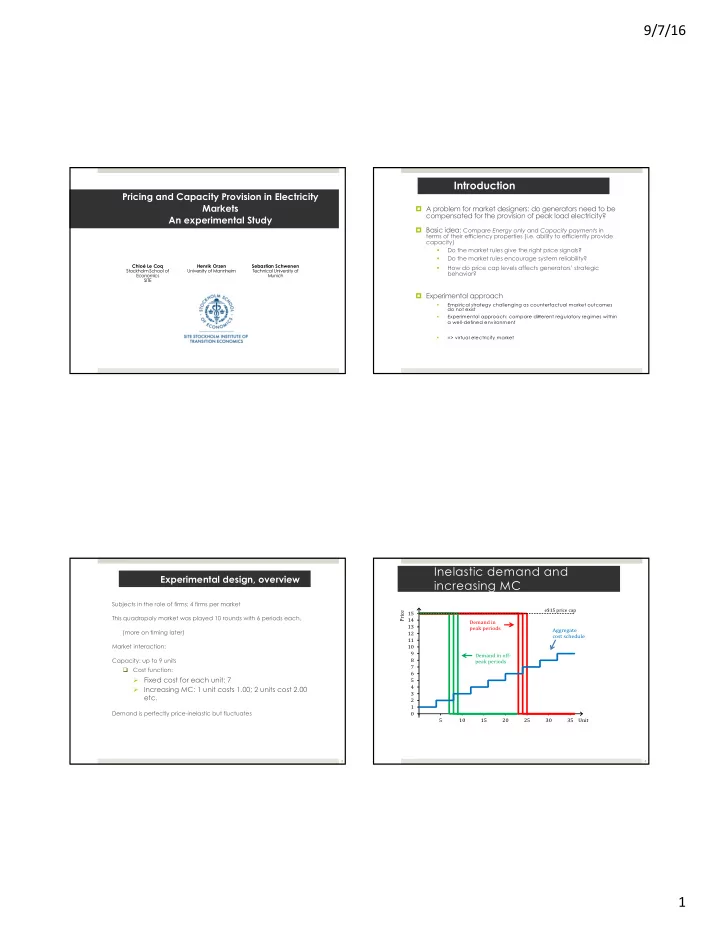

9/7/16 Introduction Pricing and Capacity Provision in Electricity Markets ¤ A problem for market designers: do generators need to be compensated for the provision of peak load electricity? An experimental Study ¤ Basic idea: Compare Energy only and Capacity payments in terms of their e ffi ciency properties (i.e. ability to e ffi ciently provide capacity) Do the market rules give the right price signals? § Do the market rules encourage system reliability? § Chloé Le Coq Henrik Orzen Sebastian Schwenen § How do price cap levels affects generators’ strategic Stockholm School of University of Mannheim Technical University of behavior? Economics Munich SITE ¤ Experimental approach § Empirical strategy challenging as counterfactual market outcomes do not exist § Experimental approach: compare di ff erent regulatory regimes within a well-defined environment § => virtual electricity market Inelastic demand and Experimental design, overview increasing MC Subjects in the role of firms; 4 firms per market e$15 price cap Price 15 This quadropoly market was played 10 rounds with 6 periods each, 14 Demand in 13 peak periods Aggregate (more on timing later) 12 cost schedule 11 Market interaction: 10 9 Demand in off- Capacity: up to 9 units 8 peak periods 7 q Cost function: 6 Ø Fixed cost for each unit: 7 5 4 Ø Increasing MC: 1 unit costs 1.00; 2 units cost 2.00 3 etc. 2 1 Demand is perfectly price-inelastic but fluctuates 0 -1 0 5 10 15 20 25 30 35 Unit 3 4 1

