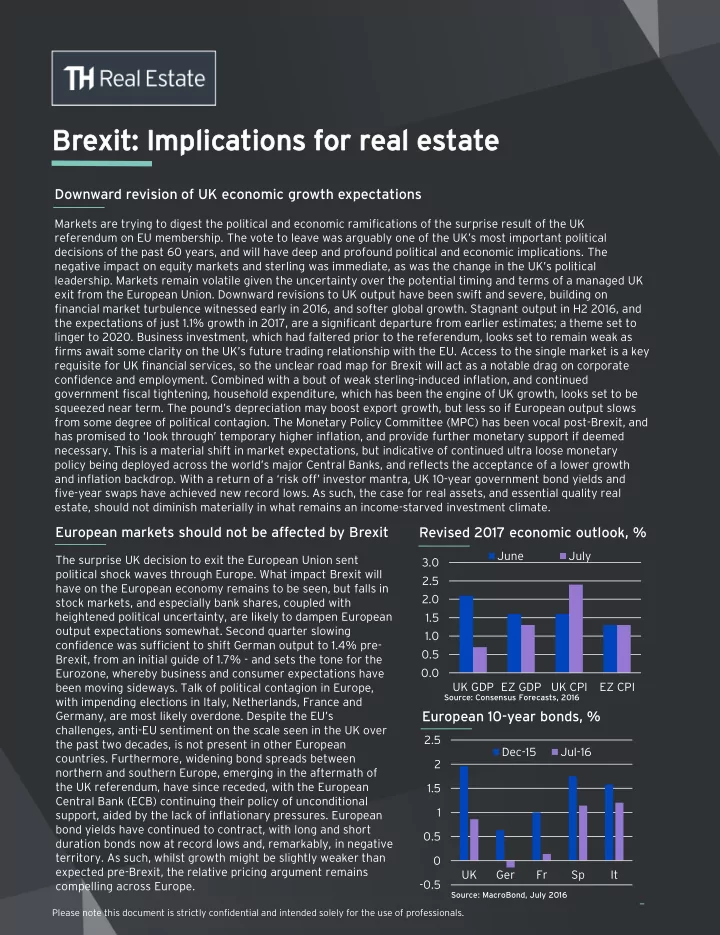

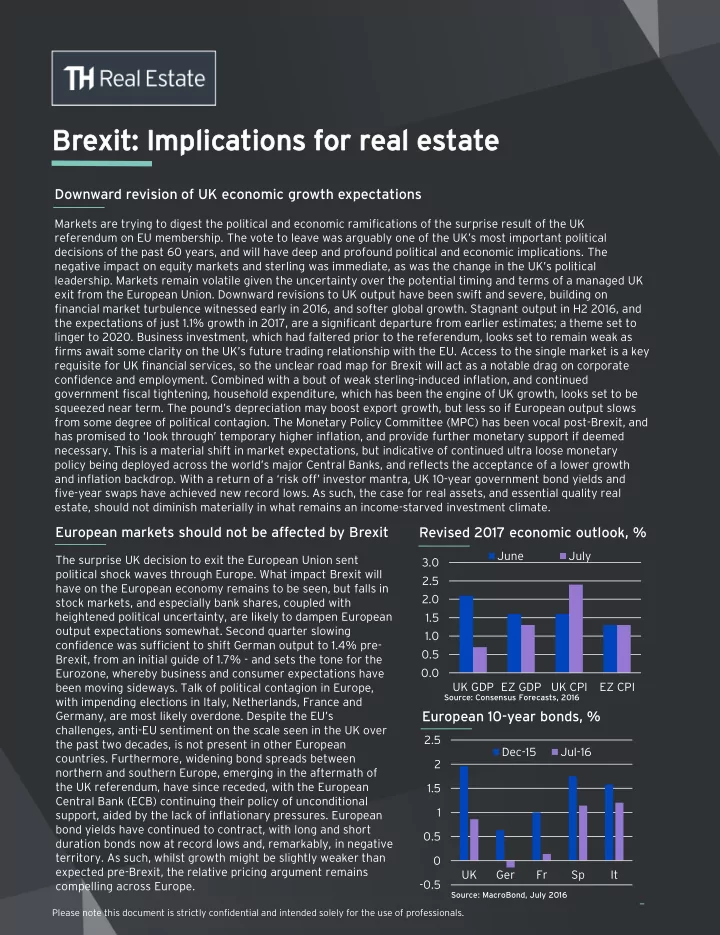

Brexit xit: : Implicatio ations ns for rea eal l estate Downward revision of UK economic growth expectations Markets are trying to digest the political and economic ramifications of the surprise result of the UK referendum on EU membership. The vote to leave was arguably one of the UK’s most important political decisions of the past 60 years, and will have deep and profound political and economic implications. The negative impact on equity markets and sterling was immediate, as was the change in the UK’s political leadership. Markets remain volatile given the uncertainty over the potential timing and terms of a managed UK exit from the European Union. Downward revisions to UK output have been swift and severe, building on financial market turbulence witnessed early in 2016, and softer global growth. Stagnant output in H2 2016, and the expectations of just 1.1% growth in 2017, are a significant departure from earlier estimates; a theme set to linger to 2020. Business investment, which had faltered prior to the referendum, looks set to remain weak as firms await some clarity on the UK’s future trading relationship with the EU. Access to the single market is a key requisite for UK financial services, so the unclear road map for Brexit will act as a notable drag on corporate confidence and employment. Combined with a bout of weak sterling-induced inflation, and continued government fiscal tightening, household expenditure, which has been the engine of UK growth, looks set to be squeezed near term. The pound’s depreciation may boost export growth, but less so if European output slows from some degree of political contagion. The Monetary Policy Committee (MPC) has been vocal post-Brexit, and has promised to ‘look through’ temporary higher inflation, and provide further monetary support if deemed necessary. This is a material shift in market expectations, but indicative of continued ultra loose monetary policy being deployed across the world’s major Central Banks, and reflects the acceptance of a lower growth and inflation backdrop. With a return of a ‘risk off’ investor mantra, UK 10-year government bond yields and five-year swaps have achieved new record lows. As such, the case for real assets, and essential quality real estate, should not diminish materially in what remains an income-starved investment climate. European markets should not be affected by Brexit Revised 2017 economic outlook, % June July The surprise UK decision to exit the European Union sent 3.0 political shock waves through Europe. What impact Brexit will 2.5 have on the European economy remains to be seen, but falls in 2.0 stock markets, and especially bank shares, coupled with heightened political uncertainty, are likely to dampen European 1.5 output expectations somewhat. Second quarter slowing 1.0 confidence was sufficient to shift German output to 1.4% pre- 0.5 Brexit, from an initial guide of 1.7% - and sets the tone for the 0.0 Eurozone, whereby business and consumer expectations have UK GDP EZ GDP UK CPI EZ CPI been moving sideways. Talk of political contagion in Europe, Source: Consensus Forecasts, 2016 with impending elections in Italy, Netherlands, France and European 10-year bonds, % Germany, are most likely overdone. Despite the EU’s challenges, anti-EU sentiment on the scale seen in the UK over 2.5 the past two decades, is not present in other European Dec-15 Jul-16 countries. Furthermore, widening bond spreads between 2 northern and southern Europe, emerging in the aftermath of the UK referendum, have since receded, with the European 1.5 Central Bank (ECB) continuing their policy of unconditional 1 support, aided by the lack of inflationary pressures. European bond yields have continued to contract, with long and short 0.5 duration bonds now at record lows and, remarkably, in negative territory. As such, whilst growth might be slightly weaker than 0 expected pre-Brexit, the relative pricing argument remains UK Ger Fr Sp It -0.5 compelling across Europe. Source: MacroBond, July 2016 Please note this document is strictly confidential and intended solely for the use of professionals.

