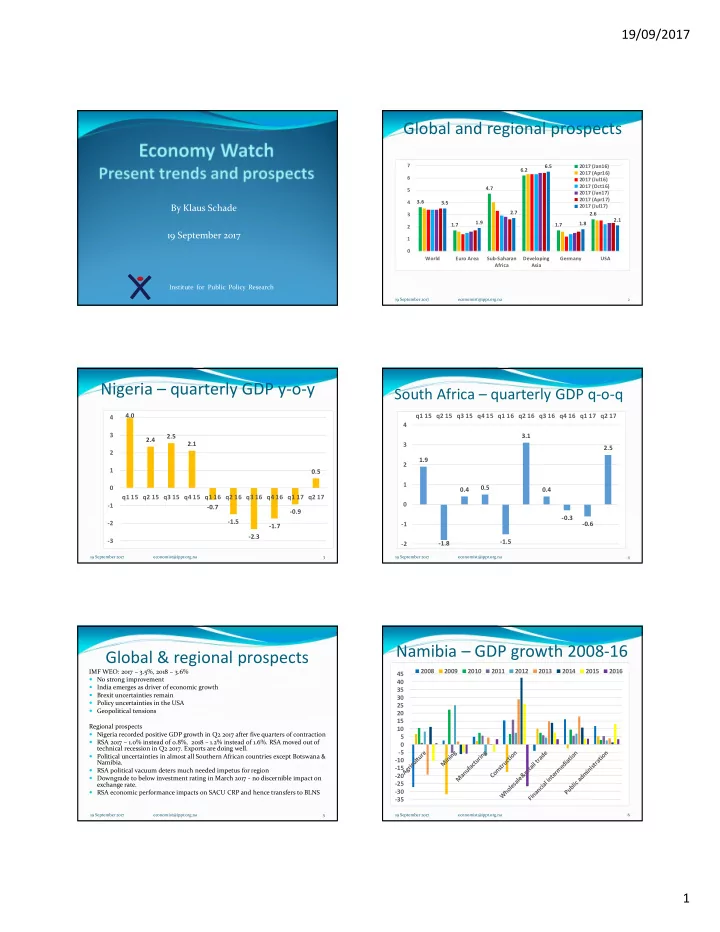

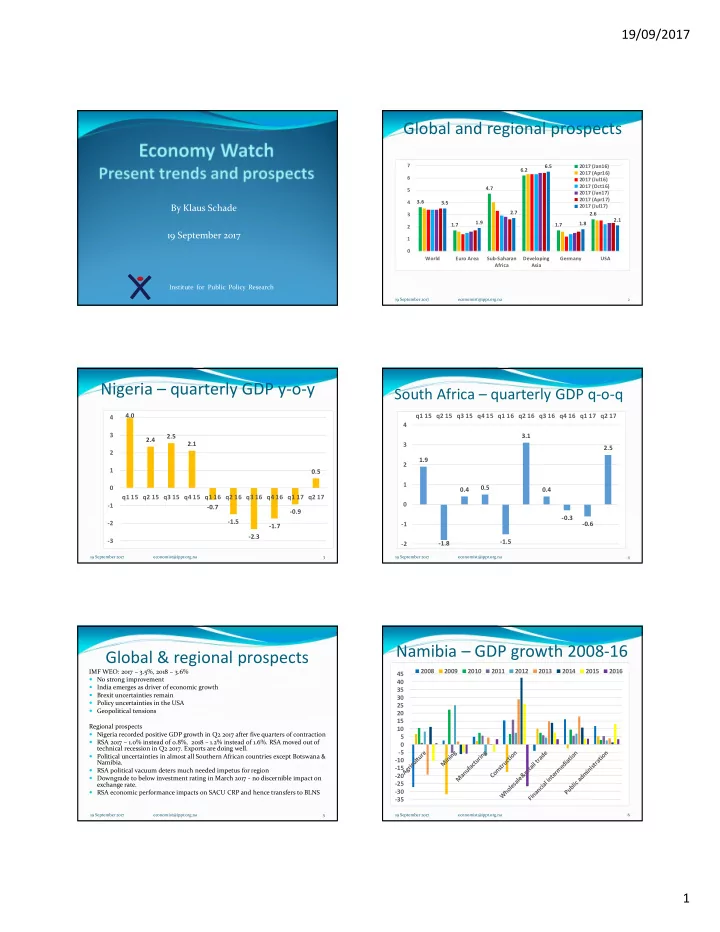

19/09/2017 Global and regional prospects 7 6.5 2017 (Jan16) 6.2 2017 (Apr16) 6 2017 (Jul16) 2017 (Oct16) 4.7 5 2017 (Jan17) 2017 (Apr17) 4 3.6 3.5 By Klaus Schade 2017 (Jul17) 2.7 2.6 3 2.1 1.9 1.8 1.7 1.7 2 19 September 2017 1 0 World Euro Area Sub-Saharan Developing Germany USA Africa Asia Institute for Public Policy Research 19 September 2017 economist@ippr.org.na 2 Nigeria – quarterly GDP y-o-y South Africa – quarterly GDP q-o-q 4.0 q1 15 q2 15 q3 15 q4 15 q1 16 q2 16 q3 16 q4 16 q1 17 q2 17 4 4 3 3.1 2.5 2.4 2.1 3 2.5 2 1.9 2 1 0.5 1 0.5 0 0.4 0.4 q1 15 q2 15 q3 15 q4 15 q1 16 q2 16 q3 16 q4 16 q1 17 q2 17 0 -1 -0.7 -0.9 -0.3 -1.5 -2 -1 -0.6 -1.7 -2.3 -3 -1.5 -2 -1.8 19 September 2017 economist@ippr.org.na 3 19 September 2017 economist@ippr.org.na 4 Namibia – GDP growth 2008-16 Global & regional prospects 2008 2009 2010 2011 2012 2013 2014 2015 2016 IMF WEO: 2017 – 3.5%, 2018 – 3.6% 45 � No strong improvement 40 � India emerges as driver of economic growth 35 � Brexit uncertainties remain 30 � Policy uncertainties in the USA 25 � Geopolitical tensions 20 15 Regional prospects 10 � Nigeria recorded positive GDP growth in Q2 2017 after five quarters of contraction 5 � RSA 2017 – 1.0% instead of 0.8%, 2018 – 1.2% instead of 1.6%. RSA moved out of 0 technical recession in Q2 2017. Exports are doing well. -5 � Political uncertainties in almost all Southern African countries except Botswana & -10 Namibia. -15 � RSA political vacuum deters much needed impetus for region -20 � Downgrade to below investment rating in March 2017 - no discernible impact on -25 exchange rate. � RSA economic performance impacts on SACU CRP and hence transfers to BLNS -30 -35 19 September 2017 economist@ippr.org.na 5 19 September 2017 economist@ippr.org.na 6 1

