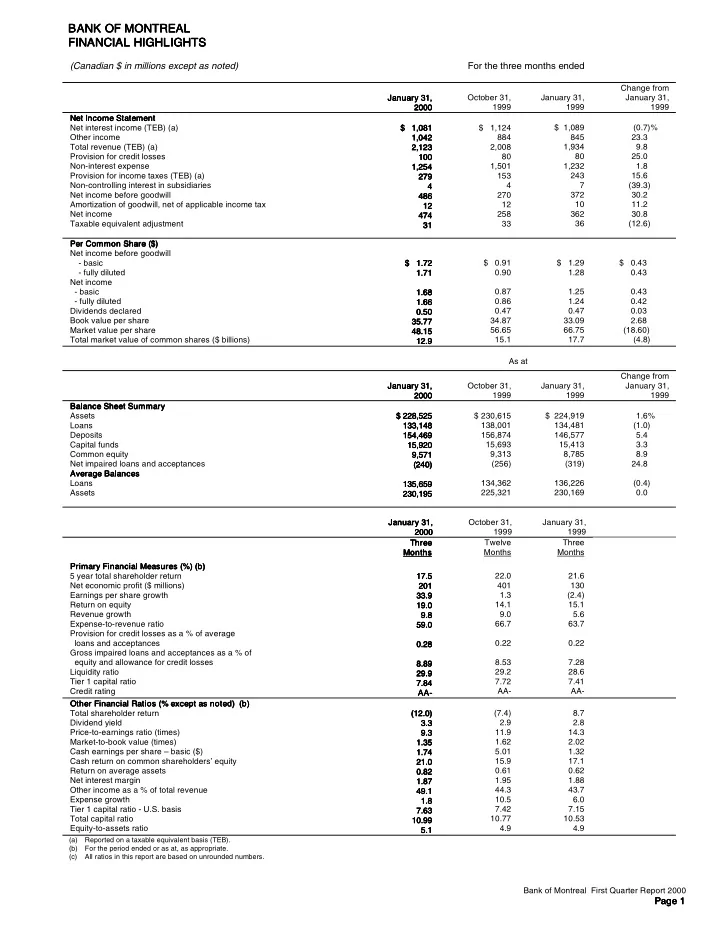

BANK OF MONTREAL BANK OF MONTREAL BANK OF MONTREAL BANK OF MONTREAL FINANCIAL HIGHLIGHTS FINANCIAL HIGHLIGHTS FINANCIAL HIGHLIGHTS FINANCIAL HIGHLIGHTS (Canadian $ in millions except as noted) For the three months ended Change from January 31, January 31, October 31, January 31, January 31, January 31, January 31, 1999 1999 1999 2000 2000 2000 2000 Net Income Statement Net Income Statement Net Income Statement Net Income Statement Net interest income (TEB) (a) $ 1,081 $ 1,081 $ 1,081 $ 1,081 $ 1,124 $ 1,089 (0.7)% Other income 1,042 1,042 884 845 23.3 1,042 1,042 Total revenue (TEB) (a) 2,008 1,934 9.8 2,123 2,123 2,123 2,123 Provision for credit losses 80 80 25.0 100 100 100 100 Non-interest expense 1,254 1,254 1,254 1,254 1,501 1,232 1.8 Provision for income taxes (TEB) (a) 279 279 153 243 15.6 279 279 Non-controlling interest in subsidiaries 4 7 (39.3) 4 4 4 4 Net income before goodwill 270 372 30.2 486 486 486 486 Amortization of goodwill, net of applicable income tax 12 10 11.2 12 12 12 12 Net income 258 362 30.8 474 474 474 474 36 (12.6) Taxable equivalent adjustment 33 31 31 31 31 Per Common Share ($) Per Common Share ($) Per Common Share ($) Per Common Share ($) Net income before goodwill - basic $ 1.72 $ 1.72 $ 1.72 $ 1.72 $ 0.91 $ 1.29 $ 0.43 - fully diluted 1.71 1.71 0.90 1.28 0.43 1.71 1.71 Net income - basic 0.87 1.25 0.43 1.68 1.68 1.68 1.68 0.86 1.24 0.42 - fully diluted 1.66 1.66 1.66 1.66 Dividends declared 0.50 0.50 0.47 0.47 0.03 0.50 0.50 Book value per share 34.87 33.09 2.68 35.77 35.77 35.77 35.77 Market value per share 56.65 66.75 (18.60) 48.15 48.15 48.15 48.15 Total market value of common shares ($ billions) 15.1 17.7 (4.8) 12.9 12.9 12.9 12.9 As at Change from January 31, January 31, October 31, January 31, January 31, January 31, January 31, 1999 1999 1999 2000 2000 2000 2000 Balance Sheet Summary Balance Sheet Summary Balance Sheet Summary Balance Sheet Summary Assets $ 228,525 $ 228,525 $ 228,525 $ 228,525 $ 230,615 $ 224,919 1.6% Loans 133,148 133,148 133,148 133,148 138,001 134,481 (1.0) Deposits 154,469 154,469 156,874 146,577 5.4 154,469 154,469 Capital funds 15,693 15,413 3.3 15,920 15,920 15,920 15,920 