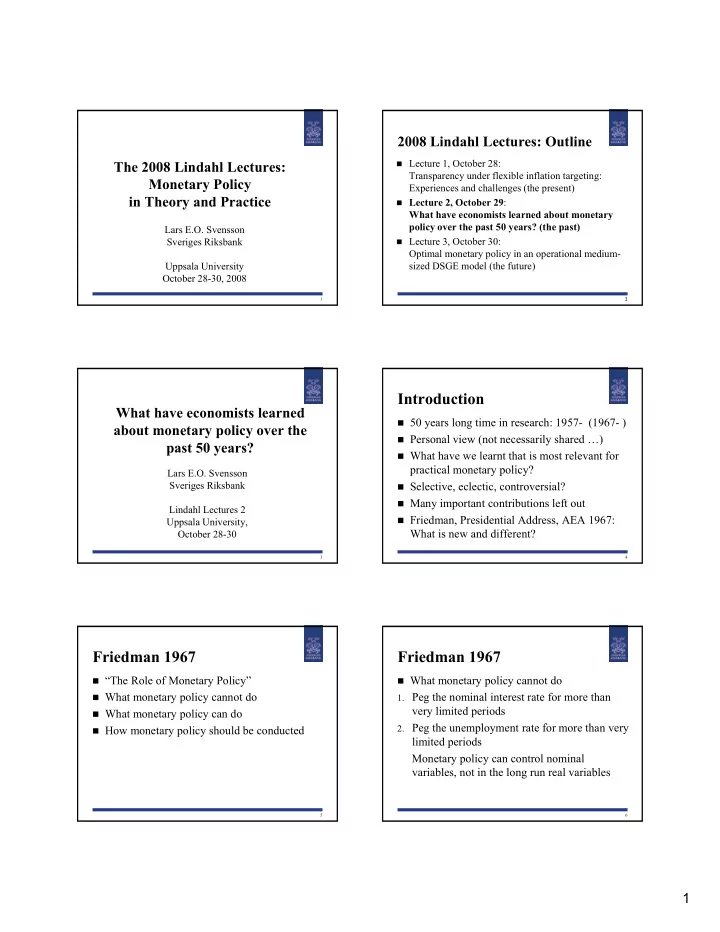

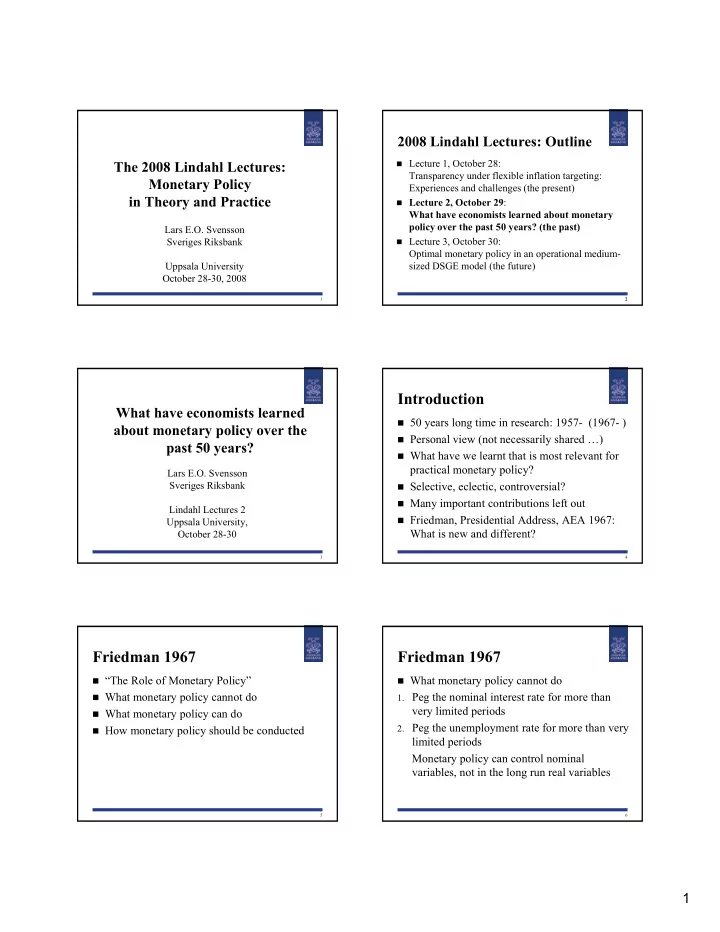

2008 Lindahl Lectures: Outline The 2008 Lindahl Lectures: � Lecture 1, October 28: Transparency under flexible inflation targeting: Monetary Policy Experiences and challenges (the present) in Theory and Practice y � Lecture 2, October 29 : What have economists learned about monetary policy over the past 50 years? (the past) Lars E.O. Svensson Sveriges Riksbank � Lecture 3, October 30: Optimal monetary policy in an operational medium- Uppsala University sized DSGE model (the future) October 28-30, 2008 1 2 Introduction What have economists learned � 50 years long time in research: 1957- (1967- ) about monetary policy over the � Personal view (not necessarily shared …) past 50 years? � What have we learnt that is most relevant for practical monetary policy? i l li ? Lars E.O. Svensson Sveriges Riksbank � Selective, eclectic, controversial? � Many important contributions left out Lindahl Lectures 2 � Friedman, Presidential Address, AEA 1967: Uppsala University, What is new and different? October 28-30 3 4 Friedman 1967 Friedman 1967 � “The Role of Monetary Policy” � What monetary policy cannot do � What monetary policy cannot do 1. Peg the nominal interest rate for more than very limited periods � What monetary policy can do 2. Peg the unemployment rate for more than very h l f h � How monetary policy should be conducted limited periods Monetary policy can control nominal variables, not in the long run real variables 5 6 1