UK market correction amidst occupier and investment uncertainty H1 2016 recorded a marked slowdown in investment and occupier demand, linked to economic and political uncertainties and concerns relating to historically keen real estate pricing. Changes to real estate taxation in the Chancellor’s March budget, which eroded 1% of capital values, also dampened investor activity given the higher all-in transaction costs. Brexit and the associated volatility in financial markets, slump in business confidence, and heightened liquidity needs, has magnified property market pricing uncertainty. The immediate sell-off of UK REITs and the subsequent suspension of a number of open-ended property investment funds, under pressure from growing redemptions, has led to a significant change in valuation assumptions for H2 2016. Although this is not envisaged to be as damaging as the listed sector, pricing will suffer. Deciphering what is a liquidity-driven sale and managed asset disposal is pivotal in forming a market forecast, as any market correction will not be uniform, differing in magnitude, timing and meaning for all sectors and markets. This is not 2008, and whilst there will be some short-term market volatility, much lower leverage and the number of well-capitalised domestic and overseas buyers of UK property, aided by sterling's weakness, should provide a floor for valuations. Notable downward revisions to economic growth and market confidence will have detrimental consequences on property investment flows, occupier demand and ultimately pricing – but by how much is greatly debated. However, real estate still offers very favourable yields compared to other asset classes, and thus strong defensive income assets are likely to outperform. The IPD initial yield of 5%, as of Q2 2016, still offers a premium against a UK 10-year bond yield of 0.9%, whilst five-year swaps have fallen to 0.6%. European CRE investment, € bn Occupier markets: Three-speed Europe European real estate investment volumes edged up in 100 300 Q2 2016, although this is more a reflection of a Quarter Total lhs 250 precipitous decline in the first quarter. Rolling annual 80 12mth Rolling volumes were nevertheless lower for a second 200 consecutive quarter, suggesting the market peaked in 60 2015. Despite economic unease, prime property yields 150 remain either stable or under downward pressure across 40 100 the EU-27, reflecting even lower sovereign bond yields. Attention should now focus on the occupier outlook, 20 50 which pre-Brexit had been in recovery mode. Effects on occupiers will vary across regions and across sectors, 0 0 but the most likely scenario is marginally slower growth. Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 A three-speed Europe is emerging. Core European 07 08 08 09 10 11 11 12 13 14 14 15 16 markets (Germany, France, Sweden and Austria) will see Source: CBRE July 2016 their advanced recovery continue, potentially at a more modest pace. The second-speed countries are the London surveys, 50 = stable southern recovery markets of Spain, Portugal and Italy, which are at a point in the cycle where real rental growth 65 is starting to pick up. The largest risk here is currently the Italian banking system. 60 55 The third-speed is the UK market, with a short-term, bleak economic outlook. Take-up and investment 50 volumes, as witnessed in H1 2016, have been slowing and 45 will stay restricted whilst EU negotiations take place. Paris, Frankfurt, Dublin, Luxembourg, Stockholm and 40 Bus Activity Job hiring Berlin have been touted as potentially absorbing some 35 UK Brexit-related company relocations, and could profit Jun-04 Jun-05 Jun-06 Jun-07 Jun-08 Jun-09 Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 in the medium to long term. Presently, however, occupiers are adopting a ‘wait -and-see ’ approach, with any significant occupier decisions relating to the UK Source: CBI/PWC Financial Services Survey being postponed until uncertainties about the future of legal operating environments are more clear.

Recommend

More recommend