9,313 8,785 8.9 Common equity 9,571 9,571 9,571 9,571 Net impaired loans and acceptances (240) (240) (256) (319) 24.8 (240) (240) Average Balances Average Balances Average Balances Average Balances Loans 134,362 136,226 (0.4) 135,659 135,659 135,659 135,659 Assets 225,321 230,169 0.0 230,195 230,195 230,195 230,195 January 31, January 31, October 31, January 31, January 31, January 31, 1999 1999 2000 2000 2000 2000 Three Three Three Three Twelve Three Months Months Months Months Months Months Primary Financial Measures (%) (b) Primary Financial Measures (%) (b) Primary Financial Measures (%) (b) Primary Financial Measures (%) (b) 5 year total shareholder return 17.5 17.5 17.5 17.5 22.0 21.6 Net economic profit ($ millions) 201 201 401 130 201 201 Earnings per share growth 1.3 (2.4) 33.9 33.9 33.9 33.9 Return on equity 14.1 15.1 19.0 19.0 19.0 19.0 Revenue growth 9.8 9.8 9.8 9.8 9.0 5.6 Expense-to-revenue ratio 59.0 59.0 66.7 63.7 59.0 59.0 Provision for credit losses as a % of average loans and acceptances 0.22 0.22 0.28 0.28 0.28 0.28 Gross impaired loans and acceptances as a % of equity and allowance for credit losses 8.53 7.28 8.89 8.89 8.89 8.89 29.2 28.6 Liquidity ratio 29.9 29.9 29.9 29.9 Tier 1 capital ratio 7.72 7.41 7.84 7.84 7.84 7.84 Credit rating AA- AA- AA- AA- AA- AA- Other Financial Ratios (% except as noted) (b) Other Financial Ratios (% except as noted) (b) Other Financial Ratios (% except as noted) (b) Other Financial Ratios (% except as noted) (b) Total shareholder return (12.0) (12.0) (12.0) (12.0) (7.4) 8.7 Dividend yield 3.3 3.3 3.3 3.3 2.9 2.8 Price-to-earnings ratio (times) 9.3 9.3 9.3 9.3 11.9 14.3 Market-to-book value (times) 1.35 1.35 1.62 2.02 1.35 1.35 Cash earnings per share – basic ($) 5.01 1.32 1.74 1.74 1.74 1.74 Cash return on common shareholders’ equity 15.9 17.1 21.0 21.0 21.0 21.0 0.61 0.62 Return on average assets 0.82 0.82 0.82 0.82 Net interest margin 1.95 1.88 1.87 1.87 1.87 1.87 Other income as a % of total revenue 44.3 43.7 49.1 49.1 49.1 49.1 Expense growth 10.5 6.0 1.8 1.8 1.8 1.8 Tier 1 capital ratio - U.S. basis 7.42 7.15 7.63 7.63 7.63 7.63 Total capital ratio 10.77 10.53 10.99 10.99 10.99 10.99 4.9 4.9 Equity-to-assets ratio 5.1 5.1 5.1 5.1 (a) Reported on a taxable equivalent basis (TEB). (b) For the period ended or as at, as appropriate. (c) All ratios in this report are based on unrounded numbers. Bank of Montreal First Quarter Report 2000 Page Page 1 Page Page 1 1 1