19/09/2017 Namibia – GDP growth y-o-y Quarterly GDP growth – selected sectors 10 1q16 2q16 3q16 4q16 1q17 8.6 20 16.8 13.7 11.3 10.5 8 10 5.3 6.3 6.3 3.2 1.8 6 0 4.7 4.1 -2.2 -2.6 -10 -4.3 -4.5 4 -5.6 -10.7 -13.0 -20 -15.9 2 -19.5 -30 -29.5 0 -40 -34.9 q1 15 q2 15 q3 15 q4 15 q1 16 q2 16 q3 16 q4 16 q1 17 -37.7 -2 -1.2 -1.4 -50 -44.9 -1.9 -2.7 Agriculture Mining and quarrying Manufacturing Construction -4 19 September 2017 economist@ippr.org.na 7 19 September 2017 economist@ippr.org.na 8 Change in Inventories – NAD million Distribution of GDP in percent 2,277 2,500 48 2,000 1,763 47 1,450 46 1,500 1,044 45 779 1,000 44 500 259 43 0 42 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 -500 -291 41 40 -1,000 -1,129 -958 39 Compensation of employees Net operating surplus -1,500 38 -2,000 -1,785 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 19 September 2017 economist@ippr.org.na 9 19 September 2017 economist@ippr.org.na 10 Labour market trends Job losses by sector 70 2012 2013 2014 2016 58.5 56.3 60 52.2 0 50 43.4 39.2 -10,000 37.8 -4,390 -7,944 40 34.0 30.3 -11,629 29.8 28.3 -20,000 27.5 26.2 30 22.7 -30,000 20 -31,607 -40,000 10 -50,000 0 -60,000 -70,000 -74,074 -80,000 Agriculture Wholesale Public Private hhd Transport & Fishing and retail admin. and storage trade 19 September 2017 economist@ippr.org.na 11 19 September 2017 economist@ippr.org.na 12 2

