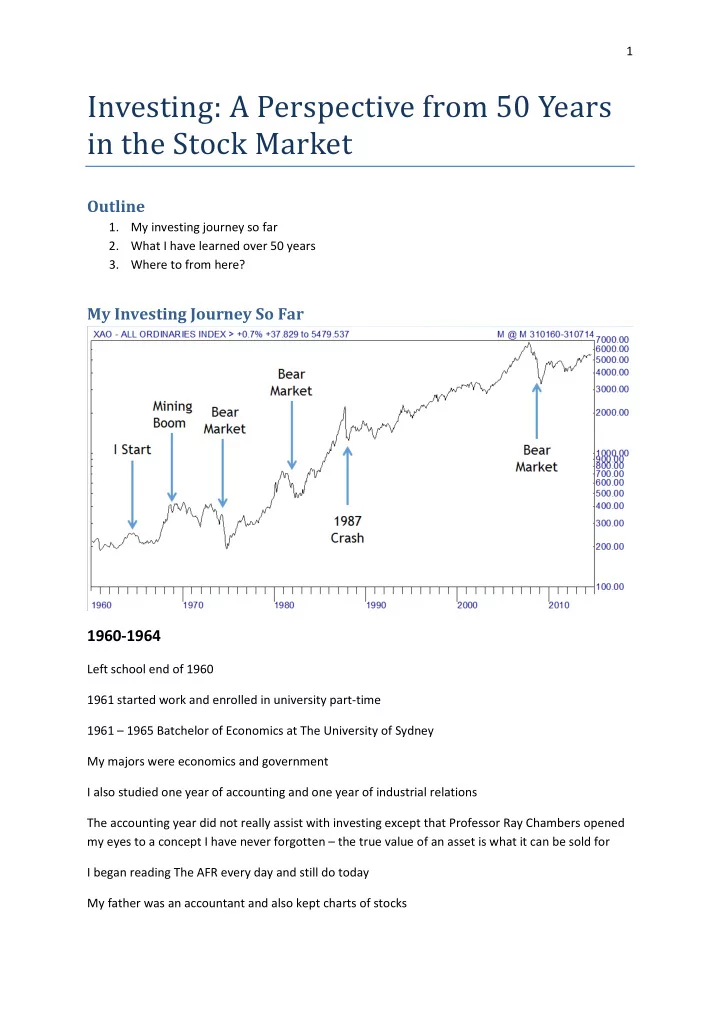

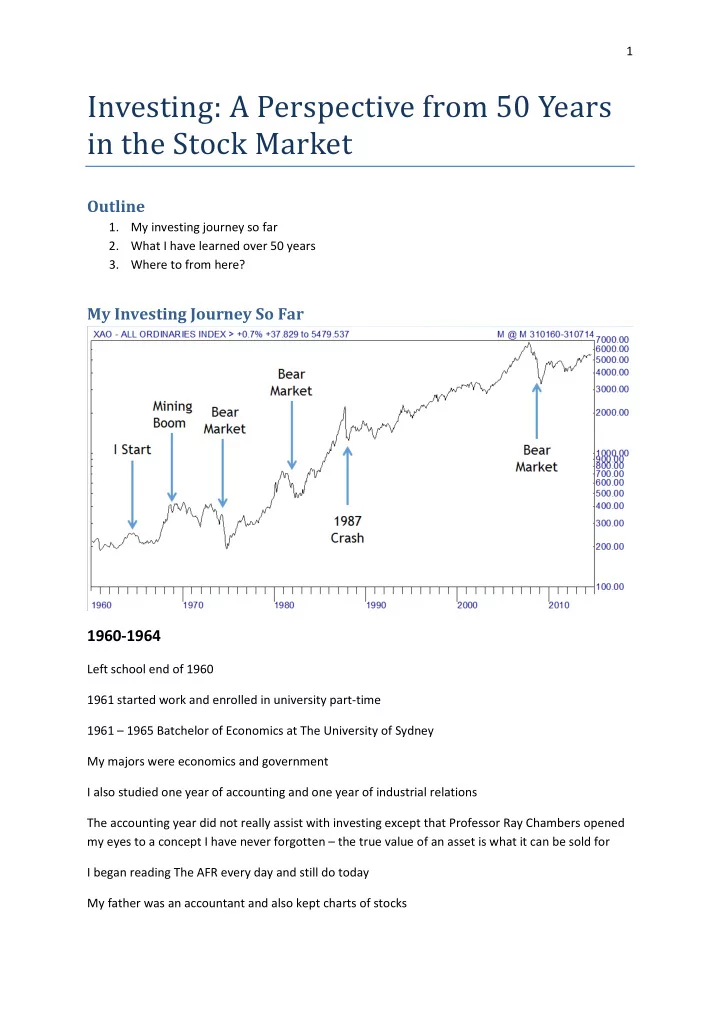

1 Investing: A Perspective from 50 Years in the Stock Market Outline 1. My investing journey so far 2. What I have learned over 50 years 3. Where to from here? My Investing Journey So Far 1960-1964 Left school end of 1960 1961 started work and enrolled in university part-time 1961 – 1965 Batchelor of Economics at The University of Sydney My majors were economics and government I also studied one year of accounting and one year of industrial relations The accounting year did not really assist with investing except that Professor Ray Chambers opened my eyes to a concept I have never forgotten – the true value of an asset is what it can be sold for I began reading The AFR every day and still do today My father was an accountant and also kept charts of stocks

2 I began reading his books on charting: • Philip Rennie’s book on Point and Figure (charts in pence – had to convert to cents) • Edwards and Magee Technical Analysis of Stock Trends • Alexander Wheelan Study Helps in Point and Figure Technique I began keeping my own point and figure charts of stocks from the AFR course of sales tables 1964-1987 In 1964, I bought my first stock: Myer Emporium As the 1960s unfolded, a share trading club was formed where I worked, which I joined We did quite well in the mining boom, but towards the end most lost interest and I was running it Once the boom was finished I wound up the club I got married in 1966 and my small investments began to grow as we saved for a block of land and built a house on it We had very little money to invest, but I continued keeping my stock charts From the day we married until my wife retired, we always lived off one income and saved the other one Initially, the savings went to buy the land and build the house, then to pay down the mortgage However, a little went to buying stocks The end of the mining boom was benign for me – I had sold all my stocks and that of the investment club based on the charts 1974 was