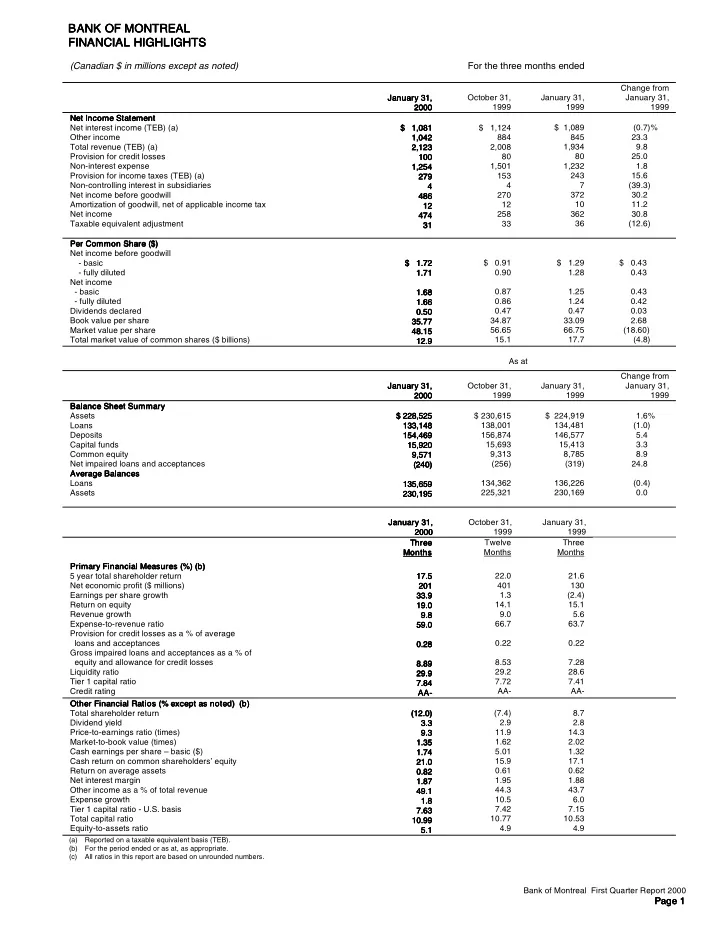

BANK OF MONTREAL BANK OF MONTREAL BANK OF MONTREAL BANK OF MONTREAL CONSOLIDATED STATEMENT OF INCOME CONSOLIDATED STATEMENT OF INCOME CONSOLIDATED STATEMENT OF INCOME CONSOLIDATED STATEMENT OF INCOME (Unaudited) (Canadian $ in millions except number of common shares) For the three months ended January 31, 2000 January 31, 2000 October 31, 1999 January 31, 1999 January 31, 2000 January 31, 2000 Interest, Dividend and Fee Income Interest, Dividend and Fee Income Interest, Dividend and Fee Income Interest, Dividend and Fee Income Loans $ 2,449 $ 2,449 $ 2,449 $ 2,449 $ 2,364 $ 2,566 Securities 701 701 632 637 701 701 Deposits with banks 274 277 231 231 231 231 3,381 3,381 3,270 3,480 3,381 3,381 Interest Expense Interest Expense Interest Expense Interest Expense Deposits 1,754 1,754 1,571 1,730 1,754 1,754 85 86 Subordinated debt 86 86 86 86 Other liabilities 491 491 491 491 523 611 2,331 2,331 2,331 2,331 2,179 2,427 Net Interest Income Net Interest Income Net Interest Income Net Interest Income 1,050 1,050 1,050 1,050 1,091 1,053 Provision for credit losses 100 100 100 100 80 80 Net Interest Income After Provision for Credit Losses Net Interest Income After Provision for Credit Losses 950 950 1,011 973 Net Interest Income After Provision for Credit Losses Net Interest Income After Provision for Credit Losses 950 950 Other Income Other Income Other Income Other Income Deposit and payment service charges 164 164 165 146 164 164 Lending fees 91 78 80 80 80 80 265 184 Capital market fees 224 224 224 224 Card services 53 53 53 53 55 48 Investment management and custodial fees 104 104 103 104 104 104 Mutual fund revenues 60 49 52 52 52 52 Trading revenues 52 65 77 77 77 77 Securitization revenues 84 75 70 70 70 70 Other fees and commissions 9 96 218 218 218 218 1,042 1,042 1,042 1,042 884 845 Net Interest and Other Income Net Interest and Other Income Net Interest and Other Income Net Interest and