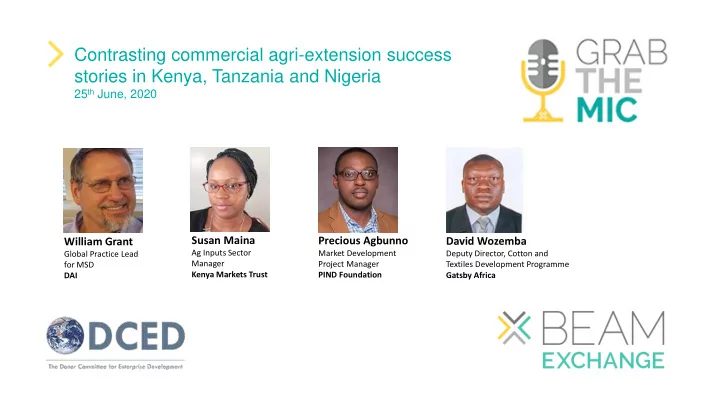

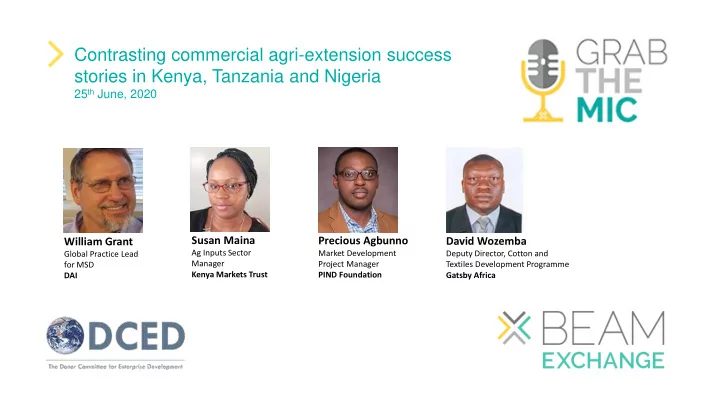

Contrasting commercial agri-extension success stories in Kenya, Tanzania and Nigeria 25 th June, 2020 Susan Maina Precious Agbunno William Grant David Wozemba Ag Inputs Sector Market Development Deputy Director, Cotton and Global Practice Lead Manager Project Manager for MSD Textiles Development Programme Kenya Markets Trust PIND Foundation Gatsby Africa DAI

Contrasting commercial agri-extension success stories – Nigeria, Kenya, Tanzania William Grant June 25, 2020

Drivers of commercially driven agricultural extension ▪ Agricultural extension is the application of scientific research and new knowledge to agricultural practices through farmer education. ▪ Expanded definition of extension : includes farmer required business skills ▪ New models link extension with promotion and sales/purchase of product ▪ Sharing technical information with farmers is good for core business. ▪ Farmers will pay for solutions, if they understand the problem ▪ Goal of Commercially driven extension : demonstrate the value proposition to increase farmer productivity/sales

Typologies of extension providers, services, revenue streams ▪ Government extension services – traditional suppliers ▪ Large Agro-allied firms : ▪ Major agricultural input companies ▪ Major agricultural offtakers ▪ Managed value chain companies ▪ New category of Local Private Extension (LPE) providers ▪ Local fabricators and agro-retailers – have hard product to sell ▪ Technical service providers – have a technical skill to sell (agronomy, veterinary, etc.) ▪ Business service providers – have business skills to sell (finance, marketing, technology) ▪ Revenue streams will vary: ▪ Direct Training fee; ▪ Embedded or subsidized service.

Evolution of Interlinkages Between Extension Providers Agro-Allied Agro-Allied Inputs Output Market Managed VC Firms Agro- Local Private Extension Public Public Dealers BSP, TESP, Fabricators Extension Extension Smallholder farmers Contractual services Flow of inputs/technology Flow of advice 5 6/26/2020 Flow of product

Conclusions and Practical cases ▪ Resilient systems: ▪ Farmers as clients ▪ Good coordination ▪ Good competition ▪ Responsive to COVID pandemic ▪ The presentations: ▪ KMT and Gatsby: Agricultural input driven model addressing services and ICT linkage platform ▪ PIND and MADE in Niger Delta: Local Private Extension service provision, ▪ Final slide will have the major takeaways

Inadequate extension services is one of the primary causes of falling productivity in Kenya Strong private Ag-tech sector – but Low government innovations – but extension focused investment in not at scale on product public extension marketing • Inconsistent quality of extension services • Models have not achieved sustainability and scale • Farmers willing to pay for farm services, not information

Promoting sustainable extension delivery models to provide farmers with information on products and their use Led by Led by Led by AGRO DEALERS INPUT MANUFACTURERS INDEPENDENT ADVISORS • Commissioned network agents • Own network of sales agents • Independent advisors linked to input firms through ICT platform • Bundled service – range of • Brand specific products with products investment in R&D • Bundled sale – range of products • Expos and demo farmers • Partner with agro dealers on demo farms, radio campaigns • Subscription based business • Commission based business model model • Paid for by input firms • In pilot stage - commercial • +500 rural agro dealers • 14 input companies structures not yet • +170,000 farmers reached • +280,000 farmers established • +50 input firms mobilized • Maize yield increase from 8 • 200 advisors serving 5,000 per expo to 20-40 bags/ha farmers

