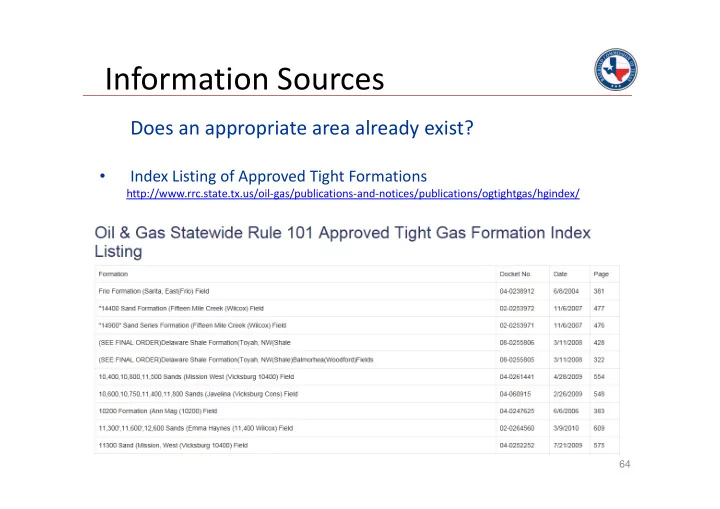

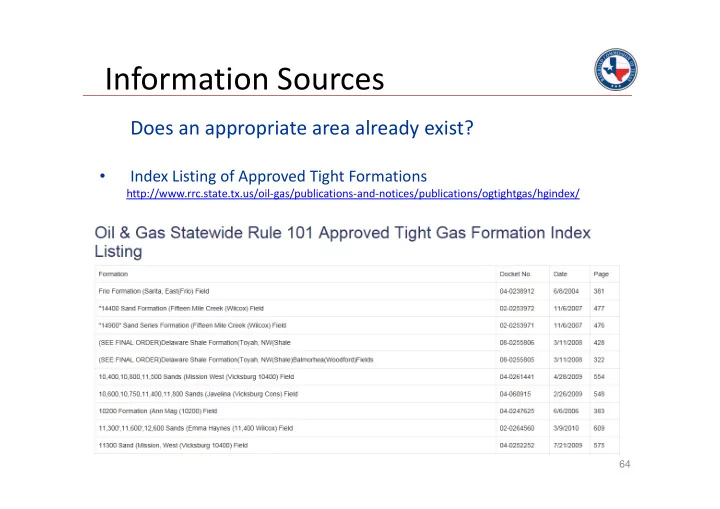

Information Sources Does an appropriate area already exist? • Index Listing of Approved Tight Formations http://www.rrc.state.tx.us/oil-gas/publications-and-notices/publications/ogtightgas/hgindex/ 64

Information Sources Does an appropriate area already exist? • Approved Tight Formation Listing – http://www.rrc.state.tx.us/media/19422/tightgasapproved.pdf 65

Information Sources • RRC Online (Neubus) Search RRC home page http://www.rrc.state.tx.us... Quick Links Box: Data - Online Research Queries… Oil & Gas Imaged Records Menu… Oil & Gas Hearing Files… https://rrcsearch3.neubus.com/esd3-rrc/index.php Docket Type: NGP 66

Information Sources • RRC Public GIS Map Viewer http://wwwgisp.rrc.state.tx.us/GISViewer2/ Search by Well API… Visibility: � Wells � High Cost Tight Sands 67