Other Income 1,992 1,992 1,992 1,992 1,895 1,818 Non-Interest Expense Non-Interest Expense Non-Interest Expense Non-Interest Expense Salaries and employee benefits 734 734 749 668 734 734 Premises and equipment 257 257 257 257 295 274 Communications 65 65 65 65 72 66 Other expenses 194 194 239 218 194 194 1,250 1,250 1,250 1,250 1,355 1,226 Amortization of intangible assets 4 4 5 6 4 4 1,254 1,254 1,254 1,254 1,360 1,232 Restructuring charge - - - - 141 - Total non-interest expense 1,254 1,254 1,254 1,254 1,501 1,232 Income Before Provision for Income Taxes, Non-Controlling Interest in Income Before Provision for Income Taxes, Non-Controlling Interest in Income Before Provision for Income Taxes, Non-Controlling Interest in Income Before Provision for Income Taxes, Non-Controlling Interest in Subsidiaries and Goodwill Subsidiaries and Goodwill Subsidiaries and Goodwill Subsidiaries and Goodwill 738 738 738 738 394 586 Income taxes 248 248 248 248 120 207 490 490 274 379 490 490 Non-controlling interest 4 4 4 4 4 7 Net Income Before Goodwill Net Income Before Goodwill Net Income Before Goodwill Net Income Before Goodwill 486 486 270 372 486 486 12 10 Amortization of goodwill, net of applicable income tax 12 12 12 12 Net Income Net Income Net Income Net Income $ 474 $ 474 $ 474 $ 474 $ 258 $ 362 Dividends Declared - preferred shares Dividends Declared $ 25 $ 25 $ 27 $ 30 Dividends Declared Dividends Declared $ 25 $ 25 $ 125 $ 125 - common shares $ 134 $ 134 $ 134 $ 134 Average Number of Common Shares Outstanding Average Number of Common Shares Outstanding 267,248,718 267,248,718 266,761,950 264,952,530 Average Number of Common Shares Outstanding Average Number of Common Shares Outstanding 267,248,718 267,248,718 $ 225,321 $ 230,169 Average Assets Average Assets Average Assets Average Assets $ 230,195 $ 230,195 $ 230,195 $ 230,195 Note: Reporting under United States generally accepted accounting principles would have resulted in Consolidated Net Income of $456 basic earnings per share of $1.61 and fully diluted earnings per share of $1.59 for the three months ended January 31, 2000. Bank of Montreal First Quarter Report 2000 Page Page 2 Page Page 2 2 2

Recommend

More recommend