Friedman 1967 Friedman 1967 � What monetary policy can do � “I believe that the potentiality of monetary policy in offsetting other forces making for 1. Avoid being a major source of disturbance: instability is far more limited than is Avoid major mistakes commonly believed ” commonly believed. 2. Provide a stable background for the economy: id bl b k d f h � “We simply do not know enough to be able to Price stability recognize minor disturbances when they occur 3. Contribute to offsetting major disturbances to or to be able to predict either what their effects the economy arising from other sources will be with any precision or what monetary policy is required to offset their effects.” 7 8 Friedman 1967 Friedman 1967 � “In this area [of monetary policy] particularly � How should monetary policy be conducted? the best is likely to be the enemy of the good. Two requirements: � 1 st requirement : Choose target that monetary Experience suggests that the path of wisdom is to use monetary policy explicitly to offset to use monetary policy explicitly to offset policy can control: exchange rate, price level, policy can control: exchange rate price level other disturbances only when they offer a or broad money ‘clear and present danger’.” Fixed exchange rate not suitable for US � Price level in principle best, but too imperfect � control (long and variable lag) Broad money (better control, shorter lag) � 9 10 Friedman 1967 Friedman 1967 “[W]e cannot predict at all accurately just “Perhaps, as our understanding of monetary � � what effect a particular monetary action will phenomena advances, the situation will have on the price level and, equally important, change. But at the present stage of our just when it will have that effect ” just when it will have that effect. understanding the long way around seems the understanding, the long way around seems the surer way to our objective. Accordingly, I “Attempting to control directly the price level � believe that a monetary total [aggregate] is the is therefore likely to make monetary policy best currently available immediate guide or itself a source of economic disturbances criterion [target] for monetary policy…” because of false stops and starts.” 11 12 2

Friedman 1967 Friedman 1967 2 nd requirement : Avoid sharp swings in “Perhaps, as our understanding of monetary � � phenomena advances , the situation will policy: Achieve steady but moderate rate of change. But at the present stage of our growth of specified monetary aggregate understanding the long way around seems the understanding , the long way around seems the � “That is the most that we can ask from � “That is the most that we can ask from surer way to our objective. Accordingly, I monetary policy at our present stage of believe that a monetary total [aggregate] is the knowledge. But that much – and it is a great best currently available immediate guide or deal – is clearly within our reach.” criterion [target] for monetary policy…” 13 14 Monetary targeting Friedman 1967 2 nd requirement : Avoid sharp swings in � Tried in many countries: Failed and was � policy: Achieve steady but moderate rate of abandoned growth of specified monetary aggregate � In contrast, inflation targeting has worked fine � “That is the most that we can ask from � “That is the most that we can ask from � In Germany, monetary targeting seemed to G i d monetary policy at our present stage of work (Bundesbank impressive performance) knowledge . But that much – and it is a great � But Bundesbank was actually a deal – is clearly within our reach.” nontransparent inflation targeter � Friedman changed his view 15 16 Better knowledge of Inflation targeting transmission mechanism (!) � Flexible IT: Stabilize both inflation around � Conventional wisdom OK, but more channels inflation targeting and resource utilization (expectations) � Forecast targeting: Choose interest-rate path � Aggregate demand (channels: interest-rate, so forecast of inflation and resource utilization so forecast of inflation and resource utilization credit (fin acc) expectations) ( real interest credit (fin acc), expectations) ( real interest “looks good” rate, Taylor Principle) � Why does targeting inflation directly (and � Aggregate supply/Phillips curve (vertical, real stabilizing resource utilization) work? MC/output gap, expectations) 17 18 3

Better knowledge of Better knowledge of transmission mechanism transmission mechanism � Expectations (of future short interest rates) � Theoretical developments matched by better empirical methods (Kalman filtering, VAR, � “Management of expectations” (Woodford) Bayesian methods) � Choosing and publishing interest-rate paths � Current frontier: Empirical Bayesian DSGE � Current frontier: Empirical Bayesian DSGE (RBNZ 1997; Norges Bank 2005; Riksbank, ( 199 k 200 ik b k models (Riksbank: RAMSES, operational) Sedlabanki Islands 2007; CNB 2008, …) � Importance of credibility and transparency 19 20 Avoid and escape from Monetary aggregates matter deflation and liquidity traps little (or not at all) � When Zero Lower Bound for interest rate � But credit aggregates may matter binds, use exchange rate as instrument � ECB Nov 2007: Woodford, ECB paper � McCallum: Taylor rule for exchange rate � Theoretical: No separate channel from money � Svensson: Foolproof Way to Escape from a S l f f to inflation (no microfoundations for P*, real i fl i ( i f d i f * l Liquidity Trap money gap, …) � Empirical: Little or no predictive info about future inflation beyond other explanatory variables (also for low-frequency movements, Woodford) 21 22 Friedman misunderstood Lindahl on money and prices? � “Inflation is always and everywhere a � “The primary factors, which decide the circulation [of money], also have a direct influence on the price monetary phenomenon” level, whereby the changes of the money supply and � Correlation between endogenous variables the price level admittedly command each other but do (nominal variables cointegrated) (nominal variables cointegrated) not display a one-sided causal connection in either � Correlation with inflation higher for interest direction. Hence, the changes of the price level are not explained by a reference to the simultaneous rates and currency depreciation (Galí) changes of the money supply.” � Causality depends on monetary-policy regime [“On the Relationship Between Money Supply and Price Level,” Upps. Univ. Årsskr. 1929, p.17-18] 23 24 24 4

Recommend

More recommend