently, in exchange for lower pay or similar concessions. And from the employers’ viewpoint, t he pandemic has brought to light how densified floorplans for offices, where white-collar workers sit close to one another, are no longer as viable. Judging by how quickly the outbreak can spread at various meat plants and factories, I think the likelihood of infections getting out of control in a populated office is very high. Thus, there is now a choice for companies to make going forward. They can either: • Invest in more office space so that employees have more personal room to allow for social distancing, while spending a significant amount of time and dollars implementing new health policies and safeguards. Alternatively, companies can rotate the people coming into the office on certain days instead of increasing floorspace, though this method may result in inefficiency. • Have employees work remotely. Due to the profit motive and the need to control costs in a recession, it’s no surprise many companies are choosing the latter option rather than shelling out the money to make the necessary workplace changes. A Q2 survey done by Gartner revealed 74% of respondents have plans to shift some employees to remote work permanently, with 23% looking to convert at least a fifth of their workforce:

COVID-19 and migration/WFH trends are bearish for Boston Properties (BXP) A well-known commercial REIT, Boston Properties deals in large scale Class A office properties (close to 200 in total), with a focus on the central business districts (CBD) of five major gateway cities: Boston, New York City, Washington DC, Los Angeles, and San Francisco. Below is a geographic breakdown of the company’s portfolio, in net operating income terms: Heading into this COVID-19 crisis, the company had already been struggling with slow growth for years, due to oversaturation in city centers, management’s high le vel of conservatism (they only look to acquire extremely low risk assets with lease duration of at least 96 months), and just by virtue of already being the largest publicly-traded office REIT in the country. That’s the short explanation of why the stock had been going nowhere from 2015 to 2020: Looking ahead, the bear case for the remainder of the year is pretty obvious, but if we were to look at the company more intricately, it becomes clear Boston Properties is going to feel the pain more than most of its peers. Three are three major reasons for this.

1. Offices that cater to banks and the financial sector are at high risk of downsizing initiatives due to WFH trends. Looking at Boston Properties’ portfolio, we can estimate that ~30% of their tenants are in the financial industry (including RE and insurance) : One striking observation that has gone under the radar regarding the pandemic was how quickly the employees of major banks and financial services firms adapted to remote work, despite all of the complications and data security risks involved. As the industry weighs spending cuts to counter the economic crisis, permanently shifting finance jobs away from the office would save millions annually on rent and infrastructure. Personally, I think banking and finance employees tend to have an easier time working from home due to already being accustomed to the sedentary nature of their work and ease of setting up a home office (helped by better relative compensation vs other industries). Through JaguarLive, JaguarMedia and First Read, w e’ve touched on multiple occasions how the leaders at Morgan Stanley (which currently has 90% of employees working from home), JPMorgan (90%), Mastercard (90%), Visa ( “majority” ), UBS (80%), and Barclays ( “vast majority” ) are now questioning the need for as much office floorspace. And we can now add Citi and Goldman Sachs to the list, after both banks recently said that the refilling of office desks is voluntary, including across seniority levels. BofA (major tenant of BXP) seems to be the lone holdout, with sections of the leadership insisting employees continue to be at their work desks. Looking at the overall picture, according to a Partnership for New York City poll in June, more than a third of respondents in the financial sector predicted that just 10% of their employees would return to city offices by August 15th, while 29% would return by December 31st. If firms are expecting less than a third of employees returning by the end of the year, it implies they likely have the remote work infrastructure in place to continue indefinitely, and I think the desire for less office space will only intensify. It also begs the question of whether companies can start sourcing talent across the nation rather than just locally. All of this will result in a weakening of Boston Properties ’ negotiating power in both rent retention and prices. In square foot terms, roughly one-fifth of the company's leases will expire over the next two years. Looking at the most recent SEC filings, management is aiming to use upcoming renewals to increase rent per square foot from ~$55 currently, to $66 by 2022 and $68 by 2023. Based on WFH trends of the financial sector alone, I think those numbers will have to come down.

2. New York City fundamentals were already terrible going into the COVID-19 crisis. We previously covered this topic in detail with our bearish case on Bank OZK. The key things to note are that population growth in NYC has been negative since 2017, and office demand was already declining with vacancies up 260 bps to 11.3% in the space of two years (see here), during what was supposed to be a good period economically for America! In FY19, NYC represented 35% of Boston Properties’ rental revenue , the highest exposure out of all the cities in which the company operates. To add to what’s already been discussed, Savills was out with a report on June 26th, forecasting Manhattan asking rents to decline 26% to a 9-year low of $62.47 a square foot in a prolonged recession. If that materializes, it will just spell further misery because Manhattan office rents had already been flat since 2015, based on Cushman & Wakefield data. Separately, Moody’s is forecasting office vacancy rates to rise to 20% by 2021, with NYC rents down 25%. Doing some rough math, that does seem about right. During the early 2000s recession, NYC office vacancies increased 910 bps from trough to peak. And during the GFC, they increased 620 bps. With vacancies currently at 11.3%, Moody’s estimate would imply an 870 -bps increase, which is fairly realistic. Lastly, this is nothing new but has kind of been forgotten. The $10K cap on deductions for state and local taxes (aka SALT), as part of a 2017 tax code overhaul, has only served to make New York an increasingly unattractive place to live due to its high sales and property taxes. No doubt, this was a major contributor to the aforementioned negative population growth since 2017, and this will probably be exacerbated if the recession persists and/or remote work becomes permanent.

Recommend

More recommend