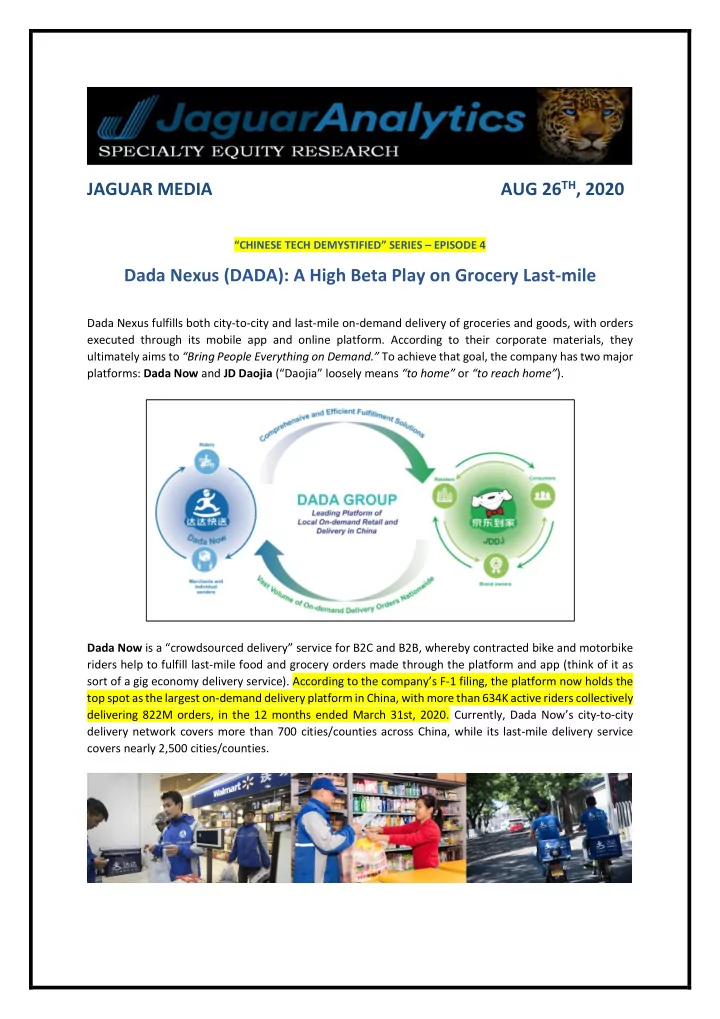

AUG 26 TH , 2020 JAGUAR MEDIA “ CHINESE TECH DEMYSTIFIED ” SERIES – EPISODE 4 Dada Nexus (DADA): A High Beta Play on Grocery Last-mile Dada Nexus fulfills both city-to-city and last-mile on-demand delivery of groceries and goods, with orders executed through its mobile app and online platform. According to their corporate materials, they ultimately aims to “Bring People Everything on Demand.” To achieve that goal, the company has two major platforms: Dada Now and JD Daojia (“ Daojia ” loosely means “to home” or “to reach home” ). Dada Now is a “ crowdsourced delivery” service for B2C and B2B, whereby contracted bike and motorbike riders help to fulfill last-mile food and grocery orders made through the platform and app (think of it as sort of a gig economy delivery service). A ccording to the company’s F -1 filing, the platform now holds the top spot as the largest on-demand delivery platform in China, with more than 634K active riders collectively delivering 822M orders, in the 12 months ended March 31st, 2020. Currently, Dada Now’s city-to-city delivery network covers more than 700 cities/counties across China, while its last-mile delivery service covers nearly 2,500 cities/counties.

Meanwhile, JD Daojia (or JDDJ in short) is a JD subsidiary that facilitates e-commerce for retailers across the country, both large and small, with focus on supermarkets and grocery outlets. It handles everything from orders to inventory/warehouse management, and even CRM and marketing. The platform currently has partnerships with just about every mega supermarket chain in China, including Walmart, Yonghui, and China Resources Vanguard (the Walmart partnership is exclusive). And in 2019, JDDJ was the largest local on-demand retail platform in the supermarket segment, with GMV in the 12 months ended March 31st, 2020 up 92.0% YoY to RMB 15.7B, from 134.7M orders and 27.6M active. Today, JD Group and Walmart each hold 51.4% and 10.8% equity interests in the company, respectively. And the two account for more than half of total revenue, with JD representing 37.8% and Walmart representing 14.9%. How did Dada Nexus rise above competition to become a top player? If you read the research note on Huya and DouYu, then this will be a familiar story. The difference here is we are swapping out Tencent for JD as the behemoth backer. When Dada Nexus first started out in 2014, they were only operating the Dada Now platform. 2014 to 2016 was around the time China saw a massive boom in food and grocery delivery, with total e-grocery sales pulling way ahead of the Western world: As a result, Dada had to compete with many direct and indirect competitors looking to take advantage of the emerging trend, like Meituan, MissFresh, Yiguo, Home-Cook, Tiantian Guoyuan, etc. Unsurprisingly, many of them were burning cash and engaging in price/discount/coupon wars, which led to over a dozen high-profile bankruptcies and closures within the space of a couple years (Yummy77 and Taojiji, to name a couple). Dada too, was facing financial worries due to significant capital investment, high logistical costs, and widening losses.

