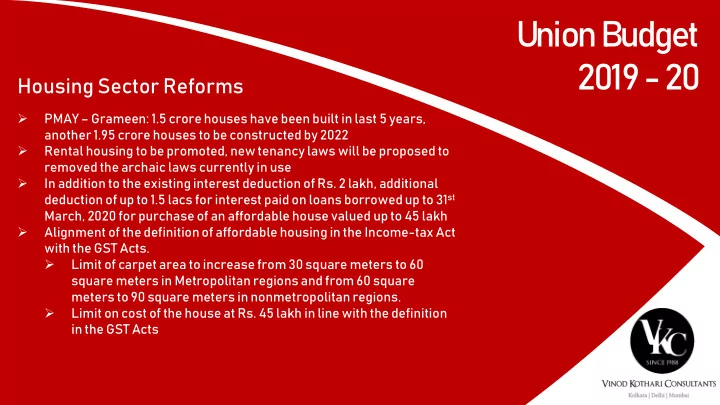

Union Budget 2019 -20 Housing Sector Reforms PMAY – Grameen: 1.5 crore houses have been built in last 5 years, another 1.95 crore houses to be constructed by 2022 Rental housing to be promoted, new tenancy laws will be proposed to removed the archaic laws currently in use In addition to the existing interest deduction of Rs. 2 lakh, additional deduction of up to 1.5 lacs for interest paid on loans borrowed up to 31 st March, 2020 for purchase of an affordable house valued up to 45 lakh Alignment of the definition of affordable housing in the Income-tax Act with the GST Acts. Limit of carpet area to increase from 30 square meters to 60 square meters in Metropolitan regions and from 60 square meters to 90 square meters in nonmetropolitan regions. Limit on cost of the house at Rs. 45 lakh in line with the definition in the GST Acts

Union Budget 2019 -20 Infrastructure Sector Reforms Public-Private Partnership to unleash faster development and completion of tracks, rolling stock manufacturing and delivery of passenger freight services To enhance the sources of capital for infrastructure financing: Credit Guarantee Enhancement Corporation will be set up in 2019-20 An action plan to deepen the market for long term bonds, corporate bond repos, credit default swaps etc., with specific focus on infrastructure sector, will be put in place Permit investments made by FIIs/FPIs in debt securities issued by IDF-NBFCs to be transferred/sold to any domestic investor within the specified lock-in period Tax incentives for International Financial Services Centre (IFSC)

Union Budget 2019 -20 Capital Market Reforms Minimum public shareholding of listed companies is proposed to be increased from 25% to 35% Enable stock exchanges to allow AA rated bonds as collaterals Review of user-friendliness of trading platforms for corporate bonds, including issues arising out of capping of International Securities Identification Number (ISIN) Creating an electronic fund raising platform – a social stock exchange - for listing social enterprises and voluntary organizations working for the realization of a social welfare objective to raise capital as equity, debt or as units like a mutual fund Inter-operability of RBI depositories and SEBI depositories to bring about seamless transfer of treasury bills and government securities between RBI and Depository ledgers

Union Budget 2019 -20 Foreign Investment Reforms Allow FIIs, FPIs investment in debt securities issued by NBFCs Existing Know Your Customer norms for Foreign Portfolio Investors to be rationalized and simplified, to make it more investor-friendly Relaxation of KYC norms will better harness FPI investments Allow FPIs to subscribe to listed debt papers of REITs and InviTs Merge the NRI portfolio investment scheme route with FPI route Increase the statutory limit for FPI investment in a company from 24% to sectoral foreign investment limit with option given to the concerned corporates to limit it to a lower threshold FDI in aviation, media (animation, AVGC)and some other sectors 100% FDI in insurance intermediaries Local sourcing norms will be eased for FDI in Single Brand Retail sector