Public GIS Server – Identifying High Cost Gas Wells 68

Public GIS Server – Identifying High Cost Gas Wells 69

Public GIS Server – Identifying High Cost Gas Wells 70

neubus – Scanned Hearing Search 71

neubus – Scanned Hearing Search 72

neubus – Scanned Hearing Search 73

ST-1: Application for Texas Severance Tax Incentive Certification INSTRUCTIONS (Rev. 11-2011) Use the ST-1 when applying for the following incentive programs: High-Cost Gas, Marketing of Previously Flared or Vented Casinghead Gas. Use the H-12 to apply for the Enhanced Oil Recovery (EOR) Reduced Tax Rate. File the ST-1 and any required attachments with the Railroad Commission in Austin. Particular requirements for the individual incentives are given below. For information on the two incentives, call 512-463-6785. Section II. High-Cost Gas. Gas that is defined as high-cost gas under 16 Texas Administrative Code 3.101, relating to Certification for Severance Tax Reduction for Gas Produced from High-Cost Gas Wells, (Statewide Rule 101), may be eligible for a state severance tax reduction. High-cost gas includes gas produced from designated tight formations, completions below 15000 TVD, Devonian Shale, Coal Seams, or geopressured brine. In order to receive the reduction, the well must be spudded or completed after August 31, 1996. Attach a copy of the Form G-1 completion report with all applications. Additionally, for a tight formations application, provide the area designation docket number and attach a copy of a map outlining the designated tight formation area with the respective well’s location shown. Section 110 of House Bill 2425 (78 th Legislature, 2003, Regular Session) amended Texas Tax Code §201.057, effective June 20, 2003, relating to the high-cost gas tax incentive, by changing the filing procedures and dates. For any application for certification submitted to the Commission after January 1, 2004, the total allowable credit for taxes paid for reporting periods before the date the application is filed may not exceed the total tax paid on the gas that otherwise qualified for the tax reduction ant that was produced during the 24 consecutive calendar months immediately preceding the month in which the application for certification was filed with the Commission. In addition, there is a penalty for filing with the Comptroller of Public Accounts later than the 180 th day after the date of the first production or the 45 th day after the date of the well’s certification by the Commission. Section IV. Marketing Previously Flared or Vented Casinghead Gas. If casinghead gas that has been flared or vented pursuant to Commission Statewide 32 rules for 12 months or more is marketed, it is eligible for permanent exemption from state severance taxes. Application to the Commission must be made within 120 days of when the gas is first marketed.

ST-1 RAILROAD COMMISSION OF TEXAS APPLICATION FOR TEXAS Oil and Gas Division SEVERANCE TAX INCENTIVE REV. 11-11 PO Box 12967 CERTIFICATION Austin, Texas 78711-2967 Section I READ INSTRUCTIONS ON REVERSE SIDE 1. Operator name, exactly as shown on P-5, Organization Report 2. Operator P-5 No. 3. RRC Dist. No. 4. Operator address, including city, state, and zip code 5. Incentive being filed for: (select one) High-cost Gas – Sec I,II 7. Field No, 6. Field Name Flared/Vented Gas Marketing – Sec I,IV Complete the indicated sections and the 9. Lease/ID No. 8. Lease Name Certification area Use Form H-12 for EOR incentive applications Section II. HIGH-COST GAS Incentive. Read Instruction No. 1 Attachments required. 10. Check NGPA high-cost category for which incentive certification is required. 107 Tight Sands 107 Deep Gas 107 other Area Designation Docket No. _________________________ specify _________________________ Section IV. MARKET PREVIOUSLY FLARED OR VENTED CASINGHEAD GAS Incentive. Read Instruction No. 3 16. Identify the twelve consecutive months in which flaring or venting took place and MCF volume flare/vented each month month/year volume month/year volume month/year volume month/year volume 1. 4. 7. 10. 2. 5. 8. 11. 3. 6. 9. 12. 17. Name of gas gatherer filed on Form P-4 to gather the marketed gas. 18. Date first marketed month/year gas carried by the named gatherer CERTIFICATION: I declare under penalties prescribed in ____________________________ ___________________________ TNRC §91.143 that I am authorized to make this signature name (type or print) application, that this application was prepared by me or under my supervision and direction, and that data and ____________________ ____________________ ____________ facts stated herein are true, correct and complete, to the title phone w/AC date best of my knowledge.

RAILROAD COMMISSION OF TEXAS Oil and Gas Division _____________________________________________ NOTICE TO OIL AND GAS WELL OPERATORS TIGHT GAS AREA DESIGNATIONS WITH NON-CONTIGUOUS ACREAGE AND/OR WINDOW ACREAGE This notice addresses applications for tight gas area designation (Statewide Rule 101) that propose two or more sections of discontinuous acreage to be included as a single area in one application, and/or applications that propose to exclude a section of “window” acreage within the proposed area. Administrative review places the following restrictions on the policy of allowing applications proposing two or more sections of non-contiguous acreage as a single area: 1. Each non-contiguous section of acreage must be able to qualify on its own with respect to the flow rate and permeability requirements listed in Statewide Rule 101; 2. All data point wells for an application must be located within the proposed area; and 3. The lateral separation between any non-contiguous sections of acreage cannot exceed 2.5 miles. Administrative review places the following restrictions on the policy of allowing applications that exclude a section of “window” acreage from the applied-for area: 1. If the “window” acreage contains a well that can be used as a datapoint well for the application, that window acreage cannot be excluded. Also, the datapoint well within that acreage must be used in the application. Austin, Texas December 2011 PLEASE FORWARD TO THE APPROPRIATE SECTION OF YOUR COMPANY

Recommend

More recommend