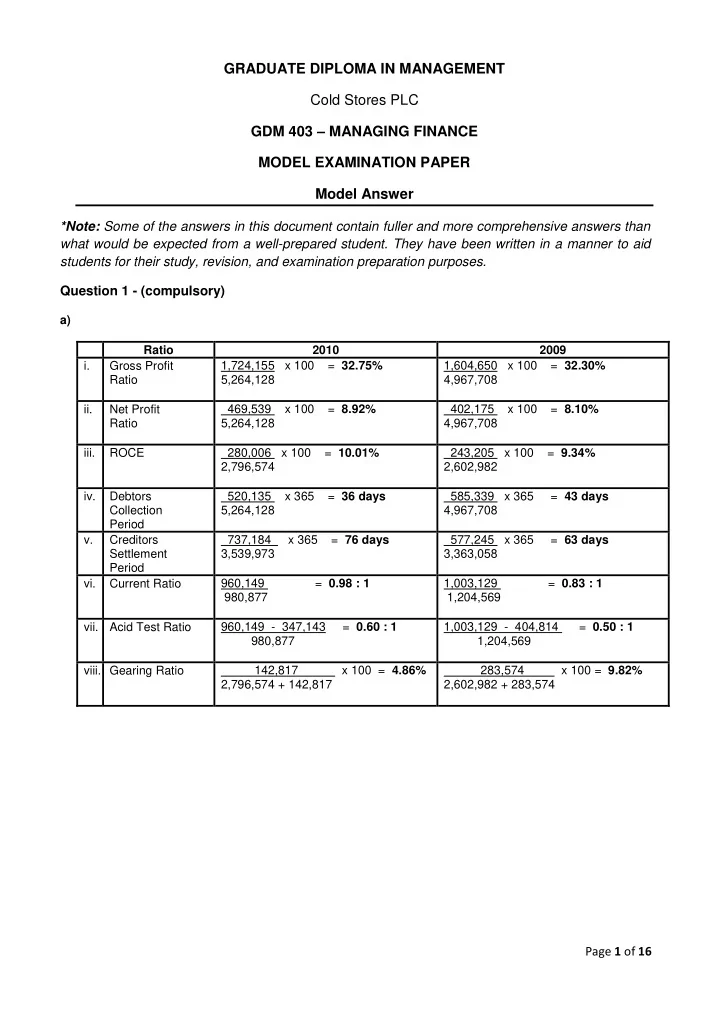

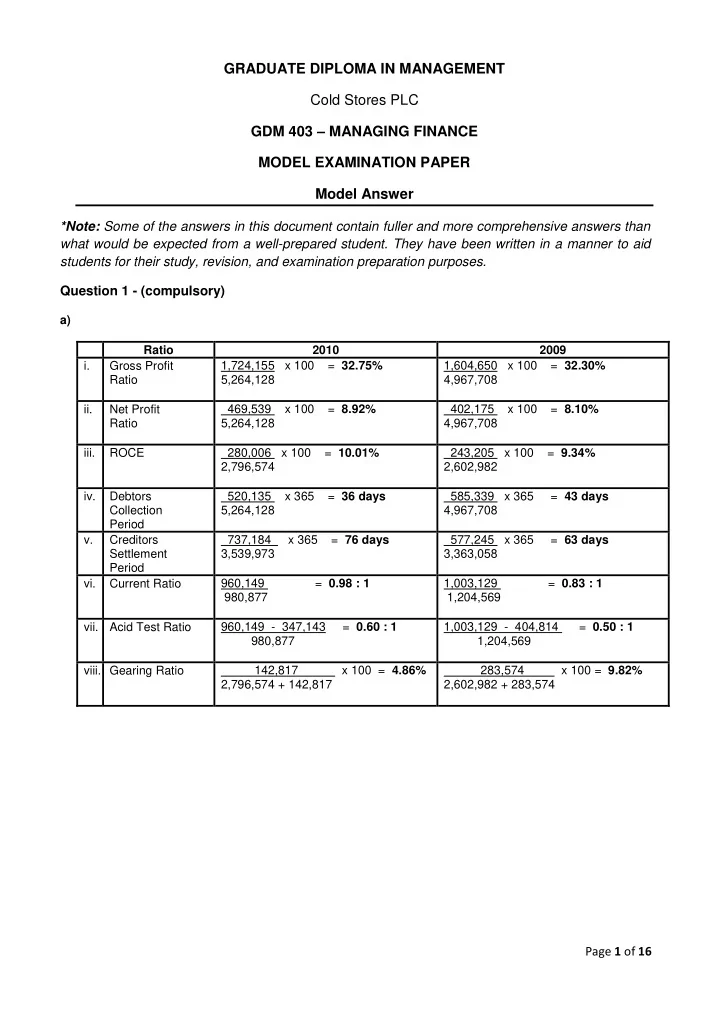

GRADUATE DIPLOMA IN MANAGEMENT Cold Stores PLC GDM 403 – MANAGING FINANCE MODEL EXAMINATION PAPER Model Answer *Note: Some of the answers in this document contain fuller and more comprehensive answers than what would be expected from a well-prepared student. They have been written in a manner to aid students for their study, revision, and examination preparation purposes. Question 1 - (compulsory) a) Ratio 2010 2009 i. Gross Profit 1,724,155 x 100 = 32.75% 1,604,650 x 100 = 32.30% Ratio 5,264,128 4,967,708 ii. Net Profit 469,539 x 100 = 8.92% 402,175 x 100 = 8.10% Ratio 5,264,128 4,967,708 iii. ROCE 280,006 x 100 = 10.01% 243,205 x 100 = 9.34% 2,796,574 2,602,982 iv. Debtors 520,135 x 365 = 36 days 585,339 x 365 = 43 days Collection 5,264,128 4,967,708 Period v. Creditors 737,184 x 365 = 76 days 577,245 x 365 = 63 days Settlement 3,539,973 3,363,058 Period vi. Current Ratio 960,149 = 0.98 : 1 1,003,129 = 0.83 : 1 980,877 1,204,569 vii. Acid Test Ratio 960,149 - 347,143 = 0.60 : 1 1,003,129 - 404,814 = 0.50 : 1 980,877 1,204,569 viii. Gearing Ratio 142,817 x 100 = 4.86% 283,574 x 100 = 9.82% 2,796,574 + 142,817 2,602,982 + 283,574 Page 1 of 16

b) Report To : Managing Director, Cold Stores PLC From : Name Date : 1 January 2011 Subject : Commenting on the financial performance and position of Cold Stores PLC Introduction I have been asked to examine the most recent financial statements of Cold Stores PLC. This report is based upon my analysis of the financial statements of the company for the year ended 31 December 2010 together with the comparative figures for the previous year. The analysis is based upon a number of relevant accounting ratios which have been calculated previously. Financial Performance Cold Stores (CS) has been able to maintain a stable financial performance across the two years 2010 and 2009, with the GP, NP, and ROCE ratios showing consistent figures. GP ratio has shown a slight increment from 32.30% to 32.75%. The reason behind this should be the fact that the sales revenue increment of about 6% has been consumed by the cost of sales increment of about 6%. Thus, CS should focus on methods to reduce their cost of sales through ways such as planning production to facilitate bulk buying to obtain discounts, more internal sourcing of natural resources by improving the number