What have we learnt from the various models trialled in the Kenyan context Led by Led by Led by AGRO DEALERS INDEPENDENT ADVISORS INPUT MANUFACTURERS ✓ Strong incentives to ✓ Strong incentives to ✓ Existing network that can deliver service & deliver quality services be leveraged innovate and build commercial ✓ Trusted, ongoing ✓ Quality of service likely to models relationships with farmers be high ✓ Impartial farmer advice • Limited outreach • Own product focused • Pilot stage ad scaling capacity • Many parallel channels models will take time • Quality of service may be causing confusion and • Quality of service may be inconsistent fatigue to farmers inconsistent

Local Private Extension Services Experience from Nigeria’s Niger Delta Precious Chidi Agbunno, Partnership Initiatives in the Niger Delta (PIND) Foundation Ganiat Tijani Ettu, MADE 10

Background Niger Delta • 40m people, Oil rich - distortions, Context conflict zone, high levels of poverty Nigeria and the Niger • Overarching goal of reducing poverty Delta PIND and conflict in the region MADE • DFID project to accompany PIND Strategy • Value chain analysis of viable sectors • Market systems approach Need for a better understanding of how to address farmers’ productivity through extension services Very few LPEs, Poor alignment of Poor state of Handout mainly donor value and government Mentality. focused incentives, etc. extension services 11

Capacity Building Process & Typology How did the projects respond? Identifying entrepreneurial LPEs and pilot models in high value sectors • Technical training materials and methodology • Enterprise training – Value Proposition and How to sell the training to farmers • Farmer as client, not donor • Relationships • Smart grants to help buy down risk and to test-out new models • Product Retailing with Business Services Technical Extension Embedded Services Providers Services Providers • • BDS Agro-dealers • Training • • Linkages to finance & Seed Entrepreneurs • Demonstrations • Markets Village Level Vaccine Dealers • Water/ soil testing etc • Spray Services Providers • Technology SPs, etc

Evolution Dynamics Services • Coverag • How did they evolve? Growth e & Staff • Started as one man companies • Income • Sustainabilit y Typically sold to projects, NGO, Government • Mindset Chang Attended project capacity building program, • e Pilot began to change mindset and service offerings and Replica Added new products in their sectors, moved into • te new sectors, Capacit created linkages with specialists in business • y skills, joint ventures Building Leveraged different competencies and • relationships Greatly expanded client base • “Every problem a farmer has is Evolving faster than the projects’ ability to keep • an opportunity for me to make up money” - ZAL Consulting 13

Project Performance & Market Resilience PIND/MADE: # LPEs Vs Project Outreach (2015 - 2019) 561,546 600,000 3000 2540 500,000 2500 2661 1739 400,000 2000 325,487 300,000 1500 165,262 200,000 1000 426 207 100,000 60,182 500 11,296 0 0 2015 2016 2017 2018 2019 Outreach LPEs Market Resilience: COVID-19 ADAPTATION Key Learnings Adaptation Strategies Use of virtual platforms Strong fundamental relationships bring • • about resilient market systems Collaborative and Adaptive • Targeted efforts are required to • service offerings engender a stronger services market 14

Contrasting commercial agri-extension success stories – Nigeria, Kenya, Tanzania David Wozemba June 25, 2020

Current situation:Tanzanian cotton Levy inputs fund: Farmer Cooperatives: Ginners (off-takers): Provide minimal inputs to Coordinate farmers, distribute inputs and farmers Procure seed cotton (Low manage marketing (low quality, low volume) volume, High competition) (weak management, governance) Extension services embedded in contract farming “Inputs are often delayed, quality is low, last mile distribution is weak” “There are few Local Government: government extension Provide limited extension Cotton farmers: officers and I can’t (1 officer: 1000 cotton farmers + (552,246 growing rain-fed cotton) afford to pay for all other farmers) Low investment ($8/acre), 1,238 extension officers serving Limited extension advice, extension services” over 10m people Low yields (250kg/acre)

New model: Village Based Agents (VBAs) & Kilimo Maendeleo Digital Platform (KMDP) “Value Chain Integrator” Levy inputs fund Ginners (off-takers): Provide minimal inputs to Farmer Cooperatives: Higher volume, High farmers Coordinate farmers, distribute inputs and competition (low quality, low volume) manage marketing Limited extension services Financial Commercial institutions: digital service Provide finance for provider: New Model inputs and services Farmer registration, data management, agronomic information , Commercial input assurance of delivery, & service production & sales providers Provide (30,000 farmers to date) inputs on commercial Cotton Farmers: terms & embedded Local Government: extension information Substantial investment ($50/acre). Institutionalize the platform and & Access to extension information services delivered to the farmers demo plots Significant increase in yields (600kg/acre) (545 VBAs reaching and increased planted area 160,000 farmers)

Recommend

More recommend