Union Budget 2019 -20 Start Up India 2.0 Introduce a television programme within the DD bouquet of channels exclusively for start-ups. serve as a platform for promoting start-ups, discussing issues affecting their growth, matchmaking with venture capitalists and for funding and tax planning. To resolve the issue of Angel Tax the startups and investors who file requisite declarations will not be subjected to any kind of scrutiny in respect of valuation of share premium Valuation of shares issued to Category-II AIF shall be beyond the scope of income tax scrutiny Extension of the period of exemption of capital gains arising from sale of residential house for investment in start-ups up to 31.3.2021

Union Budget 2019 -20 NBFC Sector Reforms Interest on bad or doubtful debts in the case of NBFC-D and NBFC- ND-SI shall be charged to tax on receipt basis (Section 43D) One time six months partial guarantee to PSBs for first loss up to 10% to be provided in case of purchase of high rated pooled asset of sound NBFCs amounting to a total of 1 lakh crore during the financial year For NBFCs doing public placement of debt, maintenance of DRR done away with NBFCs, other than NBFC-Factor to be allowed on TReDs platform Amendments to Factoring Act not yet proposed Regulation of HFCs to move to the Reserve Bank of India (RBI) from NHB NHB, being the refinancer and lender, is also regulator of the housing finance sector and hence it was a conflicting and difficult mandate to NHB Expert committee to study the current situation relating to long term finance

Union Budget 2019 -20 Banking Sector Reforms To subside the cash dominated transactions, TDS of 2% will be levied on cash withdrawal exceeding Rs. 1 crore in a year from a bank account. To promote digital payments, business establishments with annual turnover more than Rs.50 crore to offer low cost digital modes of payment to their customers and no charges or Merchant Discount Rate to be imposed on customers as well as merchants. RBI and Banks are to absorb these costs

Union Budget 2019 -20 Distressed Companies Reforms The conditions of continuity of shareholding for carry forward and set off of losses shall not apply to companies whose board of directors have been suspended by NCLT and new directors have been appointed For MAT computation liability, the aggregate of brought forward losses and unabsorbed depreciation shall also be allowed as deduction. The Budget proposes to grant relaxations from the fair valuation requirements with respect to shares transferred pursuant to resolution process Currently any transfer of shares attract the fair valuation requirements under sections 56(2)(x) and the 50 CA of the Income Tax Act, 1961

Union Budget 2019 -20 Corporate Sector Reforms (1/4) Capital Market Reforms Minimum public shareholding (‘MPS’) of listed companies proposed to be increased from 25% - 35%. Over 1400 listed companies will have to offload promoter • shareholding if such proposal is made effective Impact of increased MPS on listed companies: • a) Better price discovery b) Increased public ownership c) Enhanced corporate governance standards d) MNCs might consider delisting Implementing issues may be faced while increasing MPS • Compliances to be made under various regulations • a) Disclosure under SEBI Takeover Regulations, PIT Regulations, Listing Regulations, etc. Corporate actions to be taken up for increasing MPS •

Union Budget 2019 -20 Corporate Sector Reforms (2/4) SCRA Reforms Under section 23A - Penalty for failure to furnish information, return, etc. • The penalty under this section can also be levied where the listed entity fails • to furnish information, return, etc to the SEBI. Earlier the penalty was levied if the listed entity failed to report to the stock exchange

Corporate Sector Reforms (3/4) SEBI Act Reforms Under section 14 • The General Fund constituted under the said section can be utilized for • capital expenditure as per annual capital expenditure plan approved by the Board and the Central Government. New Insertion - Reserve Fund shall be constituted and 25% of the annual • surplus shall be transferred to such Reserve Fund. After application towards expenses, the surplus of the General Fund to be • transferred to Consolidated Fund of India. Cont..

Corporate Sector Reforms (4/4) Under section 15C • Penalty shall be levied under the section if the listed entity fails to redress • investors' grievances when called upon to do so either in writing or by means of electronic communication. Under Section 15F • Penalty for non compliance by stock brokers extended to one crore rupees • New Section 15HAA inserted • Penalty for alteration, destruction, etc., of records and failure to protect the • electronic database of Board inserted. Penalty shall not be less than one lakh rupees but which may extend to ten • crore rupees or three times the amount of profits made out of such act, whichever is higher.

Recommend

More recommend