of farmers dedicated to supply raw materials to CS, and other internal sourcing initiatives. The NP ratio has shown a decrement, though negligible, when coming to 2010. The NP ratio is currently at 8.92% from 200 9’s 8.10%. It is visible that whilst expenses such as distribution and administration have not shown significant variations, other operating expenses have increased by about Rs. 1 million. However, this increment has been set-off by the reduction of the interest expense and increase in the other operating income. It is advisable that the management looks into this increment of other operating expenses and take necessary remedial actions to rectify the same. ROCE has been about 10% in both the years, which is a healthy figure, which would retain existing shareholders as well as attract future shareholders. Financial Position A key highlight with consideration to CS’s financial position is that it is recovering from an overdraft situation, and moving into a cash rich position when coming into 2010. The debtors ’ collection period has reduced by one week. This is probably due to the company’s 2010’s sales being mostly in cash and the previous debtors having paid in to the company in 2010, the company’s trade and other receivable has decreased by about Rs. 65 million. This can also be seen as reason for the company ’s cash position turnaround. The organisation should ensure that this positive trend continues into the future. The creditor s’ settlement period has increased by about two weeks, and currently stands at 76 days. This is an acceptable level in general, and is a positive factor when considering the company’s working capital position. However, considering part of the company’s trade creditors being farm ers in rural areas such as Pilimatalawa, Daulagala, Danthurai, Hedeniya and Kandy regions of Hatharaliyadda, Pujapitiya and Aludeniya, it may seem unethical to latent the payments to them, as their livelihoods depend on CS’s timely payments. Thus, it can be advised that whilst maintaining the current creditor’s payment period, to prioritise the suppliers and ensure that better timely payments are made to suppliers such as farmers. Both the current ratio and the acid test ratio have shown favourable increments when coming to 2010 (current ratio from 0.83 : 1 to 0.98 : 1, and acid test ratio from 0.50 : 1 to 0.60 : 1), highlighting the healthy Page 2 of 16

