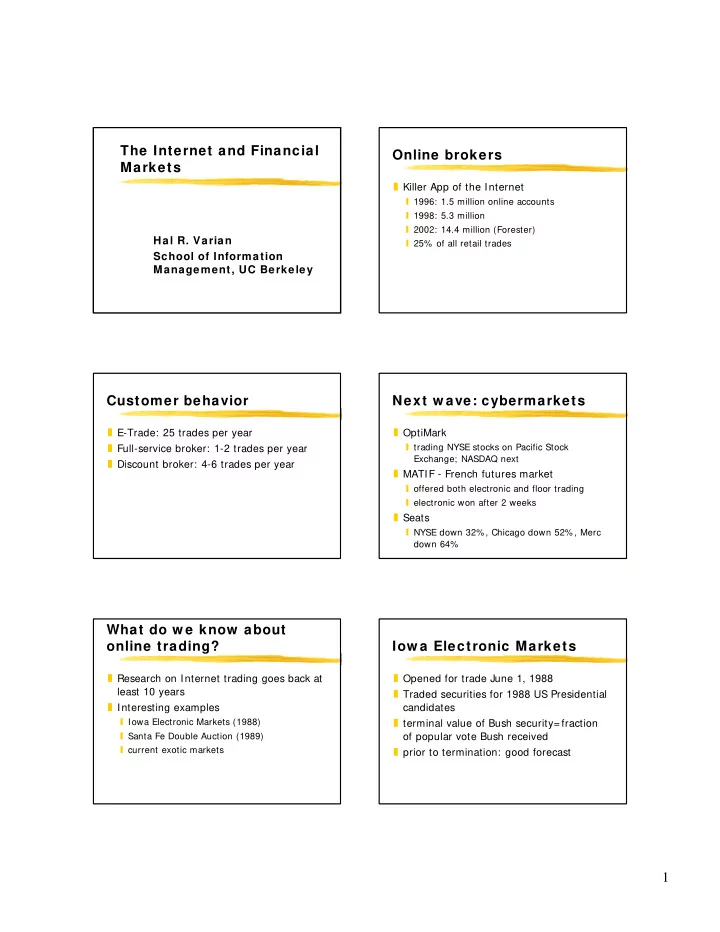

The Internet and Financial Online brokers Markets T Killer App of the Internet S 1996: 1.5 million online accounts S 1998: 5.3 million S 2002: 14.4 million (Forester) Hal R. Varian S 25% of all retail trades School of Information Management, UC Berkeley Customer behavior Next w ave: cybermarkets T E-Trade: 25 trades per year T OptiMark T Full-service broker: 1-2 trades per year S trading NYSE stocks on Pacific Stock Exchange; NASDAQ next T Discount broker: 4-6 trades per year T MATIF - French futures market S offered both electronic and floor trading S electronic won after 2 weeks T Seats S NYSE down 32% , Chicago down 52% , Merc down 64% What do w e know about online trading? Iow a Electronic Markets T Research on Internet trading goes back at T Opened for trade June 1, 1988 least 10 years T Traded securities for 1988 US Presidential T Interesting examples candidates S Iowa Electronic Markets (1988) T terminal value of Bush security= fraction S Santa Fe Double Auction (1989) of popular vote Bush received S current exotic markets T prior to termination: good forecast 1

Outcome of IEM Why w as IEM so accurate? T Vote forecast for Bush: 53.2% (exact) T More rational participants? T Vote forecast for Dukakis: 45.2% (off by S No, they showed same biases .2%) T Market reflects weighted average T Comparison to polls S marginal traders R higher investment S much less volatile R higher return S polls exhibit classic biases R more frequent trades S market did not exhibit biases R more “rational” Santa Fe Double Auction Outcome of Santa Fe T Program trading in bid/ask market T Winner: Todd Kaplan, economics grad student T Tournament play T Why he won…. T $10,000 prize offered by IBM T What his program did T 30 programs S “non-adaptive, non-predictive, non-stochastic, S 15 economists, 9 computer scientists, 3 and non-optimizing” mathematicians, etc. Kaplan’s algorithm Current exotic markets T “Let others do negotiating. When bid and T Idea Futures Market ask get with 10%, jump in and steal the S “DJIA below 7,000 by 11/30/99” trade” S “Nuke capable terrorists by 2000” T Clearly dominated, even when other S “Mark McGwire hits more than 61 home runs” programs optimized against it T Hollywood Stock Exchange T “Evolutionary tournament” S security payoff on box office gross during first 4 weekends S after 28,000 plays had total domination S other entertainment bets S then market crashed! T Above are not for real money 2

HP sales forecasting Securitization T Chen and Plott (1998) T David Bowie bonds = $55 million T Arrow-Debreu securities T Catastrophe bonds S payoff contingent on sales of HP printers S $477 million bonds tied to 1997 East Coast hurricane S internal to HP S $137 million bond tied to California S real-money bets earthquake T Consistently better than HP forecasts T Relationship to insurance markets? T Relationship to online trading? Conclusions T Electronic trading is here to stay T Exotic markets are useful forecasting tools T Electronic agents will be used, but may well be passive T Transparency is important T Securitization will thrive 3

Recommend

More recommend