9/7/16 Experimental design, overview (2) Experimental Design, timing Timing : each round has 6 periods. In each period there is spot market ¤ competition with given capacities Rounds 1 - 2: Each firm has a production capacity of 9 units. ¤ Rounds 3 - 10: Capacities are determined at the beginning of each ¤ Demand is realized round. Periods Uncertain Demand Treatment variables: ¤ s = 0 s = 1 s = 2 s = 3 s = 4 s = 5 s = 6 Price cap ¤ LOW LOW LOW LOW HIGH HIGH Capacity market ¤ Stage 1 Stage 2 Capacity choices Supply function competition (price, quantity) => 3 treatments Stage 1 : simultaneous capacity choices (up to 9 units) under demand uncertainty Fixed cost for each unit (=7) + Increasing MC: 1 unit costs 1.00; 2 units cost 2.00 etc. Price cap = 15 Price cap = 30 Capacity choices are publicly observed No Capacity market Lowcap HighCap Capacity market Capacity market (CM) Experimental Design, timing Stage 1 : Capacity choices Uncertain Demand ¤ Simultaneously capacity choices under demand uncertainty Demand is realized Periods Capacity: up to 9 units, Fixed cost for each unit: 7 + Increasing MC: 1 unit costs 1.00; 2 units cost 2.00 etc. s = 6 s = 0 s = 1 s = 2 s = 3 s = 4 s = 5 LOW LOW LOW LOW HIGH HIGH Stage 1 Stage 2 Capacity choices Supply function competition (price, quantity) Stage 1 : simultaneous capacity choices (up to 9 units) under demand uncertainty Fixed cost for each unit (=7) + Increasing MC: 1 unit costs 1.00; 2 units cost 2.00 etc. Total Capacity M arket is revealed at the end of the round ¤ Capacity choices are publicly observed Stage 2 : price competition for 6 periods with Uniform-price auction 1. demand is realized for each period: Low (D=7,8,9) and High (D=23,24,25) 2. subjects bid independently and simultaneously: for each unit, bid between 0 and price cap 7 2

9/7/16 Experimental Design, timing Stage 2: price choices Uncertain Demand Demand is realized ¤ The demand is realized, Low (D=6,7,8) and High (D=23,24,25) Periods ¤ For each PERIOD s = 6 s = 0 s = 1 s = 2 s = 3 s = 4 s = 5 LOW LOW LOW LOW HIGH HIGH Stage 1 Stage 2 Capacity choices Supply function competition (price, quantity) Stage 1 : simultaneous capacity choices (up to 9 units) under demand uncertainty Fixed cost for each unit (=7) + Increasing MC: 1 unit costs 1.00; 2 units cost 2.00 etc. Capacity choices are publicly observed ¤ In addition to the fixed cost of 7, subjects pay a production costs for all units that are dispatched (not for the other units) Stage 2 : price competition for 6 periods with Uniform-price auction ¤ Unit 1 (if dispatched), costs 1, the second unit (if dispatched) costs 2, the third unit (if dispatched) costs 3, and so on. 1. demand is realized for each period: Low (D=7,8,9) and High (D=23,24,25) ¤ The exact number of units that will be dispatched (sold) is revealed in Stage 3. 2. subjects bid independently and simultaneously: for each unit, bid between 0 and price cap Stage 3 . market price equals to highest accepted bid (uniform-price auction) 9 Experimental Design, timing for capacity Stage 3: Market Price and Earnings market ¤ M arket supply function: com puter ranks bids from the lowest to the highest Capacity market: Regulator “buys” 25 units of capacity. There is a spot market price cap of 15.00 and a capacity market price cap of 30.00 ¤ Period’s M arket price: intersection of m arket supply function with inelastic dem and ¤ Screen’s sum m ary of the period Periods s = 0 s = 1 s = 2 s = 3 s = 4 s = 5 s = 6 LOW LOW LOW LOW HIGH HIGH Stage 1a Stage 1b Stage 2 Capacity market Optional capacity Supply function competition expansion (price, quantity) 11 3

9/7/16 Treatments and experimental procedure Theoretical predictions_ Hypotheses Definition: a pivotal firm j such that 𝐸 − 𝑅 $% > 0 , where 𝑅 $% ≡ ∑ 𝑟 +,% and 𝑟 % > 0 �+ Three treatments § Price cap = 15 in LowCap Hypothesis 1: With at least one pivotal bidder, the equilibrium market price equals the price cap, irrespective of the treatment. Otherwise market price equals the § Price cap = 30 in HighCap marginal costs of the last dispatched unit § Price cap = 15 and capacity market in CM Hypotheses 2: Underinvestment in the LowCap treatment and sufficient investment in HighCap and CapMarket are predicted. Experimental procedure : 92 students § Two sessions for each treatment, 3-4 independent markets per session § Avg. Payment: $24 13 14 Result 2: Avg. price over time Result 1: Avg. Market Capacity over Time 30 30 High price cap: e$30 Average market capacity 25 25 HighCap 20 LowCap Low price cap: e$15 Price (e$) CapMarket 20 15 Possible peak demand levels CapMarket 10 15 HighCap Off-peak periods 5 LowCap 10 0 2 3 4 5 6 7 8 9 10 0 1 2 3 4 5 6 7 8 9 10 Round Round => Intense com petition in off-peak => Towards the end of the experim ent the capacity levels in CAPM ARKET and HIGHCAP are => Peak-periods: Upward trend toward price cap for LowCap and CapM arket BUT not for very sim ilar HighCap => W HY? 4