cash position achieved in 2010. This turnaround is highly commendable and the management should focus on maintaining the same trend in to the future. CS is a considerably low geared organisation, where they further lowered their gearing level to 4.86% in 2010, from its 9.82% in 2009. This is due to CS having paid about Rs. 140 million of their interest bearing borrowings during 2010. Having paid a significant amount of the loans and still showing a turnaround in their cash position is a highly commendable achievement by CS. The reduction of these borrowings have resulted in lowered interest payments in 2010, as mentioned prior, and has contributed towards the organisation’s financial performance. Conclusion CS has shown a consistent financial performance and a healthy financial position when coming to 2010. Key highlights are that CS has paid off a significant amount from their borrowings, whilst maintaining a similar financial performance to that of 2009 and achieving a turnaround in their cash position. The management and staff of CS should be commended for the same whilst they should focus on taking necessary actions on the areas highlighted in this report, to ensure more improved financial status in 2011. Signed, Name Page 3 of 16

c) *all calculation in thousands (‘000) New Profit before Tax calculation to support Net Profit Margin ratio - Detail Working Answer Sales revenue 5,264,128 x 1.10 5,790,541 Cost of sales Does not change (3,539,973) Other operating income Does not change 79,167 Distribution expenses 823,243 x 1.15 (946,729) Administrative expenses 262,699 x 1.15 (302,104) Other operating expenses Does not change (170,939) Finance expenses Does not change (67,902) Profit Before Tax - 842,061 New borrowings calculation to support Gearing ratio - Detail Working Answer Previous borrowings (2010) - 142,817 New loan amount - 50,000 Total borrowings 142,817 + 50,000 192,817 New ratios - Detail Working Answer Net Profit ratio 842,061 x 100 14.55% 5,790,973 Gearing ratio 192,817 x 100 6.45% 2,796,574 + 192,817 Recommendation – As per the above calculations, it is clear that Cold Stores PLC is in adherence to both the policies after obtaining the loan, where net profit ratio is 14.55% (above 10%), and gearing ratio is 6.45% (below 15%). Therefore, it can be recommended that Cold Stores PLC obtains the proposed long term loan. Page 4 of 16

d) Importance and use of financial information to the key stakeholders of Cold Stores PLC: We can identify the following parties as key stakeholders of Cold Stores PLC: Farmers and other suppliers Customers Competitors Government Media It is important to provide financial information to the mentioned stakeholders as they aid in their various decision making activities, and enables them to obtain a clear understanding about the financial related aspects and prospects of the organisation. The use of financial information can be set out specifically as below: Farmers and other suppliers – to understand the company’s ability to make payments on a timely basis Customers – to seek opportunities to obtain discounts on future purchases and extended credit periods Competitors – to benchmark aspects such as profitability, revenue, expenses and assets Government – to understand that timely payment of taxation Recommendations on CSR activities which Cold Stores can undertake, and how such activities can affect their profitability: As Cold Stores concerns Corporate Social Responsibility (CSR) as priority and gives high concern towards the welfare of its employees, suppliers and the society as a whole, it is important that they give the due focus towards exercising various CSR activities. Few CSR activities that they could undertake can be stated as below: Cold Stores can conduct various health campaigns in villages such as in Pilimatalawa, Daulagala, Danthurai, Hedeniya and Kandy regions of Hatharaliyadda, Pujapitiya and Aludeniya, as these areas consist of farmers who supply ginger to Cold Stores Cold Stores can aim at the reduction of waste disposal during their manufacturing of various products such as beverages and ice cream. Save the environment campaigns Cold Stores can seek to increase direct purchase of other raw materials required in their production from farmers, not being just limited to direct purchasing of ginger from ginger farmers. CSR activities can have an impact on Cold Store s’ profitability, which can be two fold. In the short term , it will lead to a decrement in profitability due to cost on CSR activities. However, in the long term, Cold Stores can anticipate a possible increase in profitability due to positive customers perception and attraction resultant from the CSR initiatives. Page 5 of 16

Recommend

More recommend