Then in early 2016, Dada and JD saw synergy potential, as the former could carry out the last-mile portion of logistics while the latter has e-commerce O2O (online-to-offline) and supply chain expertise. Consequently, JD allowed JDDJ to merge with Dada, in exchange for 47.4% of equity in the resulting entity. And to support the new partnership, JD further transferred $200M cash and pledged future backing to Dada. Naturally, Dada Now and JDDJ got to enjoy vastly overlapping networks, as both platforms could work in tandem to ultimately provide low-cost and efficient e-commerce. Further, the partnership was very timely one, because it wasn’t long after that when the easy growth opportunities began to fade, as evidenced by the substantial slowdown from 2017: Consolidation soon followed. While the smaller competition struggled to cope with dwindling cash and the slowing growth, Dada Nexus wasted little time in using JD’s vast network and order flow to scale its business into untapped lower tier cities, adding thousands of previously offline retailers to its list of vendors. The best part was that Dada saw automatic expansion as JD ’s logistics division continued to beef up its presence across the country (recall the diagram below of JD ’s impressive network, from our coverage of Pinduoduo). Additionally, it was also during this period when Dada entered into key partnerships with Walmart, Yonghui, CR Vanguard, Unilever, and PepsiCo. And that’s essentially the quick summary of how the company became a leader in China’s e -grocery market.

Dada Nexus’ topline continues to grow while its net losses remain high. Due to a lot of overlap between Dada Now and JDDJ (as they tend to share customers while relying on each other throughout the fulfillment process), it’s important to figure out specifically how each segment generates revenue before diving into Dada Nexus’ financials. For Dada Now , the company categorizes revenue as coming from either Services (99.1% of revenue) or Sales of Goods (0.9% of revenue) . From what I gather, the Sales of Goods segment only consists of proceeds from selling delivery equipment to riders, and the occasional sale of unmanned retail shelves. So, it’s a pretty negligible for the most part. On the Services side, i t’s worth noting that a part from last-mile and intra-city delivery fees (from buyers/receivers specifically) , the platform also generates revenues from advertising on the app and website. Meanwhile, revenues from JDDJ are not segmented, and mainly include: delivery fees (from retailers/senders specifically) , commission fees for usage of the JDDJ platform, consulting/marketing services for retailers, and packaging services. So, in the simplest terms, all the last-mile stuff and anything to do with the end-customer falls under Dada Now “jurisdiction”, while the supply chain and marketing stuff belongs under JDDJ. As of 1Q20, the Dada Now segment represents 53.8% of revenue (vs year-ago 62.0%), and JDDJ represents the remainder, 46.2%. Obviously not much history since the merger, but it does look like JDDJ is gradually becoming a bigger part of the business in terms of sales, but both segments accelerated nicely last year (left chart on the image below). And looking at this year’s numbers: • Dada Now revenue saw 81.3% YoY growth to RMB 591.9M in Q1, and 90.5% YoY growth to RMB 837.2M in Q2. • JDDJ revenue saw 154.0% YoY growth to RMB 507.7M, and 97.9% YoY growth to RMB 485.9M in Q2. • So, all in, the company has made 78% of last year’s total sales in H1, with the typically busy 4th quarter still to come. Gross Merchandise Value (GMV) for JDDJ is the other key performance metric the company uses, and that has re-accelerated nicely this year, no doubt helped by the pandemic:

However, Dada Nexus remains unprofitable due to high operation and support costs associated with last-mile logistics. The company reported a net loss of RMB 1.45B in 2017, followed by RMB 1.88B in 2018, before seeing an improvement to RMB 1.67B in 2019 due to cutting down on marketing expenses and subsidies/incentives to JDDJ customers: Following this week’s Q2 report, the company’s net losses have totaled RMB 736.8M for the first half of 2020. So, mathematically speaking, it is on track for a slight sequential annual improvement. But realistically, I foresee higher expenses toward the back half of the year, as Dada will have to work aggressively to retain its customers gained from the pandemic (more on this below). What are Dada Nexus and JD working on currently? If we’re looking at Dada Nexus in isolation, the company is continuing to build on its partnerships , recently announcing an expansion of its partnership with CR Vanguard, arguably China's largest supermarket chain, on July 24th. Prior to the expansion, JDDJ had already integrated 1,600 CR Vanguard stores into its system, and CR Vanguard had also launched its first membership program on JDDJ in April. In fact, since the partnership began in 2018, CR Vanguard's online sales have seen a sevenfold increase. Under this new agreement, JDDJ will provide CR Vanguard with full/half/store warehouse solutions, a product assortment plus inventory management system, and the two will work in tandem to create an “ annual Omni-channel Shopping Festival ” (essentially something like 618 or Singles Day) .

Recommend

More recommend