19/09/2017 External trade Job losses by region Omusati Kunene Ohangwena Oshikoto 30,000 Imports Exports Trade balance 0 25,000 20,000 -5,000 15,000 -6,919 -7,564 -10,000 -8,730 10,000 5,000 -15,000 0 Q1 Q2 Q3 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 -5,000 -20,000 2014 2014 2014 2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 -5,894 -6,193 -10,000 -7,561 -7,917 -4,885 -22,794 -25,000 -11,016 -11,641 -11,420 -15,000 -14,244 19 September 2017 economist@ippr.org.na 13 19 September 2017 economist@ippr.org.na 14 Main imports Main exports 50 20 15 40 10 30 5 20 0 10 Q1 Q2 Q3 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 14 14 14 15 15 15 15 16 16 16 16 17 17 0 Q1 Q2 Q3 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Mineral fuels & oil Vehicles 14 14 14 15 15 15 15 16 16 16 16 17 17 Boilers, machinery etc Electrical machinery & equipm. Diamonds Fish Copper ore Fodder Copper cathodes Zinc and articles thereof Live animals 19 September 2017 economist@ippr.org.na 15 19 September 2017 economist@ippr.org.na 16 Prospects – primary sector Prospects – secondary sector � Agricultural sector doing well this year (>10%) � Restocking of livestock could reduce livestock numbers sold to abattoirs. However, record exports of live animals in Q2 2017. � Forecast: Average to above-average rainfall � Beverage production expected to increase due to improved water � However, rainfall patterns unpredictable supply � Mining – better performance this and next year expected: � Construction-related manufacturing activities will remain under pressure (metal fabrication, cement, etc.) � Diamond mining expected to increase with new � Construction: further contraction expected, since budget cuts will be commissioned exploration vessel felt this year. Completion of Neckartal dam and WB port extension next year. SADC Gateway port construction stretched over longer � Zinc & Copper prices increased due to demand, but could period of time result in return to production of mothballed mines elsewhere � Capital investment by SoEs hampered by Government’s fiscal stance � Uranium: limited impact of Husab expected this year, but � Mineral processing, diamond processing could benefit from increased production increase in 2018. Full production? mineral production � Husab at full production second largest uranium mine � Import of raw material for value-addition in Namibia: frozen pilchard, milk powder, mineral ores etc. globally. Hence full production will have impact on global � Electricity – Refit programme going to add 55MW by end of 2017 to prices (remain currently at very low levels) and hence on domestic supply production at Roessing and Langer Heinrich 19 September 2017 economist@ippr.org.na 17 19 September 2017 economist@ippr.org.na 18 3

19/09/2017 Prospects – Tertiary sector Prospects – Labour market � Wholesale and retail trade affected by retrenchments in � Recovery in subsistence agriculture expected owing to construction and related industries, but benefited from additional demand from subsistence farmers & families. good rainfall, except in Kunene north � Tourism expected to perform well despite currency appreciation � Tourism (hotels & restaurants, transport and related over past 18 months and despite drop in shopping tourists from services) create more jobs Angola. � Increased insecurity in other regions – Turkey, North Africa, etc. � In contrast, substantial job losses in construction and � Additional airlines expected to increase number of visitors. related industries � More important: Length of stay and daily expenditure. � Impact on wholesale and retail trade sector � Transport affected by declining demand from construction, but benefiting from increased mining output. Transit shipments affected by demand from Angola, restrictions on transportation of certain goods in Zambia, weak performance of RSA economy. � Professional services linked to construction face head winds 19 September 2017 economist@ippr.org.na 19 19 September 2017 economist@ippr.org.na 20 Namibia policy environment � Ongoing review of NIPA by MITSMED in close consultations with private sector -> positive Thank you for your attention � NEEEF – review is addressing areas of most concern to private sector such as ownership pillar � Draft Rent Bill can impact on the construction of new houses and offices � Procurement Act could have positive impact on demand for Please visit IPPR’s web site for this domestically produced goods and services and hence support domestic economic growth presentation and other reports: � Private sector could follow with stronger emphasis on local procurement and identification of goods and services that could be produced in Namibia www.ippr.org.na � Short-term fiscal measures in right direction, but we can’t shy away from structural issues such as bloated public service and non- performing SoEs -> need to be addressed to ensure sustainable growth and job creation. Current steps taken regarding SoEs point n the right direction. � Moody’s downgrading: Impact remains to be seen, since Fitch has so far maintained the rating. Experiences show that upgrade will take time. 19 September 2017 economist@ippr.org.na 21 19 September 2017 economist@ippr.org.na 22 4

Recommend

More recommend