9/7/16 Result 3: price, pivotal bidder, rel. Result 4: treatment effect (rounds 8-10): capacity HighCap vs. Low Cap (8-10 rounds) Dependent variable: Markup 0× 4$4 56 Degree of Dependent variable: DMPA = DMPA = 10 L O W C A P H IG H C A P C A P M A RKET 4$4 56 market power abuse Rounds Rounds Rounds Rounds Rounds Rounds 1-10 8-10 1-10 8-10 1-10 8-10 At least one pivotal firm Without pivotal firms Pivotal 5.800 *** 7.425 *** 18.844 *** 16.417 *** 2.501 *** 1.283 (0.000) (0.000) (0.000) (0.009) (0.000) (0.277) H IGH C AP − 24.023 *** − 2.941 − 2.364 ** − 3.688 (0.001) (0.846) (0.044) (0.726) RelCap (Q-D) 0.009 0.053 − 0.005 − 0.145 − 0.058 *** − 0.164 *** C AP M ARKET − 28.763 *** − 9.714 1.171 44.521 *** (0.496) (0.246) (0.881) (0.624) (0.002) (0.003) (0.000) (0.317) (0.342) (0.000) RelCap × Pivotal − 0.095 *** − 0.240 *** − 0.540 *** − 1.013 ** − 0.156 ** − 0.085 RelCap − 3.196 ** 0.257 (0.007) (0.000) (0.000) (0.033) (0.040) (0.512) (0.042) (0.266) Round 0.040 − 0.016 − 0.091 − 1.146 ** 0.035 0.154 H IGH C AP × RelCap − 1.490 − 0.012 (0.130) (0.889) (0.170) (0.018) (0.205) (0.361) (0.680) (0.982) Number of females − 0.272 *** − 0.033 − 0.346 − 1.425 *** − 0.185 ** − 0.040 C AP M ARKET × RelCap − 2.651 − 2.295 *** (0.000) (0.756) (0.150) (0.006) (0.025) (0.790) (0.292) (0.000) Constant 0.884 ** − 0.179 2.010 ** 8.591 2.000 *** 3.700 *** Round 3.411 1.560 − 0.199 − 0.596 (0.020) (0.833) (0.039) (0.192) (0.000) (0.003) (0.286) (0.625) (0.708) (0.190) 𝑂 480 144 384 90 480 144 Number of females 3.064 − 0.381 − 0.874 * − 1.164 *** Adjusted 𝑆 0 0.741 0.902 0.847 0.808 0.388 0.535 (0.295) (0.901) (0.067) (0.007) Constant 75.927 *** 85.677 *** 6.536 *** 4.209 (0.000) (0.000) (0.000) (0.303) => “pivotal” : significant and substantial effect (but not for CapMarket for 8-10 𝑂 123 123 255 255 rounds) Adjusted 𝑆 0 0.202 0.271 0.058 0.346 => High cap treatm ent effect (if pivotal) is due to higher m arket capacity levels Result 5 : Av. capacity market price Conclusions 15 14 Lower spot price and security supply come at the cost of increasing ¤ 13 capacity payment 12 Price (e$) 11 10 Capacity markets do not rule out market power abuse ¤ 9 8 Price cap matters for generators’ responsiveness but higher price cap ¤ 7 does fully not translate to higher market prices 6 95% confidence interval 5 4 Mean 3 2 Marginal capacity cost 1 More treatments: ¤ Equilibrium 0 3 4 5 6 7 8 9 10 Information available Round Demand-side bidding => Average paid e$ 8.8 in LowCap and e$ 10.3 in CapM arket Hydropower: subjects are able to save units for the next period => Average paid e$ 15.8 in HighCap 5

9/7/16 Thank you Chloé Le Coq chloe.lecoq@hhs.se 6

Recommend

More recommend