another thing – again I got out early based on the charts – but watched in horror as the market closed lower for seven consecutive months This was a great preparation for the severe bear markets to come in 1981, 1987, 1990, 1994, 2002 and especially 2008 In the 1970’s we paid off the mortgage and I began to assemble a significant share portfolio March 1987 Age 43 - I resigned my job with $180,000 plus a house in assets We would live off my wife’s salary and I would build our investments full-time, aiming to have the house plus $1 million in stocks by the time I was 60 1988-1989 I undertook the Graduate Diploma in Applied Finance and Investing full-time

3 I earned a little money as a census supervisor and some fieldwork for the electoral commission and Australia Post while I was studying Financial Statement Analysis led to me teaching fundamental analysis in the graduate diploma before I had graduated 1990-2014 I continued teaching fundamental analysis, but then had the opportunity to write two courses in, and to teach, technical analysis in the Graduate Diploma and that became my focus I gradually moved out of teaching and began writing for Shares magazine and later for Smart Investor, BRW, AFR and others I had written four books on investing I had built a website that is a teaching tool for investors By 2008 I had quit writing for magazines and newspapers My wife had retired Our capital had grown to $2.4 million plus the apartment we live in I have since revised and expanded two of the books I am not retired – I am a full-time investor I write extensively for my website and newsletter I speak to groups around the country on investing – though I plan to cut back This table shows an important aspect of my investing journey The reasoning was: • It was useful to compare my returns to the super fund managers • Much of the super was compulsory, preserved and had tax advantages • A self-managed super fund was not possible anyway • I took it over once we reached preservation age My evolution as an investor:

4 • I started buying stocks based 90% on charts • 1964-1985 I declared I was a share trader for tax purposes, which has some tax advantages • Since dividend imputation and the capital gain tax discount, I have been taxed as an investor • I had morphed from a trader to an investor • I now use charting for timing and fundamental analysis for stock selection (value) My sense is that the split for me now is: • 25% Charting • 75% Fundamental analysis but this is subjective and arguable … Because of where I have come from I still struggle to not let price dominate my focus: • Price can signal information/analysis the smart money has before news is announced • Price is important for capital preservation (I invest in small stocks) • Markets move in cycles and I am a market timer However, I am now more and more focussed on the way the business is performing and its prospects • Especially, looking for high return and growth in earnings • And above all buying at a price that is reasonable compared to value

5 What I have Learned over 50 Years What DOES NOT Work What DOES Work Trying to predict the market Following a strategy and a process • It cannot be done with any Assess the phase of the market • • Consistency or Implement your strategy • • Precision Follow a disciplined process based on Even expert forecasters get the direction right rules and guidelines • less than half the time, which is worse than As the phase of the market changes – chance move through the strategy Buying stocks whose price has risen strongly Buying stocks whose price is low relative to • These have been great investments – but value • for other investors Price is what you pay • • You are investing new money at high Value is what you get prices Pay too high a price relative to value and • Return is likely to be low • Risk will be higher Speculation Investing Buying stocks that Buying part ownership of a business that • • Do not make a profit Makes a profit • • Do not pay a dividend Pays a dividend • • Are searching for minerals or energy Is conservatively financed (low debt) • • Looking for a new cure Has a competitive advantage • • Developing a new technology Has a rate of return higher than your • cost of capital Starting a new business • Investing in them is risk capital Can be bought at a price that is low relative to value Guru Seeking Develop your own investment plan Beware people who explain the past as a This involves: • platform to predict the future Formal investment education to a • Any competent historian can explain the postgraduate level • past, but Wide reading and study – Read a book • Prediction is the role of fortune tellers every month about • o Investing Facts provided are often highly selective • o Biographies of investors or Qualifications are no proof of ability – o History of markets ask to see their investment results • Develop a written investment plan No one book has all the answers • • Requires years of experience, thought If you do not understand the guru’s plan and testing deeply, you will abandon it under • Writing it down will expose the gaps and pressure in the market logical inconsistencies Sufi Teaching Story: • It is complete if, in any situation you “O my people! Do you want knowledge without difficulty, truth without falsehood, great encounter, you can find the relevant rule or guideline in the plan attainment without effort, progress without sacrifice?” If it is not written down, stop fooling yourself that you have a complete plan and know what Very soon a very large crowd gathered, everyone shouting “Yes, Yes!” you are doing (Craig Foreman) “Excellent!” said the mullah. “I only wanted to know. You may rely on me to tell you about it if I ever discover any such thing.”

6 What DOES NOT Work What DOES Work Seeking high returns Defensive investing It is near impossible for most investors to match, The first commandment is preservation of capital • let alone beat the market consistently Manage risk so that losses are always • The higher the return you seek over the small • market return, the greater the risk you Allow returns to compound have to take • You can’t make the market give you Risks to be managed: • money Market risk • • To get more money from the market, Specific risk • you need more capital to invest and Financial risk • • More time to allow your capital to Liquidity risk compound Specific risk is managed by: • Investment grade stocks Diversification • Rising or high and stable Return • Purchase at a reasonable price • Stop-loss and position size Unstructured investing Continuous improvement Usually takes the form of jumping from idea Good records are the mark of a good to idea investor: • Maybe acting on tips or articles • Keep a journal that documents all • No understanding of what you are decisions • Track returns year to date against the doing i.e. no investment plan • Using price alone to try to avoid target return or the market return at least weekly difficult and time-consuming analysis • Assess all completed investments • No clear and consistent guidelines for against the process in your stock selection • No rules and guidelines for managing investment plan • Make an annual review of all losing investments • Little or no measurement of progress investments seeking to identify ways to improve your investing through each year • Make an annual review of all winning investments seeking to identify the sources of success and build them into your plan

Recommend

More recommend